Idaho Charitable Remainder Inter Vivos Unitrust Agreement

Description

How to fill out Charitable Remainder Inter Vivos Unitrust Agreement?

You might invest hours online looking for the sanctioned document template that fulfills the federal and state requirements you need.

US Legal Forms provides a multitude of legal templates that can be reviewed by experts.

You can easily download or print the Idaho Charitable Remainder Inter Vivos Unitrust Agreement from the service.

If you wish to find another version of your form, use the Search field to find the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you may sign in and click the Obtain button.

- Subsequently, you may complete, modify, print, or sign the Idaho Charitable Remainder Inter Vivos Unitrust Agreement.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of the purchased document, navigate to the My documents tab and click the relevant button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document format for the region/city of your choice. Review the form outline to verify you have selected the right one.

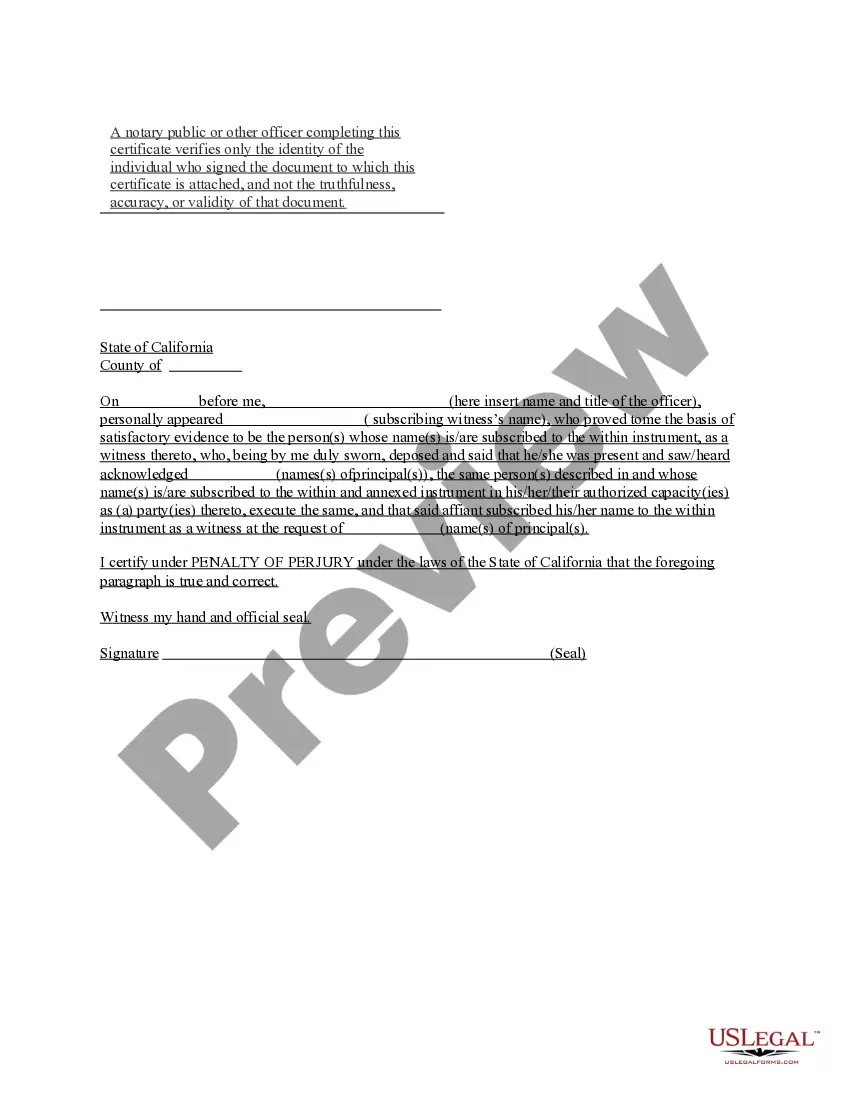

- If available, use the Review button to examine the document format as well.

