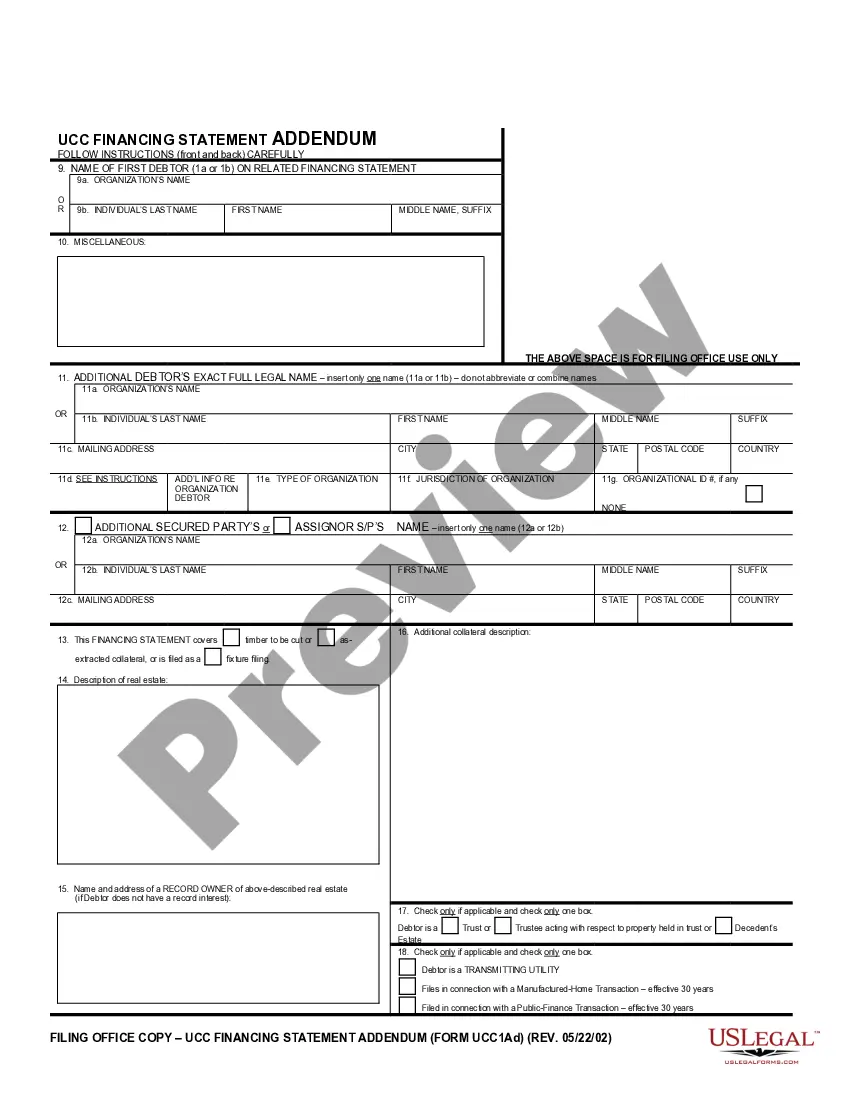

UCC3 - Financing Statement Amendment Addendum - Iowa - For use after July 1, 2001. This form is to be used as an addendum to the financing statement amendment. This form is to be filed in the real estate records.

