Iowa Online Marketing Agreement

Description

How to fill out Online Marketing Agreement?

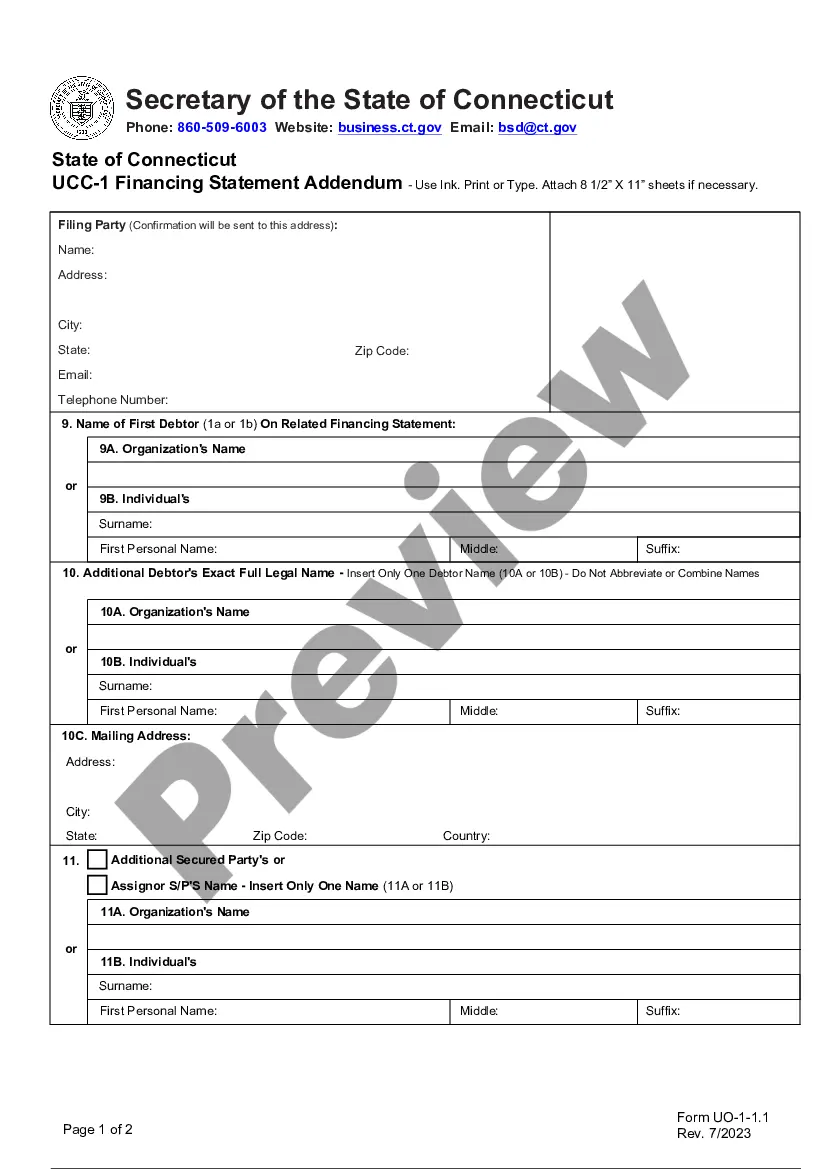

Discovering the right lawful file template can be a have a problem. Obviously, there are a lot of templates available on the Internet, but how would you discover the lawful kind you want? Use the US Legal Forms internet site. The services delivers a large number of templates, like the Iowa Online Marketing Agreement, that can be used for business and private demands. All the forms are inspected by professionals and satisfy federal and state demands.

If you are currently listed, log in for your bank account and click the Acquire switch to find the Iowa Online Marketing Agreement. Make use of your bank account to appear from the lawful forms you have bought in the past. Visit the My Forms tab of your bank account and get yet another duplicate from the file you want.

If you are a whole new end user of US Legal Forms, here are basic instructions so that you can follow:

- Very first, be sure you have selected the correct kind to your metropolis/state. You may look over the form while using Preview switch and look at the form information to ensure it is the best for you.

- In case the kind fails to satisfy your preferences, take advantage of the Seach industry to discover the right kind.

- When you are positive that the form is acceptable, click on the Get now switch to find the kind.

- Pick the costs program you need and enter in the needed info. Create your bank account and buy the order making use of your PayPal bank account or Visa or Mastercard.

- Select the file structure and down load the lawful file template for your system.

- Full, change and printing and sign the acquired Iowa Online Marketing Agreement.

US Legal Forms is definitely the most significant local library of lawful forms where you will find various file templates. Use the service to down load expertly-created paperwork that follow condition demands.

Form popularity

FAQ

5% A 5% tax is imposed on the sales price of all equipment, as defined by Iowa Code section 423D. 1, sold or used in Iowa. This tax is reported and remitted on the monthly sales and use tax return. Iowa Sales and Use Tax Guide Iowa Department of Revenue (.gov) ? node ? printable ? print Iowa Department of Revenue (.gov) ? node ? printable ? print

Iowa Sales Tax Rates The state sales tax rate in Iowa is 6%. There is also a local option tax of 1% in effect in much of the state. Iowa Sales Tax Information, Sales Tax Rates, and Deadlines accuratetax.com ? resources ? iowa accuratetax.com ? resources ? iowa

The marketplace facilitator must collect Iowa sales tax on all taxable Iowa sales, regardless of the location or sales volume of the marketplace seller. Some states have enacted laws that allow marketplace facilitators and marketplace sellers to agree which party will collect and remit on sales of the seller's items.

When buying a vehicle in Iowa, you'll pay 5% of the vehicle's sales price, whether buying from a private seller or a car dealer. Iowa's sales tax law does not discriminate between the two. Unless you qualify for a tax exemption (discussed below), you are required to pay tax on your vehicle purchase. How Much are Used Car Sales Taxes in Iowa? - PrivateAuto privateauto.com ? blog ? used-car-sales-taxes-in-i... privateauto.com ? blog ? used-car-sales-taxes-in-i...

What States Have No Sales Tax on RVs. There are currently five states that have no sales tax at all. These are Alaska, Delaware, Montana, New Hampshire, and Oregon. The states with the lowest combined state and local sales tax rates are Hawaii, Wyoming, Wisconsin, and Maine. What State Has No Sales Tax on RVs? - RVshare rvshare.com ? blog ? what-state-has-no-sales-tax-... rvshare.com ? blog ? what-state-has-no-sales-tax-...

A 5% tax is imposed on the sales price of all equipment, as defined by Iowa Code section 423D. 1, sold or used in Iowa. This tax is reported and remitted on the monthly sales and use tax return.

Iowa retailers making sales online directly to customers are responsible for collecting and remitting tax for all taxable sales to Iowa customers and on taxable sales to customers in other states, if the retailer meets or exceeds the thresholds in those states.

Iowa's economic nexus threshold is $100,000 in sales in the current or previous calendar year. To calculate the threshold, you should include gross sales. You should register for a sales tax permit on the next transaction after crossing the threshold, as confirmed by the state notice.