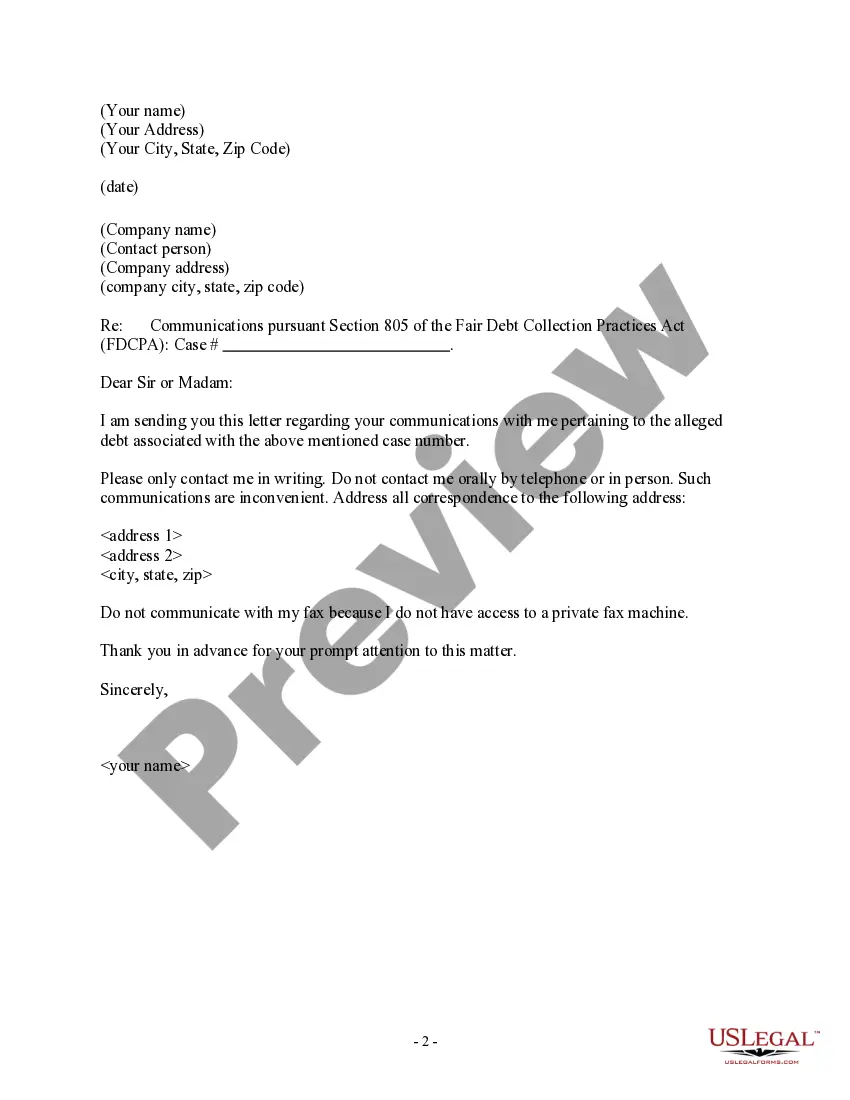

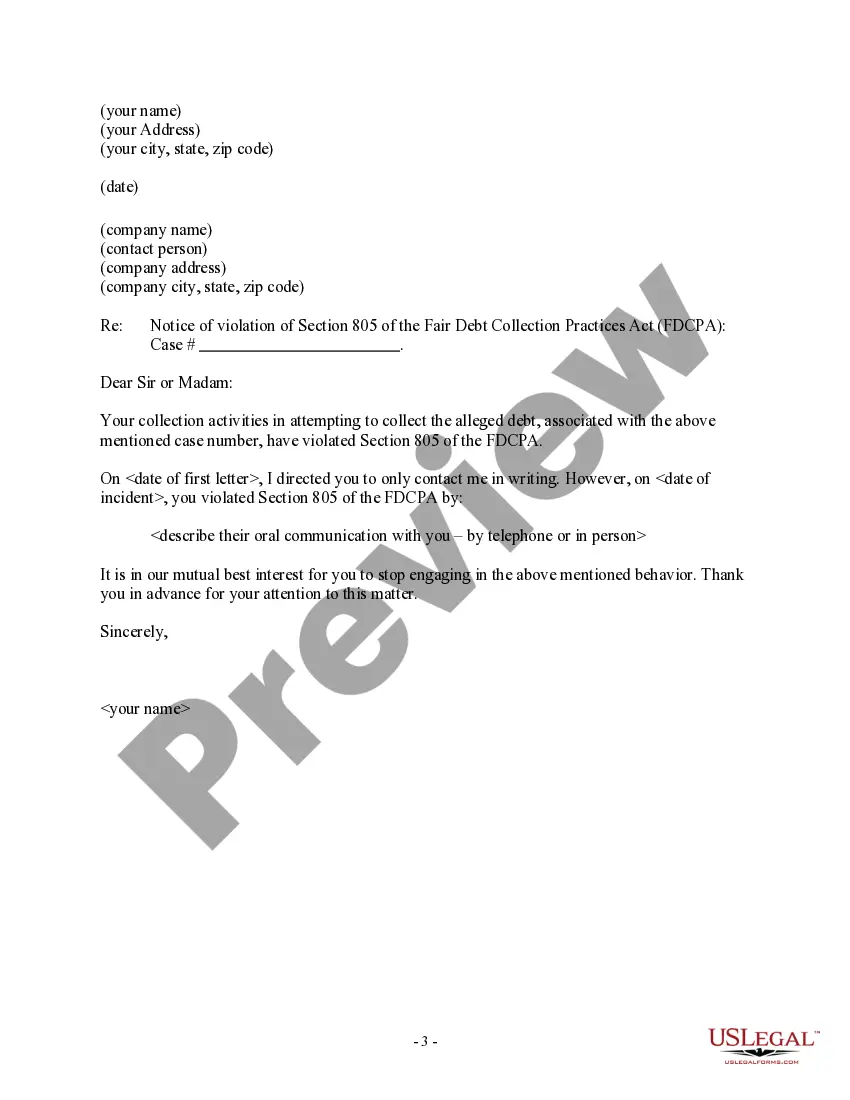

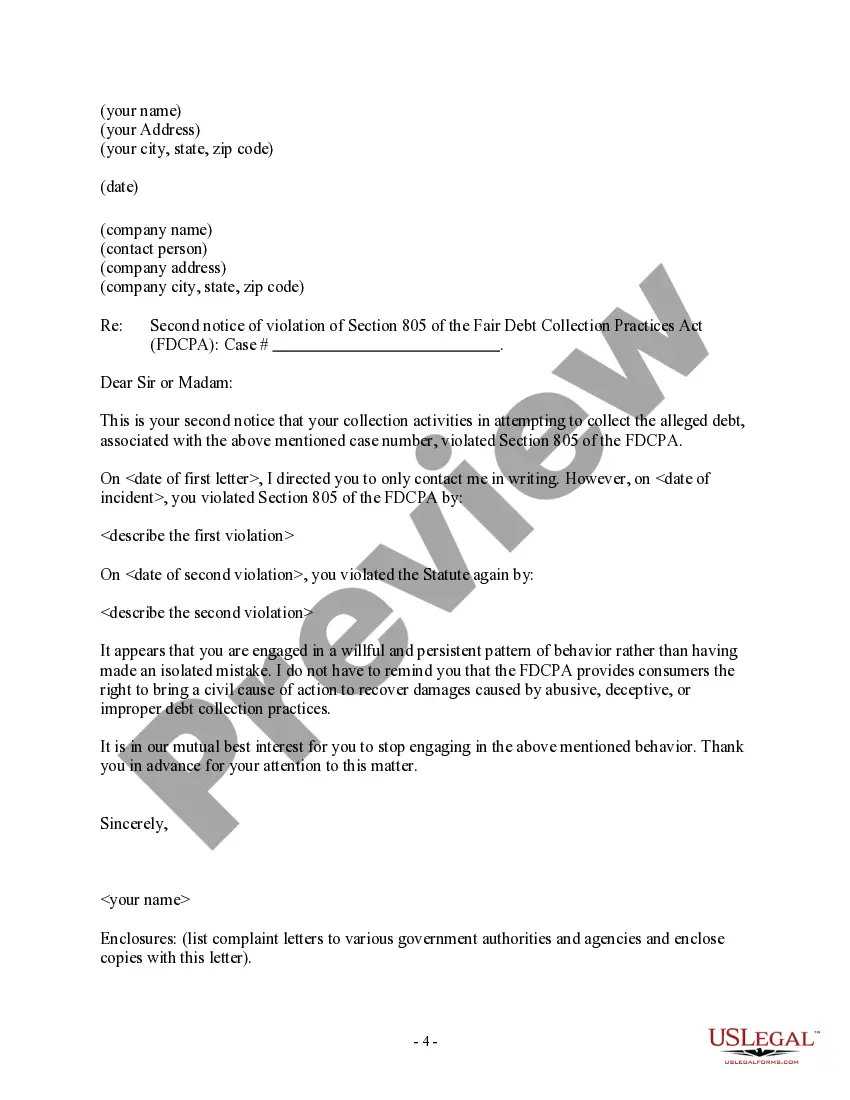

Iowa Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

Are you currently in a location where you frequently need documents for either business or personal purposes.

There is a wide variety of legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers countless form templates, including the Iowa Letter to Debt Collector - Only Contact Me In Writing, designed to comply with state and federal regulations.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- After logging in, you can download the Iowa Letter to Debt Collector - Only Contact Me In Writing template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Select the form you require and ensure it corresponds to the correct city/state.

- Click the Review button to examine the document.

- Check the summary to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Lookup field to find the template that aligns with your requirements.

- Upon finding the correct form, click Acquire now.

- Choose the pricing plan you prefer, provide the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- Select a convenient file format and download your copy.

- Retrieve all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Iowa Letter to Debt Collector - Only Contact Me In Writing at any time, if desired. Simply click on the appropriate form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes. The service provides well-designed legal document templates suitable for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

Unless your state law provides otherwise, the FDCPA only requires debt collectors, not original creditors, to verify debts in certain circumstances. This requirement includes law firms that are routinely engaged in collecting debts.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

How long does a judgment lien last in Iowa? A judgment lien in Iowa will remain attached to the debtor's property (even if the property changes hands) for ten years.

Each state has a law referred to as a statute of limitations that spells out the time period during which a creditor or collector may sue borrowers to collect debts. In most states, they run between four and six years after the last payment was made on the debt.

If the collection agency first contacts you by phone, insist that they contact you in writing. Do not give personal or financial information to the caller until you have confirmed it is a legitimate debt collector.

If a debt collector fails to validate the debt in question and continues trying to collect, you have a right under the FDCPA to countersue for up to $1,000 for each violation, plus attorney fees and court costs, as mentioned previously.

You can submit a complaint via the FTC website under the link for consumer complaint. Contact each credit reporting agency and dispute the debt. You can do this via their websites. Notify them that you have failed to receive debt verification from the debt collector.

Under Iowa state law, creditors have 10 years to sue for any unpaid debt that stems from a written contract. For debts based on oral agreements, the statute of limitations is five years.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.