This term sheet summarizes the principal terms with respect to a potential private placement of convertible preferred equity securities. It is not a legally binding document, but rather a basis for further discussions.

Iowa Convertible Preferred Equity Securities Term Sheet

Description

How to fill out Convertible Preferred Equity Securities Term Sheet?

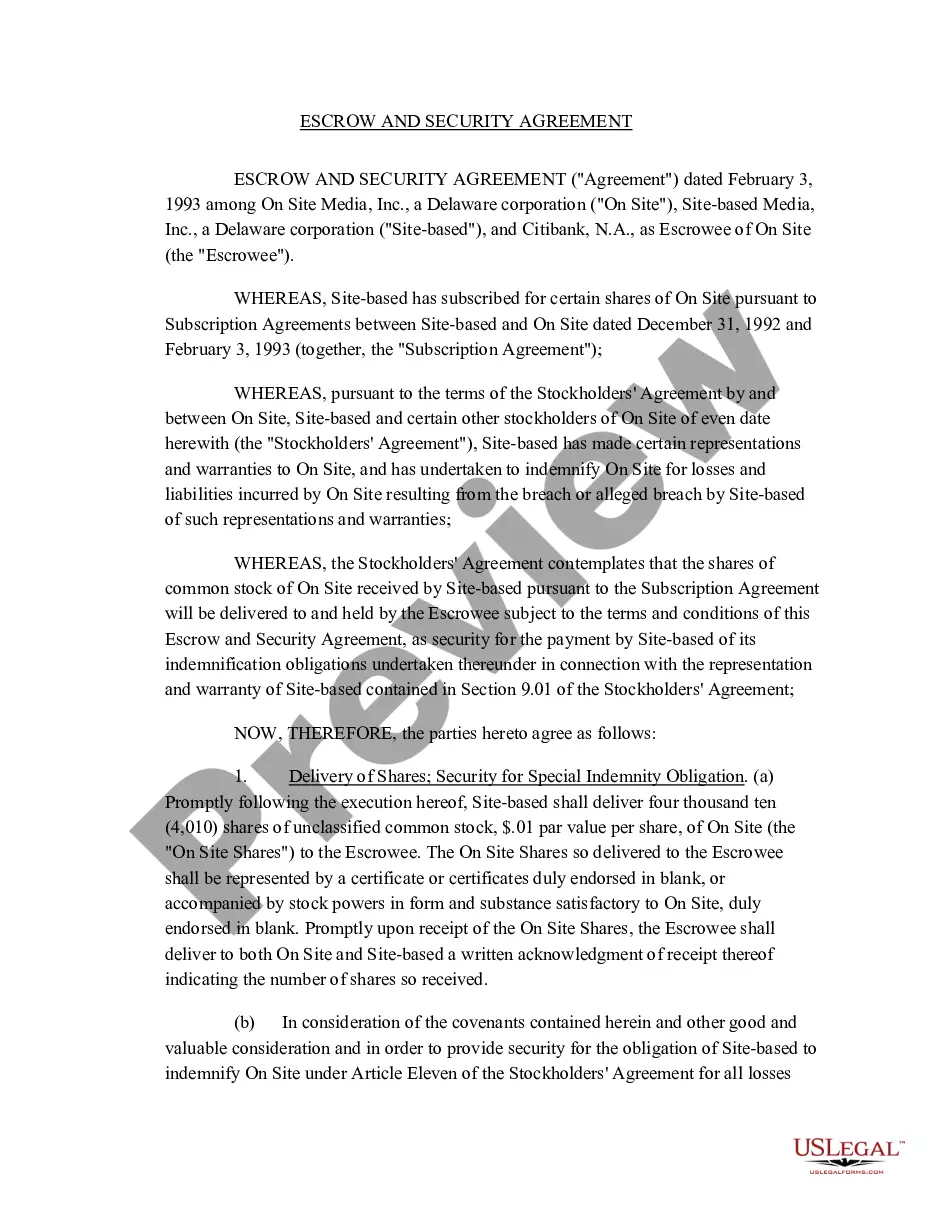

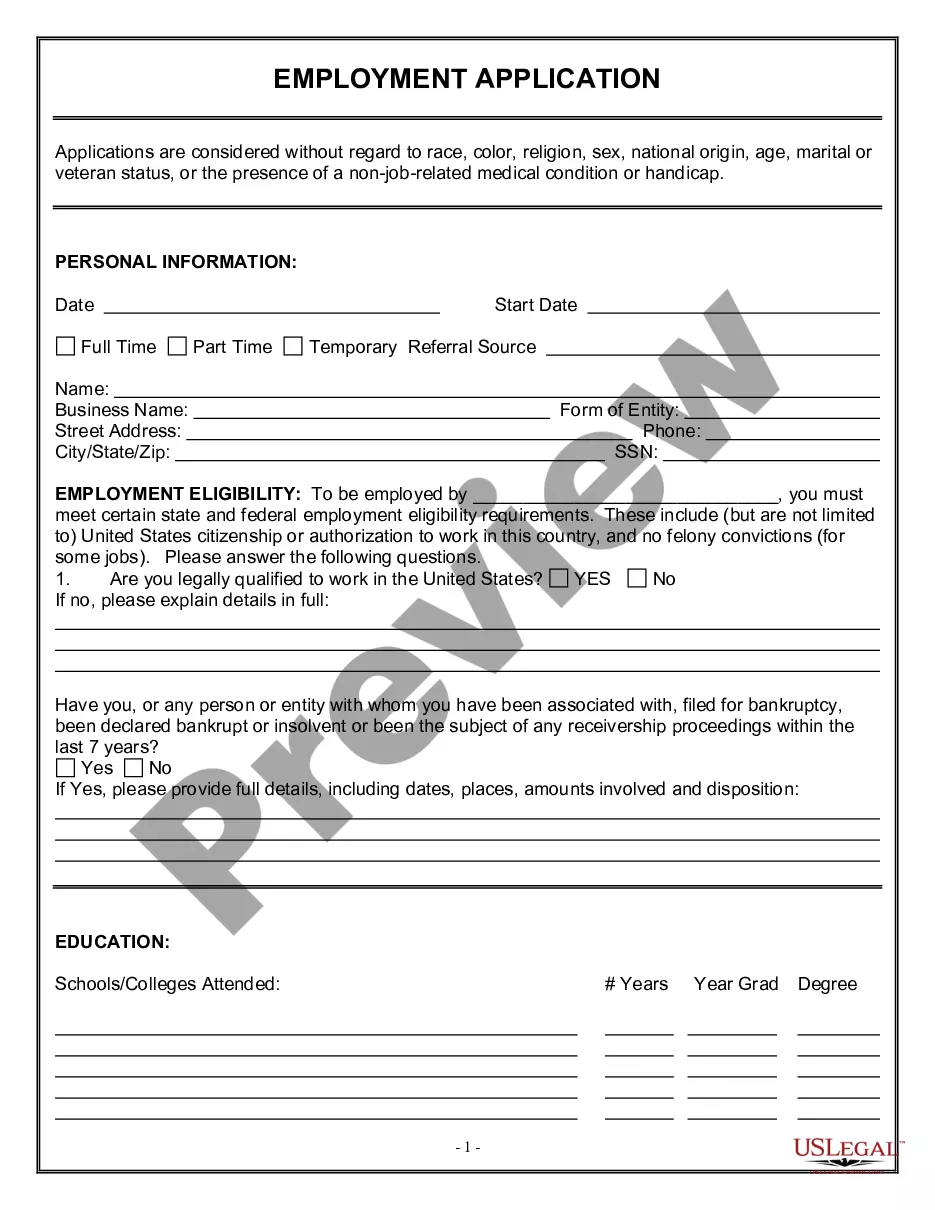

Have you been in the place the place you need to have files for possibly company or person uses nearly every working day? There are a lot of authorized document themes available on the net, but finding types you can rely is not straightforward. US Legal Forms offers thousands of kind themes, such as the Iowa Convertible Preferred Equity Securities Term Sheet, that happen to be created to meet federal and state specifications.

Should you be already knowledgeable about US Legal Forms website and possess an account, basically log in. Afterward, it is possible to obtain the Iowa Convertible Preferred Equity Securities Term Sheet format.

Unless you provide an account and want to begin using US Legal Forms, abide by these steps:

- Obtain the kind you require and make sure it is for that right city/region.

- Use the Review switch to examine the shape.

- Browse the outline to ensure that you have chosen the proper kind.

- If the kind is not what you are looking for, make use of the Research industry to get the kind that fits your needs and specifications.

- If you discover the right kind, click Purchase now.

- Choose the prices prepare you need, fill in the specified information and facts to create your money, and buy the order utilizing your PayPal or charge card.

- Select a handy file file format and obtain your version.

