Iowa Clauses Relating to Venture IPO

Description

How to fill out Clauses Relating To Venture IPO?

Are you presently within a situation where you need to have paperwork for sometimes company or individual reasons just about every working day? There are a variety of legitimate document web templates available on the Internet, but getting versions you can rely isn`t straightforward. US Legal Forms offers thousands of type web templates, much like the Iowa Clauses Relating to Venture IPO, which are composed to fulfill federal and state needs.

When you are presently familiar with US Legal Forms internet site and get your account, merely log in. Next, you may download the Iowa Clauses Relating to Venture IPO format.

If you do not provide an account and wish to begin using US Legal Forms, follow these steps:

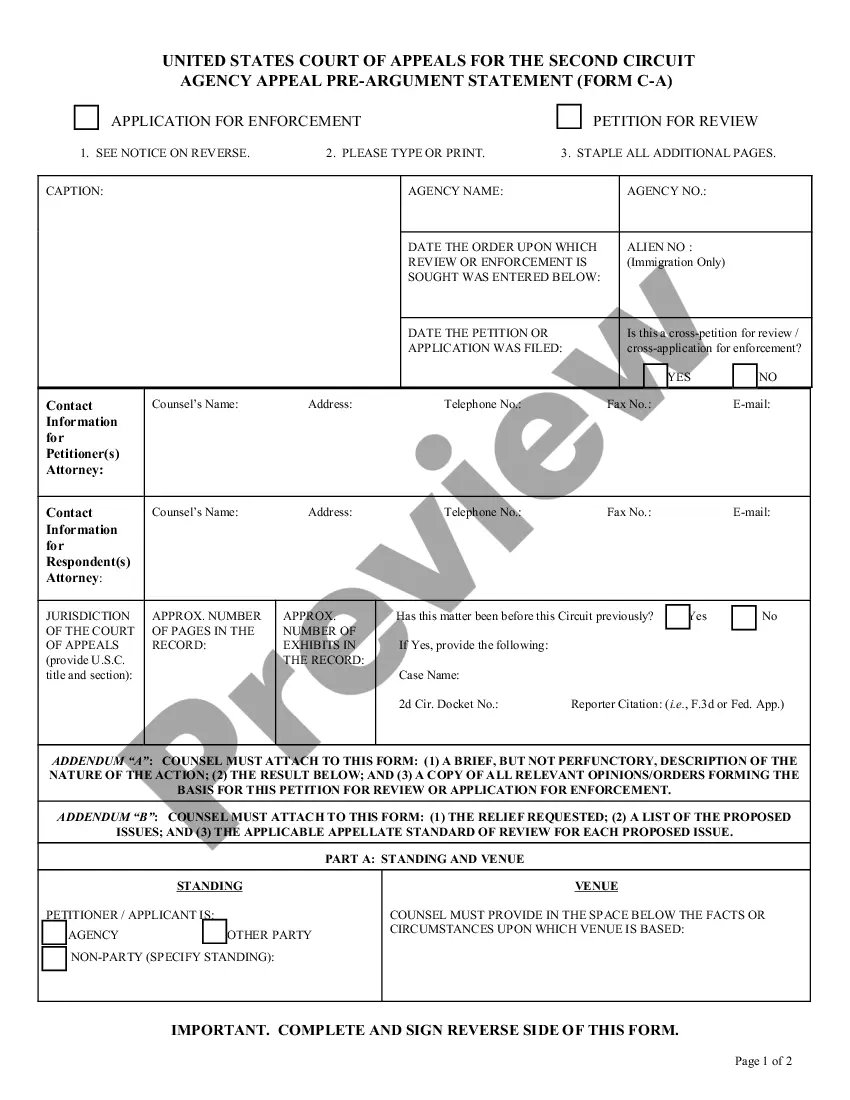

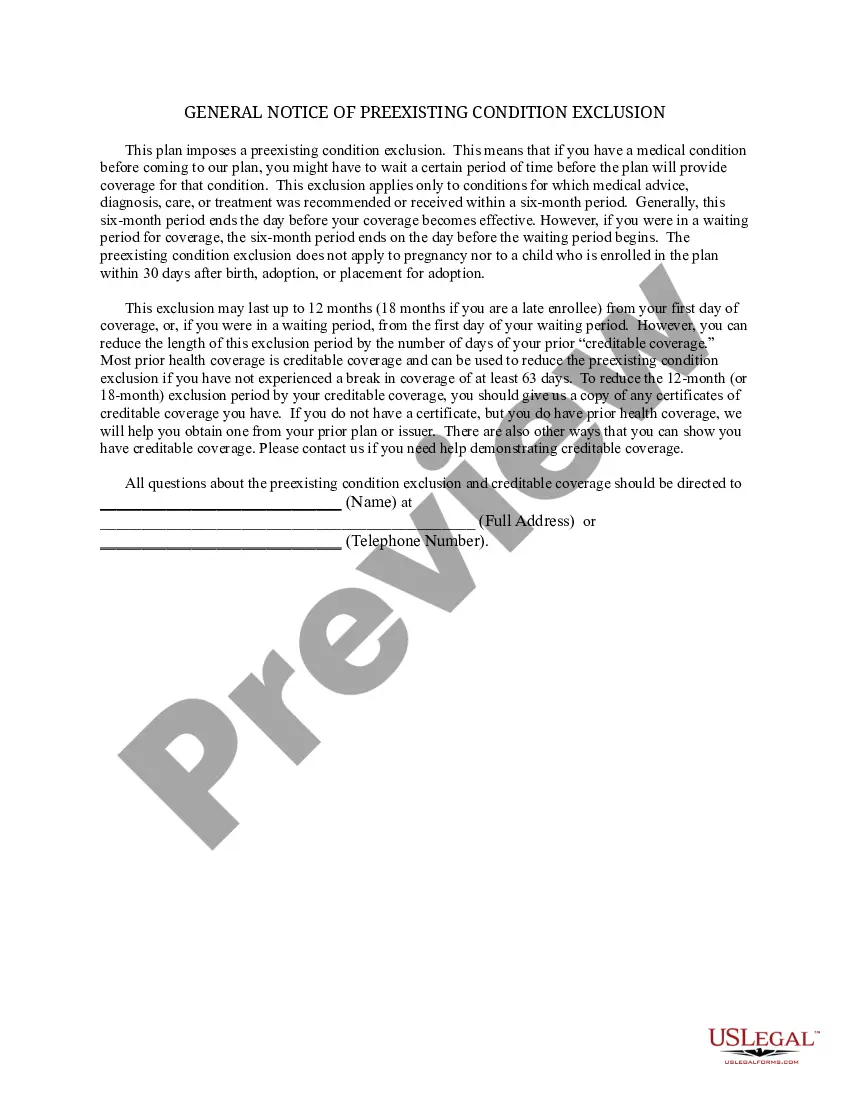

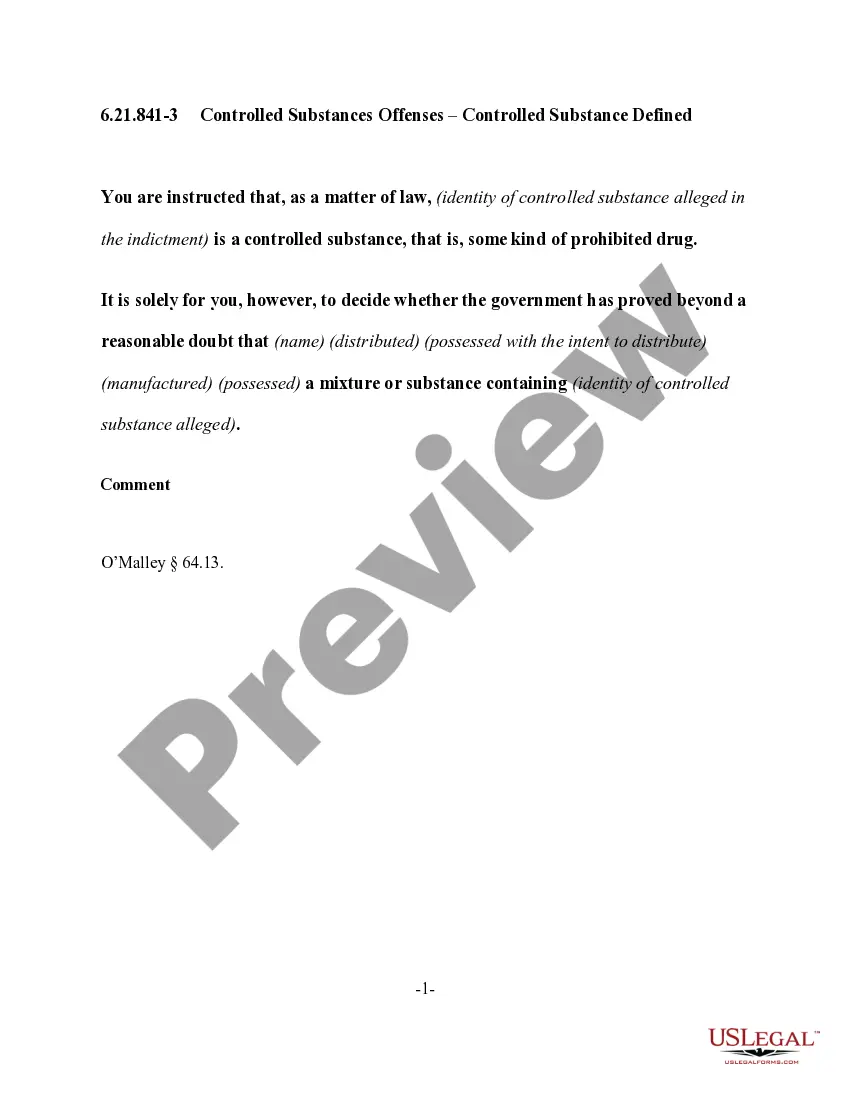

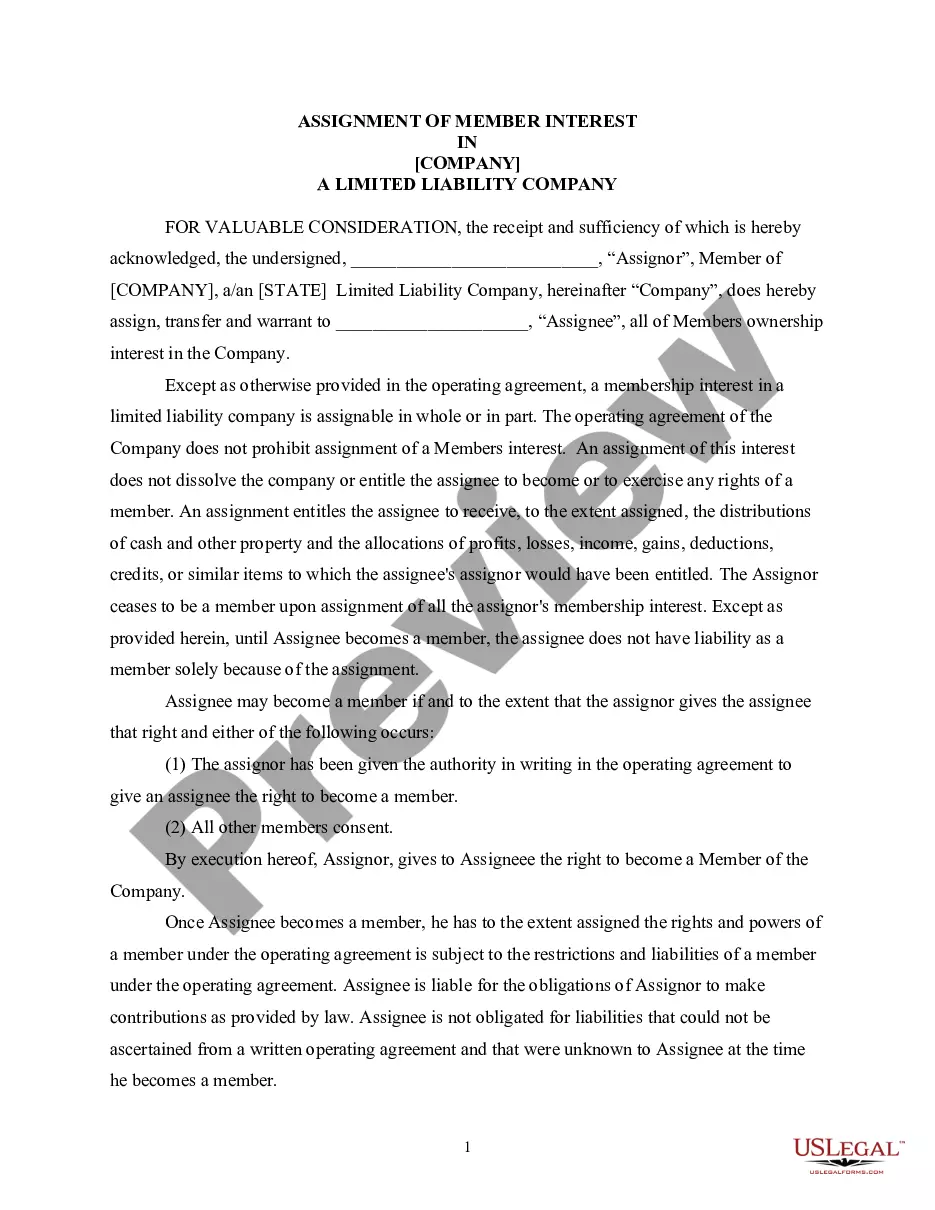