Iowa UCC3 Financing Statement Amendment Addendum

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

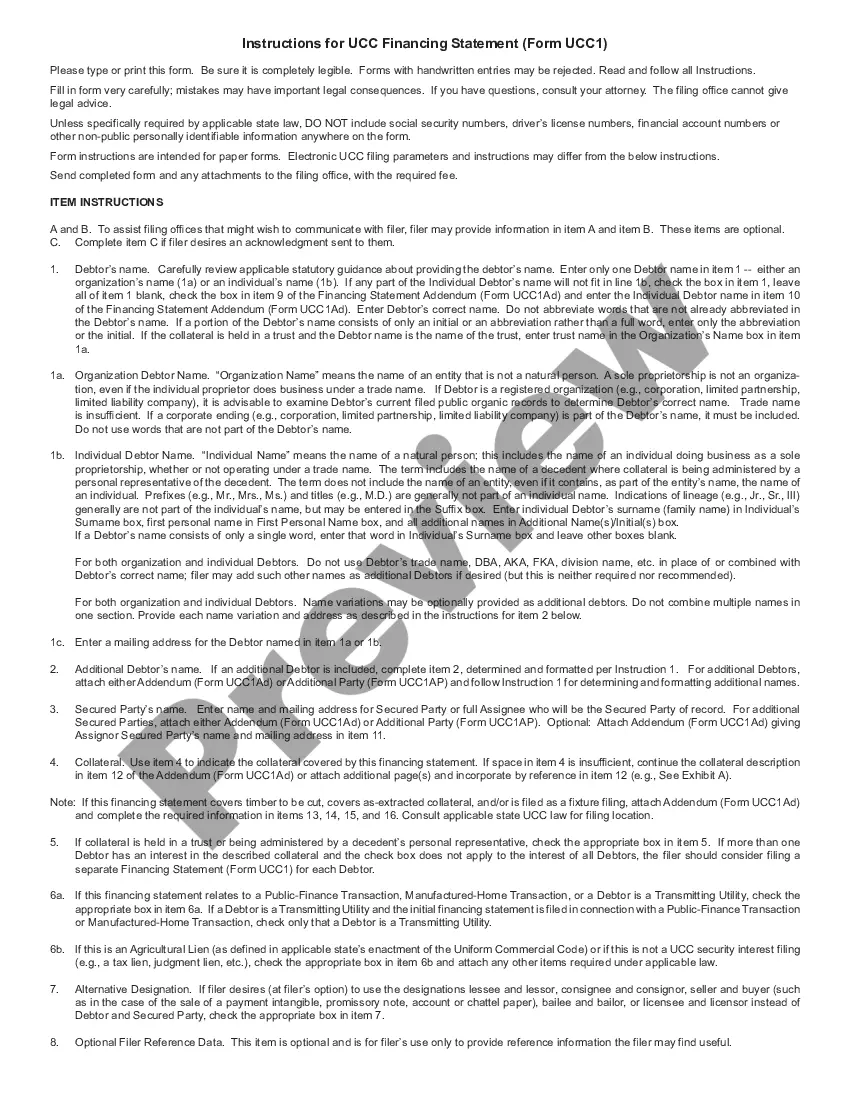

How to fill out Iowa UCC3 Financing Statement Amendment Addendum?

Obtain one of the most extensive collections of legal documents.

US Legal Forms provides a means to locate any state-specific file in just a few clicks, including Iowa UCC3 Financing Statement Amendment Addendum samples.

No need to waste your time searching for a court-acceptable sample.

Utilize the Preview feature if available to examine the document's content. If everything is accurate, click the Buy Now button. After choosing a pricing plan, set up your account. Make payment via credit card or PayPal. Download the document to your device by clicking Download. That's it! You should fill out the Iowa UCC3 Financing Statement Amendment Addendum form and proceed with it. To ensure accuracy, consult with your local legal advisor for assistance. Register and easily navigate through about 85,000 useful forms.

- Our certified professionals ensure that you receive the latest documents each time.

- To utilize the forms library, select a subscription and create an account.

- If you've already registered, simply Log In and then click Download.

- The Iowa UCC3 Financing Statement Amendment Addendum template will automatically be saved in the My documents section (a section for every document you save on US Legal Forms).

- To create a new account, refer to the straightforward instructions below.

- If you intend to use a state-specific example, be certain to specify the correct state.

- If feasible, review the description to understand all of the details of the document.

Form popularity

FAQ

True. If a financing statement is filed improperly, it can make the security interest unperfected, which may jeopardize the creditor's rights. Using the Iowa UCC3 Financing Statement Amendment Addendum can help ensure that your filings comply with the necessary requirements, thereby protecting your security interest effectively.