Discover every one of the document themes you have purchased in the My Forms food selection. You can obtain a extra version of Iowa Convertible Preferred Equity Securities Term Sheet any time, if possible. Just select the essential kind to obtain or produce the document format.

Use US Legal Forms, one of the most substantial selection of authorized varieties, to save lots of efforts and prevent blunders. The assistance offers skillfully produced authorized document themes that can be used for an array of uses. Produce an account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

The journal entry for issuing preferred stock is very similar to the one for common stock. This time Preferred Stock and Paid-in Capital in Excess of Par - Preferred Stock are credited instead of the accounts for common stock.

The preferred stock converts into a variable number of shares and the monetary value of the obligation is based solely on a fixed monetary amount (stated value) known at inception. ingly, it should be classified as a liability under the guidance in ASC 480-10-25-14a.

Convertible preferred shares can be converted into common stock at a fixed conversion ratio.

Conversion price can be calculated by dividing the convertible preferred stock's par value by the stipulated conversion ratio. Conversion premium: The dollar amount by which the market price of the convertible preferred stock exceeds the current market value of the common shares into which it may be converted.

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

A preference share that is issued on the terms that it is liable to be converted to an agreed number of ordinary shares or cash: At a certain time or on the happening of a particular event (for example, on the sale or initial public offering of the issuing company).

Redeemable convertible preference share It is liable to be redeemed by that body corporate. On redemption, the shareholder receives: an agreed cash amount; or. an agreed number of ordinary shares in the issuing body corporate.