Iowa Amendment of terms of Class B preferred stock

Description

How to fill out Amendment Of Terms Of Class B Preferred Stock?

Discovering the right legal file format can be quite a have a problem. Obviously, there are a lot of web templates available on the net, but how do you find the legal type you want? Use the US Legal Forms website. The support offers a large number of web templates, like the Iowa Amendment of terms of Class B preferred stock, that you can use for organization and private requires. All the forms are examined by professionals and fulfill state and federal needs.

Should you be presently signed up, log in in your accounts and click the Download key to obtain the Iowa Amendment of terms of Class B preferred stock. Make use of your accounts to look from the legal forms you possess ordered earlier. Check out the My Forms tab of the accounts and have another copy of your file you want.

Should you be a fresh customer of US Legal Forms, listed here are simple directions for you to stick to:

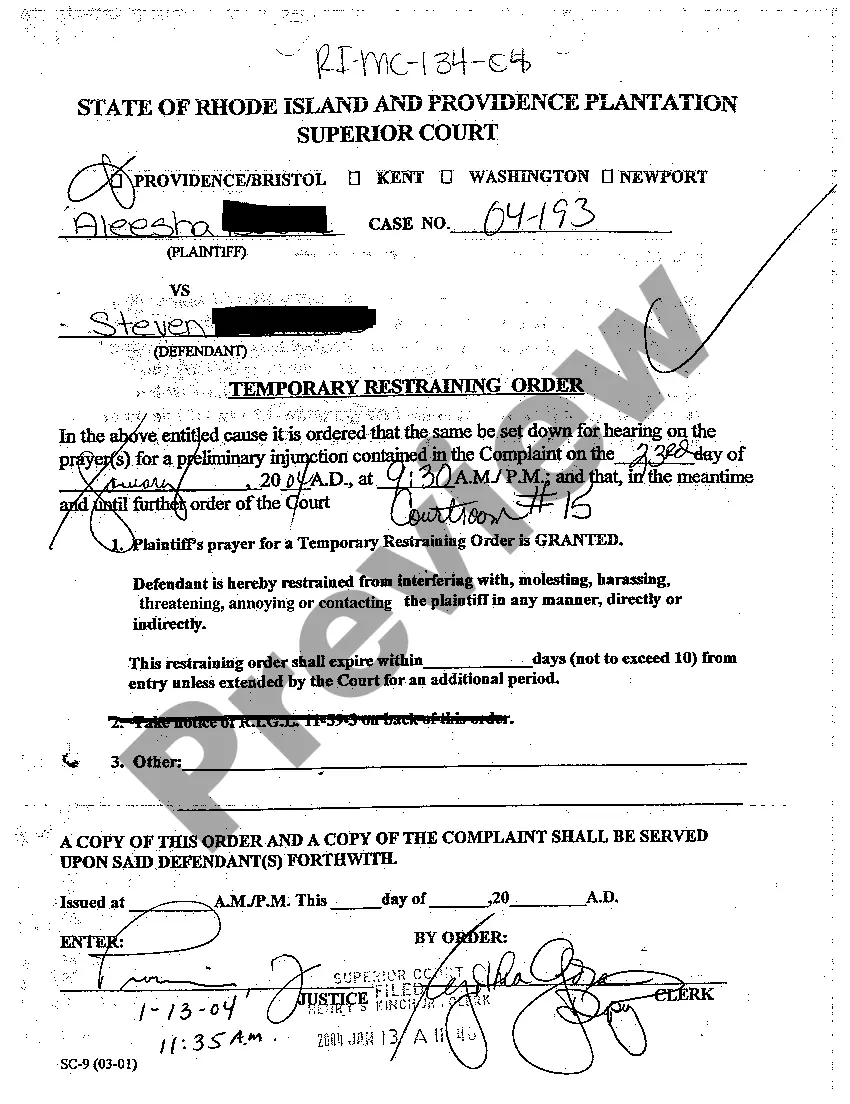

- Very first, make certain you have selected the proper type to your metropolis/state. It is possible to examine the form while using Review key and read the form information to make certain it will be the right one for you.

- In case the type will not fulfill your expectations, use the Seach discipline to discover the appropriate type.

- When you are positive that the form is acceptable, select the Purchase now key to obtain the type.

- Choose the pricing prepare you want and enter in the needed information. Design your accounts and pay money for the order utilizing your PayPal accounts or credit card.

- Select the data file formatting and download the legal file format in your device.

- Total, edit and print and signal the obtained Iowa Amendment of terms of Class B preferred stock.

US Legal Forms is the most significant collection of legal forms for which you will find a variety of file web templates. Use the service to download appropriately-created files that stick to status needs.

Form popularity

FAQ

Preferred shares have numerous rights which can be attached to them, such as cumulative dividends, convertibility, and participation.

Noncumulative describes a type of preferred stock that does not entitle investors to reap any missed dividends. By contrast, "cumulative" indicates a class of preferred stock that indeed entitles an investor to dividends that were missed.

Whether a preferred stock is cumulative or straight (non-cumulative) determines if the issuer must make up skipped payments. If it's cumulative, the issuer must pay missed dividends to preferred stockholders at some point. If it's straight, the issuer will not make up skipped dividends.

They calculate the cost of preferred stock by dividing the annual preferred dividend by the market price per share. Once they have determined that rate, they can compare it to other financing options. The cost of preferred stock is also used to calculate the Weighted Average Cost of Capital.

Cumulative preferred stock includes a provision that requires the company to pay shareholders all dividends, including those that were omitted in the past, before the common shareholders are able to receive their dividend payments. These dividend payments are guaranteed but not always paid out when they are due.

Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past, the dividends owed must be paid out to cumulative preferred shareholders first.

Typically, company founders and employees receive common stock, while venture capital investors receive preferred shares, often with a liquidation preference. The preferred shares are typically converted to common shares with the completion of an initial public offering or acquisition.

Cumulative preference shares allow owners to receive cumulative dividend payouts from the company even if the company is not profitable. In years when the corporation is not profitable, these dividends will be reported as arrears and will be paid in full when the business becomes profitable.