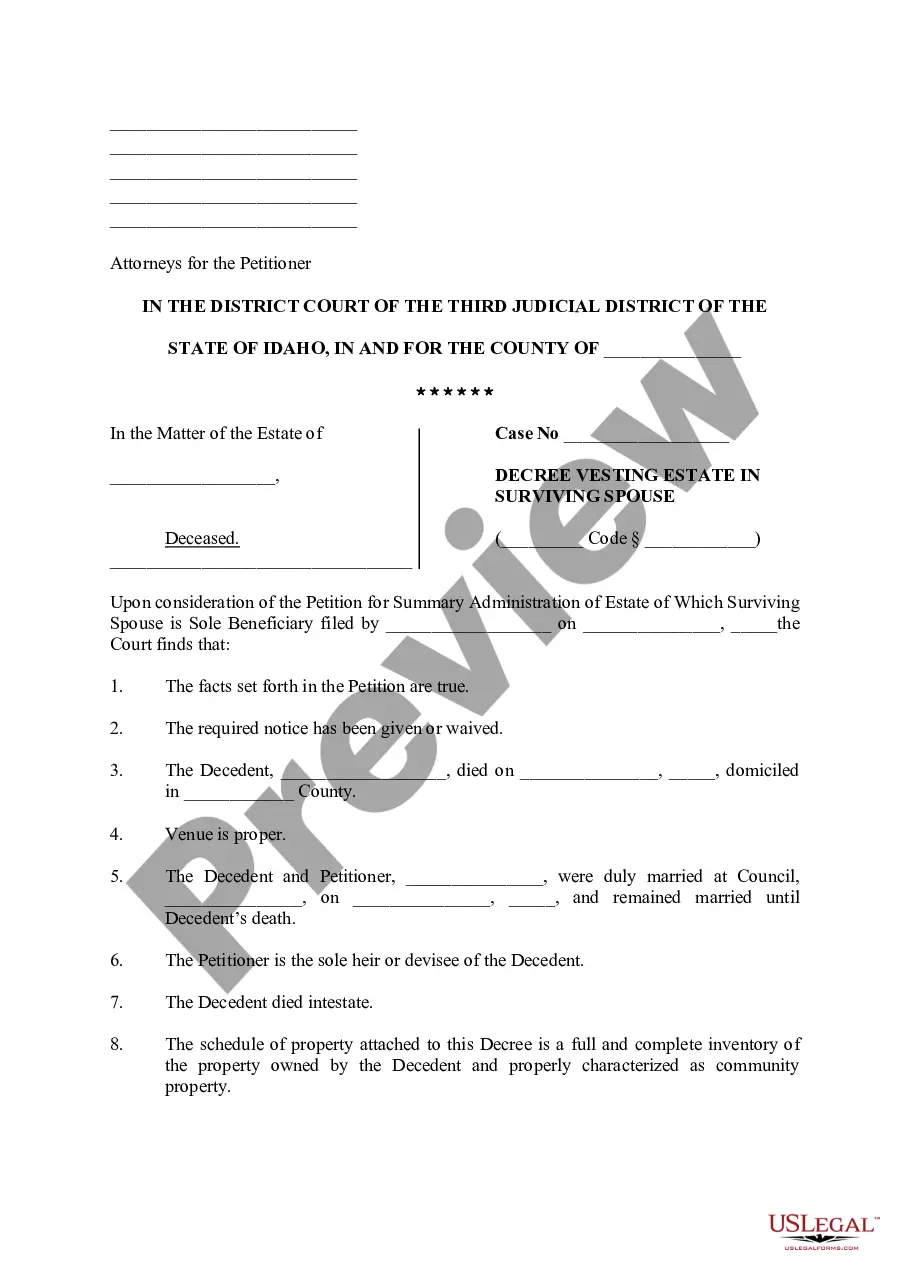

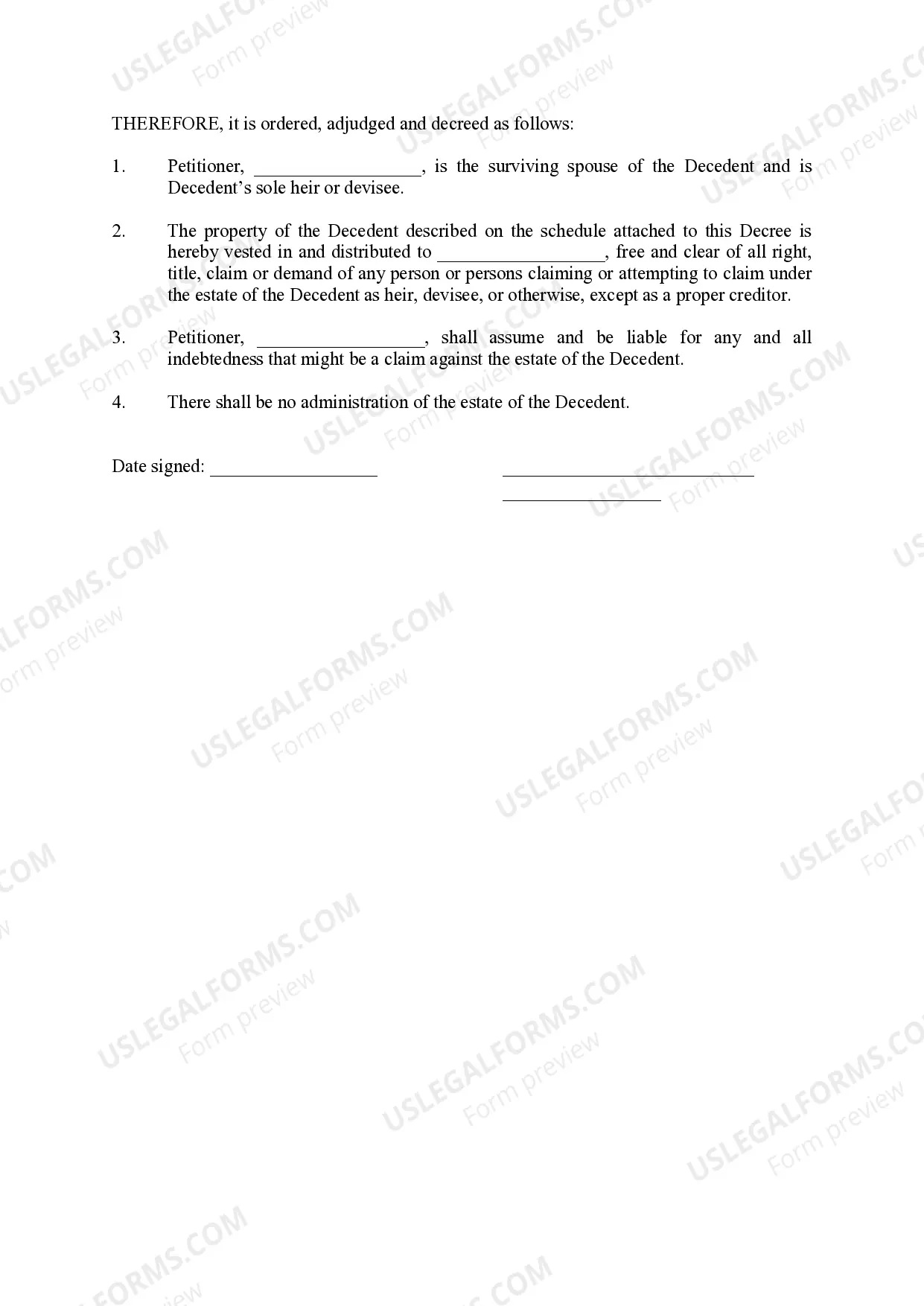

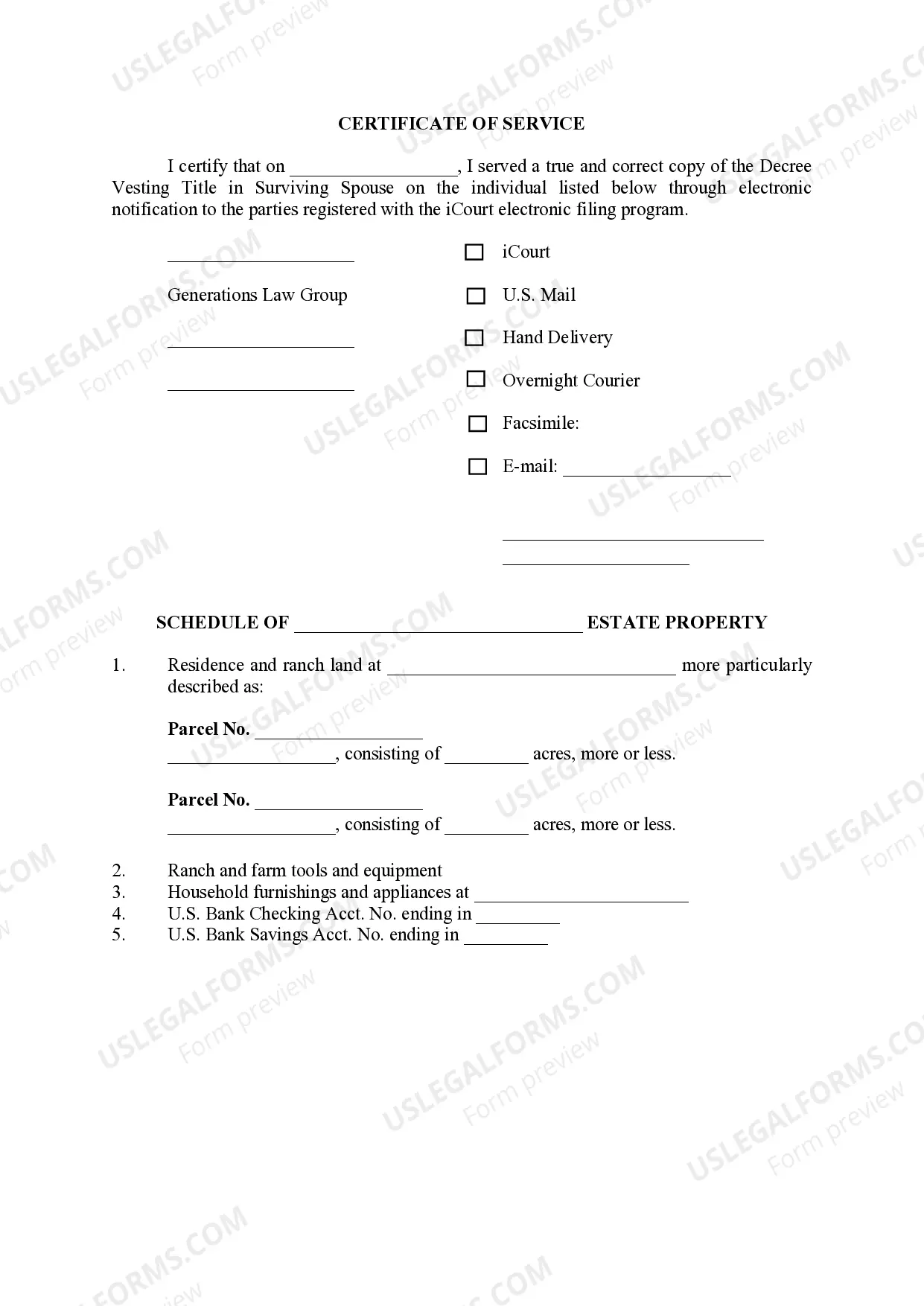

Idaho Decree Vesting Estate in Surviving Spouse

Description

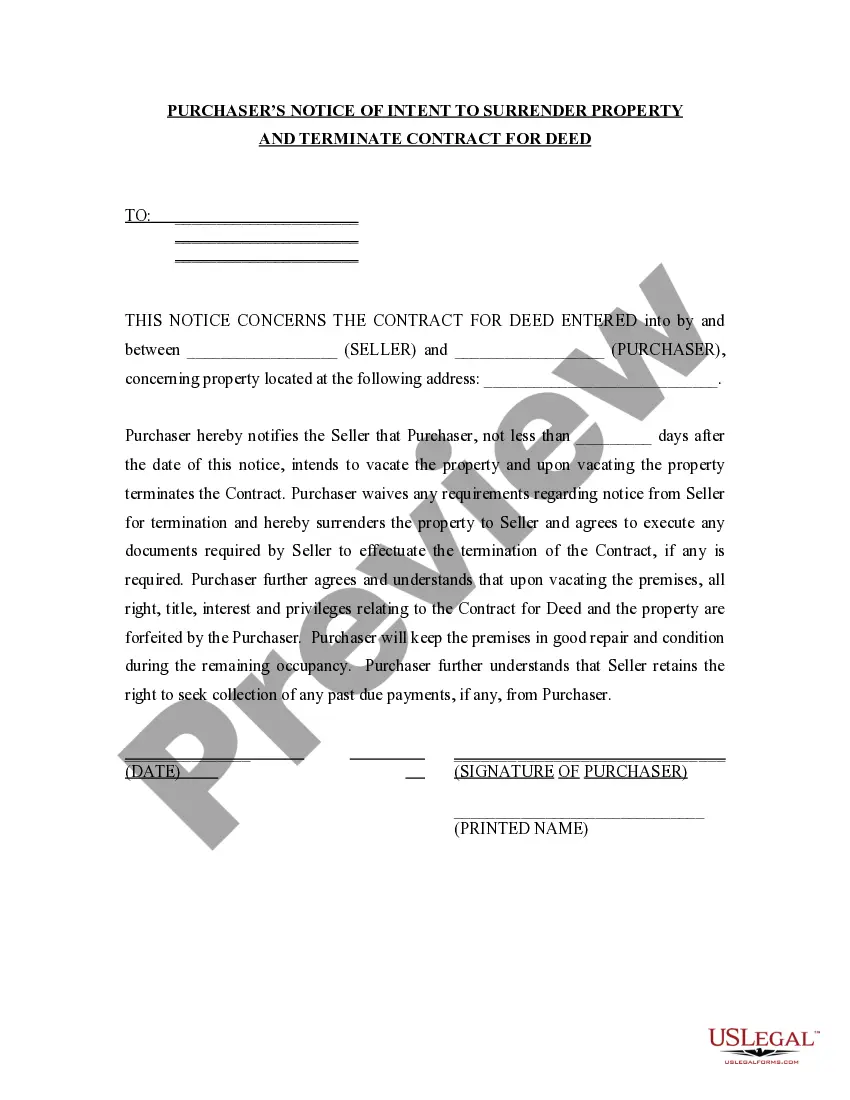

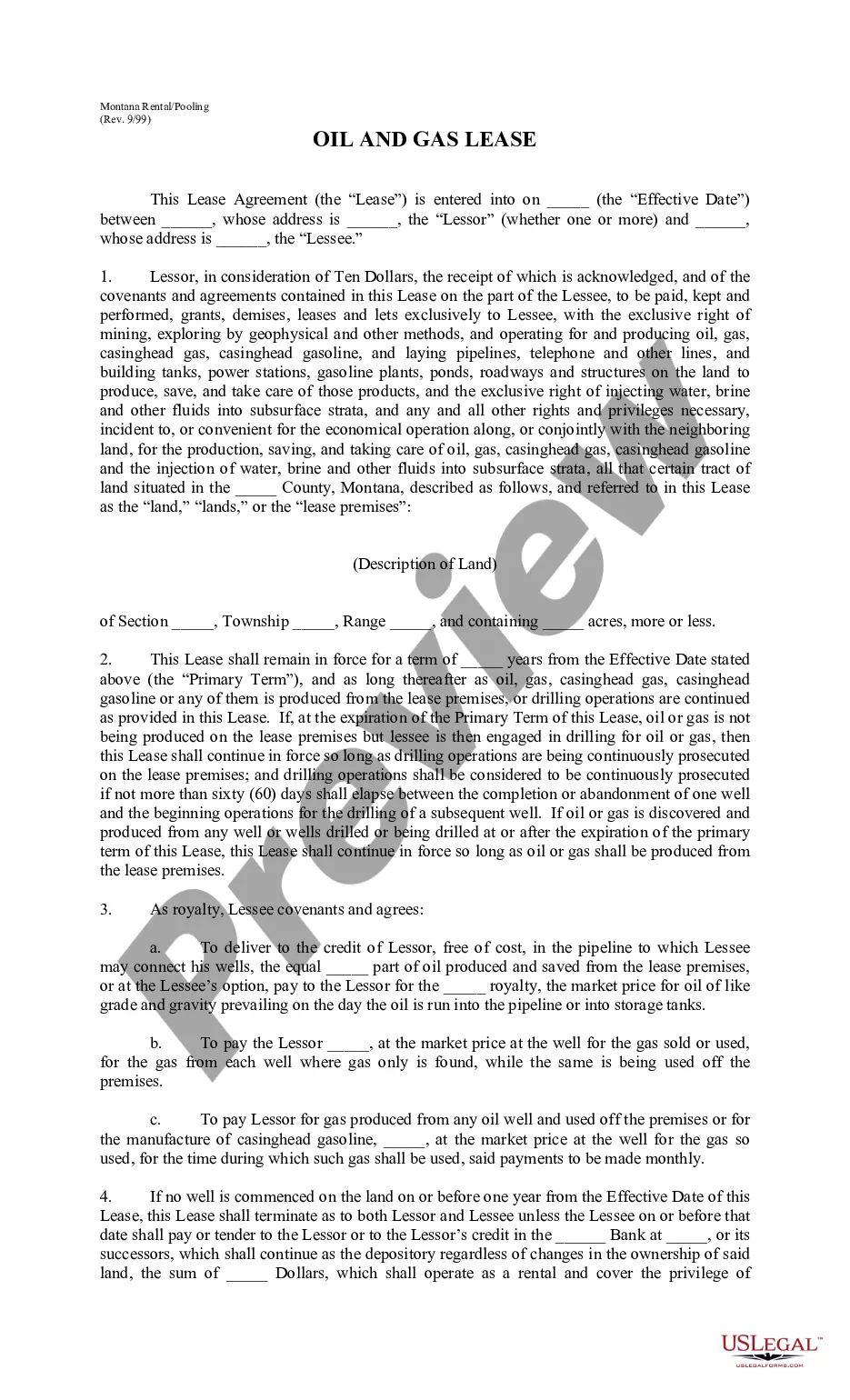

How to fill out Idaho Decree Vesting Estate In Surviving Spouse?

Utilize US Legal Forms to obtain a printable Idaho Decree Vesting Estate in Surviving Spouse.

Our court-acceptable forms are composed and frequently revised by experienced attorneys.

Ours is the most comprehensive Forms library available online and offers reasonably priced and precise templates for consumers, attorneys, and small to medium-sized businesses.

Hit Buy Now if it’s the form you want, create your account, and make your payment using PayPal or a debit/credit card. Download the document to your device and feel free to reuse it multiple times. Use the Search feature if you need to locate another document template. US Legal Forms provides numerous legal and tax templates and packages suitable for business and personal requirements, including the Idaho Decree Vesting Estate in Surviving Spouse. Over three million users have already successfully utilized our platform. Select your subscription plan and acquire high-quality forms in just a few clicks.