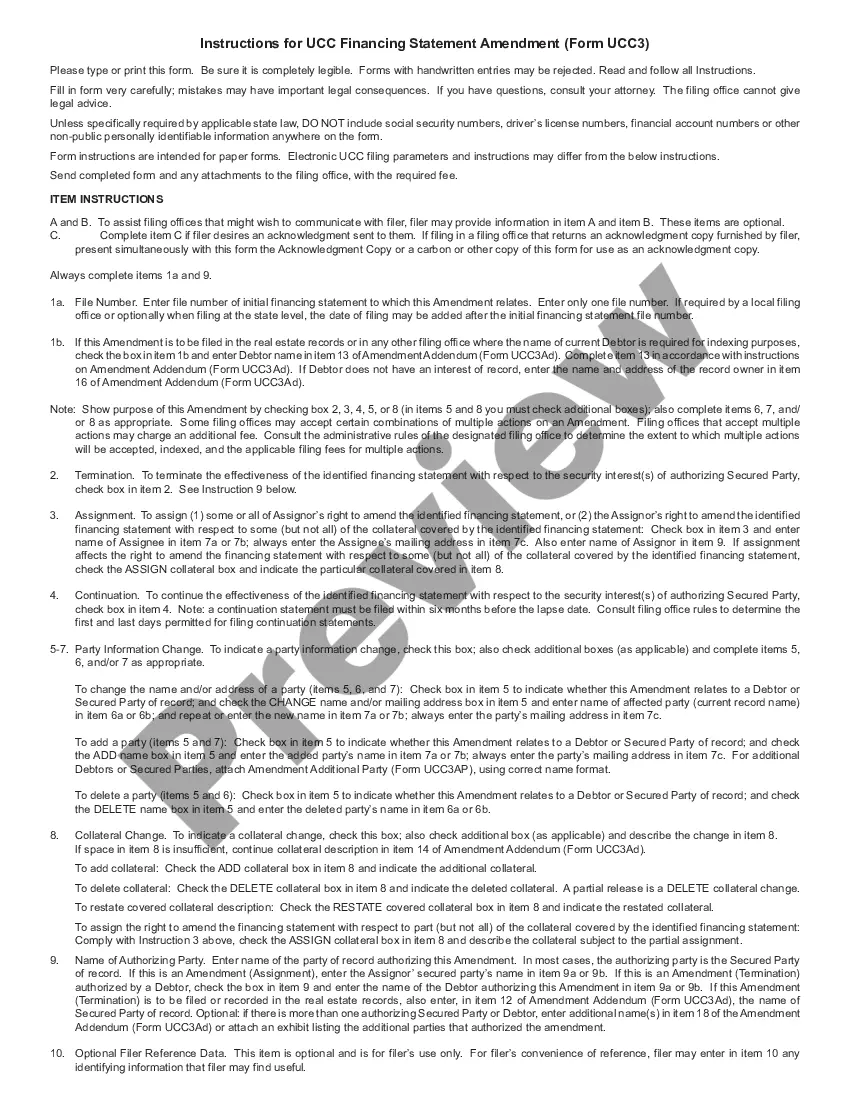

A UCC financing statement amendment is a document that modifies an existing UCC filing. It updates information regarding the debtor, creditor, or collateral, ensuring the financing statement remains accurate. Using the Iowa UCC3 Financing Statement Amendment Addendum, you can make these updates easily and maintain the effectiveness of your security interest.

Filing a UCC 3 termination requires you to complete the Iowa UCC3 Financing Statement Amendment Addendum form for terminating a statement. Include all pertinent details to ensure proper processing. You can file the completed form with the Iowa Secretary of State’s office online or by mail. Consider using the US Legal Forms platform for access to customizable templates and step-by-step instructions.

To file a UCC financing statement amendment, you need to prepare and complete the Iowa UCC3 Financing Statement Amendment Addendum form. Ensure you include all relevant information that reflects the changes you wish to make. Once filled out properly, submit the form to the Iowa Secretary of State's office, either online or by mail. For convenience, you can use the US Legal Forms platform, which provides straightforward templates and guidance to simplify the process.

A UCC filing is a legal document that secures a creditor's interest in a debtor's personal property. When a creditor files a UCC statement, it publicly alerts others about their claim on the property. The UCC provides a standard framework to streamline these filings, making them more accessible. Consider the Iowa UCC3 Financing Statement Amendment Addendum for any updates or amendments you need to make after the initial filing.

Filling out a UCC financing statement requires attention to specific details. Begin by entering the name and address of the debtor and the secured party. You will also need to provide a description of the collateral. For your convenience, consider using the Iowa UCC3 Financing Statement Amendment Addendum to ensure all necessary elements are properly included.

A UCC1 financing statement is effective for a period of five years. A record that is not continued before its lapse date will cease to be effective, costing the secured party their perfected status and perhaps their priority position to collect. Once a financing statement has lapsed, it cannot be revived.

To continue the effectiveness of a UCC-1 financing statement beyond its initial 5-year effective period, a secured party must file a Continuation. A Continuation extends the life of the financing statement for an additional five years.Each Continuation must identify, by its file number, the UCC-1 to which it relates.

Also known as a UCC-3, and, depending on the context, a UCC-3 financing statement amendment, a UCC-3 termination statement, and a UCC-3 continuation statement. Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

To assign (1) some or all of Assignor's right to amend the identified financing statement, or (2) the Assignor's right to amend the identified financing statement with respect to some (but not all) of the collateral covered by the identified financing statement: Check box in item 3 and enter name of Assignee in item 7a