Iowa Form of Parent Guaranty

Description

How to fill out Form Of Parent Guaranty?

US Legal Forms - one of many most significant libraries of legal types in the USA - offers a variety of legal document templates you may download or printing. Making use of the web site, you can get 1000s of types for business and person uses, sorted by groups, says, or keywords.You will discover the latest models of types like the Iowa Form of Parent Guaranty within minutes.

If you currently have a subscription, log in and download Iowa Form of Parent Guaranty through the US Legal Forms catalogue. The Download switch will appear on each type you look at. You gain access to all in the past acquired types in the My Forms tab of your respective account.

If you want to use US Legal Forms the first time, allow me to share basic directions to help you get started:

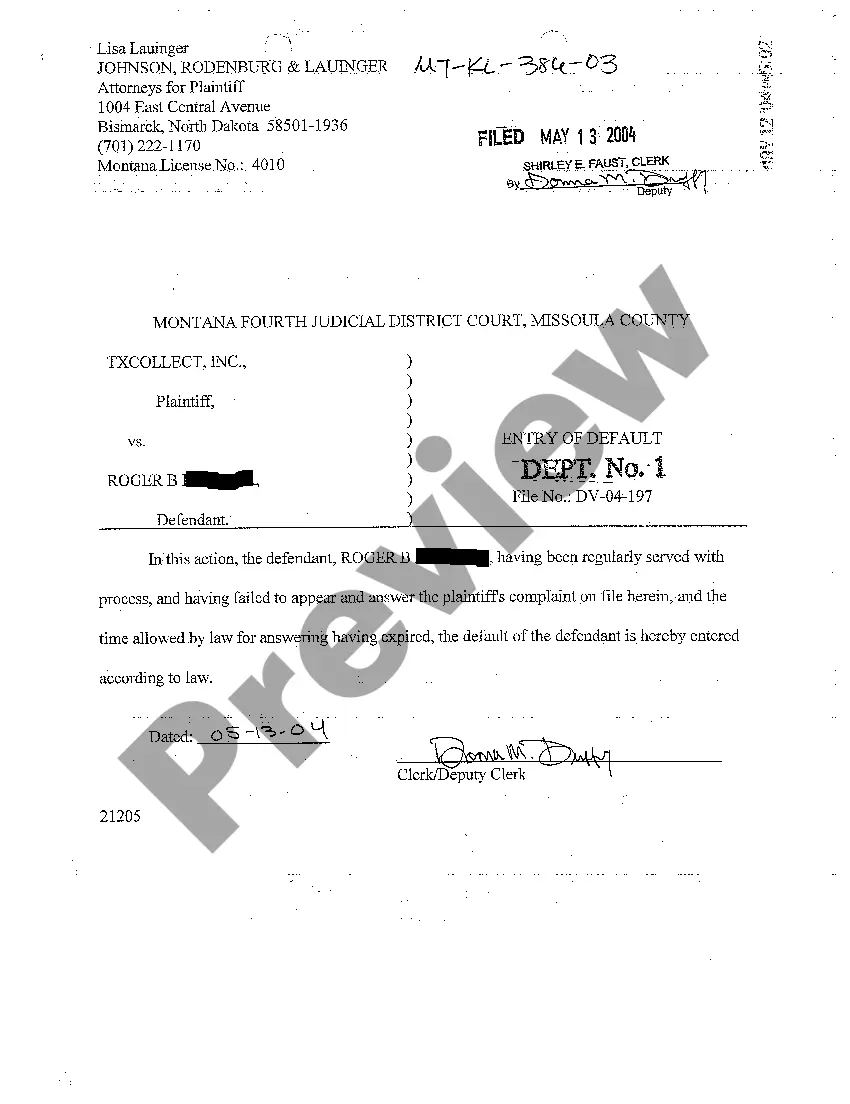

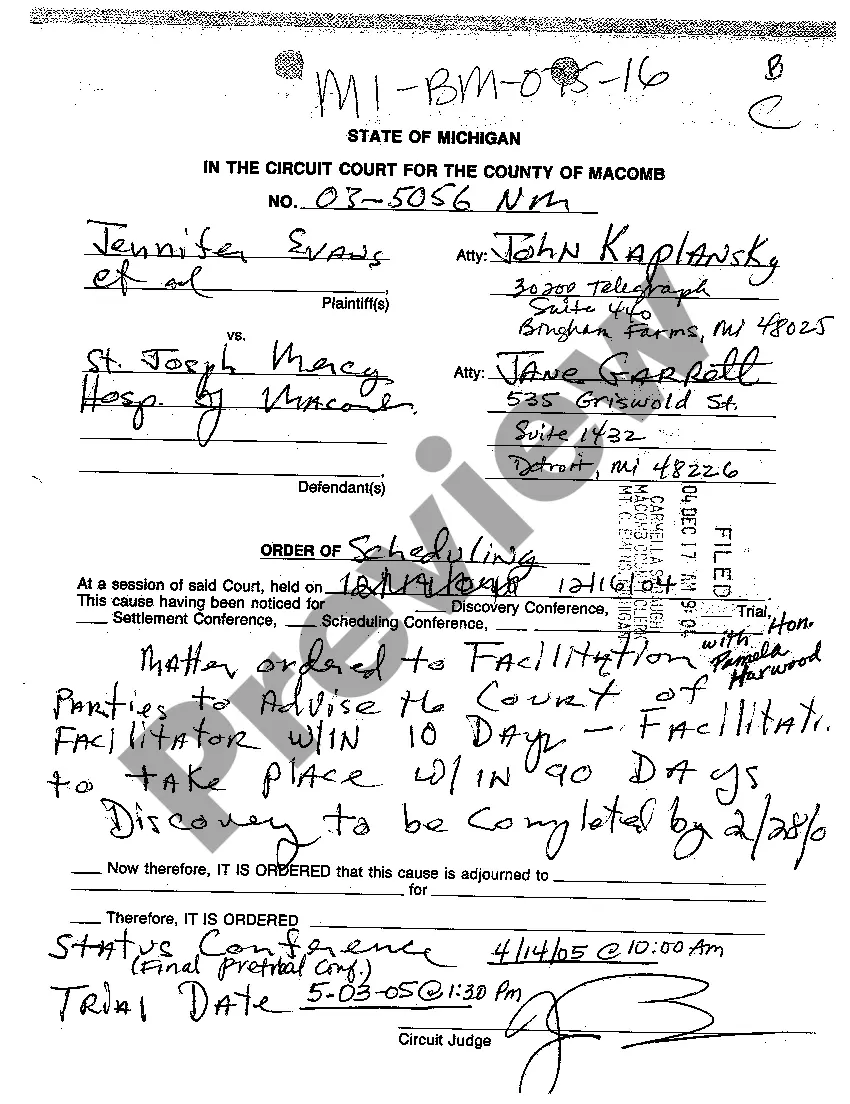

- Make sure you have selected the right type for the metropolis/county. Click the Preview switch to examine the form`s information. Browse the type explanation to actually have chosen the proper type.

- In case the type does not fit your demands, make use of the Look for area at the top of the display screen to find the the one that does.

- In case you are content with the form, confirm your choice by clicking on the Buy now switch. Then, pick the pricing plan you want and offer your qualifications to sign up for an account.

- Method the deal. Make use of your credit card or PayPal account to finish the deal.

- Find the file format and download the form in your gadget.

- Make adjustments. Fill up, revise and printing and sign the acquired Iowa Form of Parent Guaranty.

Each and every design you included with your money lacks an expiration particular date and is also your own property permanently. So, if you want to download or printing one more copy, just visit the My Forms section and then click about the type you want.

Gain access to the Iowa Form of Parent Guaranty with US Legal Forms, one of the most substantial catalogue of legal document templates. Use 1000s of skilled and state-particular templates that meet your organization or person demands and demands.

