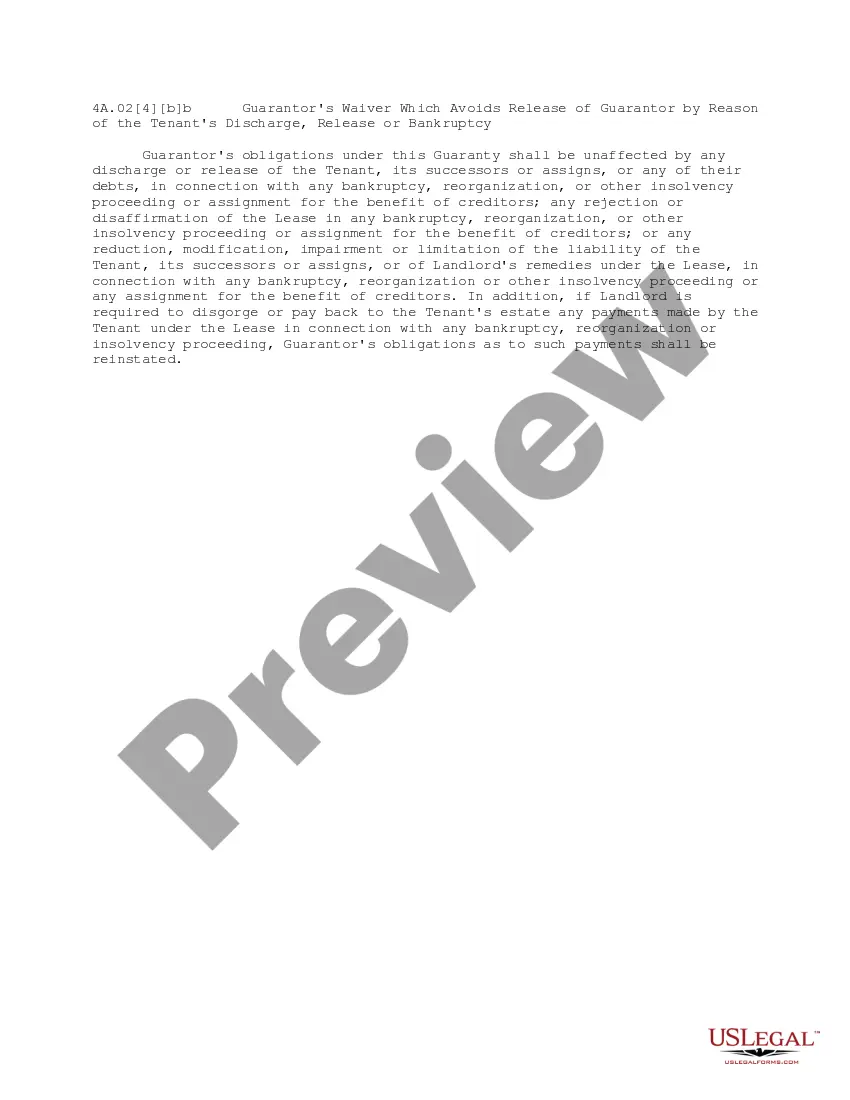

This office lease guaranty states that the guarantor's obligations under this guaranty shall be unaffected by any discharge or release of the tenant, its successors or assigns, or any of their debts, in connection with any bankruptcy, reorganization, or other insolvency proceeding or assignment for the benefit of creditors.

Iowa Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy

Description

How to fill out Guarantor Waiver Which Avoids Release Of Guarantor By Reason Of The Tenant Discharge Release Or Bankruptcy?

Discovering the right legitimate papers web template could be a have difficulties. Obviously, there are a lot of themes available online, but how will you get the legitimate develop you will need? Take advantage of the US Legal Forms internet site. The services provides 1000s of themes, including the Iowa Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy, which can be used for enterprise and private demands. Each of the varieties are checked by specialists and fulfill state and federal demands.

When you are previously signed up, log in in your bank account and click the Download option to get the Iowa Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy. Utilize your bank account to check with the legitimate varieties you possess purchased in the past. Go to the My Forms tab of your own bank account and acquire another backup in the papers you will need.

When you are a fresh user of US Legal Forms, allow me to share straightforward instructions that you should comply with:

- Very first, make certain you have selected the proper develop for your personal city/region. You can look over the shape making use of the Review option and browse the shape explanation to make sure this is the right one for you.

- In the event the develop fails to fulfill your preferences, take advantage of the Seach area to find the right develop.

- Once you are certain that the shape is proper, select the Buy now option to get the develop.

- Select the prices strategy you would like and enter in the required info. Build your bank account and pay money for your order with your PayPal bank account or Visa or Mastercard.

- Select the document file format and download the legitimate papers web template in your device.

- Complete, modify and print out and signal the attained Iowa Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy.

US Legal Forms is the largest catalogue of legitimate varieties in which you can find different papers themes. Take advantage of the service to download appropriately-manufactured paperwork that comply with status demands.

Form popularity

FAQ

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.

Can I stop being a guarantor for a loan? Once you've signed a loan agreement and the loan has been paid out, you can't get out of being a guarantor. The lender won't remove you from the agreement because your credit history, employment status and other influences all had an impact on the approval of the loan.

An agreement by which a party (the guarantor) assumes the responsibility for the payment or performance of an obligation or action of another person (the primary obligor) if that other person defaults. A guarantee creates a secondary obligation to support the primary obligor's primary obligation to a third party.

Reimbursement: the right to pursue the borrower to recover any money they paid. Subrogation: If the guarantor pays back the lender in full, they then become the lender and have all the same rights as the lender to collect the debt from the initial borrower.

A guarantor can't withdraw the guarantee unless entire debt has been fully repaid. As a tool for mitigating credit risk, lenders often require individuals to sign up as guarantors for: business loans being availed by the business entity of the individual; or loans being availed by friends and family of such individuals ...

Guarantees are a contractual arrangement where one party (the guarantor) agrees to answer for the liability of another party (the principal) to another party (the guaranteed party). Guarantors have various rights usually conferred in equity against the principal, the guaranteed party and any co-guarantors.

The guarantor waives all rights and defenses that the guarantor may have because the debtor's debt is secured by real property. This means, among other things: (1) The creditor may collect from the guarantor without first foreclosing on any real or personal property collateral pledged by the debtor.

A guarantor guarantees to pay a borrower's debt if the borrower defaults on a loan obligation. The guarantor guarantees a loan by pledging their assets as collateral. A guarantor alternatively describes someone who verifies the identity of an individual attempting to land a job or secure a passport.