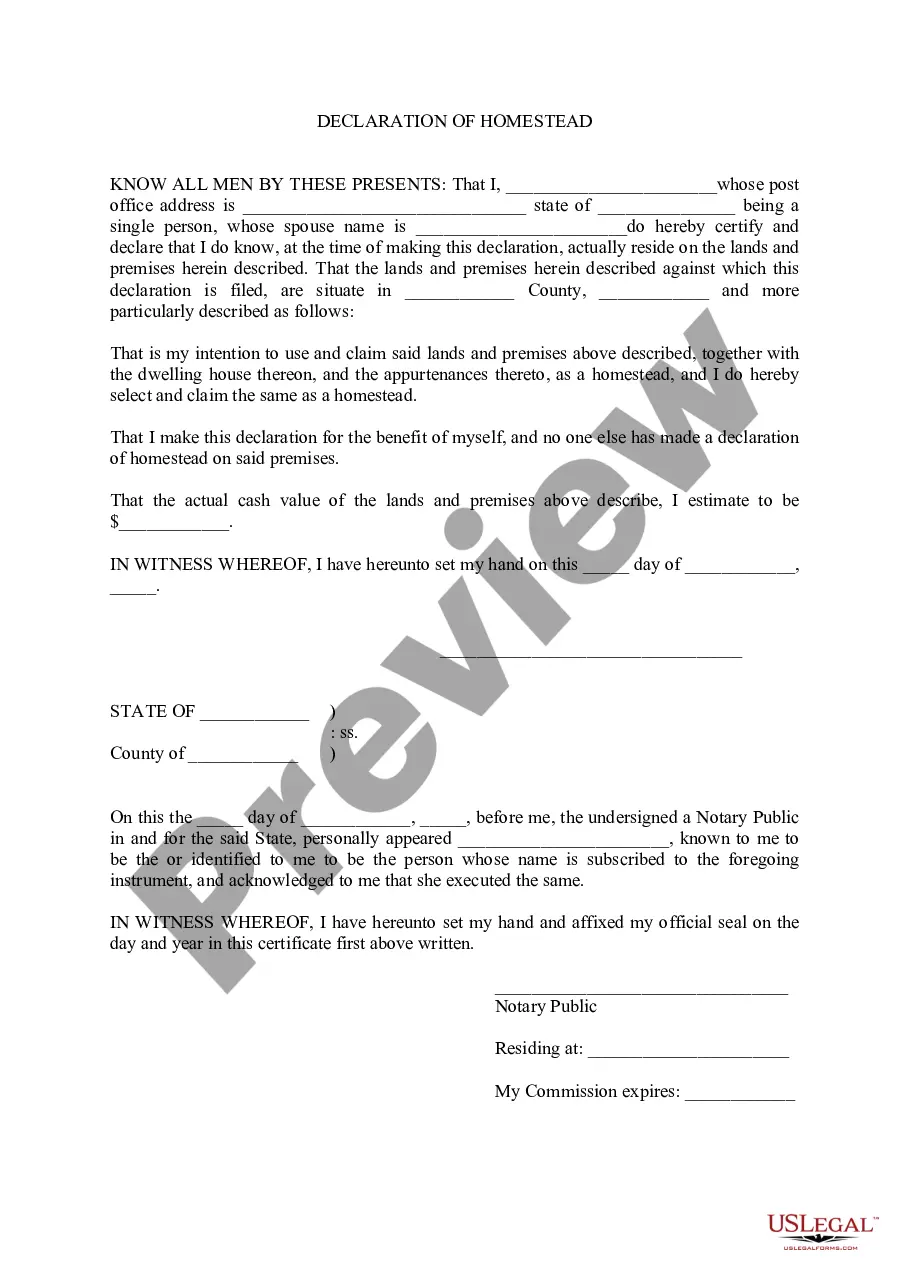

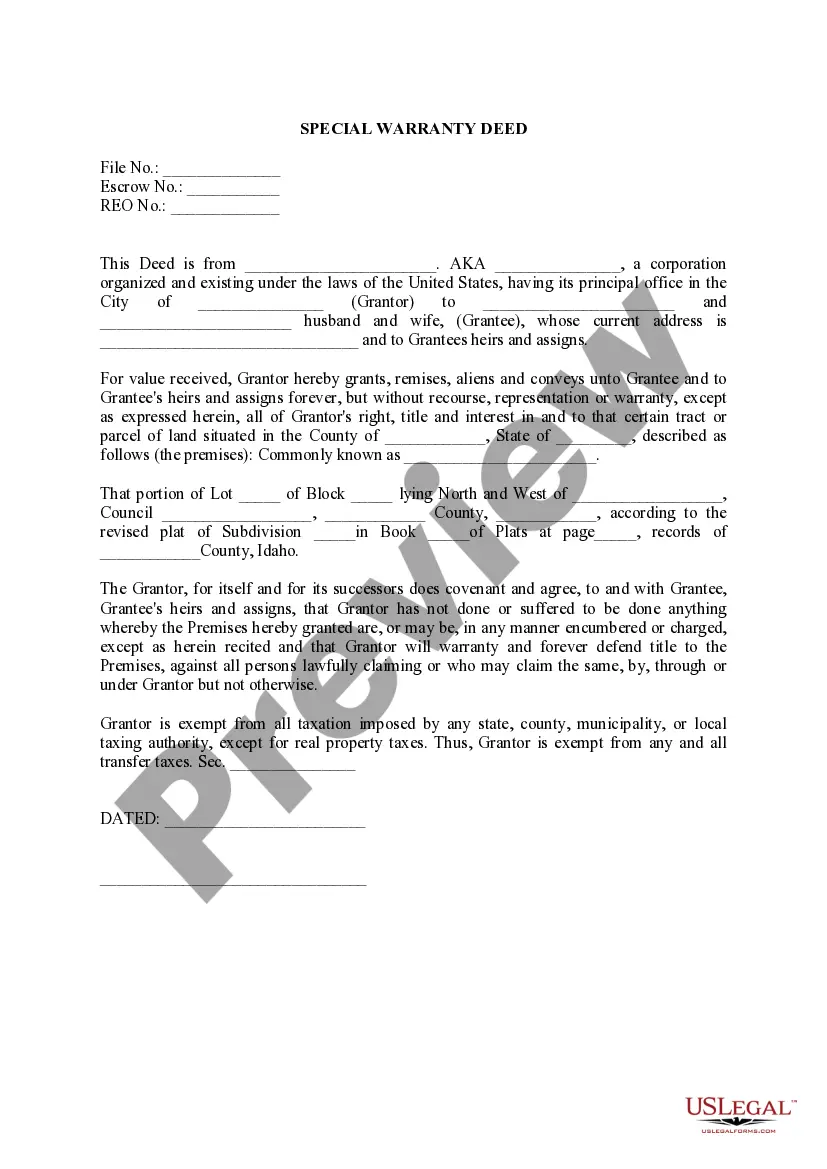

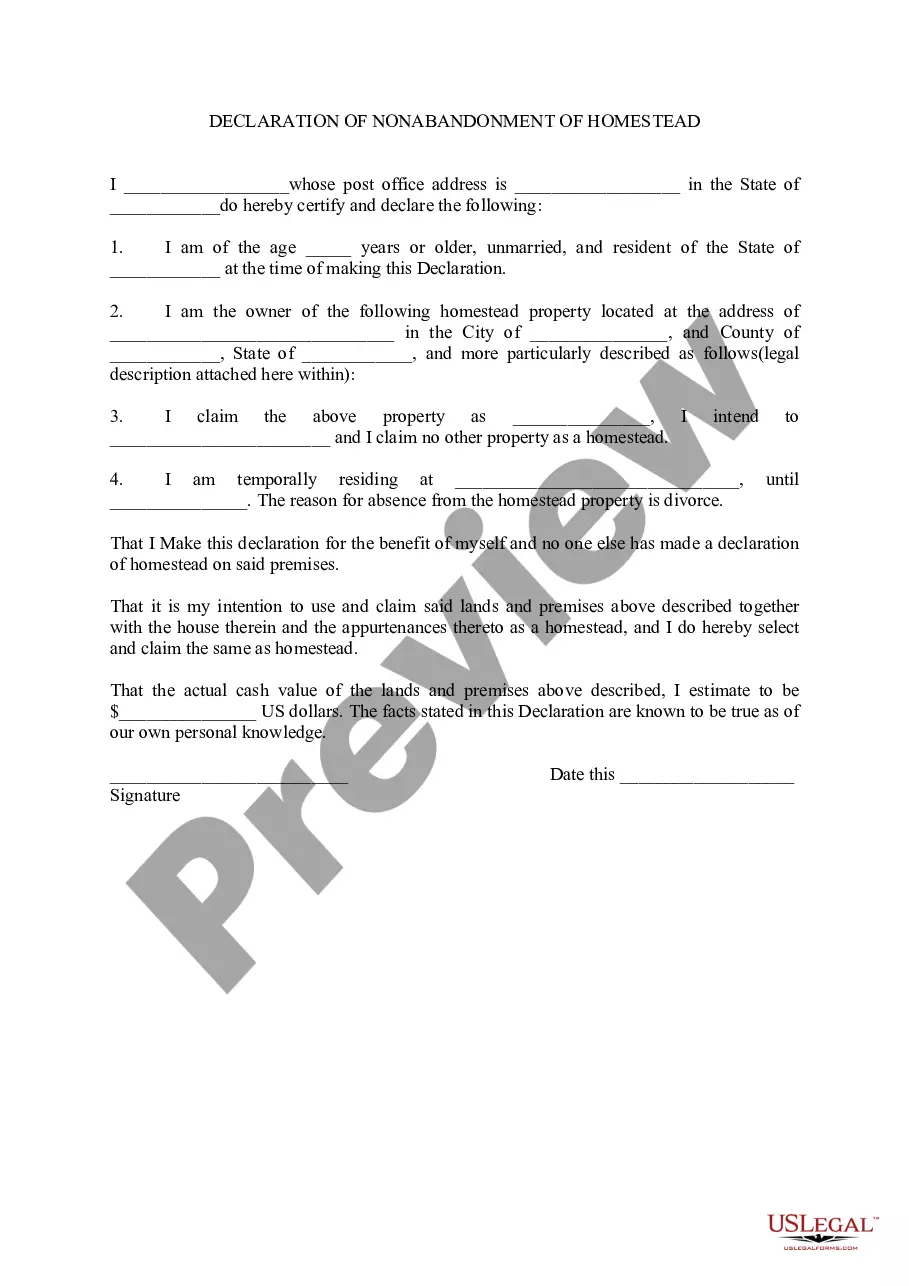

Idaho Declaration of Homestead

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Declaration Of Homestead?

Utilize US Legal Forms to obtain a printable Idaho Declaration of Homestead.

Our legally admissible documents are crafted and updated frequently by expert attorneys.

Ours is the most extensive collection of forms available on the internet, providing reasonably priced and precise templates for consumers, legal practitioners, and small to medium-sized businesses.

US Legal Forms provides thousands of legal and tax templates and bundles for both business and personal requirements, including the Idaho Declaration of Homestead. Over three million users have already effectively used our platform. Choose your subscription plan and gain access to high-quality documents in just a few clicks.

- The templates are sorted into state-specific categories, and several can be previewed prior to downloading.

- To access samples, users must possess a subscription and Log In to their account.

- Hit Download next to any template you require and locate it in My documents.

- For individuals without a subscription, follow the instructions below to effortlessly find and download the Idaho Declaration of Homestead.

