Iowa Pipeline Service Contract - Self-Employed

Description

How to fill out Pipeline Service Contract - Self-Employed?

Have you ever found yourself in a scenario where you require documentation for occasional organization or particular motives now and then.

There are numerous authentic document templates accessible online, but locating forms you can trust is not straightforward.

US Legal Forms offers a vast collection of form templates, such as the Iowa Pipeline Service Contract - Self-Employed, that are crafted to satisfy federal and state requirements.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Iowa Pipeline Service Contract - Self-Employed at any time, if needed. Click the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Iowa Pipeline Service Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct area/state.

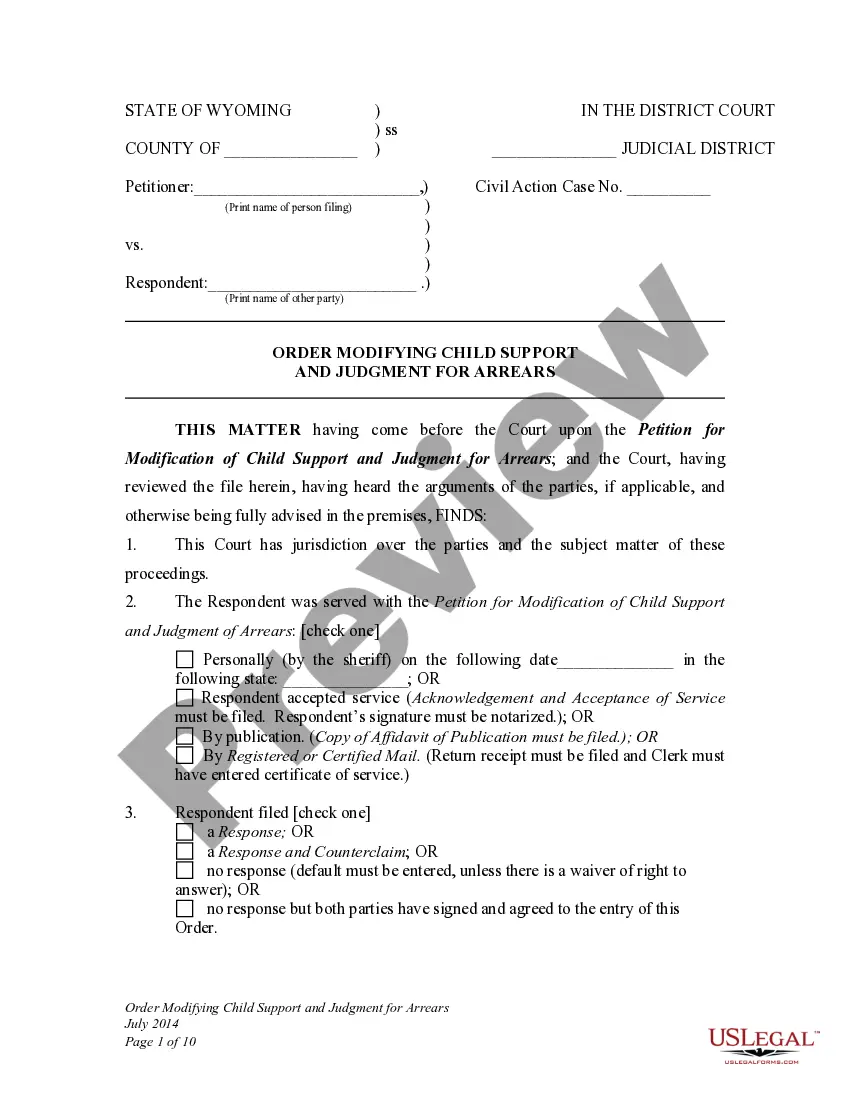

- Utilize the Preview button to review the form.

- Examine the details to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, take advantage of the Search field to find the form that meets your needs and requirements.

- Once you find the suitable form, click Buy now.

- Select the payment option you prefer, fill out the necessary information to create your account, and complete the order using your PayPal or credit card.

Form popularity

FAQ

An LLC can impact self-employment tax depending on how you choose to structure it. For members of an LLC engaged in an Iowa Pipeline Service Contract - Self-Employed, earnings are typically considered self-employment income, subject to the 15.3% tax. However, electing S-Corp status for your LLC may allow you to reduce the self-employment tax burden on a portion of your income. Consulting a tax advisor can help you make the best decision.

Yes, pipeline easement compensation is generally taxable. If you receive payments for allowing pipeline companies to use your property, the IRS considers that income, particularly relevant for those engaging in an Iowa Pipeline Service Contract - Self-Employed. It's crucial to account for this income when filing your taxes to avoid issues later on.

Income from an easement may be classified as capital gains or ordinary income, depending on the nature of the payment. If you receive compensation for an easement related to an Iowa Pipeline Service Contract - Self-Employed, it is essential to determine how it fits into your overall tax scenario. Consult a tax advisor to ensure that you report this income accurately.

As a self-employed individual, you are subject to a tax rate of 15.3% on your net earnings, which covers Social Security and Medicare taxes. If you're engaging in activities tied to an Iowa Pipeline Service Contract - Self-Employed, understanding this tax percentage is vital for your financial planning. Additionally, remember that state income taxes may apply, further affecting your total tax liability.

Iowa self-employment tax is a federal tax imposed on individuals who earn income from self-employment activities. This tax is crucial for funding Social Security and Medicare, and it affects anyone with income from an Iowa Pipeline Service Contract - Self-Employed. Keep in mind that you may also have state taxes and local taxes to consider, so it's wise to consult a tax professional.

Yes, you can operate as a contractor in Iowa without forming a formal company. Many self-employed individuals work under their names and provide services directly to clients. However, establishing a business entity can offer advantages such as liability protection and enhanced professionalism in contracts like the Iowa Pipeline Service Contract - Self-Employed. Consider your options carefully to choose what suits your business goals best.

Not all contractors in Iowa require a license; however, specific trades or projects might mandate a license to ensure compliance with state regulations. For example, electrical or plumbing work often requires certification. Holding a proper license can positively impact your ability to secure contracts, including an Iowa Pipeline Service Contract - Self-Employed. Always research local laws before starting your work.

An independent contractor agreement in Iowa outlines the relationship between a contractor and a client. This document typically defines project details, payment terms, and the scope of work. You can establish a solid foundation for your business partnership through a clear Iowa Pipeline Service Contract - Self-Employed. Utilizing a professional platform like uslegalforms can help you create an agreement tailored to your needs.

A contractor in Iowa does not need an LLC to operate legally. While an LLC can offer protection from personal liability, it is not a strict requirement to enter into an Iowa Pipeline Service Contract - Self-Employed. Evaluate your specific circumstances to determine if forming an LLC aligns with your business plans and provides the advantages you seek.

You do not need to have an LLC to work as a contractor in Iowa. However, forming an LLC can provide you with several benefits, such as personal liability protection and potential tax advantages. Choosing to register as an LLC can enhance your credibility when executing an Iowa Pipeline Service Contract - Self-Employed. Remember, the choice depends on your business goals and risk tolerance.