Idaho Sample Letter for Binding First Security Interest

Description

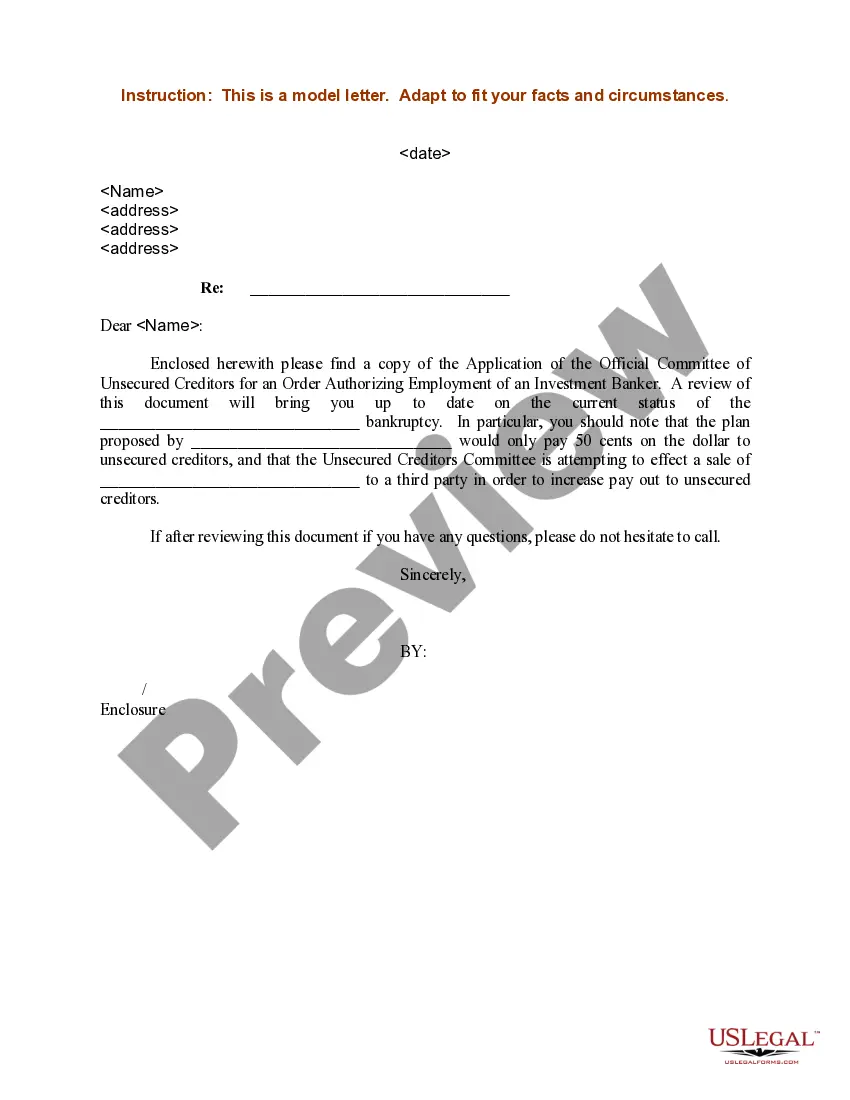

How to fill out Sample Letter For Binding First Security Interest?

Have you ever found yourself in a situation where you need documents for either business or personal reasons on a regular basis? There are numerous legal document templates available online, but finding reliable ones can be challenging. US Legal Forms provides a vast selection of form templates, including the Idaho Sample Letter for Binding First Security Interest, designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, just Log In. After that, you can download the Idaho Sample Letter for Binding First Security Interest template.

If you do not have an account and wish to start using US Legal Forms, follow these instructions: Find the form you need and ensure it is for the correct area/county. Use the Preview button to examine the form. Review the description to confirm that you have chosen the right document. If the form isn’t what you’re looking for, use the Search field to locate the form that fits your needs and requirements. Once you find the correct form, click Purchase now. Select the pricing plan you prefer, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- Access all the document templates you have purchased in the My documents section.

- You can obtain an additional copy of Idaho Sample Letter for Binding First Security Interest anytime if needed.

- Simply select the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

- The service offers professionally crafted legal document templates that you can use for various purposes.

- Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Security Documents means the Security Agreement, the Mortgages, the Intellectual Property Security Agreement, the Pledge Agreement, the Facility Guarantee, and each other security agreement or other instrument or document executed and delivered pursuant to this Agreement or any other Loan Document that creates a Lien ...

Summary: Thus, when the collateral is not in the possession of the secured party, a security agreement must be in writing to be enforceable. The agreement must be signed by the debtor, contain a description of the property, and the description must reasonably identify the property involved (the collateral).

List out the specific responsibilities of each party to the contract. Specifically define what ??providing a secure environment?? means. Outline expectations for maintaining confidentiality. Clarify how any potential security breaches will be addressed. Make sure to include language that is legally binding.

Enforcing Security Interests in Personal Property Evaluating Whether a Debtor has Defaulted. Selecting an Appropriate Remedy. Selling Collateral. After Selling Collateral or Collection of Accounts.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

Creating a security agreement Some key provisions in a security agreement include: Describing the collateral as accurately and as detailed as possible, so both the borrower and the lender agree upon the secured property. How to determine whether and when the borrower is in default under the loan.

What is a General Security Agreement? A GSA is a contract signed between two parties, a borrower and a lender. The GSA protects the lender by creating a security interest in all or some of the assets of the borrower. In sum, the GSA outlines the terms and conditions of the loan, and lists the assets used for security.

There are three requirements for attachment: (1) the secured party gives value; (2) the debtor has rights in the collateral or the power to transfer rights in it to the secured party; (3) the parties have a security agreement ?authenticated? (signed) by the debtor, or the creditor has possession of the collateral.

The only way that a secured party may perfect its security interest in money is by possession. Instruments. A lender may perfect a security interest in an instrument either by filing or possession.