Iowa Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer

Description

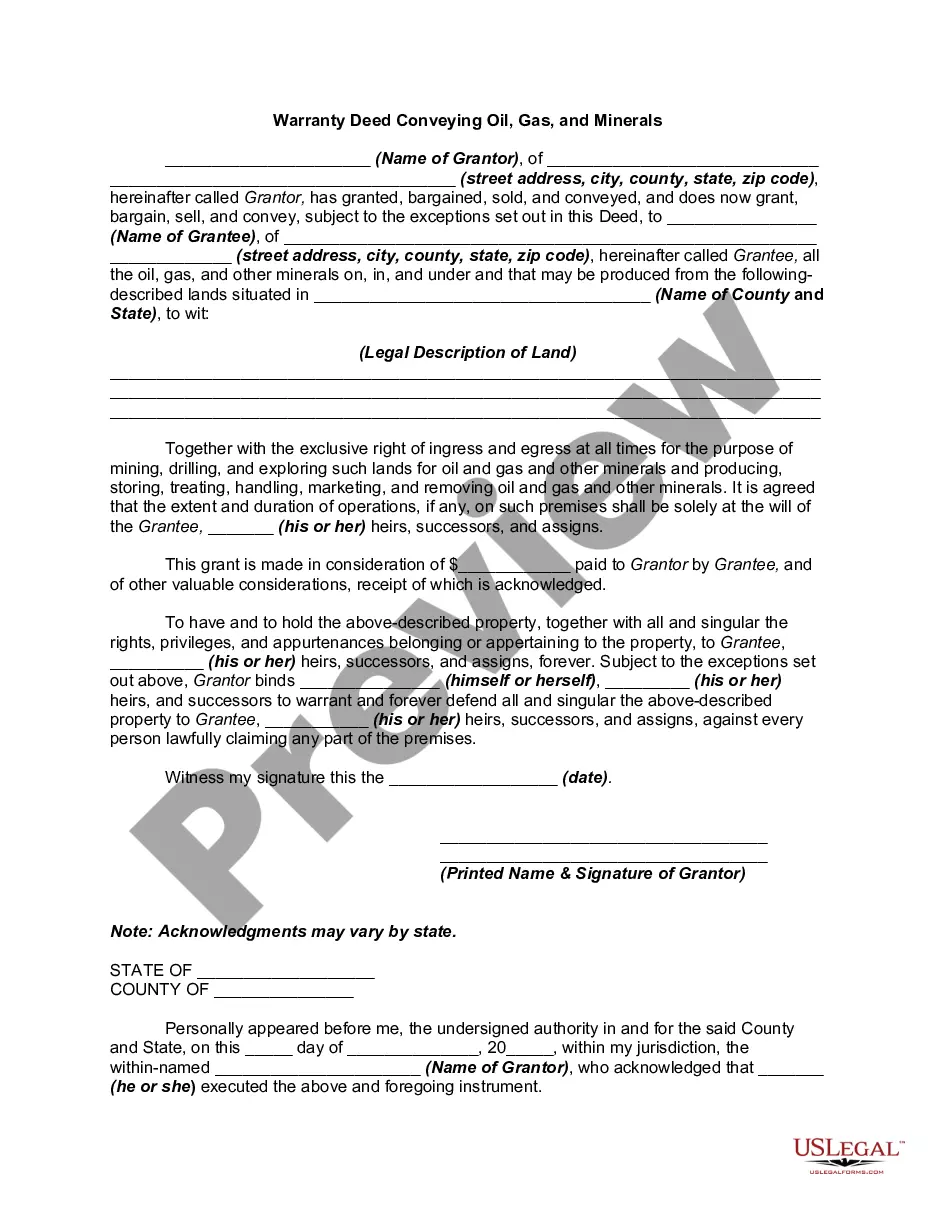

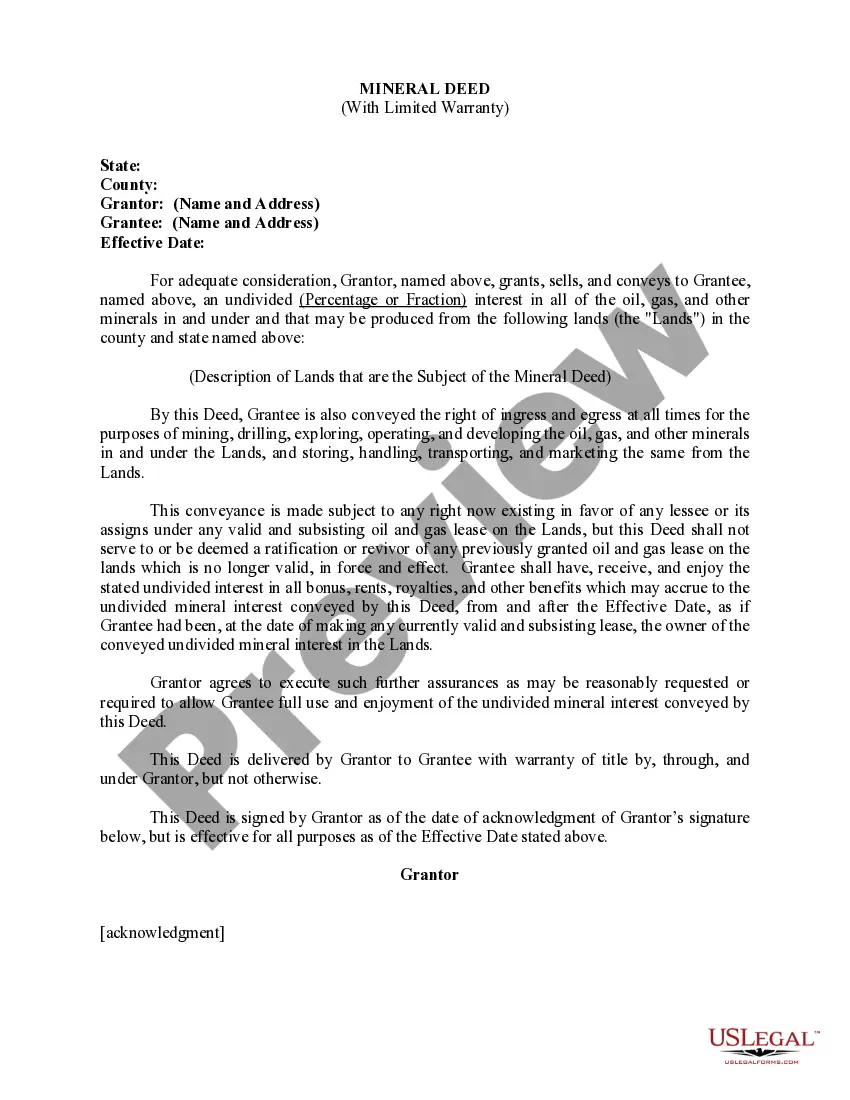

How to fill out Mineral Deed With Grantor Reserving Executive Rights In The Interest Conveyed - Transfer?

If you want to full, acquire, or print legitimate record layouts, use US Legal Forms, the largest collection of legitimate kinds, that can be found on the Internet. Use the site`s simple and practical search to find the paperwork you will need. Numerous layouts for enterprise and person purposes are sorted by classes and claims, or keywords. Use US Legal Forms to find the Iowa Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer within a few click throughs.

In case you are presently a US Legal Forms client, log in for your accounts and click on the Download option to have the Iowa Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer. You can also gain access to kinds you earlier downloaded inside the My Forms tab of your own accounts.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for that appropriate town/country.

- Step 2. Take advantage of the Review solution to look through the form`s content material. Never forget to learn the description.

- Step 3. In case you are unhappy using the type, use the Search area near the top of the screen to get other types of your legitimate type design.

- Step 4. Upon having discovered the form you will need, click on the Purchase now option. Select the pricing strategy you like and include your qualifications to register to have an accounts.

- Step 5. Process the purchase. You can use your Мisa or Ьastercard or PayPal accounts to finish the purchase.

- Step 6. Choose the structure of your legitimate type and acquire it on your own device.

- Step 7. Total, change and print or indicator the Iowa Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer.

Every single legitimate record design you purchase is the one you have forever. You might have acces to every type you downloaded with your acccount. Select the My Forms segment and pick a type to print or acquire again.

Contend and acquire, and print the Iowa Mineral Deed with Grantor Reserving Executive Rights in the Interest Conveyed - Transfer with US Legal Forms. There are many expert and express-certain kinds you can utilize for your personal enterprise or person demands.

Form popularity

FAQ

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

Unsolicited purchase offers are happening in greater numbers and for greater ? sometimes much greater ? amounts than in the past. The upshot? Sometimes selling makes good sense. Indeed, depending on your situation, the sale of your mineral rights can represent a prudent ? and even compelling ? opportunity.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

Taxes: The #1 reason for selling mineral rights is taxes. If you inherited mineral rights and then sold them for $100,000, you could pay only $5,250 in taxes and keep $94,750. If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

Mineral rights can expire if the owner does not renew them or if they go unclaimed for a certain period of time. Mineral rights can also be sold, fractionalized, or transferred through gifting or inheritance.

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.