Iowa Personnel Change Form

Description

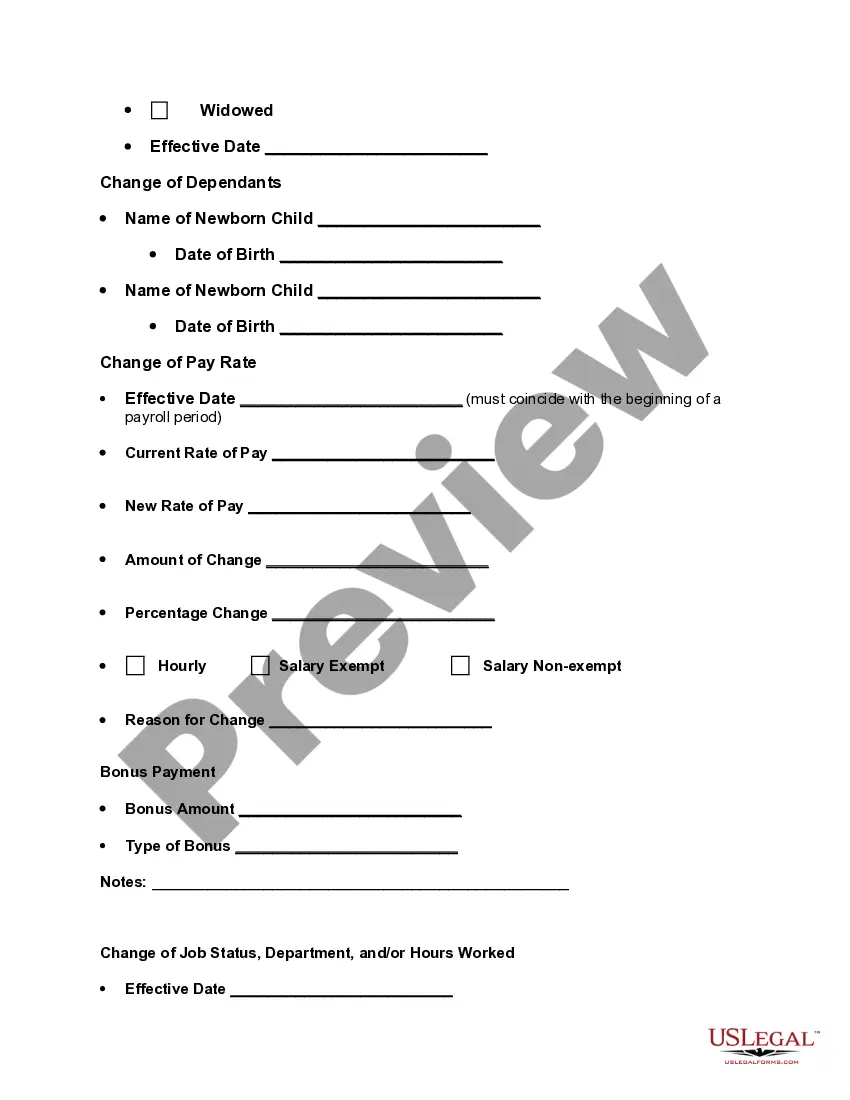

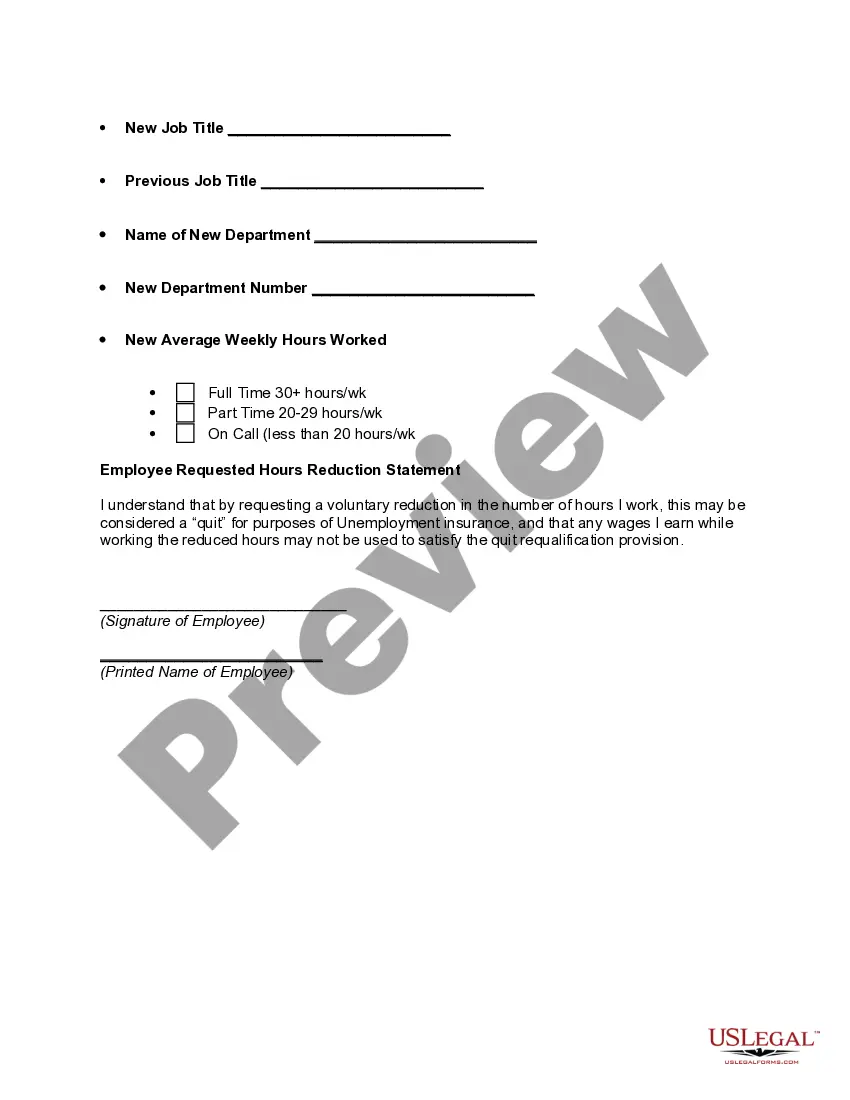

How to fill out Personnel Change Form?

Locating the appropriate valid document template can be somewhat challenging.

Certainly, there is a multitude of designs accessible online, but how can you find the accurate template you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions to follow: First, ensure you have selected the correct template for your region/county. You can view the form using the Review button and read the form description to confirm it is the right one for you. If the form does not satisfy your requirements, utilize the Search area to locate the appropriate template. Once you are certain that the form is suitable, click the Get now button to obtain the document. Choose the pricing plan you desire and input the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Iowa Personnel Change Form. US Legal Forms is the largest repository of legal templates where you can find various document formats. Utilize the service to acquire professionally-crafted paperwork that adheres to state regulations.

- The service provides thousands of templates, including the Iowa Personnel Change Form, which can be utilized for business and personal needs.

- All the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, sign in to your account and then click the Download button to obtain the Iowa Personnel Change Form.

- Use your account to search through the legal forms you may have purchased previously.

- Visit the My documents tab of your account to get another copy of the document you need.

Form popularity

FAQ

