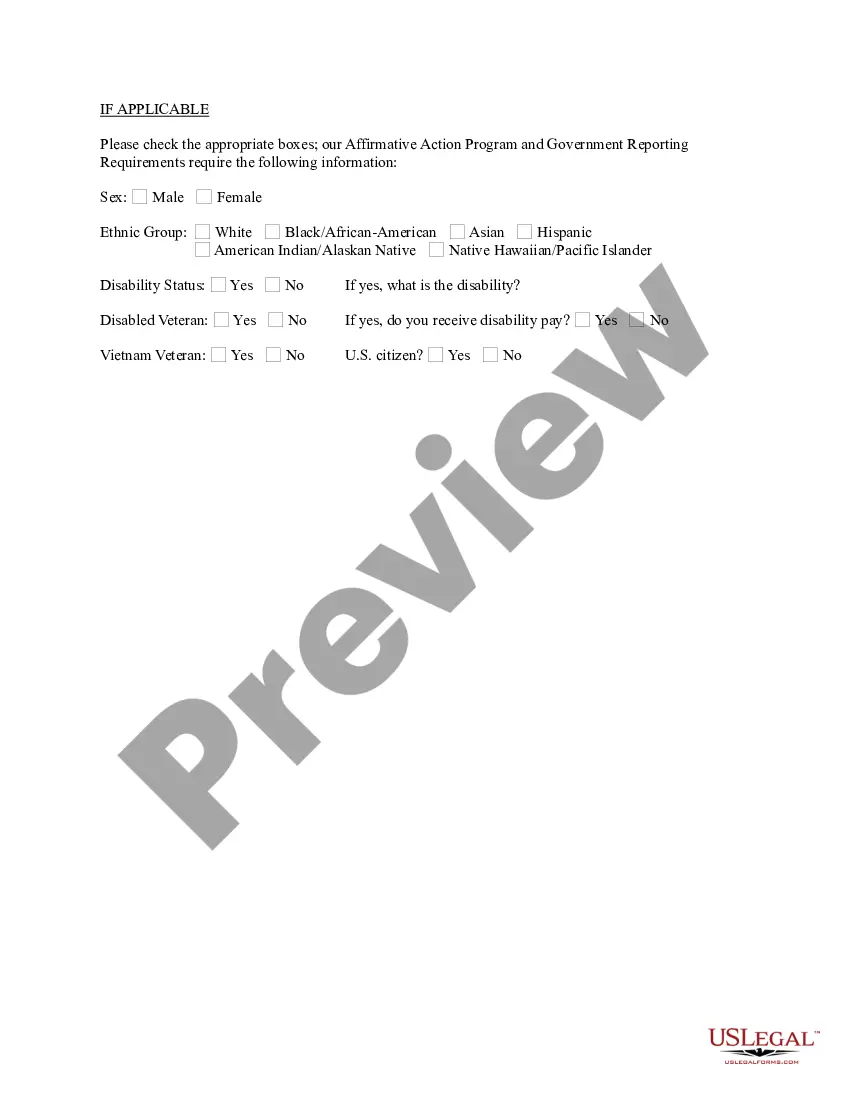

Iowa Post-Employment Information Sheet

Description

How to fill out Post-Employment Information Sheet?

Are you presently in a circumstance where you need documents for both corporate or particular purposes almost every time.

There are numerous authentic document templates accessible on the web; however, obtaining types you can depend on is not simple.

US Legal Forms offers a vast collection of templates, including the Iowa Post-Employment Information Sheet, which are designed to fulfill state and federal requirements.

Once you find the correct form, simply click Acquire now.

Select a suitable file format and download your version.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Iowa Post-Employment Information Sheet template.

- If you do not have an account and want to start utilizing US Legal Forms, follow these steps.

- Locate the form you need and confirm it’s for your correct area/region.

- Utilize the Review option to examine the form.

- Check the outline to ensure that you have chosen the correct form.

- If the form is not what you are looking for, utilize the Research field to find the form that suits your needs.

Form popularity

FAQ

Once your application has been approved, the Department of Labor will send a Monetary Determination with information on your weekly benefit amount. After making your claim, it will take between two to three weeks to receive it. Delays may be caused if the state needs additional information before sending payment.

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

The weekly benefit amount is calculated by dividing the sum of the wages earned during the highest quarter of the base period by 26, rounded down to the next lower whole dollar. The result cannot exceed the utmost weekly benefit permitted by rule.

Unemployment Insurance is a tax paid entirely by employers who are covered by the Iowa Employment Security Law. Who is Eligible? How much per week and I eligible for? The minimum weekly benefit amount is $87 and the maximum weekly benefit amount is $591.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

How much per week and I eligible for? The minimum weekly benefit amount is $87 and the maximum weekly benefit amount is $591. The weekly payment depends on the wages you were paid during prior quarters of the year and the number of dependents you have.

Extended unemployment benefits for a claimant who has previously exhausted their benefits. Payments through June 12, 2021. Individuals are eligible for the same amount of unemployment insurance benefit payment from the previous weeks they received.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

In order to maintain eligibility for unemployment benefits, you are required complete four reemployment activities each week, unless this requirement is waived by the department.

Weekly Benefit Amount To calculate the WBA, the wages in the highest quarter of the base period are divided by: 23 for zero dependents (maximum of $531) 22 for one dependent (maximum of $551) 21 for two dependents (maximum of $571)