Iowa Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc.

Description

How to fill out Long Term Performance And Restricted Stock Incentive Plan Of Ipalco Enterprises, Inc.?

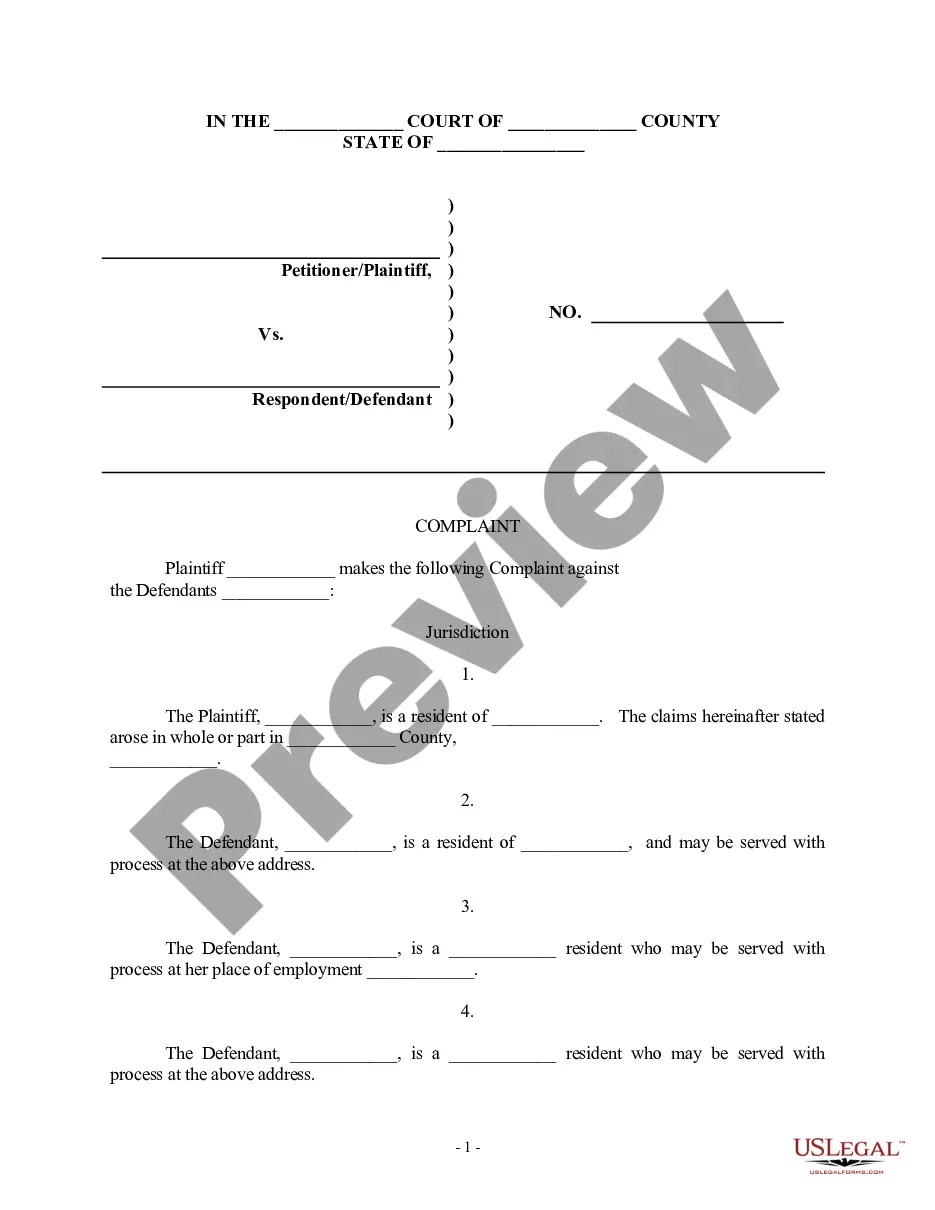

You can commit hrs on-line trying to find the legal papers format that fits the state and federal needs you require. US Legal Forms offers thousands of legal forms which can be reviewed by experts. It is simple to download or printing the Iowa Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc. from the service.

If you already possess a US Legal Forms profile, you can log in and then click the Obtain button. Next, you can comprehensive, change, printing, or sign the Iowa Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc.. Every legal papers format you acquire is your own forever. To get one more version associated with a obtained form, check out the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms web site the very first time, stick to the simple directions below:

- First, be sure that you have selected the correct papers format for the region/town of your choosing. See the form explanation to ensure you have picked out the proper form. If offered, use the Review button to search with the papers format at the same time.

- If you would like get one more variation in the form, use the Lookup discipline to get the format that suits you and needs.

- Upon having identified the format you would like, simply click Get now to carry on.

- Select the prices program you would like, enter your references, and register for a free account on US Legal Forms.

- Full the purchase. You should use your charge card or PayPal profile to purchase the legal form.

- Select the formatting in the papers and download it to your device.

