Iowa Letter of Transmittal

Description

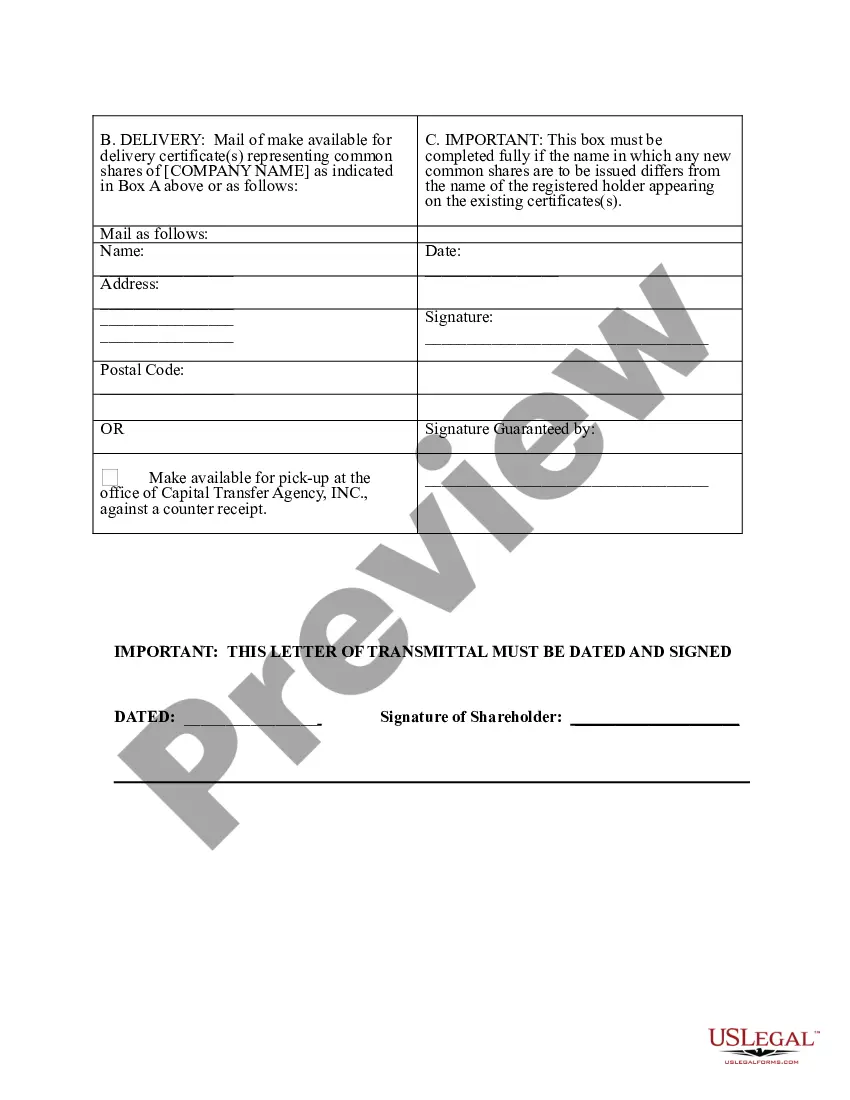

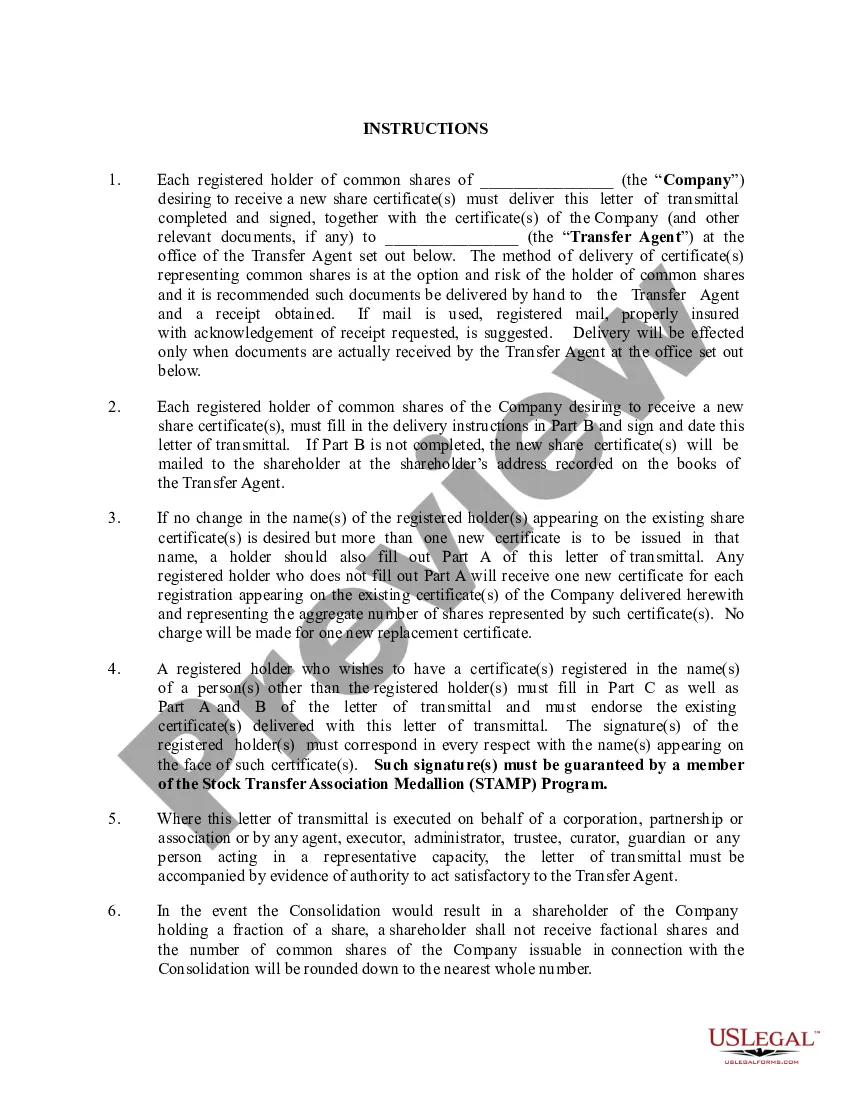

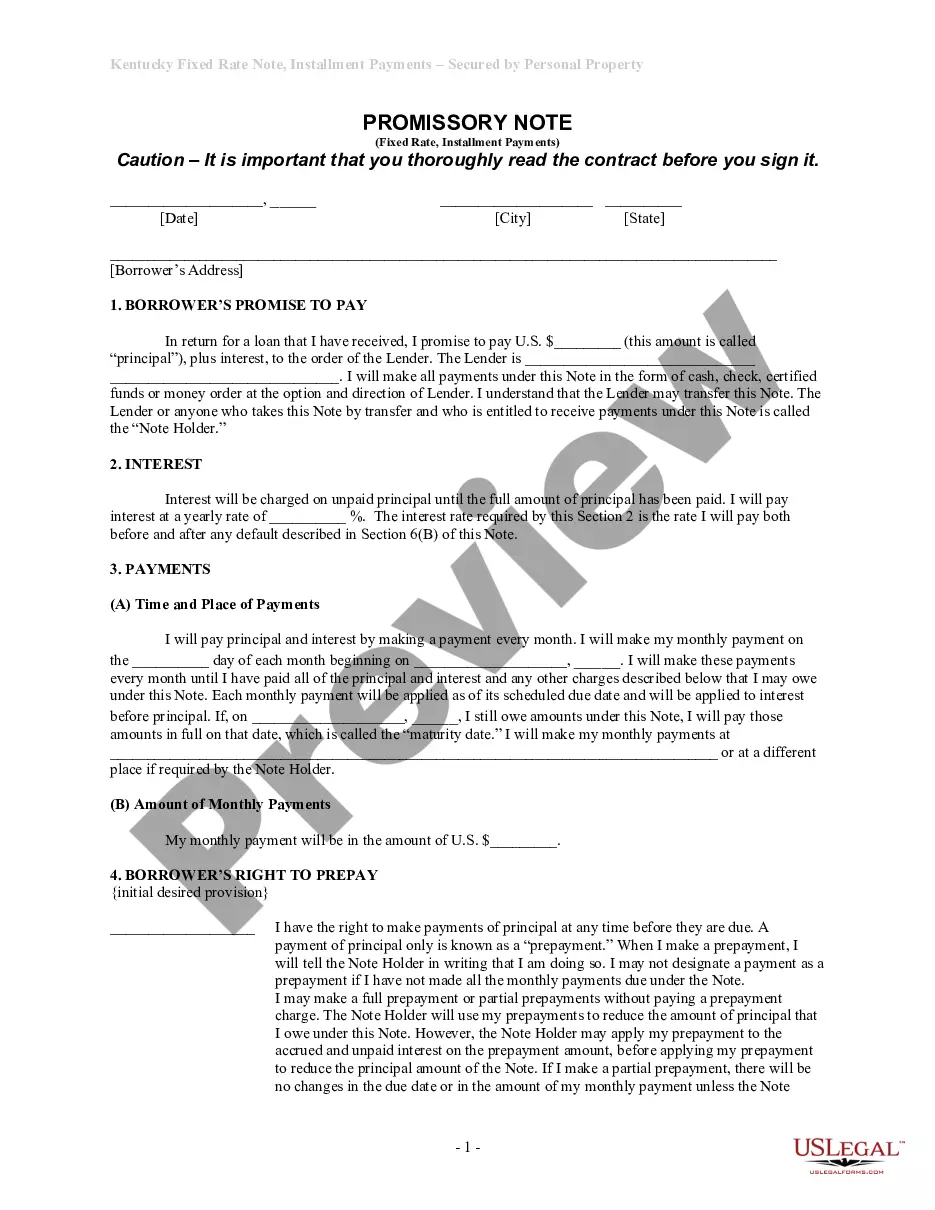

How to fill out Letter Of Transmittal?

Finding the right authorized file design can be quite a struggle. Needless to say, there are a lot of layouts available on the Internet, but how do you find the authorized type you require? Utilize the US Legal Forms internet site. The service provides thousands of layouts, such as the Iowa Letter of Transmittal, that you can use for enterprise and private demands. All of the forms are checked by experts and meet up with state and federal specifications.

In case you are presently registered, log in for your profile and click on the Acquire switch to find the Iowa Letter of Transmittal. Make use of profile to search throughout the authorized forms you possess purchased formerly. Visit the My Forms tab of the profile and acquire one more copy of your file you require.

In case you are a fresh customer of US Legal Forms, here are basic recommendations that you should adhere to:

- Very first, be sure you have selected the proper type for your personal metropolis/county. You may look through the form while using Preview switch and study the form explanation to make sure this is basically the right one for you.

