Iowa Collections Agreement - Self-Employed Independent Contractor

Description

How to fill out Collections Agreement - Self-Employed Independent Contractor?

Selecting the appropriate official document template can be a challenge. Of course, there are countless templates available online, but how do you find the official form you need? Use the US Legal Forms website. This service provides a vast array of templates, including the Iowa Collections Agreement - Self-Employed Independent Contractor, which you can utilize for business and personal needs. All documents are reviewed by professionals and meet federal and state regulations.

If you are already registered, Log In to your account and click the Download button to locate the Iowa Collections Agreement - Self-Employed Independent Contractor. Use your account to search through the official forms you may have purchased previously. Navigate to the My documents section of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/region. You can review the document using the Review button and examine the form details to ensure it is suitable for you. If the form does not meet your requirements, use the Search field to find the appropriate document. Once you are confident that the form is acceptable, click the Get now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the document format and download the official document template to your device. Finally, complete, edit, print, and sign the received Iowa Collections Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of official forms where you can find numerous document templates. Use the service to download professionally crafted paperwork that complies with state regulations.

Form popularity

FAQ

Receiving payments as an independent contractor can vary based on your agreement with clients. Common methods include bank transfers, checks, or online payment platforms. Including specific payment terms in your Iowa Collections Agreement - Self-Employed Independent Contractor can ensure timely payments and smoother transactions, providing both peace of mind and financial stability for your freelance business.

Yes, independent contractors can be sued, just like any other business entity. If a client believes a contractor has not fulfilled their obligations, legal action may result. Having an Iowa Collections Agreement - Self-Employed Independent Contractor can help clarify terms and protect both parties, potentially reducing the risk of lawsuits by setting clear expectations for service delivery.

A basic independent contractor agreement outlines the essential terms of the working relationship between a contractor and a client. It typically includes sections on project scope, payment terms, confidentiality, and duration of the contract. This document protects both parties by clearly defining expectations and responsibilities. When creating an Iowa Collections Agreement - Self-Employed Independent Contractor, ensure that it includes these key components for effective communication.

To create an independent contractor agreement, start by clearly outlining the terms of employment, including the scope of work and payment details. Specify important elements like deadlines, ownership of work, and termination conditions. You can also utilize templates available on platforms like US Legal Forms, where you can easily customize an Iowa Collections Agreement - Self-Employed Independent Contractor to meet your needs.

Recent federal rulings regarding independent contractors clarify the criteria used to determine if a worker is an independent contractor or an employee. These rules focus on the level of control employers have over workers and the nature of the work relationship. Staying informed about these changes can affect how you draft your Iowa Collections Agreement - Self-Employed Independent Contractor, ensuring that you meet legal standards.

In the United States, an independent contractor must earn $600 or more in a calendar year from a single payer to receive a 1099 form. This form reports the income you received as an independent contractor, which is essential for tax purposes. Keeping accurate records of your earnings will help ensure compliance. Utilizing an Iowa Collections Agreement - Self-Employed Independent Contractor can help track these earnings efficiently.

In Iowa, an independent contractor agreement does not typically require notarization to be enforceable. However, having the agreement notarized can lend additional credibility and serve as an official record. This step may help in case of disputes or disagreements in the future. Remember, using an Iowa Collections Agreement - Self-Employed Independent Contractor provides a strong framework for your business dealings.

The independent contractor agreement in Iowa defines the relationship between a business and an independent contractor. This document outlines the scope of work, payment terms, and responsibilities of both parties. It helps prevent misunderstandings and ensures that each party clearly understands their obligations. Using an Iowa Collections Agreement - Self-Employed Independent Contractor can be beneficial for protecting your interests.