Form popularity

FAQ

A common example of a financial guarantee contract is a parent company providing a guarantee over its subsidiary's borrowings. Because these contracts transfer significant insurance risk, they typically meet the definition of an insurance contract.

In the event that the subsidiary is unable to make its loan repayments, the parent company commits to repay the loan on behalf of the subsidiary. On the other hand, an upstream guarantee is a form of guarantee in which a subsidiary guarantees its parent company's debts.

A form of guaranty whereby a parent, as guarantor, assumes the responsibility for the payment or performance of an action or obligation of its subsidiary by agreeing to compensate the beneficiary in the event of such non-payment or performance.

What is a Guaranty Of Payment? A guaranty of payment is a document that guarantees the person who signs it will pay any debts or liabilities incurred by another party. For example, this agreement can be helpful when a seller needs financial assurance from a buyer.

Traditionally, a distinction is made between: Real guarantees relating to assets having an intrinsic value. Personal guarantees involving a debt obligation for one or more people. Moral guarantees that do not provide the lender with any real legal security.

Downstream guarantee (or guaranty) is a pledge placed on a loan on behalf of the borrowing party by the borrowing party's parent company or stockholder. By guaranteeing the loan for its subsidiary company, the parent company provides assurance to the lenders that the subsidiary company will be able to repay the loan.

This is a standard short-form guaranty (also called a guarantee) for use as an ancillary agreement to a party's commercial transaction. The guarantor unconditionally guarantees the payment and performance of a party's obligations under the underlying transaction documents.

An upstream guarantee, also known as a subsidiary guarantee, is a financial guarantee in which the subsidiary guarantees its parent company's debt.