Iowa Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

If you need to compile, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

Numerous templates for business and personal applications are categorized by types and jurisdictions, or keywords.

Every legal document template you purchase is yours indefinitely. You have access to every form you saved in your account. Click on the My documents section to choose a form to print or download again.

Be proactive and obtain, and print the Iowa Bill of Sale of Personal Property - Reservation of Life Estate in Seller using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- Use US Legal Forms to locate the Iowa Bill of Sale of Personal Property - Reservation of Life Estate in Seller in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Download button to retrieve the Iowa Bill of Sale of Personal Property - Reservation of Life Estate in Seller.

- You can also access documents you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

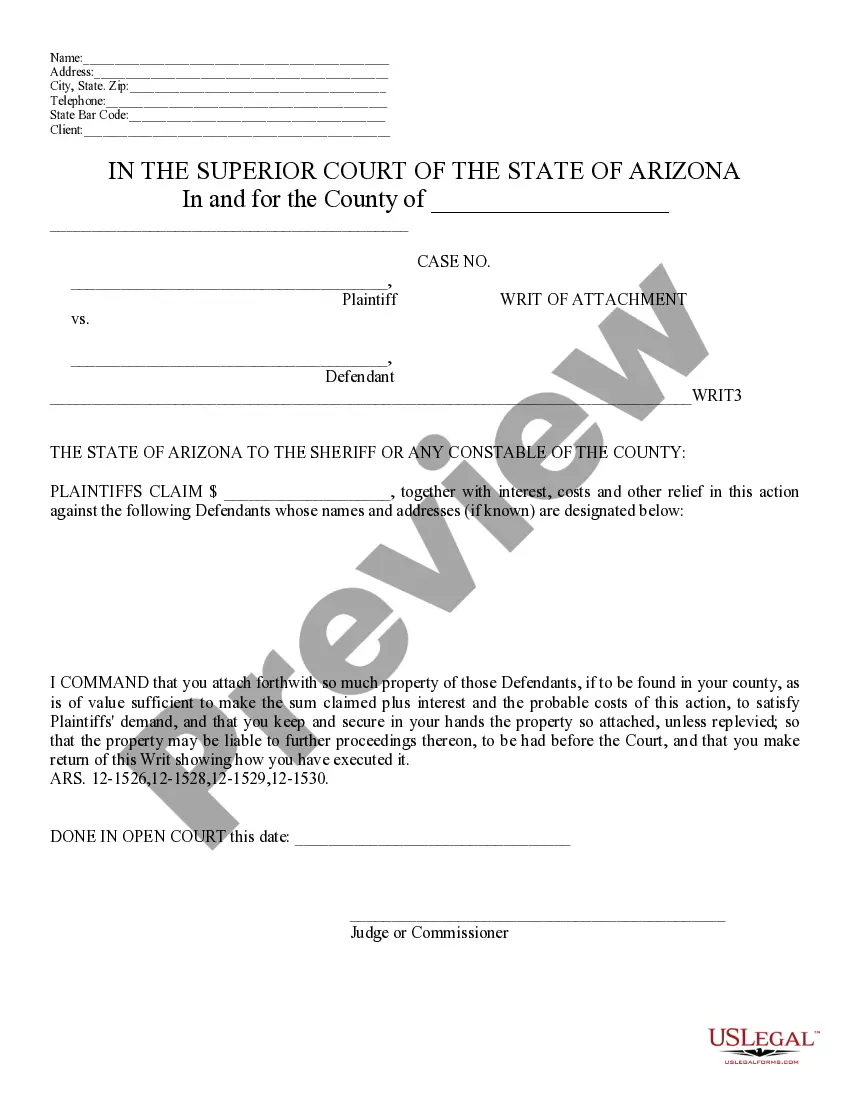

- Step 2. Use the Preview option to review the content of the form. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of your legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing option you prefer and enter your information to create an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Iowa Bill of Sale of Personal Property - Reservation of Life Estate in Seller.

Form popularity

FAQ

Yes, a bill of sale in Iowa requires a signature to validate the transaction. The seller must formally sign to indicate agreement on the sale of personal property. This helps both parties maintain clear records of the transaction. When using the Iowa Bill of Sale of Personal Property - Reservation of Life Estate in Seller, ensure that all necessary signatures are collected.

Key Takeaways. A life estate is a type of joint property ownership. Under a life estate, the owners have the right to use the property for life. Typically, the life estate process is adopted to streamline inheritance while avoiding probate.

A life estate is an interest in real property or assets that a person is given for the duration of his or her life.

A person with life interest generally (as we have not perused the Will) does not have the right to sell, transfer or alienate the property to the detriment of the absolute owner, which in your case is the son, i.e., you. It is a limited right to enjoy the property up to the death of the life holder.

If you have created a life estate and are looking to remove someone from it, you cannot do so without consent from all parties unless you have a clause or document known as a power of appointment. These powers may be written within the deed or attached to it.

A life estate is a freehold estate where ownership is limited to the duration of some person's lifetime, either the person holding the life estate the life tenant or some other designated person.

Benefits of a Life EstateThe right to live in the home until death;Maintaining a $250,000 capital gains exclusion provided you resided in the home two (2) of the last five (5) years;The right to keep a portion of the sale proceeds of the house if it is later sold;The right to rental income;More items...?12-Jun-2012

A life estate is a form of co-ownership of real property between two or more people. They each are an owner of the property, but for different periods of time. The person owning the life estate has the current right to the property for the rest of his or her life.

Advantages of a Life Estate No probate proceeding will be required to transfer title. The transfer/gift of the property to the persons who are deeded the property is a completed gift/transfer.

An interest in land that lasts only for the life of the holder. Thus, the holder of a life estate cannot leave the land to anyone in their will, because their interest in the land does not survive the person.