No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Idaho Rejection of Claim and Report of Experience with Debtor

Description

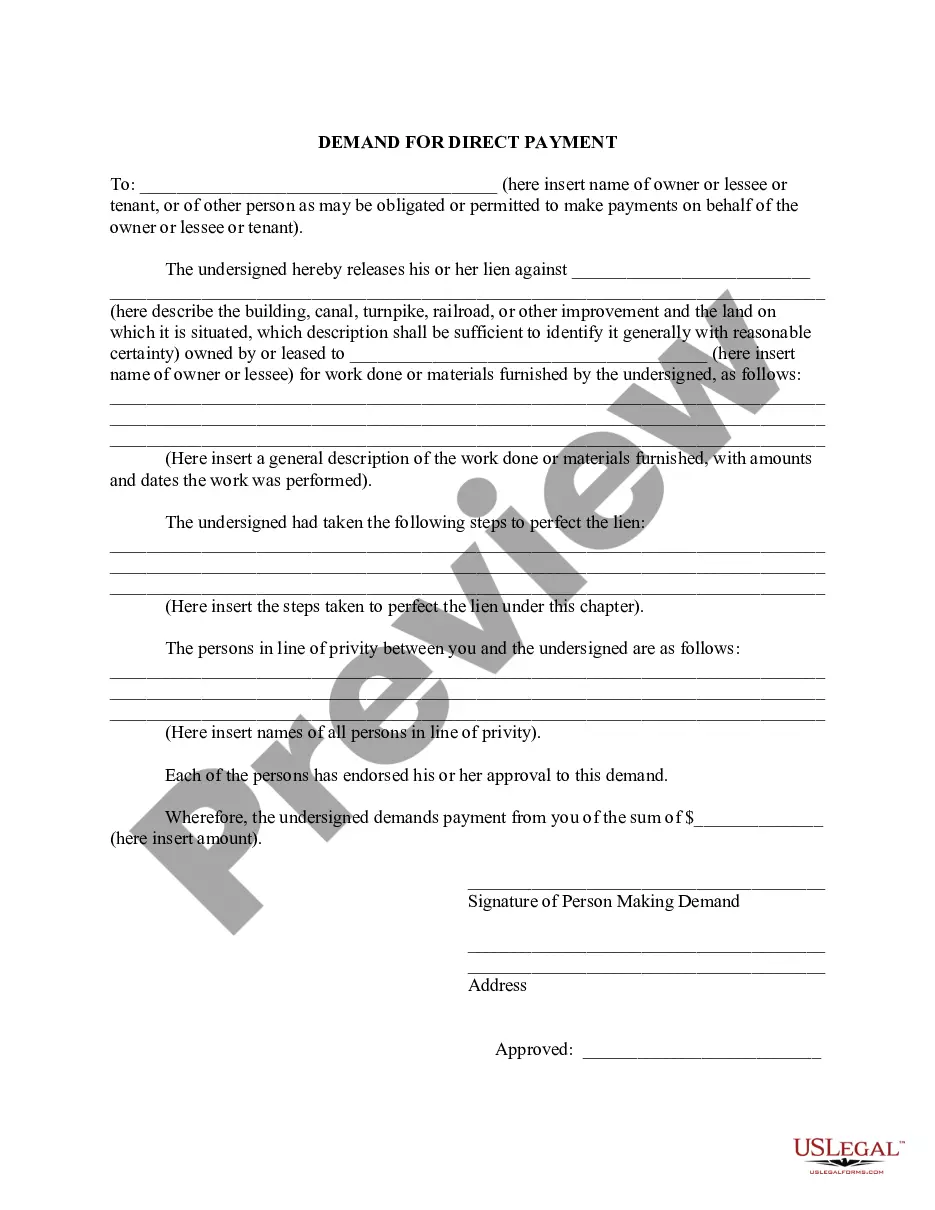

How to fill out Rejection Of Claim And Report Of Experience With Debtor?

