Iowa Disability Services Contract - Self-Employed

Description

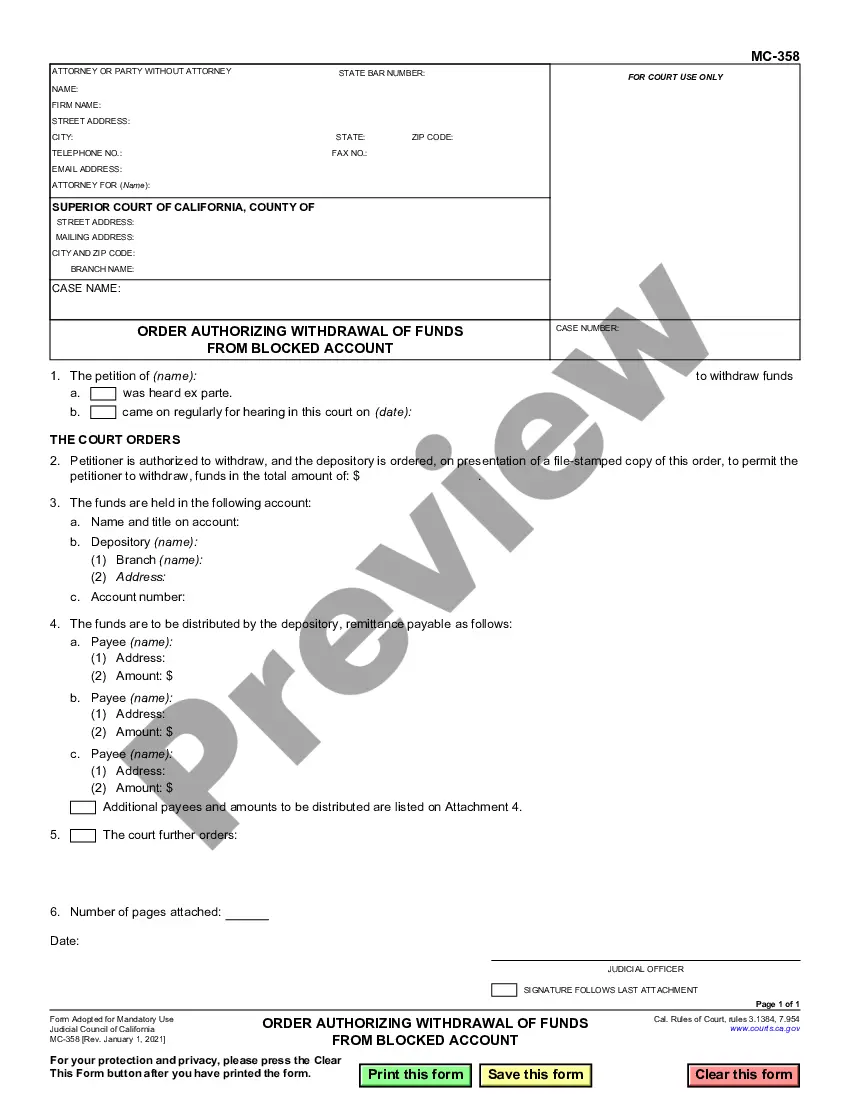

How to fill out Disability Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a range of legal form templates that you can download or print. By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms like the Iowa Disability Services Contract - Self-Employed in moments.

If you have an account, Log In and download the Iowa Disability Services Contract - Self-Employed from the US Legal Forms repository. The Download button will appear on every form you view. You can access all previously saved forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple steps to get started: Ensure you have selected the correct form for your city/state. Click the Preview button to review the content of the form. Check the form summary to confirm that you have chosen the right document. If the form does not meet your requirements, use the Search box at the top of the screen to find one that does. Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your details to register for the account. Process the transaction. Use your credit card or PayPal account to complete the payment. Choose the format and download the form to your device. Make edits. Fill out, revise, and print and sign the saved Iowa Disability Services Contract - Self-Employed. Each template you added to your account has no expiration date and belongs to you forever. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need.

- Access the Iowa Disability Services Contract - Self-Employed with US Legal Forms, one of the largest collections of legal document templates.

- Utilize numerous professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

The best disability insurance for self-employed individuals varies based on specific needs and circumstances. Generally, look for policies that offer comprehensive coverage and favorable terms tailored for freelancers or contractors. Utilizing an Iowa Disability Services Contract - Self-Employed can help you find the right coverage, ensuring you receive the financial support necessary to sustain your business during challenging times.

Self-employed individuals should seriously consider having disability insurance. Unlike traditional employees, they do not have employer-sponsored coverage, leaving them vulnerable during difficult times. Opting for an Iowa Disability Services Contract - Self-Employed ensures that you protect your livelihood and maintain your financial independence if you cannot work due to a disability.

Disability insurance is often considered worth it for self-employed individuals. It offers a financial safety net, allowing you to focus on recovery without worrying about lost income. By securing an Iowa Disability Services Contract - Self-Employed, you can enhance your financial stability and peace of mind in case unexpected circumstances arise.

Yes, you can obtain disability insurance as a 1099 employee. This classification means you are self-employed, and you may need to seek specific policies designed for independent contractors. The Iowa Disability Services Contract - Self-Employed may provide favorable options to ensure you have the coverage necessary to maintain your income if you face a disabling condition.

Dave Ramsey emphasizes the importance of having a safety net in the form of disability insurance. He argues that being prepared for unforeseen events is crucial, especially for self-employed individuals. With an Iowa Disability Services Contract - Self-Employed, you can safeguard your financial future by ensuring that you have a reliable income stream if you become unable to work.

Yes, disability insurance is crucial for self-employed individuals as it provides a safety net in case you become unable to work due to illness or injury. Unlike traditional employees, self-employed individuals don’t have employer-provided coverage, so it falls on you to secure this important protection. Incorporating an Iowa Disability Services Contract - Self-Employed into your planning can safeguard your income and help you maintain your standard of living during tough times.

If you are self-employed, you typically need liability insurance, health insurance, and possibly property insurance, depending on your business type. Additionally, consider looking into disability insurance as part of your Iowa Disability Services Contract - Self-Employed. This coverage helps protect your income in case of an unexpected event that prevents you from working. Assess your specific needs to ensure comprehensive coverage.

To file for disability in Iowa, you should first gather all necessary documents, including medical records and your employment history. Next, complete the application form specifically for the Iowa Disability Services Contract - Self-Employed, which you can find on the US Legal Forms platform. Make sure to follow the guidelines closely and provide accurate information to avoid delays. Once completed, submit your application to the Iowa Department of Human Services for review.

To qualify for short-term disability due to anxiety, you typically need to demonstrate how your condition impairs your ability to work effectively. This may include diagnosis from a mental health professional and documentation of treatment. Utilizing the Iowa Disability Services Contract - Self-Employed can help you understand the specific requirements and ensure your application is well-supported.

Self-employed individuals can qualify for disability benefits, provided they meet specific criteria related to income and medical conditions. Documentation of both your business and health status is vital in this process. With resources from the Iowa Disability Services Contract - Self-Employed, you can better navigate the nuances and prepare a compelling case for your claim.