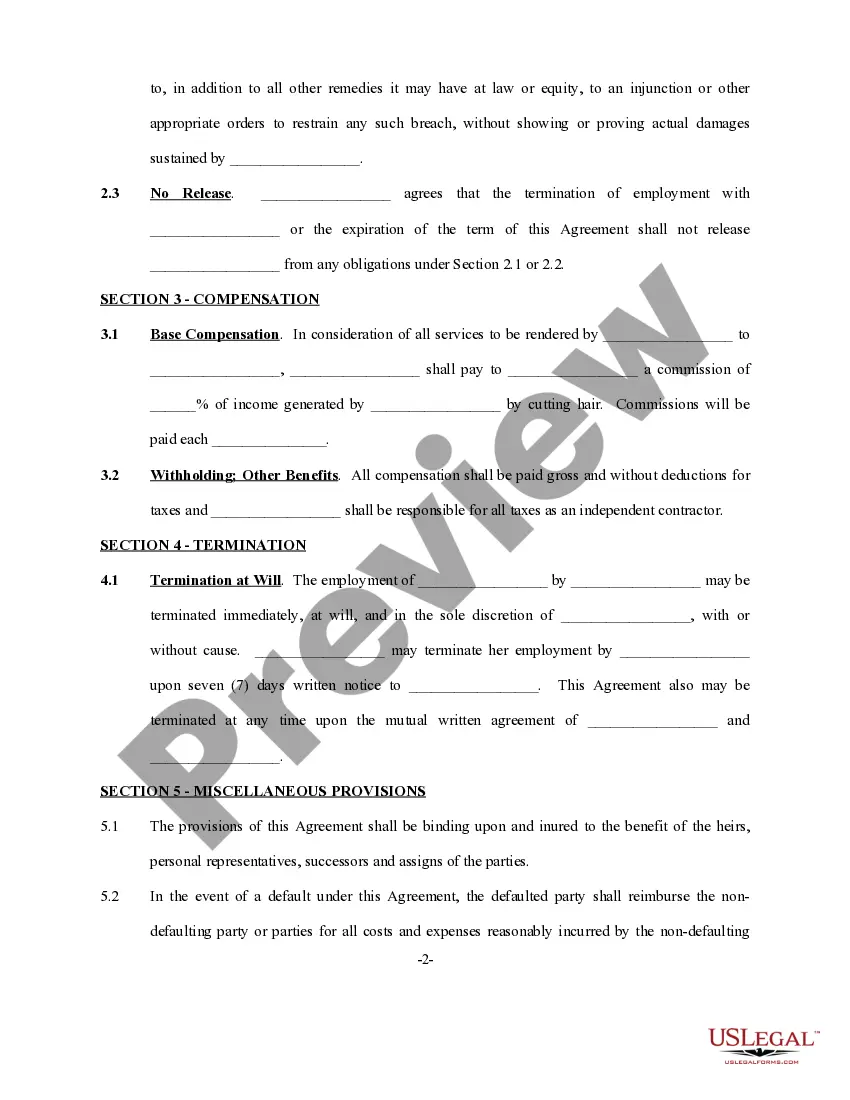

Iowa Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop

Description

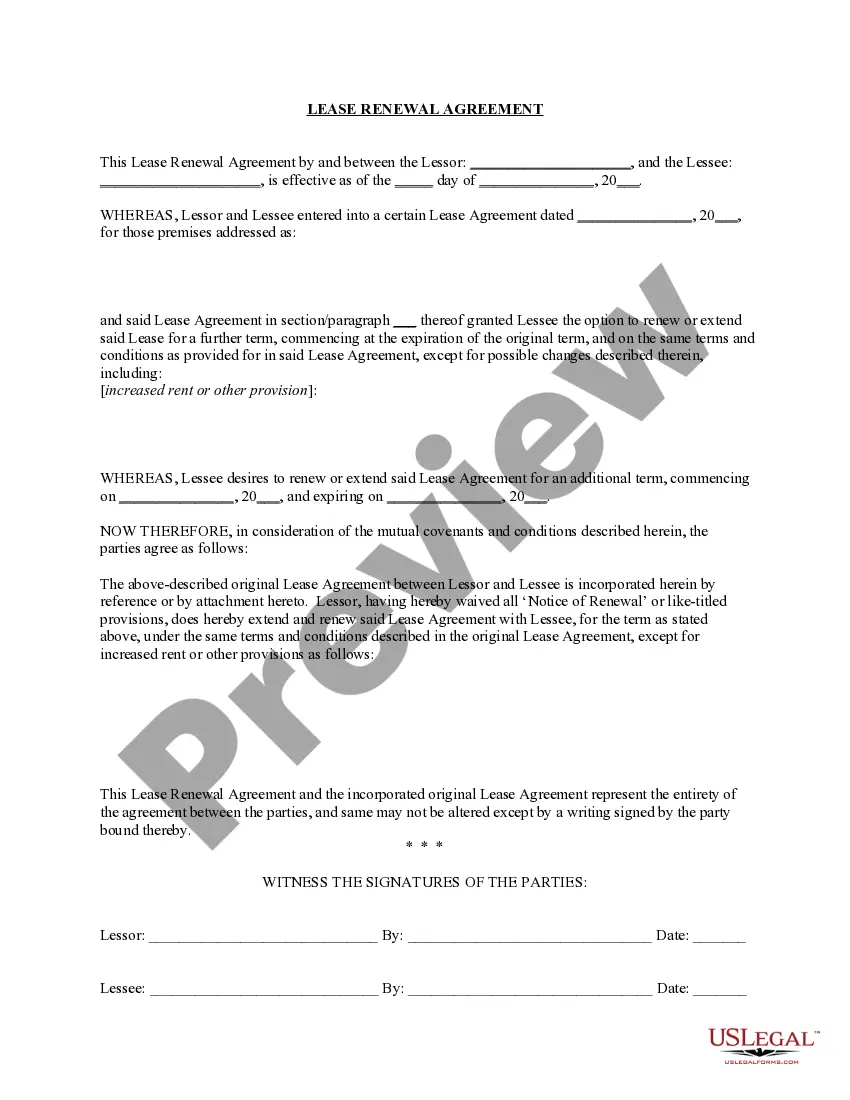

How to fill out Self-Employed Independent Contractor Employment Agreement - Hair Salon Or Barber Shop?

If you have to comprehensive, obtain, or printing lawful papers web templates, use US Legal Forms, the biggest collection of lawful types, which can be found on the Internet. Utilize the site`s easy and handy lookup to obtain the files you require. A variety of web templates for business and personal functions are categorized by categories and states, or keywords and phrases. Use US Legal Forms to obtain the Iowa Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop within a couple of mouse clicks.

Should you be currently a US Legal Forms customer, log in to the accounts and click the Down load button to obtain the Iowa Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop. You may also gain access to types you previously saved from the My Forms tab of your own accounts.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for that right city/country.

- Step 2. Utilize the Review choice to check out the form`s information. Do not neglect to read through the information.

- Step 3. Should you be not happy using the kind, take advantage of the Research area towards the top of the screen to discover other types in the lawful kind web template.

- Step 4. Upon having identified the shape you require, select the Buy now button. Opt for the prices prepare you prefer and add your references to register for the accounts.

- Step 5. Process the financial transaction. You can utilize your charge card or PayPal accounts to accomplish the financial transaction.

- Step 6. Find the file format in the lawful kind and obtain it in your product.

- Step 7. Full, edit and printing or indicator the Iowa Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop.

