US Legal Forms - among the largest libraries of legal forms in the States - gives a wide array of legal record web templates you may acquire or print out. Making use of the site, you will get thousands of forms for business and person functions, sorted by categories, suggests, or search phrases.You will discover the most up-to-date types of forms such as the Idaho Agreement By Heirs to Substitute New Note for Note of Decedent within minutes.

If you already have a registration, log in and acquire Idaho Agreement By Heirs to Substitute New Note for Note of Decedent from the US Legal Forms library. The Down load switch can look on every single type you perspective. You have accessibility to all formerly saved forms inside the My Forms tab of your own profile.

If you would like use US Legal Forms the very first time, here are basic directions to help you get started off:

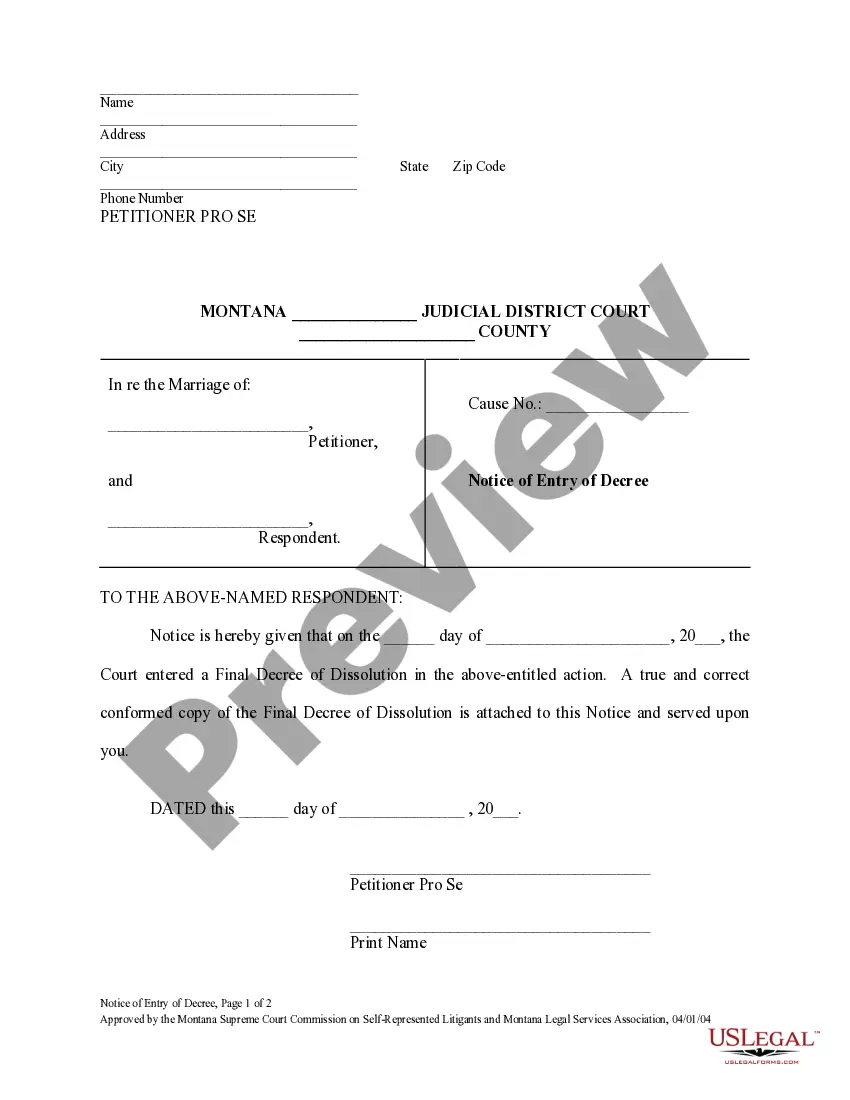

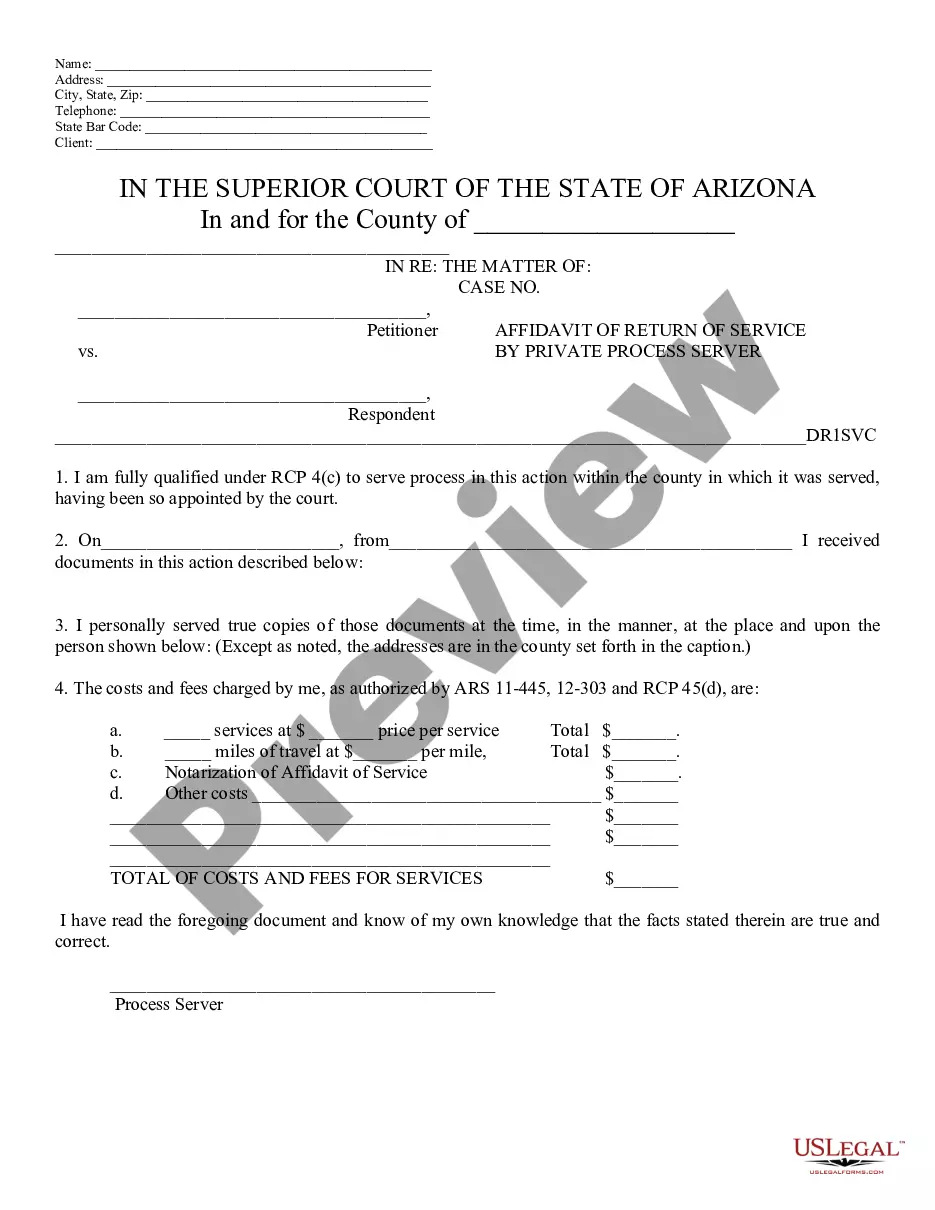

- Ensure you have picked out the right type for your area/state. Select the Review switch to check the form`s information. Read the type information to actually have selected the proper type.

- If the type does not fit your needs, use the Search field near the top of the display screen to find the one that does.

- Should you be pleased with the form, affirm your selection by clicking the Acquire now switch. Then, opt for the pricing plan you like and give your accreditations to register to have an profile.

- Method the financial transaction. Utilize your charge card or PayPal profile to complete the financial transaction.

- Select the structure and acquire the form in your system.

- Make adjustments. Complete, revise and print out and signal the saved Idaho Agreement By Heirs to Substitute New Note for Note of Decedent.

Each format you included with your bank account lacks an expiration time and is your own property forever. So, if you wish to acquire or print out an additional version, just visit the My Forms segment and click on around the type you want.

Get access to the Idaho Agreement By Heirs to Substitute New Note for Note of Decedent with US Legal Forms, by far the most extensive library of legal record web templates. Use thousands of skilled and status-particular web templates that satisfy your company or person requires and needs.