- Find the type you need and ensure it is for the appropriate city/state.

- Use the Preview switch to analyze the form.

- See the explanation to ensure that you have chosen the right type.

- If the type isn`t what you`re trying to find, make use of the Research industry to obtain the type that meets your requirements and needs.

- Once you find the appropriate type, click Acquire now.

- Choose the pricing plan you desire, fill out the required details to produce your money, and pay money for the order making use of your PayPal or credit card.

- Decide on a hassle-free data file file format and download your version.

Locate every one of the document web templates you might have purchased in the My Forms menus. You can obtain a further version of Iowa Clauses Relating to Venture IPO at any time, if necessary. Just click the needed type to download or produce the document format.

Use US Legal Forms, the most substantial collection of legitimate types, in order to save time and avoid errors. The services offers appropriately created legitimate document web templates which can be used for an array of reasons. Create your account on US Legal Forms and begin generating your daily life a little easier.

Form popularity

FAQ

The term venture capital-backed IPO refers to the initial public offering of a company that was previously financed by private investors. These offerings are considered a strategic plan by venture capitalists to recover their investments in the company.

A venture capital-backed IPO (Initial Public Offering) is the process by which a privately held startup or company raises capital by offering its shares to the public for the first time. In this case, the company has received funding from venture capital firms to help grow and develop the business.

Anyone can invest in public markets while only wealthy individuals can invest in private markets. Public investors can buy and sell at any time while private investments require a longstanding time commitment. Public investors can passively manage investments while private investors mentor the companies they invest in.

IPOs backed by venture capital sponsors are significantly more underpriced in the short run. We suggest that this is due to higher levels of information asymmetry. In the long run, return on assets as well as operating margins suggest that buyout backed IPOs outperform those backed by venture capital.

Investors generally factor in the revenue trends of the company, market caps, rivals, and alterations in the value of the stock from time to time. But a major difference between venture capital vs public stock market is that the investors of stock markets cannot access the management team of the business.

Key Takeaways. An initial public offering means a company can sell its shares on the public market. Staying private keeps ownership in the hands of private owners. IPOs give companies access to capital while staying private gives companies the freedom to operate without having to answer to external shareholders.