- When the type will not meet up with your needs, take advantage of the Seach industry to find the appropriate type.

- When you are certain that the form would work, click on the Acquire now switch to find the type.

- Choose the rates program you want and enter in the required information and facts. Design your profile and buy an order utilizing your PayPal profile or Visa or Mastercard.

- Select the data file formatting and down load the authorized file design for your product.

- Full, edit and print and sign the acquired Iowa Letter of Transmittal.

US Legal Forms may be the largest collection of authorized forms in which you can see different file layouts. Utilize the company to down load professionally-made paperwork that adhere to express specifications.

Form popularity

FAQ

Why did the Department send me a letter? We send letters for the following reasons: You have a balance due. We have a question about your tax return.

The Bottom Line Whether you receive all of your 1099 forms or not, taxpayers must report the income when they file their taxes. Taxpayers do not need to send their 1099 forms to the IRS when filing but should report any errors on their 1099s.

If you made a payment during the calendar year as a small business or self-employed (individual), you are most likely required to file an information return to the IRS. Receipt of certain payments may also require you to file an information return to the IRS.

Businesses are required to electronically file W-2s and 1099s containing Iowa tax withholding for the tax year. Employers may include W-2s and 1099s without Iowa withholding; however, they are not required. If you do not have Iowa tax withholding, you are not required to file W-2s or 1099s.

If you are in Alaska, Florida, Illinois, New Hampshire, Nevada, New York, South Dakota, Tennessee, Texas, Washington, or Wyoming. You're not required to file Forms 1099-NEC and 1099-MISC with your state.

A penalty of $500 applies to each occurrence of filing a late or inaccurate Form W-2/1099. Starting with tax year 2022, the Verified Summary of Payments (VSP) is no longer required.

What withholding permit number do I use to file? The Department will accept both the 12-digit permit number and 9-digit permit number when filing withholding returns, W-2s, and 1099s. All permits issued after November 15, 2021 will have a 9-digit number. The Department recommends using the 9-digit number when possible.

Some states require you to send them a copy of the 1099 forms you filed with the IRS. Other states don't require you to send a copy because they participate in the Combined Federal/State Filing Program (CF/SF).