A deed in lieu of foreclosure is a method sometimes used by a lienholder on property to avoid a lengthy and expensive foreclosure process, with a deed in lieu of foreclosure a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor basically deeds the property to the bank instead of them paying for foreclosure proceedings. Therefore, if a debtor fails to make mortgage payments and the bank is about to foreclose on the property, the deed in lieu of foreclosure is an option that chooses to give the bank ownership of the property rather than having the bank use the legal process of foreclosure.

Idaho Offer by Borrower of Deed in Lieu of Foreclosure

Description

How to fill out Offer By Borrower Of Deed In Lieu Of Foreclosure?

Finding the right authorized file template could be a have a problem. Needless to say, there are tons of templates available online, but how will you find the authorized develop you want? Use the US Legal Forms internet site. The services delivers thousands of templates, including the Idaho Offer by Borrower of Deed in Lieu of Foreclosure, which can be used for company and private requires. All the varieties are inspected by pros and meet state and federal requirements.

In case you are previously listed, log in in your profile and click the Acquire key to obtain the Idaho Offer by Borrower of Deed in Lieu of Foreclosure. Make use of your profile to look from the authorized varieties you possess bought in the past. Go to the My Forms tab of your respective profile and obtain yet another version in the file you want.

In case you are a whole new user of US Legal Forms, allow me to share simple guidelines so that you can follow:

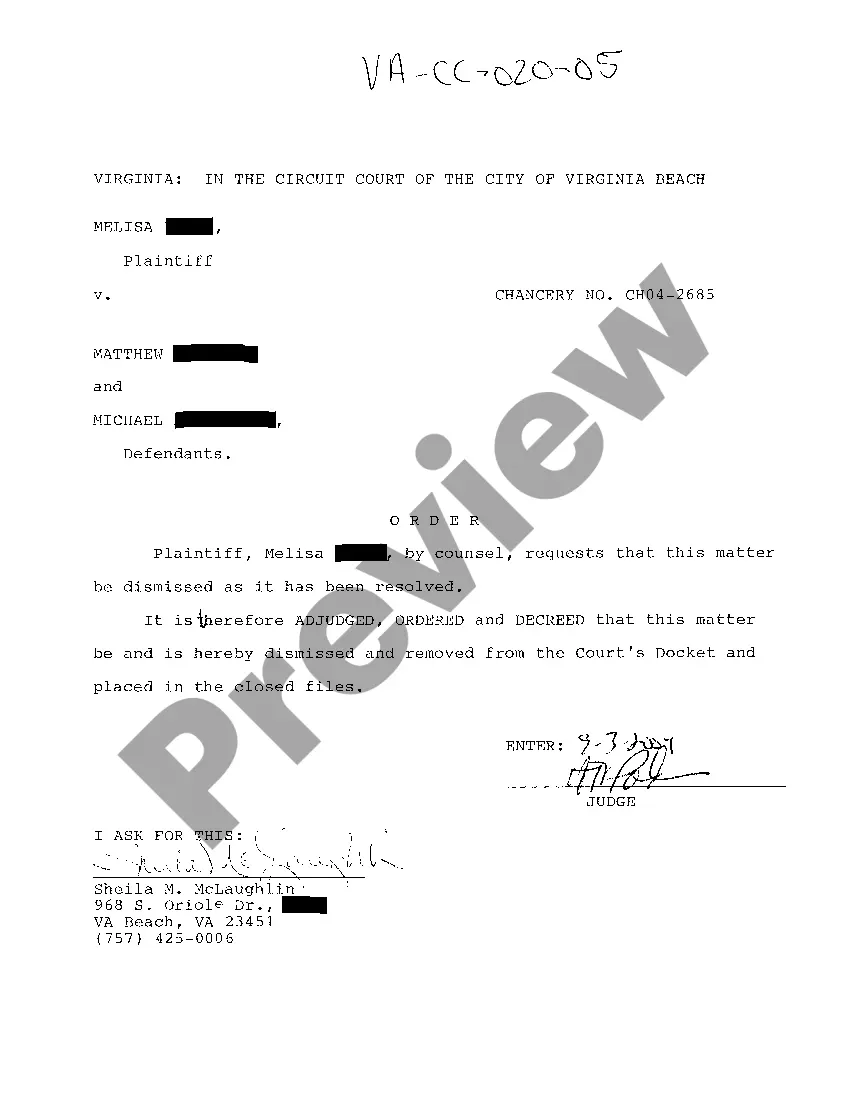

- Initial, make certain you have chosen the proper develop to your area/state. You may check out the shape using the Review key and study the shape outline to make sure this is basically the best for you.

- In case the develop does not meet your expectations, utilize the Seach discipline to discover the right develop.

- When you are sure that the shape would work, click the Acquire now key to obtain the develop.

- Opt for the rates program you want and type in the needed info. Design your profile and pay money for the order utilizing your PayPal profile or bank card.

- Opt for the file formatting and down load the authorized file template in your system.

- Complete, modify and produce and sign the obtained Idaho Offer by Borrower of Deed in Lieu of Foreclosure.

US Legal Forms may be the greatest catalogue of authorized varieties that you can find a variety of file templates. Use the service to down load expertly-made documents that follow express requirements.

Form popularity

FAQ

The court may not render judgment for more than the amount by which the entire amount of indebtedness due at the time of sale exceeds the fair market value at that time, with interest from date of sale, but in no event may the judgment exceed the difference between the amount for which such property was sold and the ...

Typically, the nonjudicial foreclosure sale process takes anywhere from 125 to 140 days. Notice of the date of sale must be given no less than 120 days after a notice of default has been recorded in the county record where the property is situated. Idaho Code § 45-1506.

Idaho Statutes 5-214A. Action to foreclose mortgage on real property. An action for the foreclosure of a mortgage on real property must be commenced within five (5) years from the maturity date of the obligation or indebtedness secured by such mortgage.

45-507. Claim of lien. (1) Any person claiming a lien pursuant to the provisions of this chapter must file a claim for record with the county recorder for the county in which such property or some part thereof is situated.

Idaho has judicial foreclosure, but has non-judicial foreclosure is the most common. A non-judicial foreclosure means that a ?Power of Sale? clause is in the deed of trust or the mortgage paperwork. This gives the lender the authority to sell the property if the borrower defaults on the loan.

Although about 60% of the US states are mortgage states, Idaho is considered a deed state. A deed of trust is an agreement between a beneficiary, grantor, and trustee. A deed is signed to a trustee as a form of security to ensure that the performance of obligation is fulfilled.

Typically, the nonjudicial foreclosure sale process takes anywhere from 125 to 140 days. Notice of the date of sale must be given no less than 120 days after a notice of default has been recorded in the county record where the property is situated. Idaho Code § 45-1506.

How Can I Stop a Foreclosure in Idaho? A few potential ways to stop a foreclosure include reinstating the loan, redeeming the property before the sale, or filing for bankruptcy. (Of course, if you're able to work out a loss mitigation option, like a loan modification, that will also stop a foreclosure.)

18-4001. Murder defined. Murder is the unlawful killing of a human being including, but not limited to, a human embryo or fetus, with malice aforethought or the intentional application of torture to a human being, which results in the death of a human being.

How Do I Avoid Foreclosure? You may be able to avoid foreclosure by making arrangements with your lender, such as getting forbearance or agreeing to a loan modification. Other options may include refinancing with a hard money loan or reverse mortgage.