Every single lawful papers web template you acquire is yours for a long time. You possess acces to each and every kind you saved inside your acccount. Go through the My Forms area and pick a kind to printing or obtain once again.

Compete and obtain, and printing the Iowa Self-Employed Independent Contractor Employment Agreement - Hair Salon or Barber Shop with US Legal Forms. There are many specialist and state-distinct types you can utilize for the business or personal demands.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

Taxgirl says: Barbers and beauticians are generally independent contractors. Occasionally, you'll come across those that may be classed as employees but due to the nature of the business, you tend to see more classed as independent contractors.

LLC vs. Sole ProprietorshipBarbers who work as independent contractors will probably start out operating as a sole proprietorship. In fact, you don't have to do anything but earn extra income to operate as a sole proprietorship.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

The contract specifies the basis of the appointment and your expectations; it ensures that the employee clearly understands them prior to starting work. What should be included? A contract is a binding document on both parties and should be carefully worded.

You earn money as a contractor, consultant, freelancer, or other independent worker. You income is reported on 1099-MISC (Box 7), 1099-K (Box 1a), or you receive cash, check or credit card sales transactions, instead of a W-2.

Barbers usually serve male clients for shampoos, haircuts, and shaves. Some fit hairpieces and perform facials. Hairdressers, or hairstylists, provide coloring, chemical hair treatments, and styling in addition to shampoos and cuts, and serve both female and male clients.

This blog post was written for all the salons/spas in our industry that classify workers as 1099. This includes stylists, estheticians, nail techs, massage therapists, support staff, etc. I use the term worker because a 1099 worker IS NOT an employee.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.