Iowa Equipment Maintenance Agreement with an Independent Sales Organization

Description

How to fill out Equipment Maintenance Agreement With An Independent Sales Organization?

You might spend hours online attempting to locate the official document template that satisfies the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by professionals.

You can download or print the Iowa Equipment Maintenance Agreement with an Independent Sales Organization from the service.

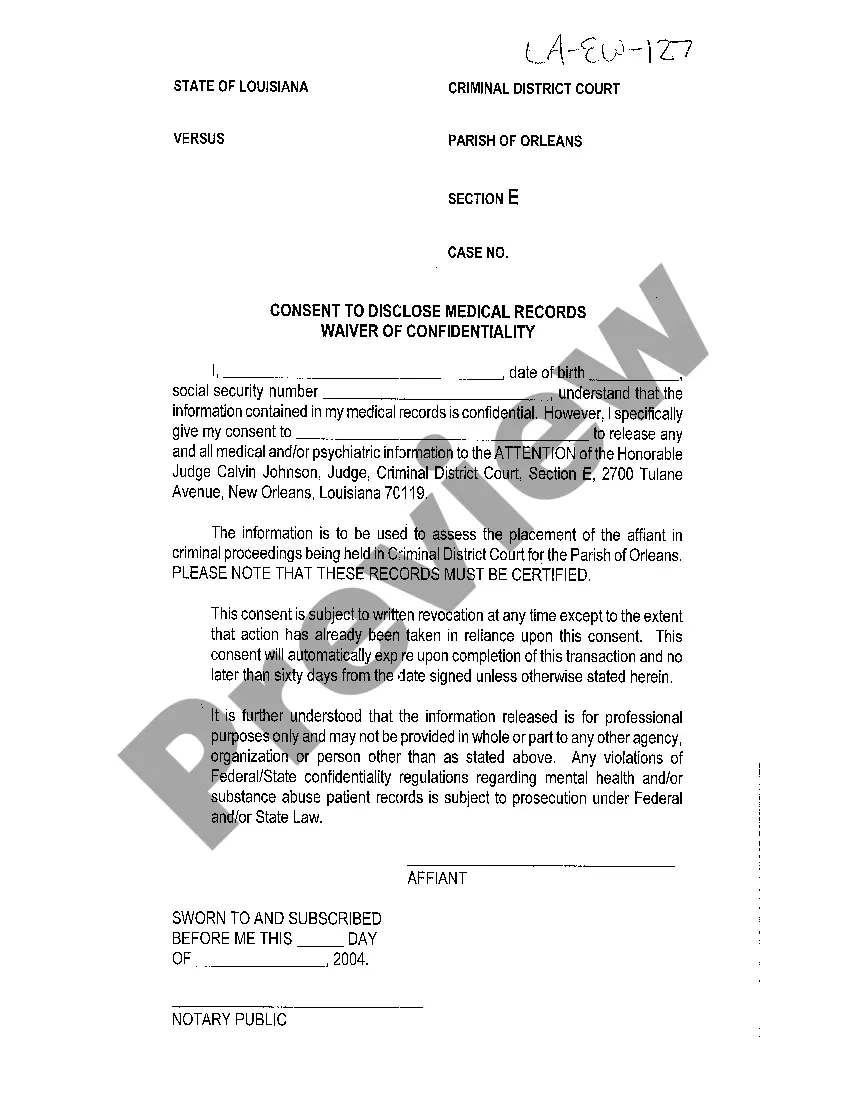

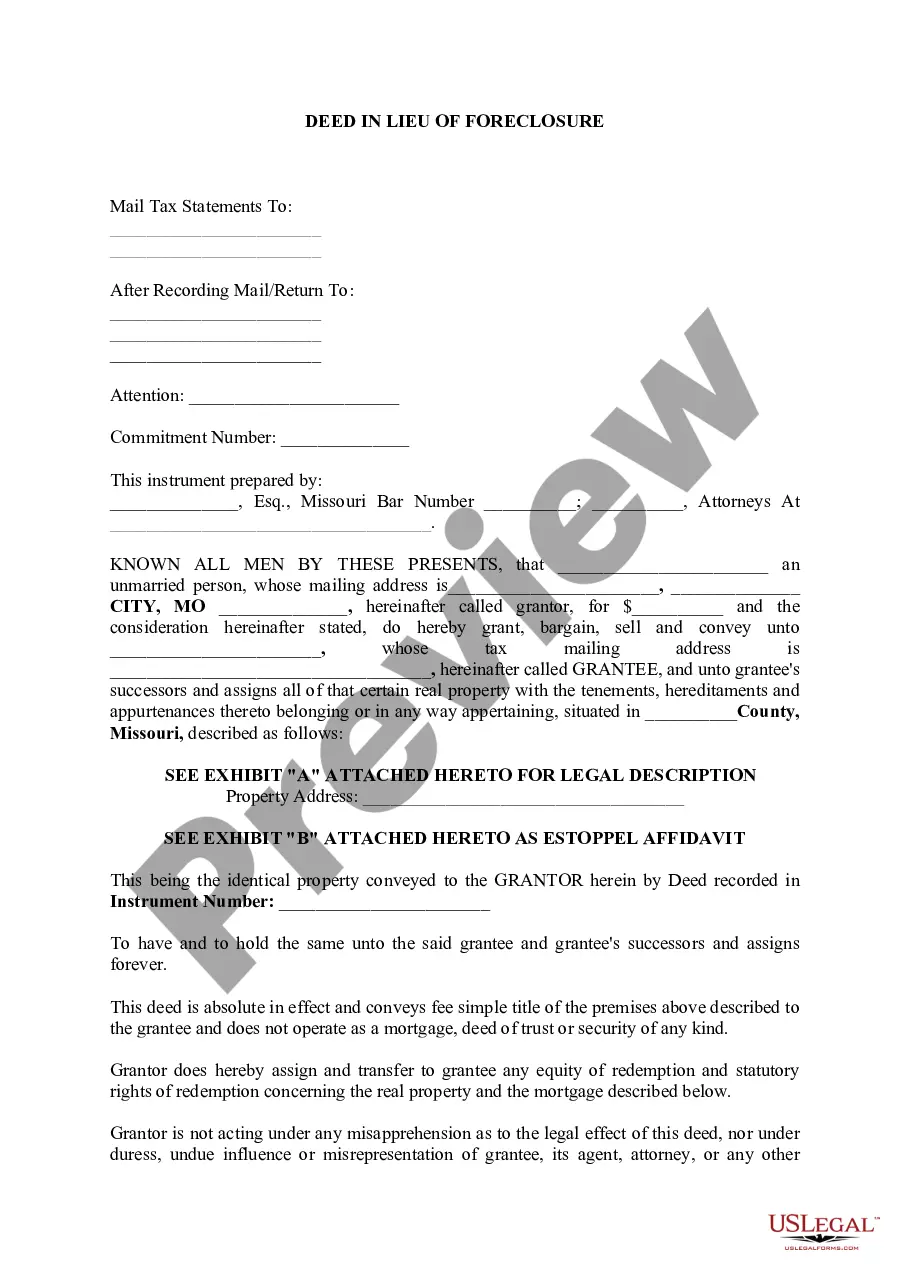

If available, utilize the Preview button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, modify, print, or sign the Iowa Equipment Maintenance Agreement with an Independent Sales Organization.

- Each legal document template you purchase is yours indefinitely.

- To get another copy of the purchased document, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/area of your preference.

- Review the form details to confirm you have chosen the correct template.

Form popularity

FAQ

Services provided to the following entities are exempt from sales and use tax: Iowa private nonprofit educational institutions, the federal government, Iowa governmental subdivisions, Iowa government agencies, certain nonprofit care facilities, nonprofit museums, and nonprofit legal aid organizations.

The following are exempt from Iowa sales or use tax when they are performed on or in conjunction with new construction, reconstruction, alteration, expansion, or remodeling of a building or structure. In all other circumstances, such as repair work, they are taxable.

