Statutory Guidelines [Appendix A(4) IRC 468B] regarding special rules for designated settlement funds.

Iowa Special Rules for Designated Settlement Funds IRS Code 468B

Description

How to fill out Special Rules For Designated Settlement Funds IRS Code 468B?

Are you currently in a position in which you will need paperwork for either company or individual reasons almost every working day? There are plenty of lawful document templates accessible on the Internet, but locating types you can rely isn`t easy. US Legal Forms delivers a huge number of form templates, like the Iowa Special Rules for Designated Settlement Funds IRS Code 468B, that are published to satisfy federal and state needs.

Should you be already informed about US Legal Forms web site and get a merchant account, merely log in. Afterward, you may down load the Iowa Special Rules for Designated Settlement Funds IRS Code 468B template.

Unless you offer an profile and would like to start using US Legal Forms, follow these steps:

- Get the form you need and make sure it is for the correct area/state.

- Use the Review option to review the shape.

- See the explanation to ensure that you have chosen the correct form.

- If the form isn`t what you are searching for, utilize the Research field to discover the form that meets your needs and needs.

- When you discover the correct form, simply click Purchase now.

- Opt for the pricing prepare you need, complete the specified information and facts to create your bank account, and pay for an order utilizing your PayPal or Visa or Mastercard.

- Decide on a practical paper structure and down load your copy.

Find all of the document templates you possess bought in the My Forms food list. You may get a extra copy of Iowa Special Rules for Designated Settlement Funds IRS Code 468B at any time, if possible. Just click the essential form to down load or print out the document template.

Use US Legal Forms, probably the most substantial assortment of lawful varieties, to save time and steer clear of faults. The service delivers appropriately produced lawful document templates which can be used for an array of reasons. Produce a merchant account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

§ 1.468B-2 Taxation of qualified settlement funds and related administrative requirements. (a) In general. A qualified settlement fund is a United States person and is subject to tax on its modified gross income for any taxable year at a rate equal to the maximum rate in effect for that taxable year under section 1(e).

