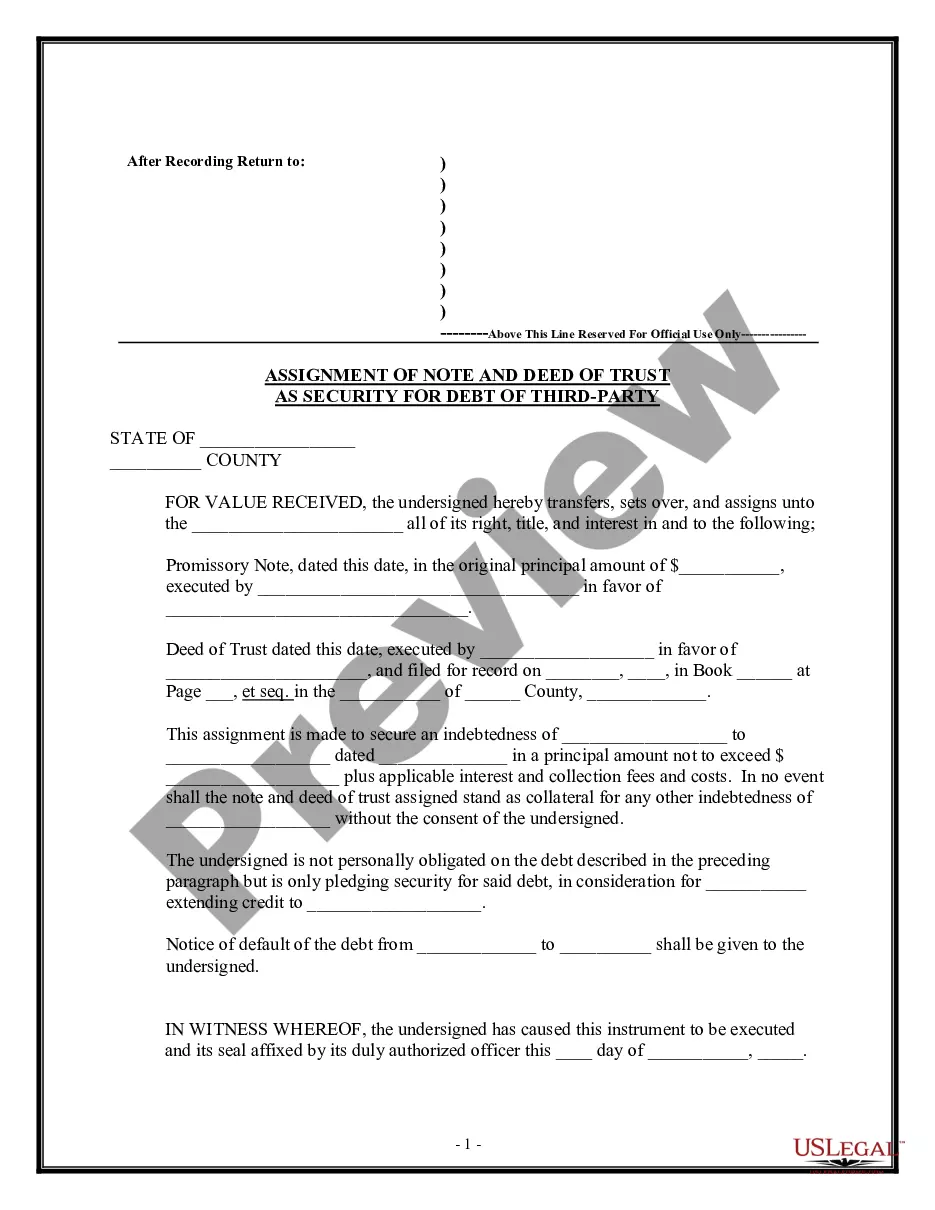

Iowa Assignment of Note and Deed of Trust as Security for Debt of Third Party

Description

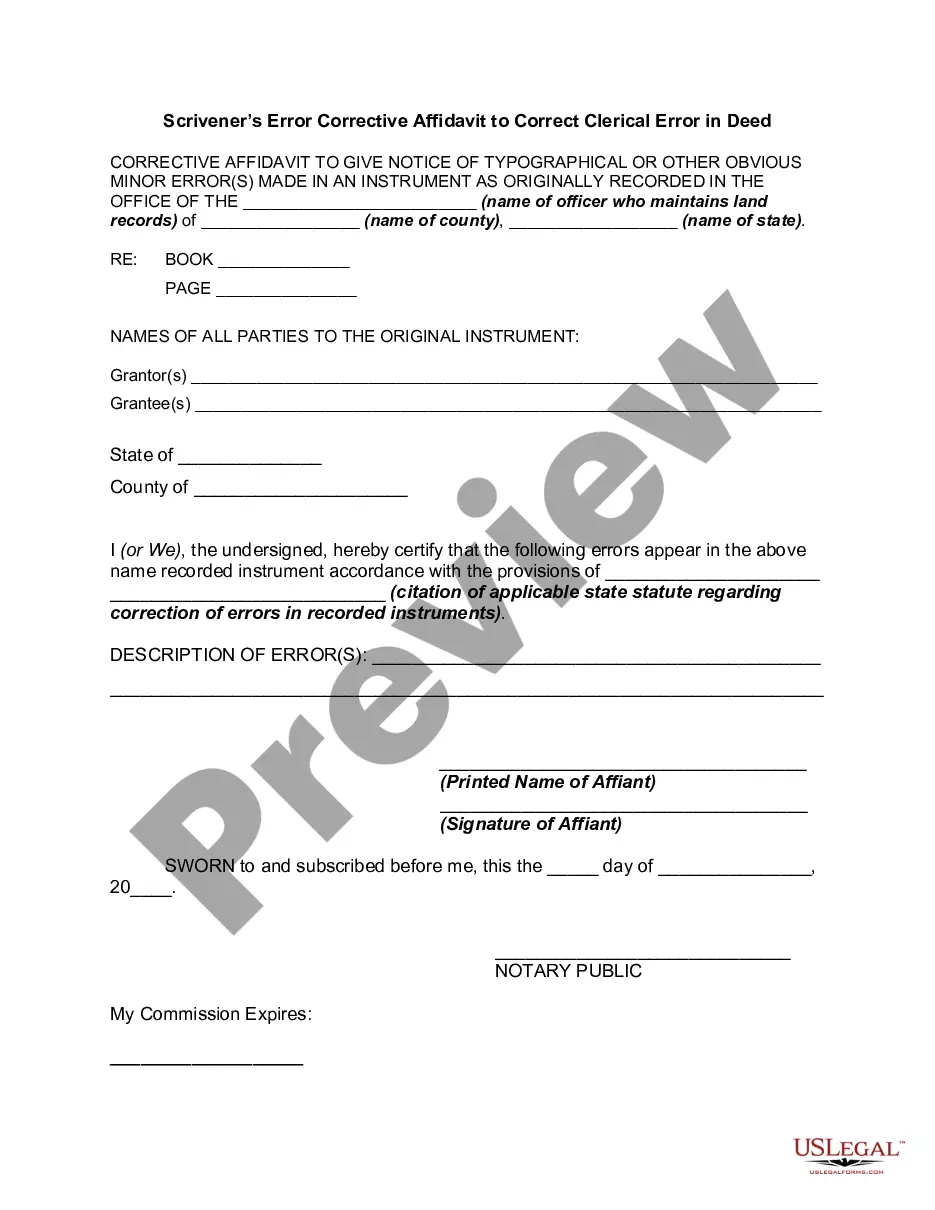

How to fill out Assignment Of Note And Deed Of Trust As Security For Debt Of Third Party?

Are you currently inside a position that you require documents for both business or personal functions virtually every time? There are a variety of legitimate document layouts available on the Internet, but finding ones you can trust isn`t effortless. US Legal Forms gives thousands of form layouts, much like the Iowa Assignment of Note and Deed of Trust as Security for Debt of Third Party, which can be composed to meet federal and state demands.

In case you are already knowledgeable about US Legal Forms site and get your account, basically log in. After that, you may down load the Iowa Assignment of Note and Deed of Trust as Security for Debt of Third Party template.

If you do not provide an account and wish to begin using US Legal Forms, follow these steps:

- Find the form you will need and ensure it is for the right metropolis/area.

- Take advantage of the Preview option to analyze the shape.

- Browse the information to actually have chosen the appropriate form.

- When the form isn`t what you are seeking, utilize the Research area to get the form that meets your requirements and demands.

- Once you find the right form, simply click Purchase now.

- Pick the costs plan you would like, submit the desired details to make your money, and pay money for the transaction making use of your PayPal or credit card.

- Choose a convenient document structure and down load your duplicate.

Get each of the document layouts you have purchased in the My Forms menus. You can get a additional duplicate of Iowa Assignment of Note and Deed of Trust as Security for Debt of Third Party anytime, if needed. Just click on the required form to down load or print the document template.