Whether labor is subject to sales tax depends upon the circumstances under which the labor is performed: If tangible personal property is not transferred, labor is not taxable. If custom-made items are sold at retail, labor is taxable.

18.25(4) A preventive maintenance contract is a contract which requires only the visual inspection of equipment and no repair is or shall be included. The gross receipts from the sale of a preventive maintenance contract is not subject to tax.

Is the Job New Construction, Reconstruction, Alteration, Expansion, or Remodeling? If it is, the labor is exempt from sales tax. This exemption applies to real property and structures only. It does not apply to tangible personal property.

Services provided to the following entities are exempt from sales and use tax: Iowa private nonprofit educational institutions, the federal government, Iowa governmental subdivisions, Iowa government agencies, certain nonprofit care facilities, nonprofit museums, and nonprofit legal aid organizations.

Sales tax applies to flourless granola bars, chewing gum, pet food, cigarettes, firearms and soda pop. But plain bulk sugar is exempt. Breakfast cereals, bottled water, cakes, cookies and ice cream, take-and-bake pizza, napkins, paper plates, milk and eggnog are also sales tax-free.

Sales of tangible personal property in Iowa are subject to sales tax unless exempted by state law. Sales of services are exempt from Iowa sales tax unless taxed by state law. The retailer must add the tax to the price and collect the tax from the purchaser.

Sales of services are exempt from Iowa sales tax unless taxed by state law. The retailer must add the tax to the price and collect the tax from the purchaser.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.