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

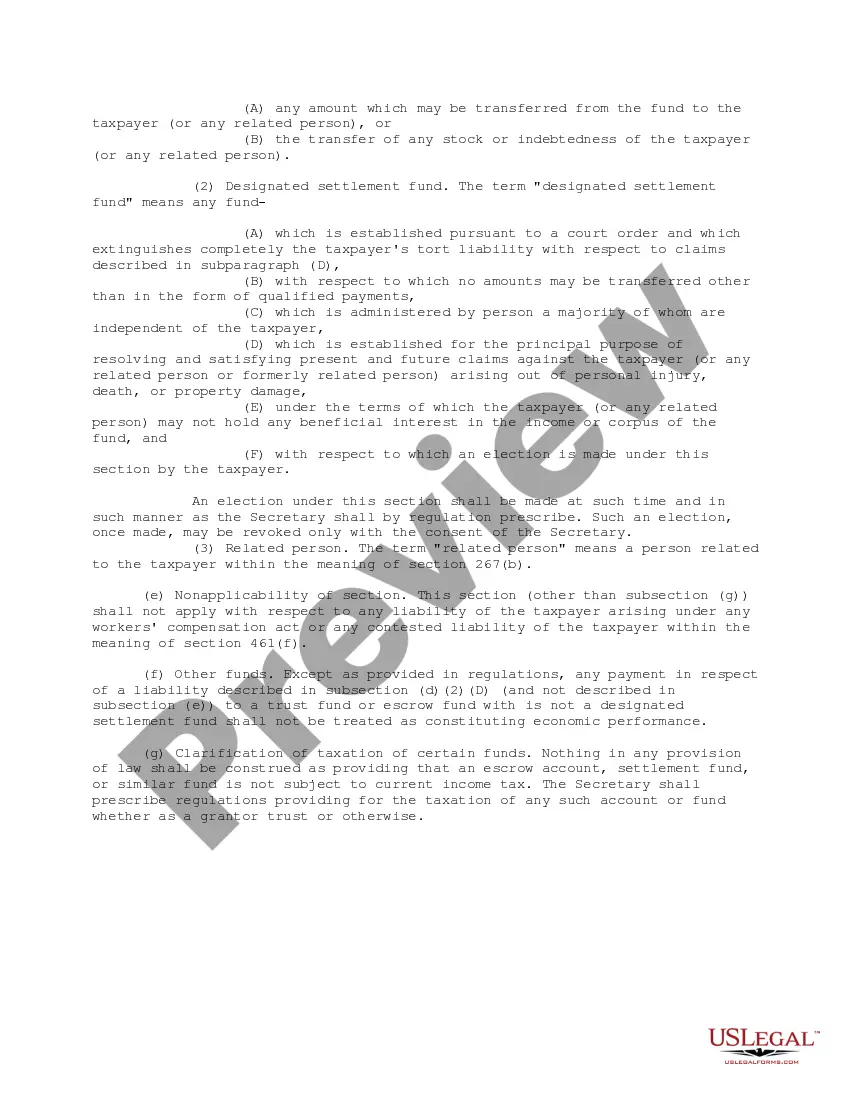

Internal Revenue Code (IRC) § 468B provides for the taxation of designated settlement funds and directs the Department of the Treasury to prescribe regulations providing for the taxation of an escrow account, settlement fund, or similar fund, whether as a grantor trust or otherwise.

A Qualified Settlement Fund (QSF), also referred to as a 468B Trust, is an exceptionally useful settlement tool that allows time to properly resolve mass tort litigation and other cases involving multiple claimants.

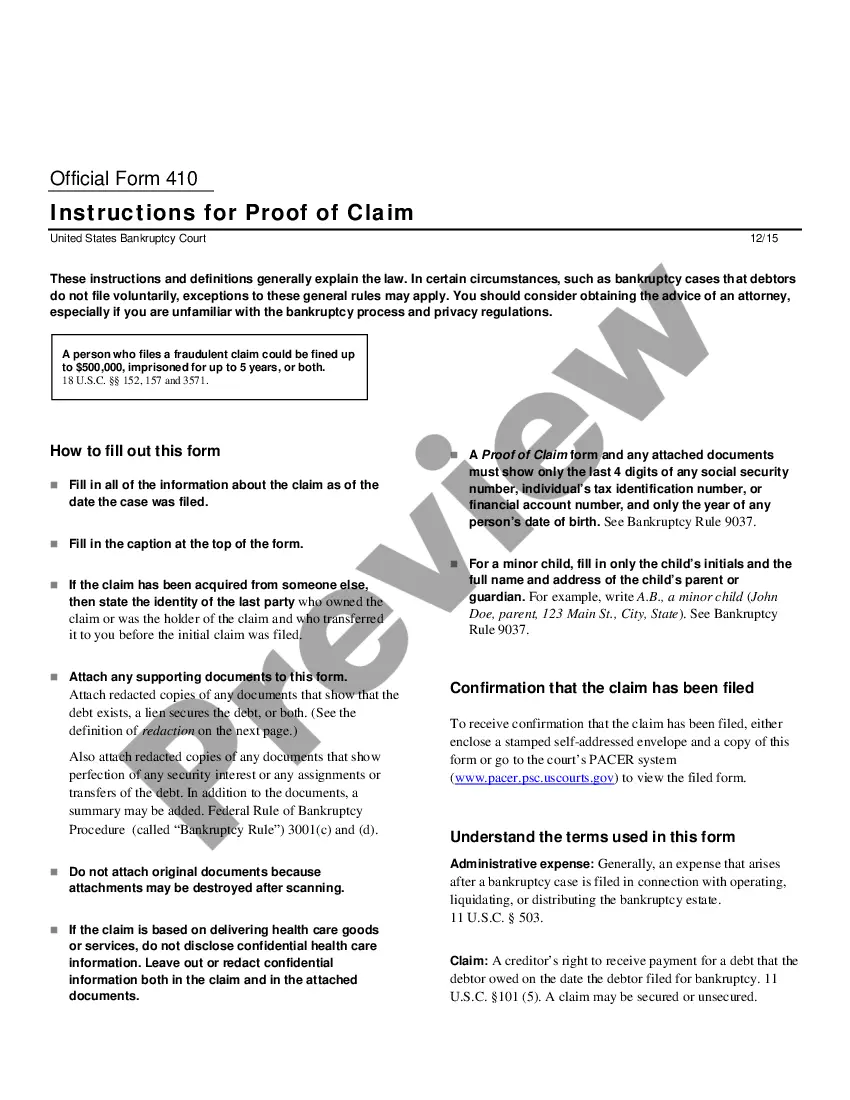

How do law firms establish qualified settlement funds? Be established pursuant to a court order and is subject to continuing jurisdiction of the court (26 CFR § 1.468B(c)). Resolve one or more contested claims arising out of a tort, breach of contract, or violation of law. A trust under applicable state law.

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

The financial statement income or loss of a disregarded entity is included on Part I, line 7a or 7b, only if its financial statement income or loss is included on Part I, line 11, but not on Part I, line 4a. with its most recently filed U.S. income tax return or return of income filed prior to that day.