- Make alterations to your papers if required. You can comprehensive, change and sign and printing Iowa Long Term Performance and Restricted Stock Incentive Plan of Ipalco Enterprises, Inc..

Obtain and printing thousands of papers web templates utilizing the US Legal Forms web site, that provides the largest collection of legal forms. Use skilled and condition-particular web templates to deal with your small business or personal requirements.

Form popularity

FAQ

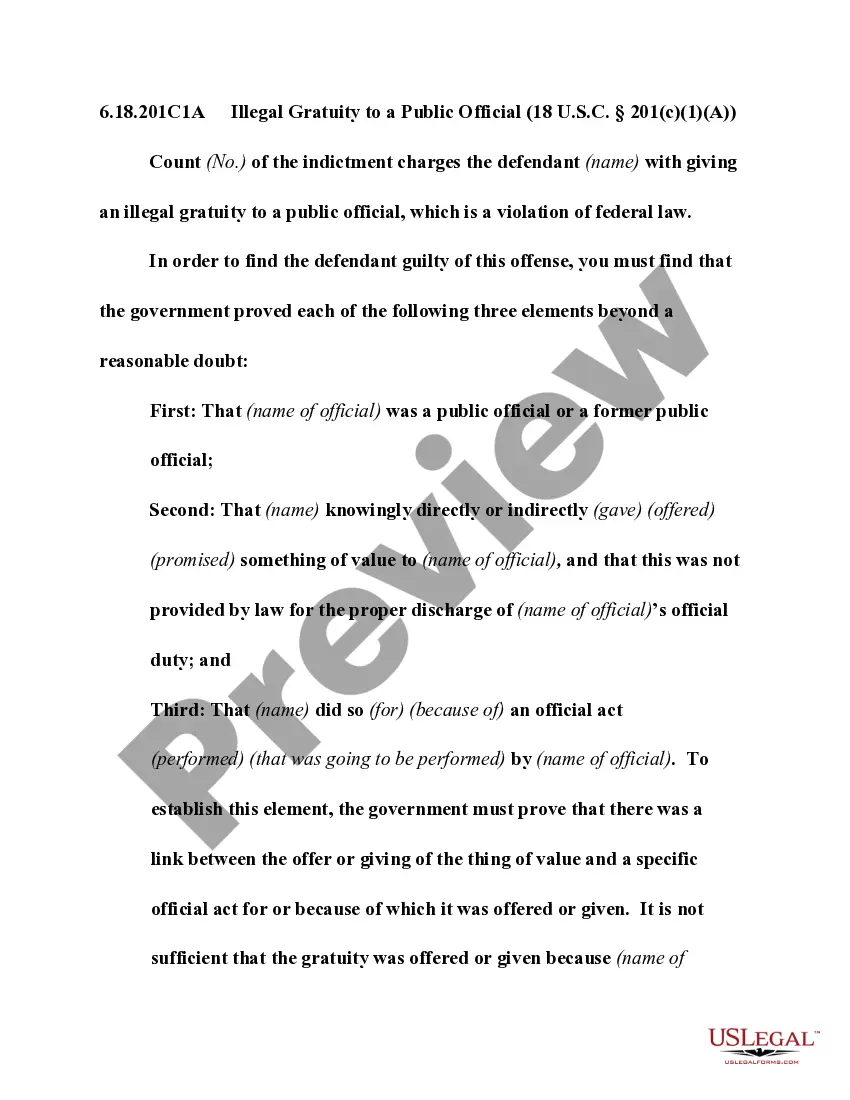

RSUs are a type of restricted stock (which may also be known as ?letter stock? or ?restricted securities?). Restricted stock is company stock that cannot be fully transferable until certain restrictions have been met. These can be performance or timing restrictions, similar to restrictions for options.

You lose all your unvested RSU shares when you quit your job. For the vested RSU shares that are already in your brokerage account, you can keep those since it is your money as soon as it vests.

RSUs have no actual financial value to the employee when issued. However, once they vest, employees can receive shares of stock or, less commonly, an equivalent value in cash. Until the RSUs vest, they remain an unfunded promise to compensate the recipient at some point in the future.

1 There are many ways to structure an employee equity program, but the vast majority of private companies choose stock options (options) or restricted stock units (RSUs).

Some investors opt to sell their RSUs right away, before they have an opportunity to gain or lose value. It is a savvy way to minimize these capital gains taxes and avoid RSUs being taxed twice.

A company can choose to grant equity based on a predefined value on the grant date or predefined number of shares (the former is more popular). Unlike an appreciation-based award, a restricted stock will still have value upon vesting even if the per-stock value decreases.

In summary, RSUs in public companies offer more immediate liquidity, allowing employees to sell their shares as soon as they vest. On the other hand, private company RSUs involve waiting for specific events or finding a willing buyer to access the value of the shares.

Equity compensation is non-cash pay that is offered to employees. Equity compensation may include options, restricted stock, and performance shares; all of these investment vehicles represent ownership in the firm for a company's employees. At times, equity compensation may accompany a below-market salary.