Idaho Chapter 13 Packet REVISED 12/1/2017 Fillable3,158 KB is a document containing all the required forms and instructions for filing a Chapter 13 Bankruptcy in the state of Idaho. It includes a Voluntary Petition, Statement of Financial Affairs, Summary of Schedules, Notice of Filing, Debtor's Certification, Proof of Claim Form, Plan of Reorganization, and other relevant forms. The Chapter 13 packet provides step-by-step instructions for completing each of the forms and filing the bankruptcy petition. It also contains information on how to calculate the bankruptcy payment, how to calculate the trustee fees, and other important details. The packet is fillable, meaning that the information can be entered directly into the forms. There are two versions of the packet: one for individuals and one for businesses.

Idaho Chapter 13 Packet REVISED 12/1/2017 Fillable3,158 KB

Description

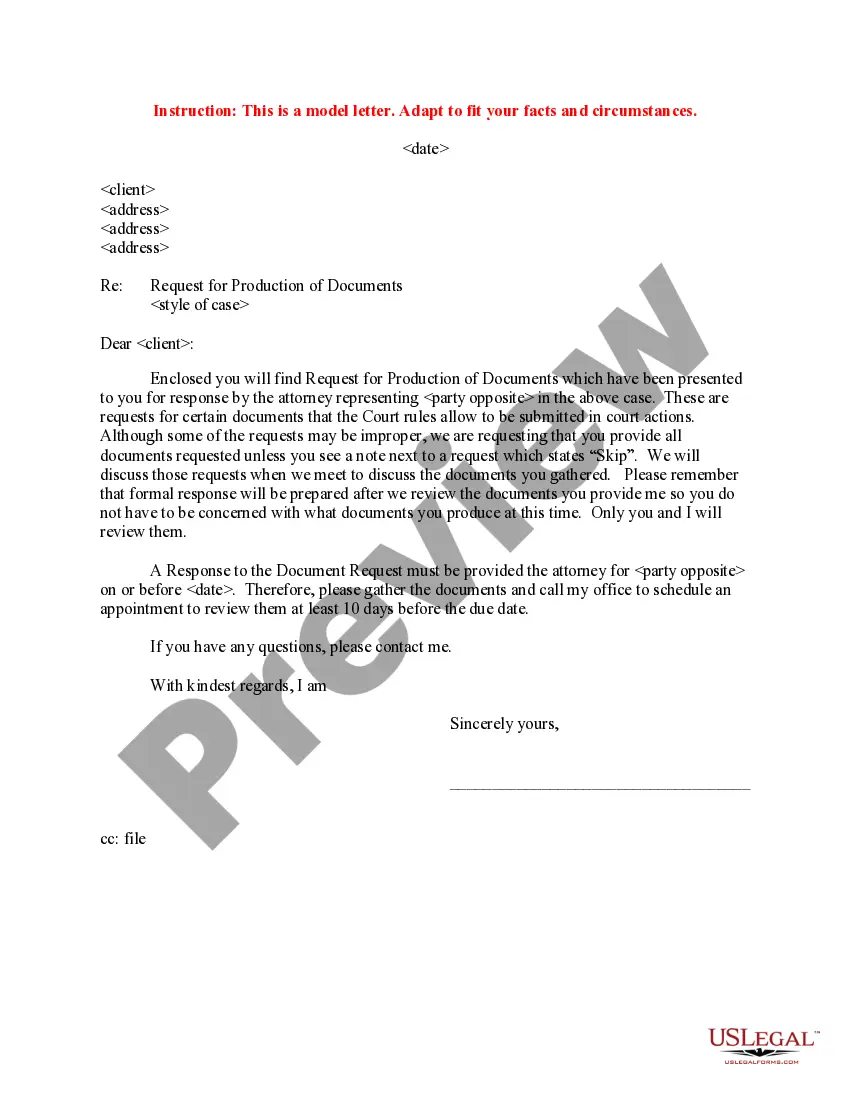

How to fill out Idaho Chapter 13 Packet REVISED 12/1/2017 Fillable3,158 KB?

US Legal Forms is the easiest and most affordable method to find appropriate legal documents.

It represents the largest online collection of business and personal legal forms created and verified by attorneys.

Here, you can discover printable and fillable forms that adhere to federal and state regulations - just like your Idaho Chapter 13 Packet REVISED 12/1/2017 Fillable3,158 KB.

- Accessing your template requires just a few straightforward steps.

- Account holders with an active subscription simply need to Log In to the platform and download the form onto their device.

- Once downloaded, it can be retrieved from their profile under the My documents section.