- Ensure that you acquire the correct form relative to the state it is required in.

- Examine the form by reviewing the description and utilizing the Preview option.

- Select Buy Now if it’s the template you are looking for.

- Create your account and complete payment through PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Employ the Search function if you need to locate another document template.

Form popularity

FAQ

A Declaration of Homestead is a way to protect your home from unsecured creditors. The Declaration of Homestead protects the equity or cash value in your home. To find out the equity you have in your home, get the fair market value of your home.

Florida Homestead Tax Exemptions for each year must be filed by March 1 unless that day falls on a Sunday. For 2020, the exemption needs to be filed by March 2, 2020, since March 1, 2020 is a Sunday.

New homeowners must file a one-time application and have an Idaho-issued driver's license or identification card to establish the home as their primary residence and qualify for the property tax exemption. The Homeowner's Exemption Application is available from the assessor's office in each county.

Filing for the Homestead Exemption can be done online. Homeowners may claim up to a $50,000 exemption on their primary residence. The first $25,000 of this exemption applies to all taxing authorities.

A valid Florida driver's license. Either a valid voter's registration or a Declaration of Domicile, reflecting the homeowner's Florida address. At least one of your automobiles must be registered in Florida.

Homestead Exemption reduces the value used to calculate property taxes by 50 percent of the home, including up to one acre of land, up to a maximum dollar amount determined by the state Legislature. Homestead Exemption is available to all Idaho property owners on their primary residence.

Basically, a homestead exemption allows a homeowner to protect the value of her principal residence from creditors and property taxes. A homestead exemption also protects a surviving spouse when the other homeowner spouse dies.

Method #2: Take Advantage of All Applicable Tax Breaks Standard homestead exemption: The home of each Georgia resident that is owner-occupied as a primary residence may be granted a $2,000 exemption from most county and school taxes. The $2,000 is deducted from the 40% assessed value of the homestead.

Declaring a homestead on your owner occupied, primary residence in California will protect some of your equity, ownership amount, from creditors in or out of bankruptcy. California also offers an automatic homestead exemption, that does not require filing a declaration.