Iowa Natural Gas Inventory Forward Sale Contract

Description

How to fill out Natural Gas Inventory Forward Sale Contract?

Have you been in the situation in which you need to have papers for sometimes organization or personal purposes nearly every working day? There are tons of lawful papers templates available on the net, but finding types you can rely isn`t simple. US Legal Forms gives a large number of type templates, like the Iowa Natural Gas Inventory Forward Sale Contract, which can be composed to fulfill federal and state demands.

In case you are already acquainted with US Legal Forms website and get an account, merely log in. Following that, you are able to obtain the Iowa Natural Gas Inventory Forward Sale Contract web template.

If you do not provide an profile and would like to begin to use US Legal Forms, abide by these steps:

- Discover the type you require and make sure it is for that correct area/region.

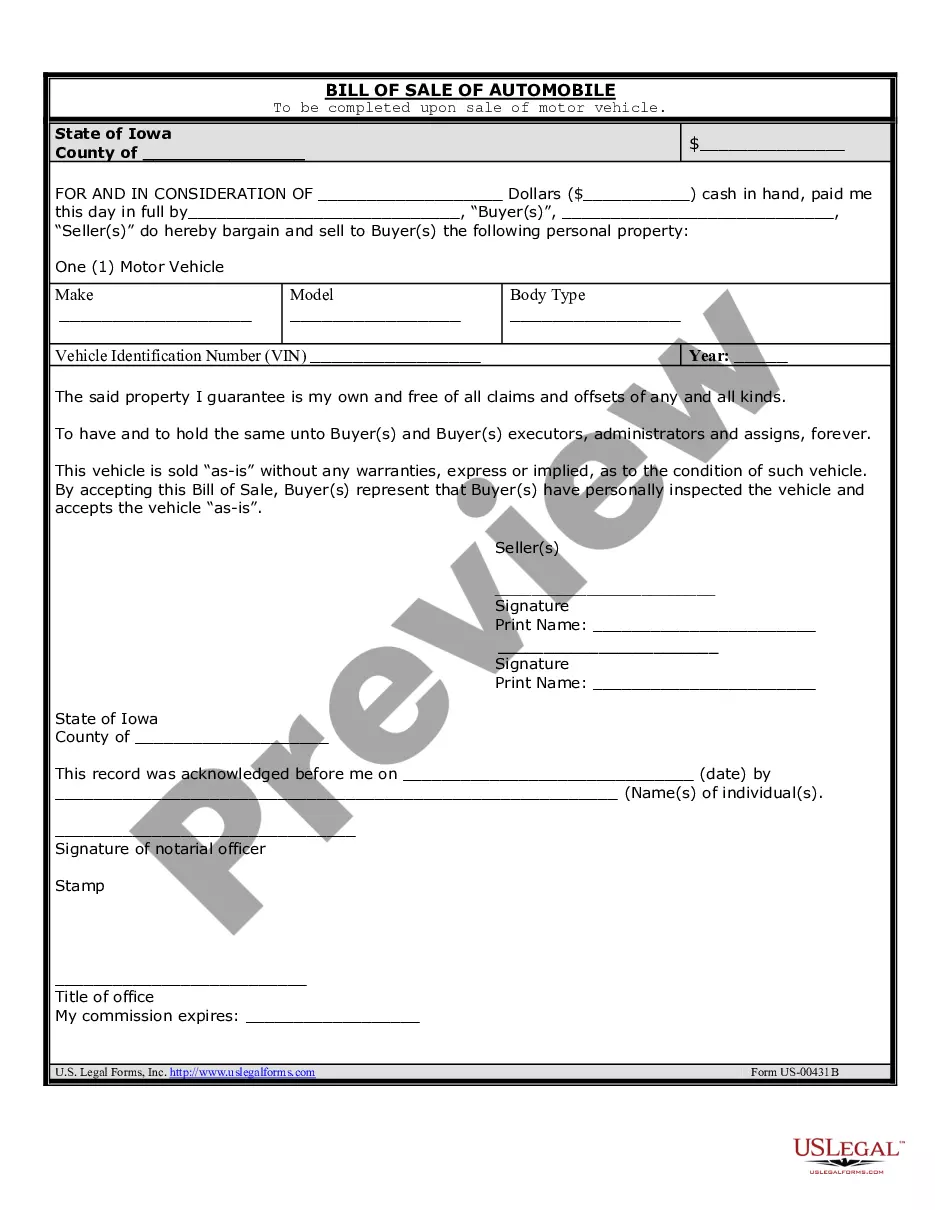

- Make use of the Preview switch to review the form.

- See the information to actually have chosen the appropriate type.

- In case the type isn`t what you are searching for, take advantage of the Look for discipline to discover the type that meets your needs and demands.

- If you discover the correct type, simply click Get now.

- Opt for the costs program you need, complete the necessary information to make your account, and pay for an order with your PayPal or credit card.

- Decide on a practical data file file format and obtain your backup.

Get every one of the papers templates you have purchased in the My Forms food selection. You can aquire a more backup of Iowa Natural Gas Inventory Forward Sale Contract at any time, if needed. Just go through the necessary type to obtain or produce the papers web template.

Use US Legal Forms, probably the most comprehensive variety of lawful kinds, in order to save time as well as avoid mistakes. The services gives professionally produced lawful papers templates which you can use for a selection of purposes. Make an account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

Sales tax applies to flourless granola bars, chewing gum, pet food, cigarettes, firearms and soda pop. But plain bulk sugar is exempt. Breakfast cereals, bottled water, cakes, cookies and ice cream, take-and-bake pizza, napkins, paper plates, milk and eggnog are also sales tax-free. Iowa law on sales tax exemptions is long and complicated desmoinesregister.com ? news ? 2018/03/01 desmoinesregister.com ? news ? 2018/03/01

You have two options when it comes to filing sales tax in Iowa: File online ? File online at the Iowa Department of Revenue. You can remit your Iowa tax payment through their online system. AutoFile ? AutoFile ? Let TaxJar file your sales tax for you. We take care of the payments, too.

Tax Exempt Items Food for human consumption. Manufacturing machinery. Raw materials for manufacturing. Utilities and fuel used in manufacturing. Medical devices and services. What Is a California Sales Tax Exemption? [Definition Examples] sambrotman.com ? california-sales-tax-exem... sambrotman.com ? california-sales-tax-exem...

(10)Painting, papering and interior decorating. a.In general. Persons engaged in the business of painting, papering, and interior decorating are selling a service subject to sales tax. Tax on enumerated services, Iowa Admin. Code r. 701-219.13 - Casetext casetext.com ? title-iii-sales-use-and-excise-tax ? r... casetext.com ? title-iii-sales-use-and-excise-tax ? r...

Some customers are exempt from paying sales tax under Iowa law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Sales of tangible personal property in Iowa are subject to sales tax unless exempted by state law. Sales of services are exempt from Iowa sales tax unless taxed by state law. The retailer must add the tax to the price and collect the tax from the purchaser.

Iowa has a state sales tax rate of 6%, with additional local option taxes that can raise the rate up to 8%. Our calculator takes into account the location of the transaction, ensuring accurate sales tax calculations for every purchase.

Sales tax is imposed on the sales price of the sale of tangible personal property, specified digital products, or taxable services at the time the sale takes place. The seller of the goods or services is responsible for collecting, reporting, and remitting the sales tax. Iowa Sales and Use Tax Guide Iowa Department of Revenue (.gov) ? iowa-sales-and-use-tax-guide Iowa Department of Revenue (.gov) ? iowa-sales-and-use-tax-guide