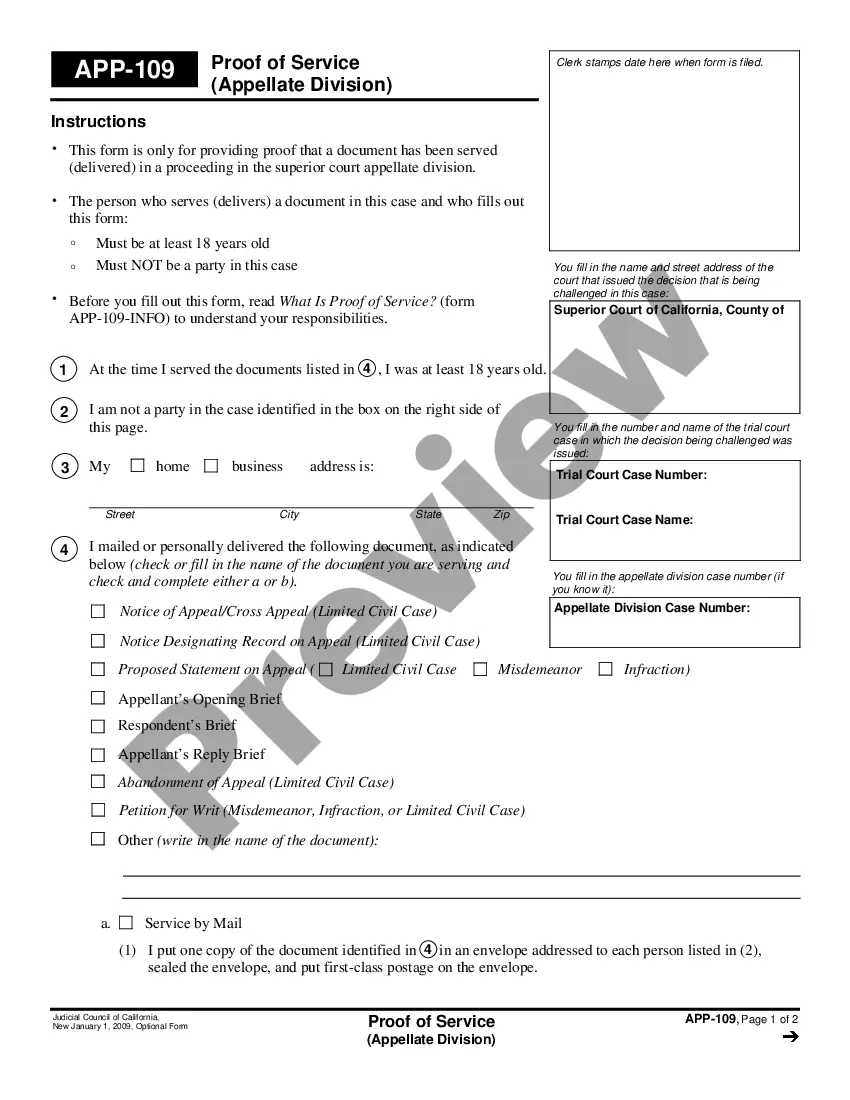

Iowa Request for Proof of Debt

Description

How to fill out Request For Proof Of Debt?

Selecting the appropriate legal document format can be challenging. Of course, there are numerous templates accessible online, but how will you acquire the legal form you need? Utilize the US Legal Forms website. This service offers thousands of templates, including the Iowa Request for Proof of Debt, which you can utilize for both business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Iowa Request for Proof of Debt. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your jurisdiction. You can preview the document using the Preview button and read the form details to confirm it is suitable for you. If the form does not meet your expectations, use the Search field to find the correct document. Once you are confident that the form is appropriate, click the Purchase now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and place your order using your PayPal account or Visa or Mastercard. Select the file format and download the legal document format to your device. Complete, edit, print, and sign the acquired Iowa Request for Proof of Debt.

With US Legal Forms, you can ensure that you're getting the most accurate and reliable legal documentation available.

- US Legal Forms is the largest collection of legal documents where you can find various document templates.

- Utilize the service to download professionally created papers that adhere to state requirements.

- Explore a vast library of templates for different legal needs.

- Access forms that are compliant with both federal and state laws.

- Get the legal assistance you need in a convenient manner.

- Find templates for both personal and business purposes.

Form popularity

FAQ

Yes, you can send a debt verification letter via email. However, ensure that you maintain a professional tone and include all relevant details in your message. It's wise to request a confirmation of receipt to ensure the creditor acknowledges your request. The Iowa Request for Proof of Debt can be effectively communicated through email, making it a convenient option for many.

To write a letter requesting proof of debt, start by clearly stating your request at the top. Include your personal information, the creditor's details, and a specific request for verification of the debt. Be sure to mention the Iowa Request for Proof of Debt to emphasize your rights. Using a structured format can guide you, and platforms like US Legal Forms provide templates to simplify this process.