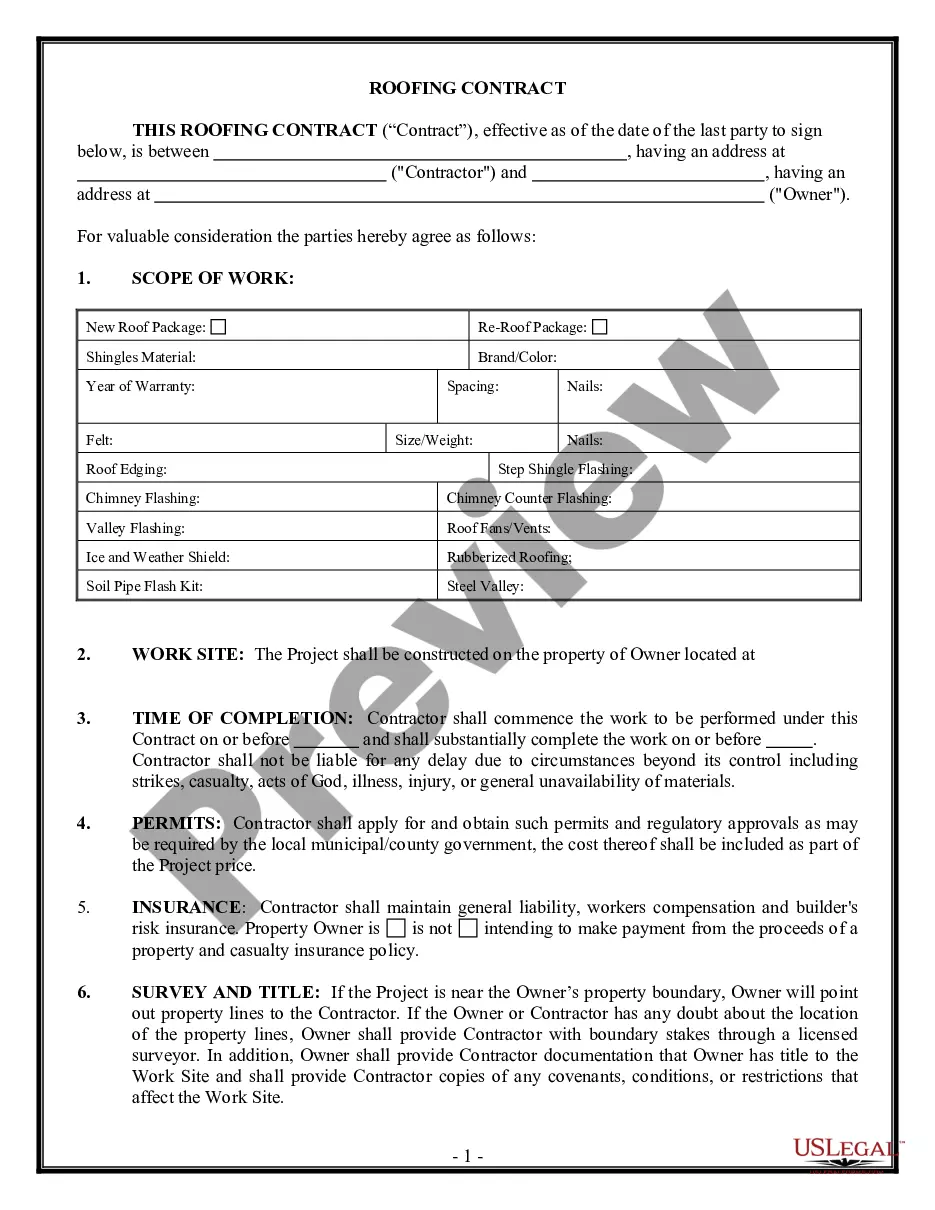

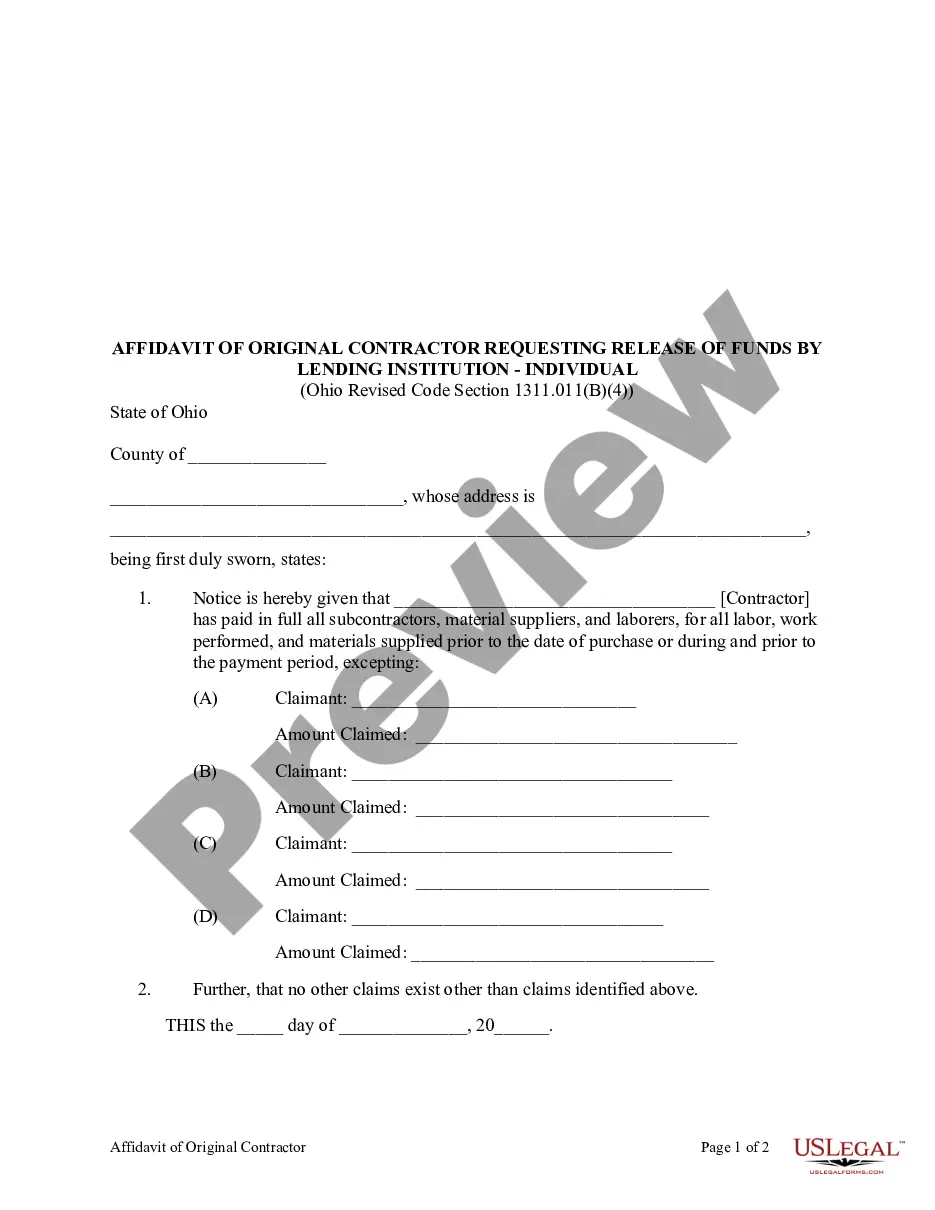

To fill out an independent contractor agreement, begin with the date and parties involved. Clearly outline the services to be provided and the payment terms, including any milestones or deadlines. Don’t forget to include sections on confidentiality and termination conditions. Utilizing a well-structured Iowa Collections Agreement - Self-Employed Independent Contractor available at uslegalforms can help you navigate this effectively.

Filling out an independent contractor form involves providing your personal information, such as name and address, along with your tax identification number. Next, describe the services you will provide and set your expected compensation. Be sure to review all guidelines for accuracy and completeness, ensuring compliance with the provisions of the Iowa Collections Agreement - Self-Employed Independent Contractor.