Iowans are taxed at 0.33% on the first $1,676 of their income; 0.67% up to $3,352; 2.25% up to $6,704; 4.14% up to $15,084; 5.63% up to $25,140; 5.96% up to $33,520; 6.25% up to $50,280; 7.44% up to $75,420; and 8.53% for income over $75,420.

All new employees for your business must complete a federal Form W-4 and the related Iowa Form IA W-4,Employee Withholding Allowance Certificate.

Employees fill out a W-4 form to inform employers how much tax to withhold from their paycheck based on filing status, dependents, anticipated tax credits, and deductions. If the form is filled out incorrectly, you may end up owing taxes when you file your return. The IRS simplified the form in 2020.

Iowa income tax is generally required to be withheld in cases where federal income tax is withheld. In situations where no federal income tax is withheld, the receiver of the payment may choose to have Iowa withholding taken out. Withholding on nonwage income may be made at a rate of 5 percent.

Form W-2 reports taxable wages paid to an employee during a one-year period, along with employment taxes withheld from paychecks for that year. Federal law requires all employers to send employees W-2 statements no matter how low earnings or wages are.

Registering as an Iowa Withholding AgentRegister with the Internal Revenue Service first to obtain a Federal Identification Number (FEIN) or call the IRS at 1-800-829-4933. There is no fee for registering. After obtaining a FEIN, register with Iowa.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

Each employee must file this Iowa W-4 with his/her employer. Do not claim more allowances than necessary or you will not have enough tax withheld. You may file a new W-4 at any time if the number of your allowances increases.