Iowa Notice to Debt Collector - Posing Lengthy Series of Questions or Comments

Description

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes posing a lengthy series of questions or comments to the consumer without giving the consumer a chance to reply.

How to fill out Notice To Debt Collector - Posing Lengthy Series Of Questions Or Comments?

If you want to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Utilize the site's intuitive and user-friendly search to locate the documents you require. Various templates for commercial and personal use are organized by categories and suggestions, or keywords.

Use US Legal Forms to locate the Iowa Notice to Debt Collector - Asking Lengthy Series of Questions or Comments in just a few clicks.

Every legal document template you acquire is your property forever. You have access to every form you saved in your account. Select the My documents section and pick a form to print or download again.

Complete and download, and print the Iowa Notice to Debt Collector - Asking Lengthy Series of Questions or Comments with US Legal Forms. There are numerous professional and state-specific forms you can use for your personal or business needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Download option to obtain the Iowa Notice to Debt Collector - Asking Lengthy Series of Questions or Comments.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

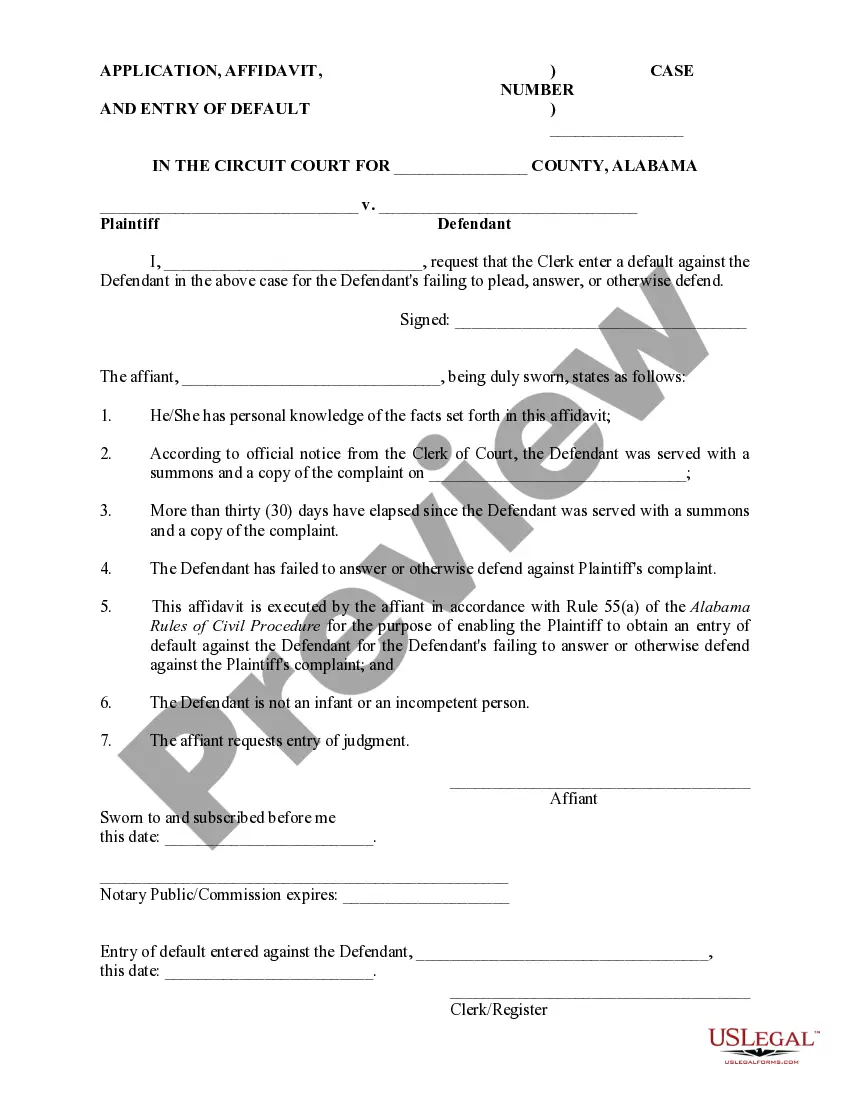

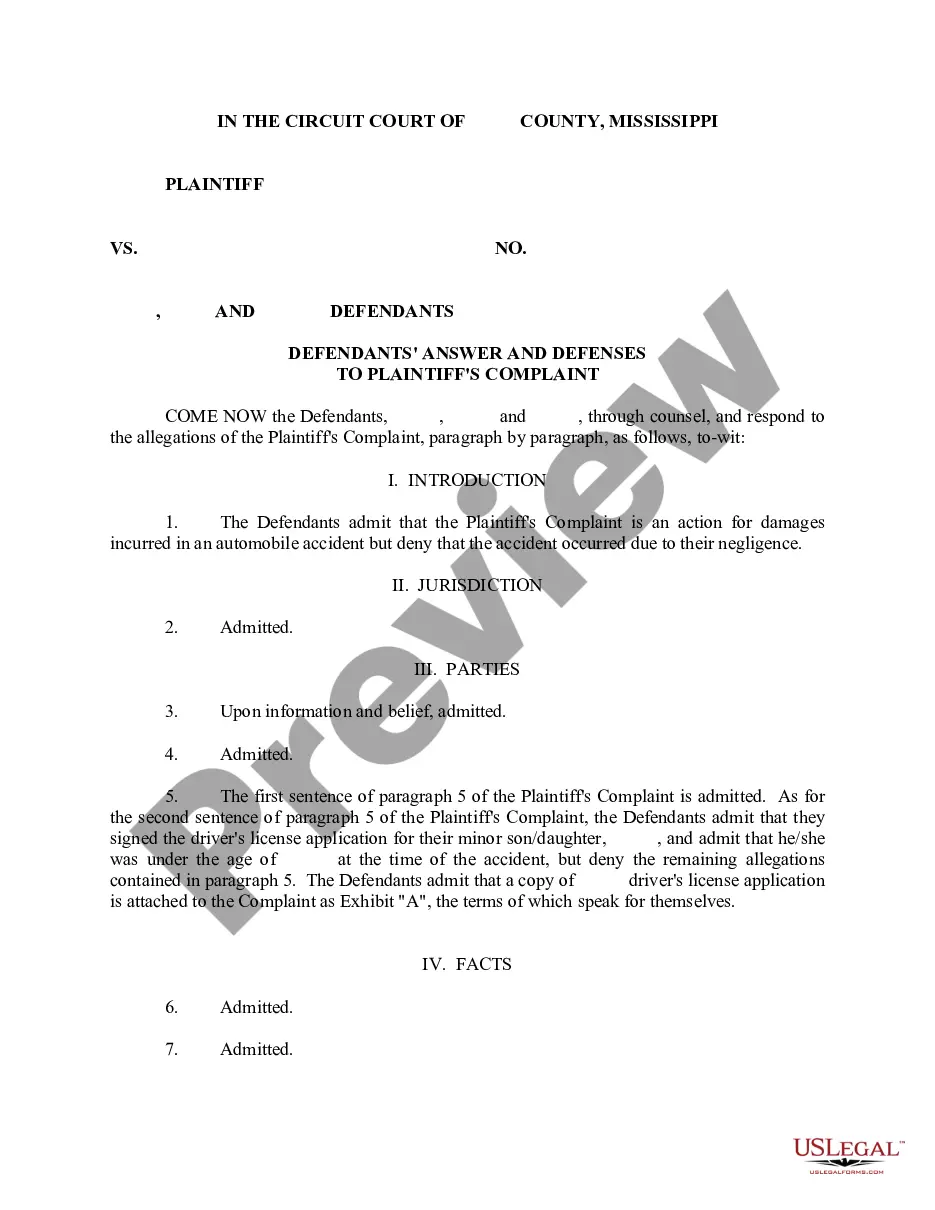

- Step 2. Use the Preview option to review the content of the form. Make sure to read the summary.

- Step 3. If you are not happy with the form, use the Search field at the top of the screen to find other types of your legal form template.

- Step 4. Once you have found the form you need, click the Get now option. Choose your preferred pricing plan and provide your details to create an account.

- Step 5. Complete the payment. You may use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal form and download it onto your device.

- Step 7. Fill out, modify, and print or sign the Iowa Notice to Debt Collector - Asking Lengthy Series of Questions or Comments.