- And here’s how to acquire a professionally prepared Idaho Chapter 13 Packet REVISED 12/1/2017 Fillable3,158 KB if you are using US Legal Forms for the first time.

Form popularity

FAQ

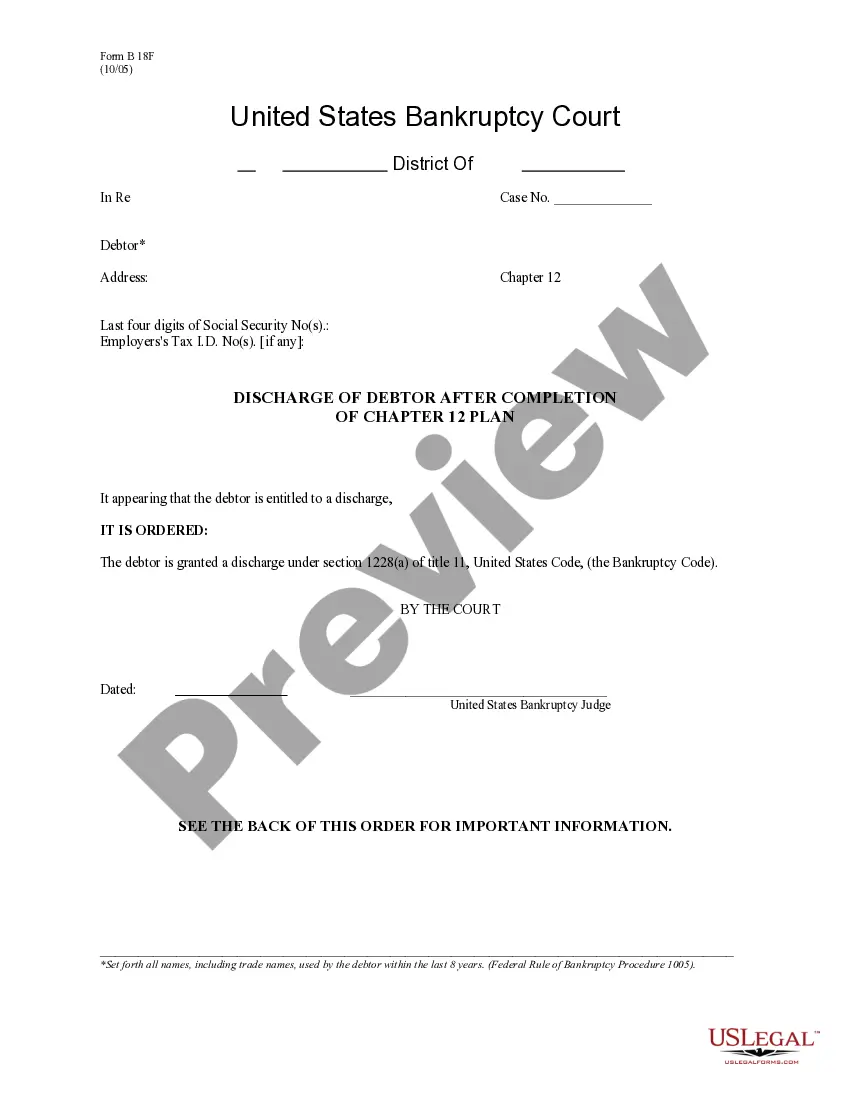

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

Chapter 13 can be useful for people with serious debts who worry about losing their homes to bankruptcy. If you adhere to your repayment plan, you'll have a new lease on financial life. Unsecured debts will be gone, but mortgages and car payments might linger.

Filing Chapter 13 Bankruptcy Chapter 13 allows debtors to repay all, or a significant portion, of their debts in 3-5 years under a court-ordered plan. The most common debts discharged in a Chapter 13 proceeding are medical bills, credit card debt and personal loans.

Any bankruptcy filing could also negatively impact your credit for some time. A Chapter 13 bankruptcy can remain on your credit report for up to 10 years, and you will lose all your credit cards. Bankruptcy also makes it nearly impossible to get a mortgage if you don't already have one.

Also do not not incur debt, use credit, credit cards, or enter into leases while in Chapter 13 without Bankruptcy Court approval, except in the case of an emergency for the protection and preservation of life, health or property. Contact your attorney if you need to sell property or incur debt.

Most Chapter 11 debtors receive a moratorium on the payment of most of their general unsecured debts for the period between the filing of the case and the confirmation of a plan. This period usually lasts for six to twelve months.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

Alabama Attorneys Counseling Individuals on Bankruptcy To file for Chapter 13, you need to file Form 122C. Entering into a debt repayment plan is a serious commitment, and it is important to consult an Alabama bankruptcy lawyer about filing for Chapter 13 in this state.