Selecting the appropriate legal document template can be challenging. Certainly, there are numerous templates available online, but how can you find the legal form you require? Utilize the US Legal Forms website. This service provides a vast array of templates, including the Idaho Rejection of Claim and Report of Experience with Debtor, that can be used for both business and personal purposes. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, sign in to your account and click the Download button to obtain the Idaho Rejection of Claim and Report of Experience with Debtor. Use your account to browse through the legal forms you have previously purchased. Visit the My documents tab in your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple guidelines you can follow.

Complete, modify, print, and sign the obtained Idaho Rejection of Claim and Report of Experience with Debtor. US Legal Forms is the largest collection of legal documents where you can find various document templates. Utilize the service to obtain well-crafted files that comply with state regulations.

- First, ensure you have selected the correct form for your city/state.

- You may preview the form using the Preview button and read the form description to verify this is suitable for you.

- If the form does not meet your requirements, use the Search field to find the correct form.

- Once you are confident that the form is appropriate, click the Download Now button to acquire the form.

- Choose the payment plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

Creditors must file a claim against an estate in Idaho within four months of the notice being sent. This deadline is critical to ensure your claims are recognized and addressed in the estate's settlement process. Using the Idaho Rejection of Claim and Report of Experience with Debtor can help ensure adherence to these important timelines.

In Idaho, the statute of limitations for most debts is generally five years. After this period, creditors can lose the right to collect, making the debt uncollectible. Understanding the implications of the Idaho Rejection of Claim and Report of Experience with Debtor can help you navigate these rules smoothly.

Creditors have a limited timeframe to collect debts from an estate in Idaho. Typically, they must file claims within four months after the notice to creditors is published. The Idaho Rejection of Claim and Report of Experience with Debtor can assist in understanding these critical timelines and protect your rights.

Yes, in Idaho, an estate must generally be settled within a year after the personal representative is appointed. However, this timeline can be extended under certain circumstances. Utilizing the Idaho Rejection of Claim and Report of Experience with Debtor can help clarify obligations and aid in a timely settlement.

In Idaho, you generally have four months to file a lawsuit against an estate after the personal representative has provided notice to creditors. If you miss this deadline, your claim may be barred. Understanding the Idaho Rejection of Claim and Report of Experience with Debtor can help you navigate these timelines effectively.

In Idaho, truancy is treated seriously, with consequences that may include fines, community service, or even court-ordered programs aimed at addressing the behavior. Repeat offenses can lead to more severe penalties. Understanding the implications of the Idaho Rejection of Claim and Report of Experience with Debtor can be beneficial if you deal with legal issues regarding education. Seeking legal assistance can provide options and paths forward.

The Unfair Claims Practice Act in Idaho ensures that insurance practices are just and fair for all parties involved. This act prohibits deceptive practices in processing claims, providing protection to policyholders. If you encounter issues, knowing about the Idaho Rejection of Claim and Report of Experience with Debtor can empower you during disputes. Resources like US Legal Forms can aid in understanding your rights and responsibilities.

Idaho Code 19-2603 deals with the sentencing procedures for various offenses, including aggravated crimes. This legislation provides insight into how sentences are determined in Idaho's legal framework. When challenging decisions related to your case, consider exploring the Idaho Rejection of Claim and Report of Experience with Debtor. This avenue may help you better understand your position.

Code 18-2603 in Idaho relates to the laws governing aggravated battery. This statute defines the offense and outlines the penalties associated with it. If you face legal challenges, understanding the implications of Idaho's laws, including the Idaho Rejection of Claim and Report of Experience with Debtor, can help you navigate your situation more effectively. Utilize reliable sources for guidance.

In Idaho, the sentence for aggravated battery can vary based on the specifics of the case. Generally, it may include a prison term that spans from 2 to 25 years, depending on the severity and circumstances of the offense. It's important to understand how the Idaho Rejection of Claim and Report of Experience with Debtor can play a role in managing related legal issues. For individuals facing these matters, consulting legal resources can provide clarity.