A bailment is the act of placing property in the custody and control of another, usually by agreement in which the holder (bailee) is responsible for the safekeeping and return of the property. When a motor vehicle is delivered to and accepted by a garage owner for storage, a bailment for mutual benefit generally results, and the relationship defines the legal relationship of the parties. The garage owner is bound to exercise ordinary care in the safeguarding of the vehicle. This can be modified somewhat by agreement between the parties.

Idaho Automobile Storage Agreement

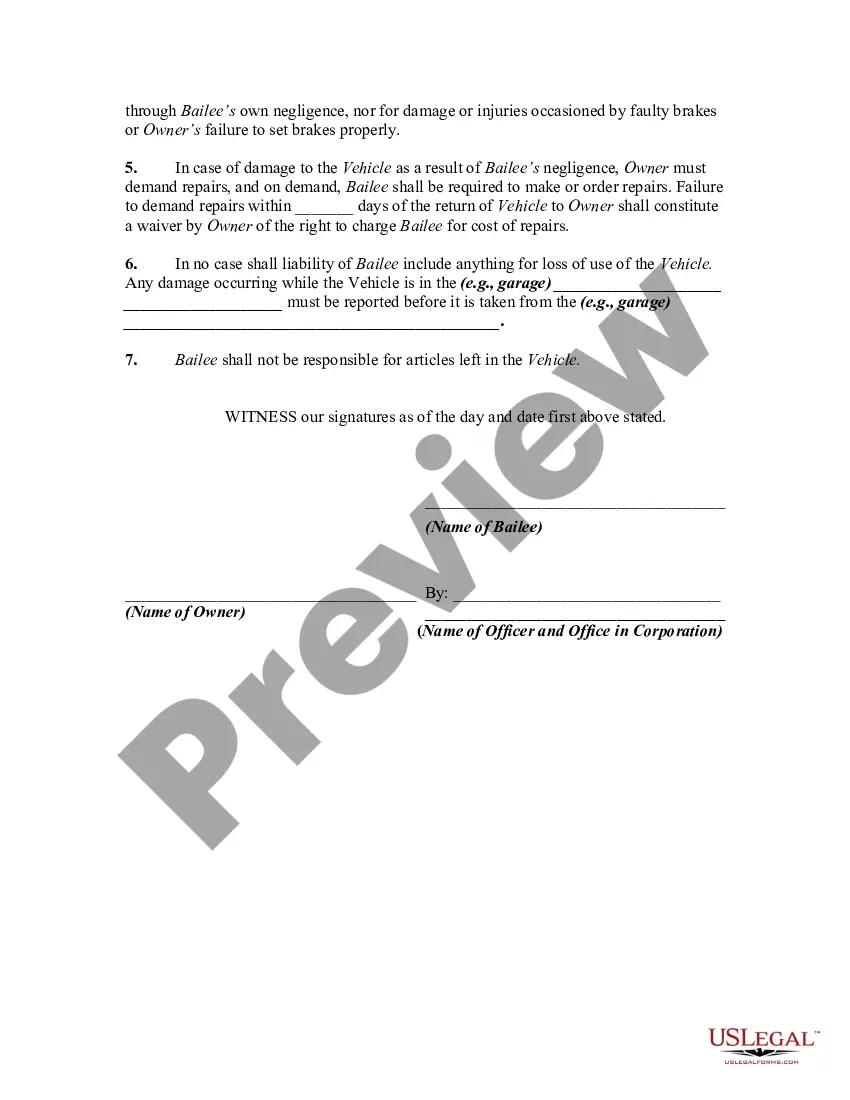

Description

How to fill out Automobile Storage Agreement?

Selecting the optimal legal document format can be a challenge. Clearly, there are numerous templates accessible online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Idaho Vehicle Storage Agreement, that you can employ for business and personal purposes.

All of the documents are reviewed by experts and comply with state and federal regulations.

If the form does not meet your needs, utilize the Search field to find the appropriate form. Once you are confident that the form is correct, click the Purchase now button to acquire the form. Select the pricing plan you wish and enter the necessary details. Create your account and complete your order using your PayPal account or credit card. Choose the file format and download the legal document format to your device. Finally, customize, print, and sign the acquired Idaho Vehicle Storage Agreement. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Take advantage of the service to obtain properly crafted paperwork that adhere to state requirements.

- If you are already registered, Log In to your account and hit the Download button to find the Idaho Vehicle Storage Agreement.

- Use your account to consult the legal forms you have previously purchased.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure that you have selected the correct form for your location/region.

- You can browse the form using the Preview button and review the form description to confirm it is suitable for you.

Form popularity

FAQ

Filling out an Idaho certificate of title requires you to enter precise information about the vehicle, including the VIN, make, model, and the owner's information. Make sure you follow the instructions carefully to ensure all fields are completed accurately. After completing the title, submit it to your local DMV for approval. Think about an Idaho Automobile Storage Agreement to keep related documents organized and secure.

In Idaho, notarization of vehicle titles is generally not required unless specific circumstances arise, such as certain title transactions or liens. However, for added security and verification, you might opt to notarize your documents. This also applies to your Idaho Automobile Storage Agreement, which can help ensure that all agreements are honored and recognized.

To transfer ownership of a car in Idaho, both the buyer and seller need to complete the necessary sections on the vehicle title. This includes signing the title and providing relevant details of both parties. After that, you must submit the title to your local DMV to officially record the transfer. To facilitate this process, you might consider using an Idaho Automobile Storage Agreement to manage related documentation.

To add a person to a car title in Idaho, you need to complete the title transfer section on the current title document. This process requires the signature of the current owner as well as the new owner's information. After filling out the required details, submit the updated title to your local DMV for processing. A well-drafted Idaho Automobile Storage Agreement can help outline the transfer process clearly.

To fill out an Idaho title, start by locating the specific title form from your local Idaho DMV or online. You will need to provide details such as the vehicle identification number, current owner's information, and the buyer's information, if applicable. Ensure you complete all sections carefully to avoid delays. Once filled out, you may also want to consider an Idaho Automobile Storage Agreement for secure document handling.

Yes, Idaho does collect sales tax on certain out-of-state purchases. This applies mainly when the items are used within Idaho, equalizing the playing field for local businesses. When dealing with an Idaho Automobile Storage Agreement, it can be essential to understand how these tax rules affect your financial decisions.

In Idaho, the sales tax on food items is set at 6%. However, there are exemptions for certain food products, which can reduce overall grocery costs. If you are considering entering an Idaho Automobile Storage Agreement and wondering about associated costs, it's important to factor in these rates.

Idaho increased its sales tax rate to 6% in 2006. Before this change, the sales tax had remained lower for several years. Understanding the current tax rate is crucial for budgeting, especially when entering an Idaho Automobile Storage Agreement.

Idaho is considered relatively tax-friendly when compared to many states. The state provides various deductions for families and businesses, promoting a favorable economic environment. By utilizing resources like an Idaho Automobile Storage Agreement, you can navigate tax responsibilities effectively.

Idaho does not classify as a completely tax-exempt state. However, it offers specific exemptions depending on various goods and services. For instance, certain agricultural products and manufacturing equipment might qualify for exemptions. If you are using an Idaho Automobile Storage Agreement, it's wise to check your tax obligations.