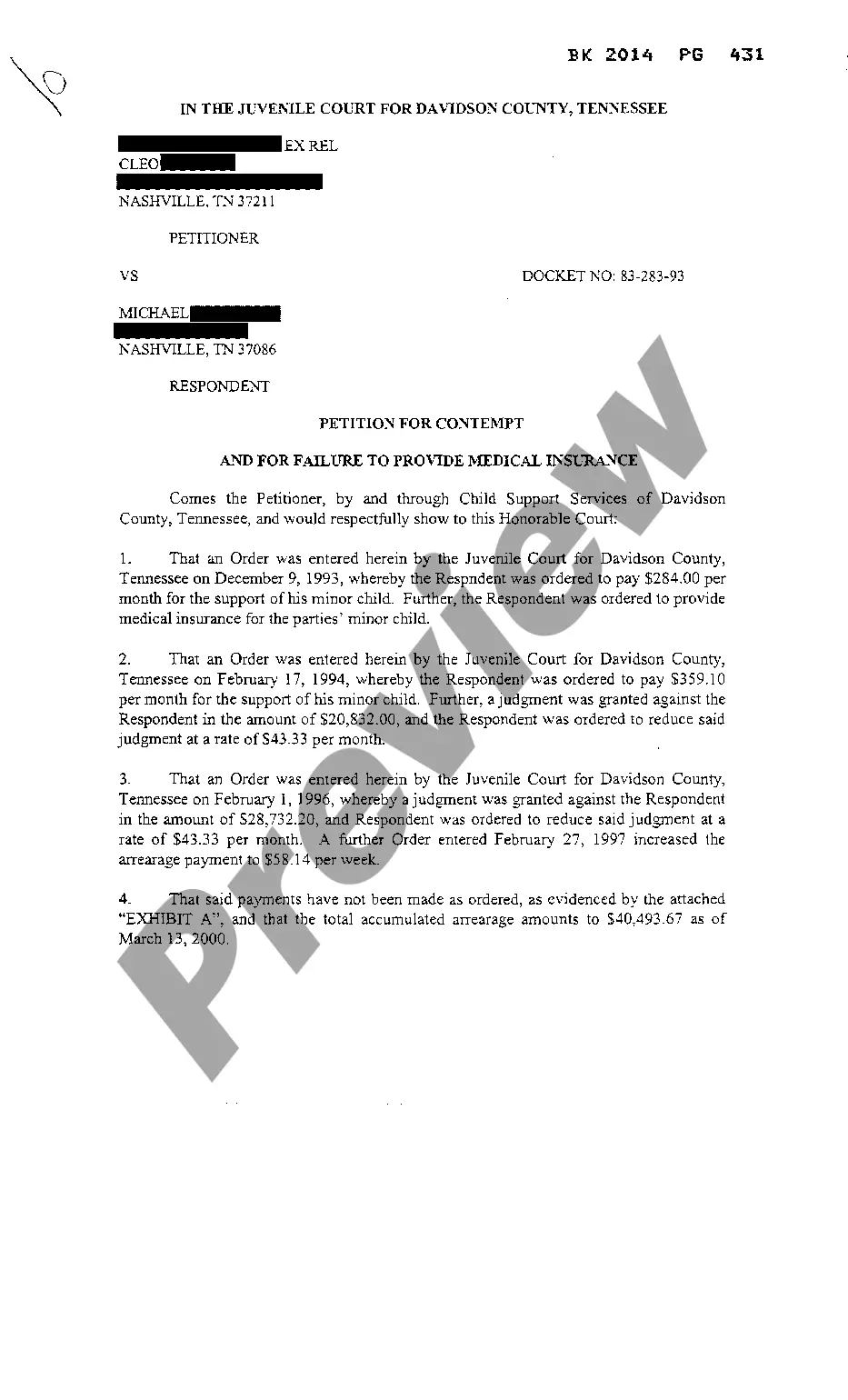

When you request proof of debt, include essential details such as the creditor's name, the amount owed, and any relevant account numbers. Additionally, it should outline the nature of the debt and the date of the last payment. These elements create a clear picture of your financial obligation, making it easier for you to understand your situation. The Iowa Request for Proof of Debt format can help ensure you include all necessary information.

In Iowa, the statute of limitations for most debts is generally five years. This means that after five years, creditors cannot legally collect the debt or sue you for it. However, it is important to note that this timeframe can vary depending on the type of debt. If you have received a notice regarding an Iowa Request for Proof of Debt, consider consulting with professionals or using platforms like US Legal Forms to better understand your rights and options.

To request proof of debt, start by drafting a formal letter addressed to the creditor or collector. In your letter, mention the account number and specify that you are invoking your rights under the Iowa Request for Proof of Debt. It is essential to send your request through certified mail to maintain a record of your correspondence. For convenience, you can find helpful resources and sample letters on the US Legal Forms platform, making your request easier and more effective.

To ask for proof of debt, you should begin by sending a written request to the creditor or collection agency. Include your personal information, details about the debt, and clearly state that you are requesting proof of the debt under the Iowa Request for Proof of Debt guidelines. This request should be sent via certified mail to ensure you have a record of your communication. Additionally, consider using platforms like US Legal Forms to access templates that simplify this process.

When asking a creditor for proof of debt, be clear and direct in your request. You can either call them or send a written request, referencing your Iowa Request for Proof of Debt. Make sure to include pertinent details, such as your account number and any relevant dates. This approach not only shows your seriousness but also helps expedite the process.

To obtain proof of debt, start by reaching out to your creditor or debt collector. You can make an Iowa Request for Proof of Debt verbally or in writing. If you face challenges in receiving the necessary documents, consider utilizing platforms like USLegalForms, which can assist you in crafting the right communication to ensure you get the proof you need.

Proof of debt can include various documents that substantiate your obligation, such as original contracts, account statements, or payment records. When making an Iowa Request for Proof of Debt, specify the type of documentation you need. These documents help clarify the terms of the debt and verify its legitimacy. Understanding what qualifies as proof can empower you in discussions with creditors.

To get a copy of your debt, you should first contact the creditor and ask for the documentation. Make sure to mention your Iowa Request for Proof of Debt to emphasize the nature of your request. If the creditor is unresponsive, you may need to consider using a service like USLegalForms, which can guide you through the process of obtaining this information.