Use US Legal Forms, one of the most considerable collection of legitimate types, to save lots of time as well as avoid faults. The assistance gives expertly produced legitimate document layouts which you can use for a range of functions. Create your account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

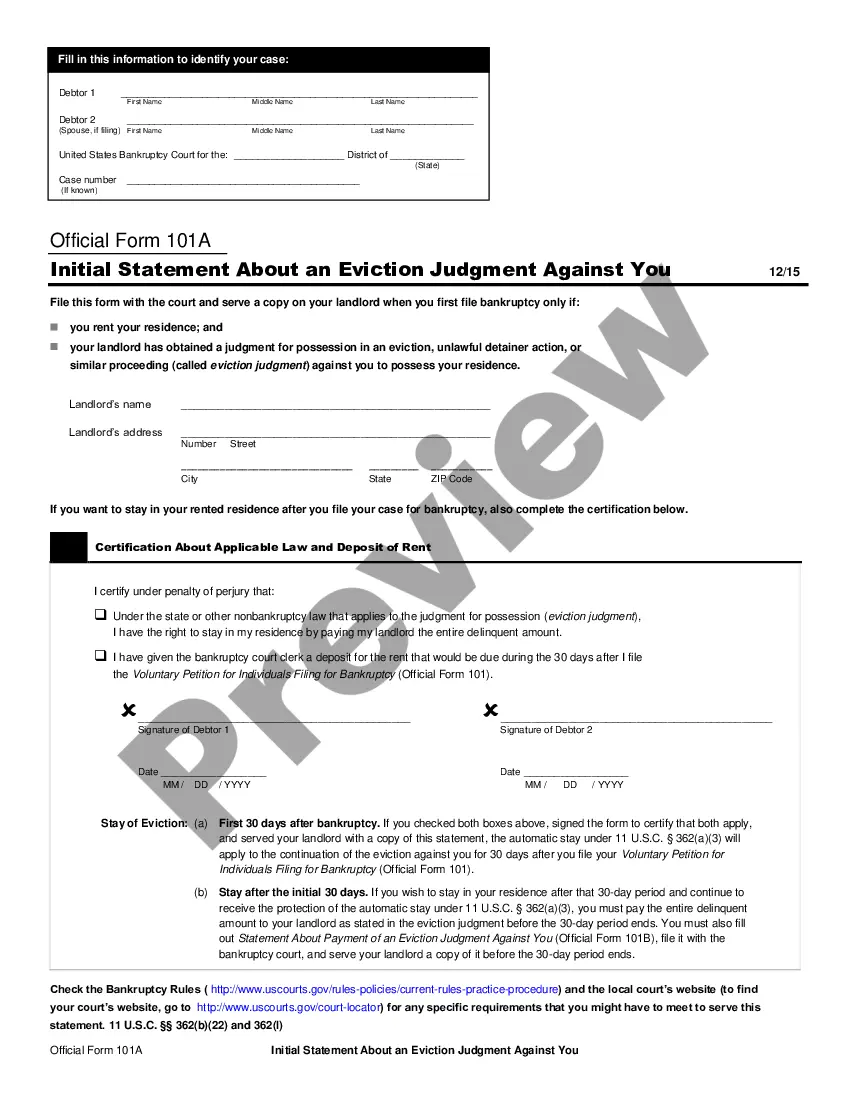

What is the Difference Between a Deed and a Deed of Trust? The primary difference between a deed and a deed of trust is the purpose of each document. A deed transfers ownership of a property from one party to another, while a deed of trust secures a loan on a property.

A trust deed is a legal agreement between you and your creditors to pay back part of what you owe over a set period. This is usually four years, but may vary.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

A Deed of Trust is an agreement between a borrower, a lender and a third-party person who's appointed as a Trustee. It's used to secure real estate transactions where money needs to be borrowed in order for property to be purchased.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

A Grant Deed is an instrument that reflects a change in ownership of real property. A Deed of Trust is an instrument that secures a debt to real property.

Back to top. Balloon Payment: An installment payment on a promissory note - usually the final one for discharging the debt - which is significantly larger than the other installment payments provided under the terms of the promissory note. Beneficiary: The lender on the note secured by a deed of trust.

P. 1.981(1). Under Iowa Rule of Civil Procedure 1.981(3), summary judgment is appropriate only when no genuine issue of material fact exists and the moving party is entitled to a judgment as a matter of law.