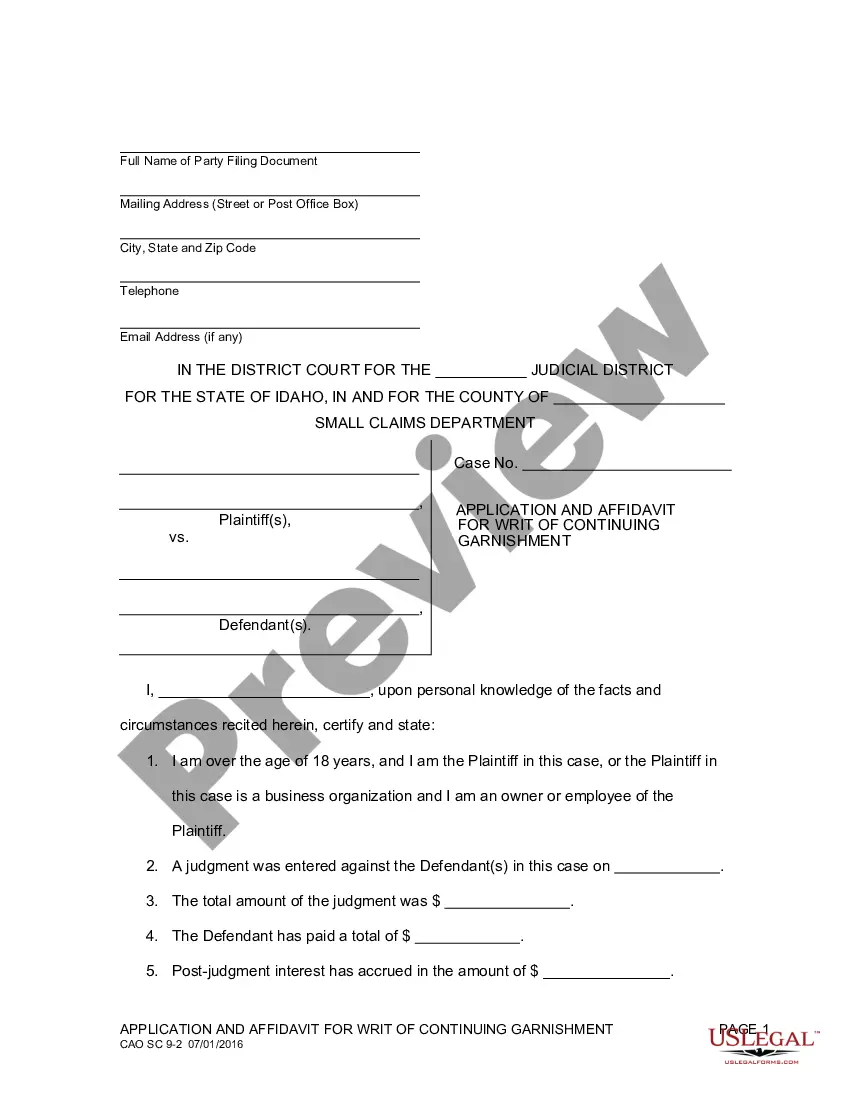

Idaho Writ of Continuing Garnishment Not Small Claims is a legal process in which a creditor can collect a debt from a debtor who has failed to pay a debt. This type of writ is used when a debtor has failed to pay a debt despite multiple attempts by the creditor to collect. This writ can also be used to garnish wages from the debtor. This writ is separate from a small claims court action. There are three types of Idaho Writ of Continuing Garnishment Not Small Claims: wage garnishments, bank levies, and property levies. A wage garnishment is a court order that requires an employer to withhold a certain portion of an employee’s wages and send them to the creditor. A bank levy is a court order that allows a creditor to seize funds from a debtor’s bank account. A property levy is a court order that allows the creditor to seize property from a debtor.

Idaho Writ of Continuing Garnishment Not Small Claims

Description

How to fill out Idaho Writ Of Continuing Garnishment Not Small Claims?

Handling formal documentation demands focus, precision, and the use of correctly-prepared templates. US Legal Forms has been assisting individuals across the country in doing just that for 25 years, so when you select your Idaho Writ of Continuing Garnishment Not Small Claims template from our platform, you can trust it complies with federal and state standards.

Interacting with our service is straightforward and efficient. To acquire the necessary document, all you require is an account with an active subscription. Here’s a concise guide for acquiring your Idaho Writ of Continuing Garnishment Not Small Claims in just a few minutes.

All documents are designed for multiple uses, like the Idaho Writ of Continuing Garnishment Not Small Claims displayed on this page. If you need them later, you can fill them out again without additional payment - simply access the My documents section in your profile and finalize your document whenever you require it. Experience US Legal Forms and prepare your business and personal documentation promptly and in complete legal adherence!

- Ensure to carefully review the form's content and its alignment with general and legal standards by previewing it or examining its description.

- Look for an alternative formal template if the one you initially opened does not fit your circumstances or state regulations (the link for that is in the upper corner of the page).

- Log in to your account and download the Idaho Writ of Continuing Garnishment Not Small Claims in your desired format. If this is your first visit to our website, click Buy now to continue.

- Create an account, select your subscription package, and complete the payment using your credit card or PayPal account.

- Choose the format you wish to receive your form in and click Download. Print the template or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

While states are free to impose stricter limits, Idaho law is the same as federal law. On a weekly basis, the garnishment can't exceed the lesser of: 25% of your disposable earnings for that week, or. the amount by which your disposable earnings for that week surpasses 30 times the federal minimum hourly wage.

For written contracts, the statute of limitations is five years. (Refer to §5-216.) For oral contracts, the statute of limitations is four years. (Refer to §5-217.)

How long does a judgment lien last in Idaho? A judgment lien in Idaho will remain attached to the debtor's property (even if the property changes hands) for five years.

Idaho and federal law protect certain wages, funds, benefits and property from being taken to pay certain types of judgments. These protected wages, funds, benefits and property are exempt from garnishment. To protect your wages, funds, benefits and property, you must file a Claim of Exemption.

(1) "Continuing garnishment" means a garnishment of wages of the judgment debtor that continues, subject to the limitations found in section 11-705, Idaho Code, until the debt is satisfied.

A creditor must collect on the debt within five years after a court issues a judgment, although a creditor can renew a judgment for additional five year periods.

How long is a mechanics lien effective in Idaho? In Idaho, all lien claimants must initiate the enforcement of the lien within 6 months from the date on which the lien was filed. Failure to meet this deadline for enforcement will result in the expiration of the lien claim.

A Judgment expires 10 years from the date of judgment if it was entered on July 1, 2015 or later, and can be renewed for 10-year periods.