Iowa Self-Employed Special Events Driver Services Contract

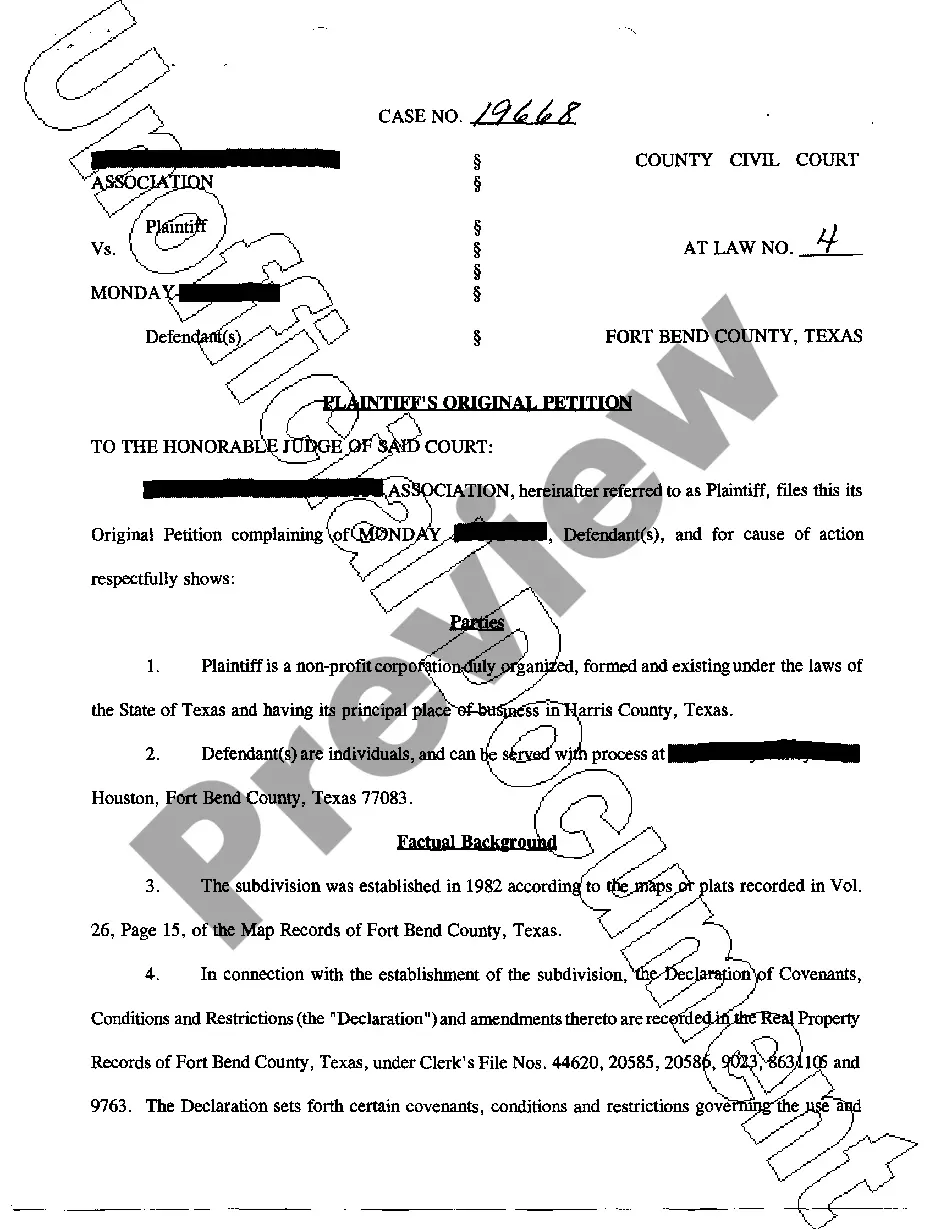

Description

How to fill out Self-Employed Special Events Driver Services Contract?

Have you ever found yourself needing documents for potential organization or specific purposes almost every day.

There are numerous legal document templates accessible online, but finding versions you can trust isn't easy.

US Legal Forms offers thousands of form templates, similar to the Iowa Self-Employed Special Events Driver Services Contract, designed to meet state and federal requirements.

Once you find the appropriate form, click Buy now.

Select the pricing option you desire, complete the necessary information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Iowa Self-Employed Special Events Driver Services Contract template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your correct state/region.

- Use the Preview button to examine the form.

- Read the description to ensure that you have selected the correct form.

- If the form isn't what you are looking for, utilize the Search field to find the form that suits your requirements and needs.

Form popularity

FAQ

Being a 1099 contract employee means you work as an independent contractor rather than a traditional employee. This classification offers flexibility in work arrangements and the ability to manage your own business expenses. If you're considering entering into an Iowa Self-Employed Special Events Driver Services Contract, you should understand your rights and responsibilities as a 1099 contractor to ensure a successful working relationship.

A contract driver is responsible for transporting goods or passengers based on the terms outlined in their contract. They manage their schedules, vehicle maintenance, and operational costs, allowing them to work independently. In the context of an Iowa Self-Employed Special Events Driver Services Contract, contract drivers often cater to special events, providing tailored services to meet client needs.

Yes, many truck drivers are classified as independent contractors, especially those who work on a 1099 basis. This classification allows them to operate their businesses with more autonomy and flexibility. When engaging in services through an Iowa Self-Employed Special Events Driver Services Contract, drivers can negotiate terms that suit their needs while maintaining their independent status.

A 1099 contract driver is a driver who operates as an independent contractor, providing services under a contract rather than as an employee. This type of driver enjoys various freedoms, including flexible scheduling and the ability to choose their clients. A well-structured Iowa Self-Employed Special Events Driver Services Contract can enhance this working relationship, ensuring clarity and mutual benefit.

Creating an independent contractor contract involves clearly outlining the terms and conditions of the work agreement. You should include details such as payment terms, scope of work, and duration of the contract. Utilizing a platform like uslegalforms can simplify this process, especially for those drafting an Iowa Self-Employed Special Events Driver Services Contract, providing templates and guidance to ensure legal compliance.

The earnings of 1099 truck drivers can vary widely based on factors such as experience, type of freight, and market demand. Generally, these drivers can earn a competitive income, especially when working under specific contracts like an Iowa Self-Employed Special Events Driver Services Contract. By understanding their costs and managing their routes effectively, many drivers find substantial financial benefits.

A 1099 driver is an independent contractor who receives Form 1099 from their employer instead of a W-2. This means they are not classified as employees and do not receive traditional employment benefits. In the context of an Iowa Self-Employed Special Events Driver Services Contract, 1099 drivers manage their own taxes and expenses, allowing for greater flexibility and independence.

A chauffeur's license in Iowa permits individuals to operate vehicles for hire, such as taxis or limousines. This license is essential for anyone wishing to provide transportation services legally. If you are considering an Iowa Self-Employed Special Events Driver Services Contract, obtaining this license is a fundamental step to ensure you can serve your clients effectively.

Getting a chauffeur's license in Iowa involves meeting specific requirements, such as passing a written test and a driving test. While it may seem daunting, most applicants find the process manageable with proper preparation. Once you have your license, you can operate under an Iowa Self-Employed Special Events Driver Services Contract, providing valuable services to your clients.

The economic nexus threshold in Iowa is determined by the level of sales a business has within the state. If your sales exceed $100,000 or you make more than 200 transactions in Iowa, you must collect sales tax. This is important for those operating under an Iowa Self-Employed Special Events Driver Services Contract, as it affects your tax obligations.