Form popularity

FAQ

To effectively stop debt collectors, use the 11-word phrase: 'I do not owe this debt, cease communications with me immediately.' This statement informs the collector of your stance and your expectation to stop the calls. It's a proactive way to assert your rights and can often lead to a quicker resolution. For added protection, consider an Iowa Notice to Debt Collector as a formal step.

If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

The definition of debt collection harassment is to intimidate, abuse, coerce, bully or browbeat consumers into paying off debt. This happens most often over the phone, but harassment could come in the form of emails, texts, direct mail or talking to friends or neighbors about your debt.

Fortunately, there are legal actions you can take to stop this harassment:Write a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

Ask the debt collector to supply you with the details of the debt he or she is attempting to collect. Who is the original creditor? What was the original amount owed? How much of what you are attempting to collect is fees and interest accrued since he or she took possession of the debt?

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Ask the debt collector to supply you with the details of the debt he or she is attempting to collect. Who is the original creditor? What was the original amount owed? How much of what you are attempting to collect is fees and interest accrued since he or she took possession of the debt?

Do not give the caller personal financial or other sensitive information. Never give out or confirm personal financial or other sensitive information like your bank account, credit card, or Social Security number unless you know the company or person you are talking with is a real debt collector.

Debt Collectors Can't Call You Repeatedly to Harass You This means that while the FDCPA doesn't place a specific limit on the number of calls debt collectors can make, it prohibits them from calling you multiple times just to harass you. (15 U.S. Code §? 1692d).

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.