Form popularity

FAQ

To set up an Idaho Charitable Remainder Inter Vivos Unitrust Agreement, begin by determining your charitable goals and the assets you wish to contribute. Next, consult with a financial advisor or attorney to draft a trust document that complies with Idaho laws. You can then transfer the designated assets into the trust, which will provide you with income for a specified period before the remaining assets go to your chosen charity. Utilizing platforms like US Legal Forms can simplify this process, offering templates and guidance for creating your trust.

The charitable remainder unitrust deduction allows you to deduct a portion of your contributions to the unitrust from your taxable income. With the Idaho Charitable Remainder Inter Vivos Unitrust Agreement, you can maximize your tax benefits while supporting a charitable cause. This deduction calculation considers the present value of the charitable contribution you plan to make in the future. It’s an excellent way to enhance your financial situation while giving back.

Typically, a charitable remainder unitrust can last for a maximum of 20 years. However, the Idaho Charitable Remainder Inter Vivos Unitrust Agreement is crafted to offer flexibility based on your specific needs. This means that you can structure the trust to align with your financial goals and future planning. Understanding the time frame is crucial for effective gift planning.

A unitrust is designed to provide income to beneficiaries while ultimately benefiting a charity. Through the Idaho Charitable Remainder Inter Vivos Unitrust Agreement, you can maintain a sustainable stream of income for yourself or loved ones during your lifetime. This type of trust supports charitable organizations in a meaningful way after your passing. It’s an effective tool for managing your financial resources.

A unitrust is a specific type of charitable remainder trust that pays a fixed percentage of the trust's value to the income beneficiary every year. This differentiates it from an annuity trust, which pays a fixed dollar amount. With an Idaho Charitable Remainder Inter Vivos Unitrust Agreement, you enjoy the potential for increasing income as the trust grows, allowing for flexibility in managing your charitable contributions and income.

The two main types of Charitable Remainder Unitrusts (CRUT) are the standard CRUT and the net income CRUT (NICRUT). While the standard CRUT pays a fixed percentage of the trust’s assets, the NICRUT only pays out if the trust generates income, which can be beneficial in certain situations. Understanding the differences helps you choose the right arrangement for your financial picture, especially when opting for an Idaho Charitable Remainder Inter Vivos Unitrust Agreement.

Setting up a Charitable Remainder Unitrust (CRUT) typically involves drafting a trust document that outlines the terms of the agreement, including the payout percentage and the beneficiary charities. You can work with a legal professional or estate planner who specializes in charitable trusts to ensure compliance with Idaho laws. An Idaho Charitable Remainder Inter Vivos Unitrust Agreement can be facilitated easily through platforms like USLegalForms, making the process smooth and efficient.

The payout from a charitable remainder unitrust typically ranges between 5% and 7% of the trust's value, based on the terms specified in the trust agreement. For an Idaho Charitable Remainder Inter Vivos Unitrust Agreement, the specific percentage can be tailored to meet your financial needs and charitable goals. This means you can plan your income to match your lifestyle while supporting charitable causes you care about.

A charitable remainder trust can either be an annuity trust, which pays a fixed amount each year, or a unitrust, which pays a percentage of the trust's assets that is valued annually. The Idaho Charitable Remainder Inter Vivos Unitrust Agreement specifically refers to the unitrust version, ensuring that your income potentially increases as the trust’s investments grow. This flexibility makes unitrusts an attractive option for managing your charitable giving.

A Charitable Remainder Trust (CRT) provides income to the donor during their life with the remainder going to charity, while a Charitable Lead Trust (CLT) distributes income to charity first, passing the remainder to the donor's beneficiaries later. The Idaho Charitable Remainder Inter Vivos Unitrust Agreement fits the CRT model, allowing you to manage assets effectively while supporting charitable causes. Choosing between these trusts depends on your financial goals and charitable intentions.