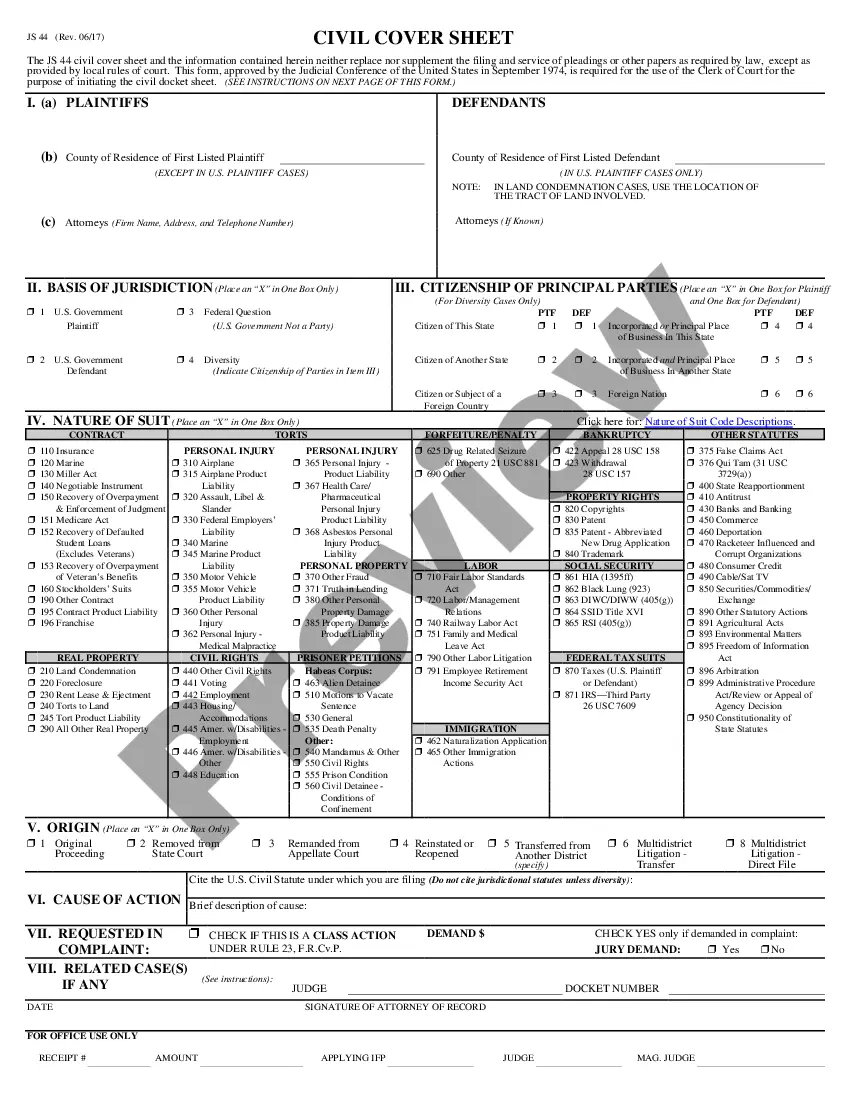

- The documents are organized into state-specific categories and some may be previewed prior to download.

- To acquire templates, users must possess a subscription and Log In to their account.

- Click Download next to any form you require and access it in My documents.

- For those without a subscription, follow these steps to easily locate and download the Idaho Decree Vesting Estate in Surviving Spouse.

- Ensure you have the correct template for the state in which it is required.

- Examine the document by reviewing the description and utilizing the Preview option.

Form popularity

FAQ

The surviving spouse has the right to Family Exempt Property.The surviving spouse has the right to receive Letters of Administration, which means that ahead of all other family members, he/she has the right to serve as the Administrator when someone dies intestate.

The Spouse Is the Automatic Beneficiary for Married People A federal law, the Employee Retirement Income Security Act (ERISA), governs most pensions and retirement accounts.

If you die without a will or the person named in the will can't serve as executor, the probate court will choose an executor. State law dictates who has priority to serve. The surviving spouse usually has first priority, followed by children. If there is no spouse or children, then other family members may be chosen.

The surviving spouse has the right to Family Exempt Property.The surviving spouse has the right to receive Letters of Administration, which means that ahead of all other family members, he/she has the right to serve as the Administrator when someone dies intestate.

Non-UPC Elective Share RightsThe remaining 21 states only allow a disinherited spouse to take a portion of the deceased spouse's probate estate. As a result, in these 21 states, the deceased spouse can completely disinherit the surviving spouse by leaving no assets that require probate.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

This law states that no matter what your will says, your spouse has a right to inherit one-third or one-half (depending on the state and sometimes depending on the length of the marriage) of your total estate. To exercise this right, your spouse has to petition the probate court to enforce the law.

Most married couples own most of their assets jointly. Assets owned jointly between husband and wife pass automatically to the survivor.This requires the will to be probated and an executor to be appointed in order to secure the assets. There are exceptions to the probate requirement for estates of $50,000 or less.