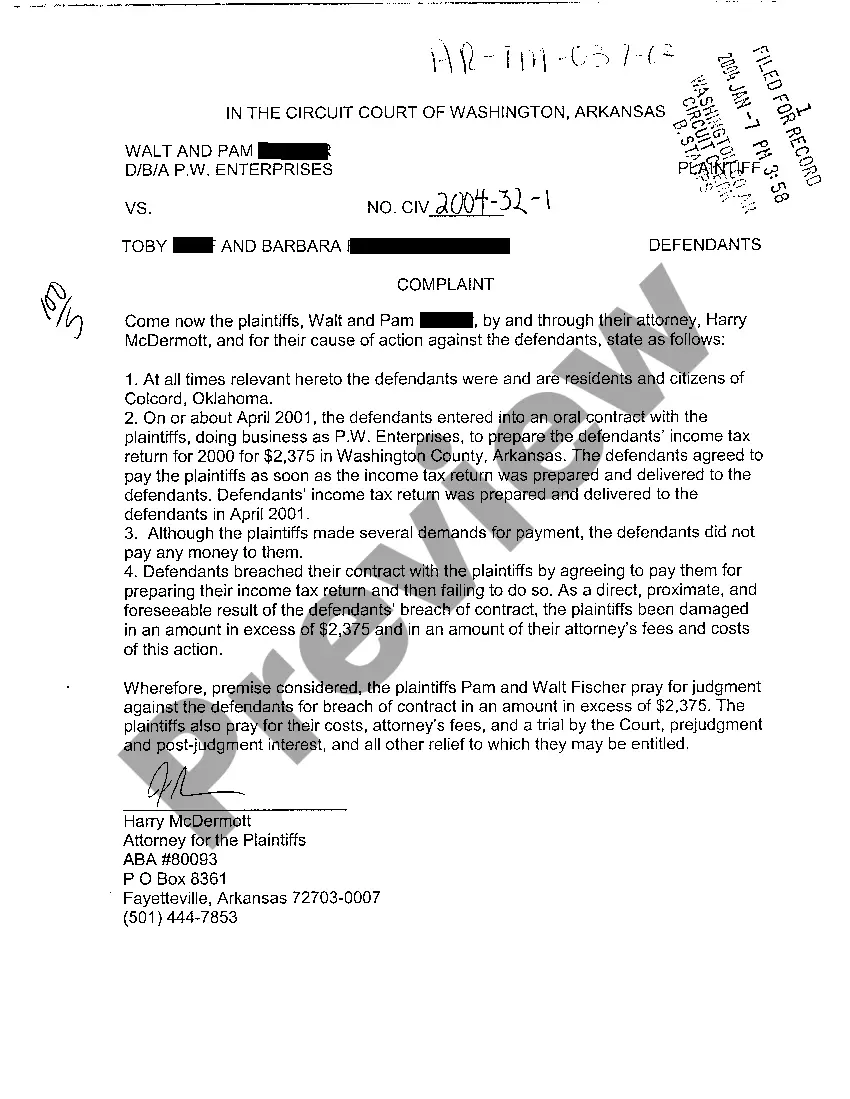

Idaho B22B — (12/10) is a type of form used by taxpayers to report their Idaho income tax withholding for the tax year. This form is specifically for employers and other entities that are required to withhold Idaho income tax from their employees or payees. The form includes details such as the employer's name, address, and Federal Identification number; the name, address, and Social Security number of the employee or payee; the amount of Idaho income tax withheld; and other relevant information. There are two types of Idaho B22B — (12/10): one for employers, and one for other withholding entities.

Idaho B22B - (12/10)

Description

How to fill out Idaho B22B - (12/10)?

Completing official documentation can be quite a hassle unless you have convenient fillable templates available. With the US Legal Forms online resource of formal paperwork, you can have confidence in the details you encounter, as all of them adhere to federal and state regulations and are reviewed by our specialists.

Acquiring your Idaho B22B - (12/10) from our collection is as straightforward as 1-2-3. Previously authorized users with a valid subscription just need to Log In and click the Download button after they locate the appropriate template. Subsequently, if necessary, users can select the same document from the My documents section of their account.

Haven't you explored US Legal Forms yet? Sign up for our service today to obtain any official document swiftly and effortlessly whenever you need it, and keep your paperwork organized!

- Document compliance confirmation. You should carefully examine the details of the form you wish to ensure it meets your requirements and complies with your state regulations. Previewing your document and reviewing its general overview will assist you in this process.

- Alternative search (optional). If you spot any discrepancies, search the library using the Search tab at the top of the page until you discover a fitting template, and click Buy Now once you identify the one you require.

- Account registration and document purchase. Create an account with US Legal Forms. After account validation, Log In and choose your optimal subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and additional usage. Choose the file format for your Idaho B22B - (12/10) and click Download to store it on your device. Print it to complete your paperwork manually, or use a feature-rich online editor to prepare an electronic version quicker and more efficiently.

Form popularity

FAQ

In Idaho, a first-time misdemeanor may lead to jail time, but it often depends on the severity of the offense. Generally, penalties can include fines, community service, or probation, rather than imprisonment. Each case is unique, so understanding the details is crucial. For help navigating misdemeanor charges, consider utilizing the resources available on US Legal Forms.

Steps for Making a Financial Power of Attorney in Idaho Create the POA Using a Statutory Form, Software, or Attorney.Sign the POA in the Presence of a Notary Public.Store the Original POA in a Safe Place.Give a Copy to Your Agent or Attorney-in-Fact.File a Copy With the Recorder's Office.

If your account filing cycle is monthly, semimonthly, quarterly, or annually, you must pay the withheld Idaho income taxes electronically or with a Form 910, Idaho Withholding Payment Voucher.

If you need to change or amend an accepted Idaho State Income Tax Return for the current or previous Tax Year, you need to complete Form 40 (residents) or Form 43 (nonresidents and part-year residents). Forms 40 and 43 are Forms used for the Tax Amendment.

An Idaho tax power of attorney, or ?Form bL375E,? is a designation that allows someone else to be able to handle a citizen's tax filing with the Idaho State Tax Commission. The taxpayer can use the fields to define the exact tax matters for which the agent will be approved to represent them.

Form 43 is the Idaho income tax return for nonresidents with income from Idaho sources.

Use Form 51 to calculate any payment due for a valid tax year 2022 extension or make estimated payments for tax year 2023 (check the appropriate year on the form). You can also use Form 51 to make payments of Qualified Investment Exemption (QIE) recapture when you don't file your income tax return by the due date.

ABE Tax Paid by Entity The election allows the pass-through entity to pay state tax at the entity level and take a federal deduction for the tax payment. This creates an Idaho credit that the entity's members can then claim against their individual income tax liability.

Form 967. Send Form 967 to us once a year. On it, you report the taxable wages and reconcile the total amount of Idaho taxes you withheld during the calendar year to the amount you paid us during the same year.