This Formula System for Distribution of Earnings to Partners provides a list of provisions to conside when making partner distribution recommendations. Some of the factors to consider are: Collections on each partner's matters, acquisition and development of new clients, profitablity of matters worked on, training of associates and paralegals, contributions to the firm's marketing practices, and others.

Iowa Formula System for Distribution of Earnings to Partners

Description

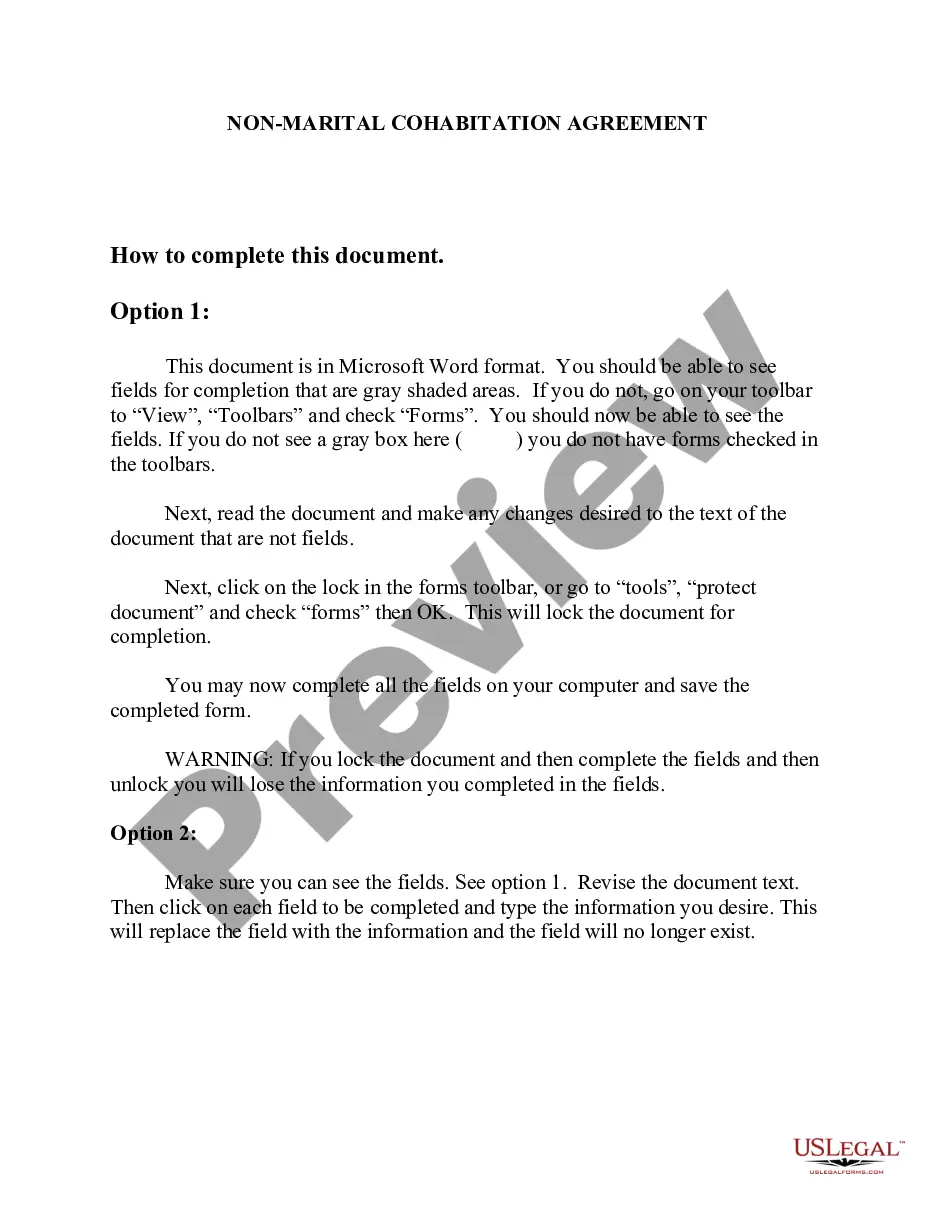

How to fill out Formula System For Distribution Of Earnings To Partners?

Choosing the right lawful file format can be quite a struggle. Of course, there are tons of layouts available on the Internet, but how can you discover the lawful form you will need? Make use of the US Legal Forms site. The support gives thousands of layouts, such as the Iowa Formula System for Distribution of Earnings to Partners, that can be used for company and private requires. All the types are examined by professionals and fulfill federal and state needs.

If you are presently listed, log in to the account and click on the Down load option to obtain the Iowa Formula System for Distribution of Earnings to Partners. Use your account to look through the lawful types you have acquired previously. Go to the My Forms tab of your account and get yet another copy from the file you will need.

If you are a whole new end user of US Legal Forms, allow me to share basic recommendations so that you can follow:

- Initially, be sure you have selected the correct form for your metropolis/state. It is possible to look through the shape while using Review option and browse the shape description to guarantee this is basically the best for you.

- In the event the form will not fulfill your requirements, take advantage of the Seach industry to find the right form.

- Once you are certain that the shape is proper, click the Acquire now option to obtain the form.

- Choose the pricing prepare you desire and enter the required info. Create your account and purchase your order utilizing your PayPal account or credit card.

- Choose the data file file format and down load the lawful file format to the product.

- Full, edit and printing and indicator the acquired Iowa Formula System for Distribution of Earnings to Partners.

US Legal Forms is the biggest catalogue of lawful types in which you can discover a variety of file layouts. Make use of the service to down load expertly-made papers that follow condition needs.

Form popularity

FAQ

If the partnership had income, debit the income section for its balance and credit each partner's capital account based on his or her share of the income. If the partnership realized a loss, credit the income section and debit each partner's capital account based on his or her share of the loss.

The partnership files a copy of Schedule K-1 (Form 1065) with the IRS to report your share of the partnership's income, deductions, credits, etc.

The net income for a partnership is divided between the partners as called for in the partnership agreement. The income summary account is closed to the respective partner capital accounts. The respective drawings accounts are closed to the partner capital accounts.

For each partner receiving guaranteed payments enter the amount on line 4 of the partner's K1 screen.

Partner capital account amounts are entered in section L, Analysis of Capital Account, of the K1 screen, including the beginning capital account amount and capital contributed during the year. These amounts flow to Schedule M-2.

If a partnership is filing an IA 1040C return on behalf of its nonresident partners no withholding or estimated payments are required.

How do I enter guaranteed payments to partners in a 1065 return using worksheet view? Go to ?Income/Deductions > Trade or business. Select Section 7 - Deductions. In Line 3 - Guaranteed payments to partners, enter amount.

So, although a partnership or LLC must file a single IRS Form 1065, the business itself does not pay the income tax. Instead, the individual and LLC members complete a Schedule K-1 to report their share of the business's profits and losses and then file this form with their personal tax returns (the IRS Form 1040).