Idaho Letter to Social Security Administration Notifying Them of Death

Description

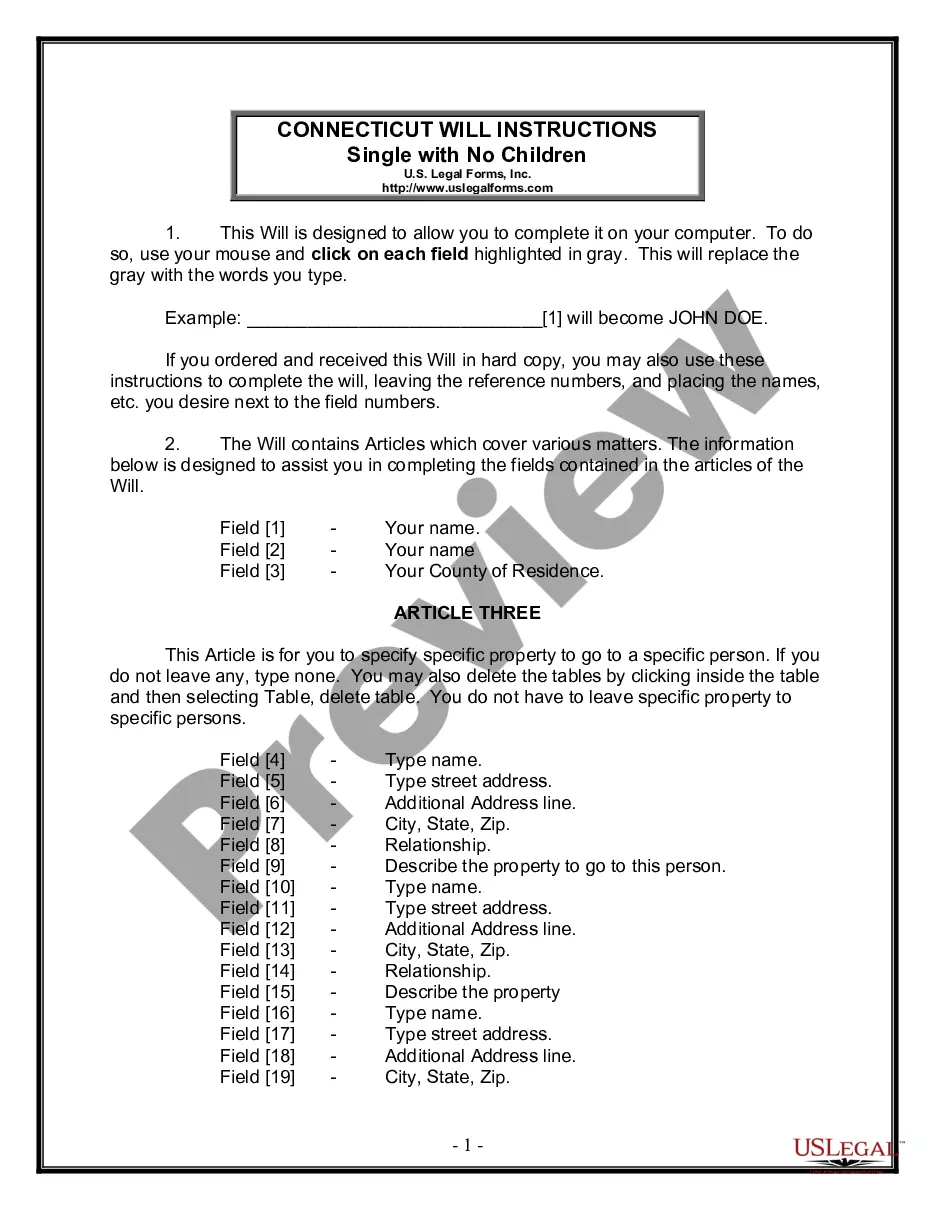

How to fill out Letter To Social Security Administration Notifying Them Of Death?

Are you currently within a placement the place you require paperwork for either organization or specific purposes almost every time? There are a variety of legitimate papers layouts available on the Internet, but locating kinds you can depend on is not effortless. US Legal Forms provides a huge number of form layouts, like the Idaho Letter to Social Security Administration Notifying Them of Death, which are created to fulfill federal and state demands.

When you are previously knowledgeable about US Legal Forms website and get a free account, simply log in. Afterward, you are able to obtain the Idaho Letter to Social Security Administration Notifying Them of Death design.

If you do not come with an bank account and wish to begin to use US Legal Forms, abide by these steps:

- Obtain the form you will need and ensure it is for that appropriate metropolis/region.

- Make use of the Review button to review the shape.

- Look at the information to ensure that you have chosen the correct form.

- In case the form is not what you are looking for, take advantage of the Search area to obtain the form that fits your needs and demands.

- Whenever you discover the appropriate form, click Acquire now.

- Choose the prices prepare you would like, submit the required info to generate your account, and purchase an order using your PayPal or Visa or Mastercard.

- Choose a handy file file format and obtain your version.

Locate every one of the papers layouts you possess bought in the My Forms food selection. You can obtain a further version of Idaho Letter to Social Security Administration Notifying Them of Death anytime, if required. Just click on the required form to obtain or print the papers design.

Use US Legal Forms, the most substantial selection of legitimate varieties, in order to save time and avoid errors. The services provides professionally made legitimate papers layouts that you can use for an array of purposes. Produce a free account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

Legally, only the owner has legal access to the funds, even after death. A court must grant someone else the power to withdraw money and close the account.

Speak With Your Boss or HR Meet your boss and request whether you can get a couple of minutes to speak with them. If your boss remains very busy, you can either inform them over a call or send the news through an email.

Depending on the value of the Estate, the bank may also ask for further proof through documents such as the Will, Probate or Letters of administration. After the bank validates the death, there is a permanent hold on any transaction accounts, which includes: You can't withdraw money from the accounts.

If you die without naming a beneficiary, your bank account will transfer through your will and through probate law, as appropriate. The way that an account is distributed after your death when you don't have a beneficiary will depend on whether you're married, if you have any named heirs or if you have children.

A death notice is a brief statement announcing someone's death. In just a few sentences, the notice explains need-to-know details about the death, along with information regarding memorial or funeral services to be held.

The next of kin must notify their banks of the death when an account holder dies. This is usually done by delivering a certified copy of the death certificate to the bank, along with the deceased's name and Social Security number, bank account numbers, and other information.

A court must grant you the power to withdraw money from the account if you're neither a joint owner or an account beneficiary. For example, an executor must produce proof of executor status and a certified copy of the death certificate to collect funds and place them in an estate account.

To date, 453.7 million different numbers have been issued. Q20: Are Social Security numbers reused after a person dies? A: No. We do not reassign a Social Security number (SSN) after the number holder's death.