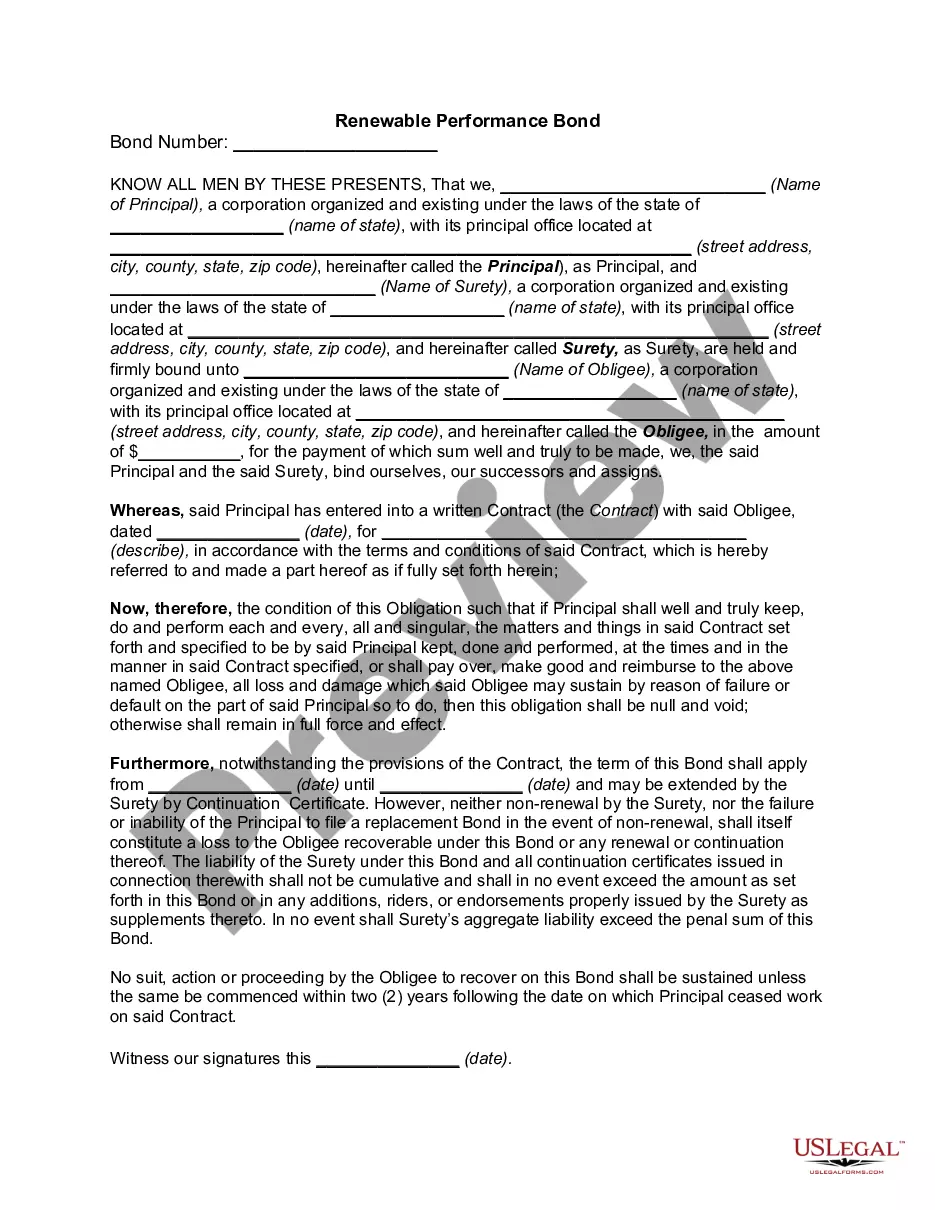

Iowa Renewable Performance Bond

Description

How to fill out Renewable Performance Bond?

Finding the right legitimate papers web template might be a battle. Naturally, there are plenty of themes available online, but how can you get the legitimate form you need? Make use of the US Legal Forms internet site. The services provides a huge number of themes, such as the Iowa Renewable Performance Bond, which you can use for company and personal requirements. All the types are checked out by professionals and fulfill federal and state specifications.

In case you are previously authorized, log in to the profile and then click the Download key to find the Iowa Renewable Performance Bond. Utilize your profile to look throughout the legitimate types you have bought previously. Proceed to the My Forms tab of your respective profile and obtain one more version in the papers you need.

In case you are a whole new customer of US Legal Forms, allow me to share easy directions for you to follow:

- Initial, make sure you have selected the appropriate form for your area/county. It is possible to check out the form while using Review key and study the form outline to make sure this is the best for you.

- In case the form does not fulfill your preferences, make use of the Seach area to discover the right form.

- When you are certain that the form is suitable, go through the Acquire now key to find the form.

- Opt for the pricing strategy you desire and enter the essential information. Create your profile and purchase the transaction using your PayPal profile or charge card.

- Pick the data file formatting and acquire the legitimate papers web template to the system.

- Comprehensive, change and print and signal the acquired Iowa Renewable Performance Bond.

US Legal Forms may be the most significant collection of legitimate types that you will find a variety of papers themes. Make use of the service to acquire expertly-manufactured documents that follow express specifications.

Form popularity

FAQ

In order to get a performance bond, the contractor agrees to pay the surety a small percentage of the total bond amount, usually between 1% and 4%. In exchange, the surety promises to pay up to the agreed bond amount if the contractor fails to deliver on its obligations.

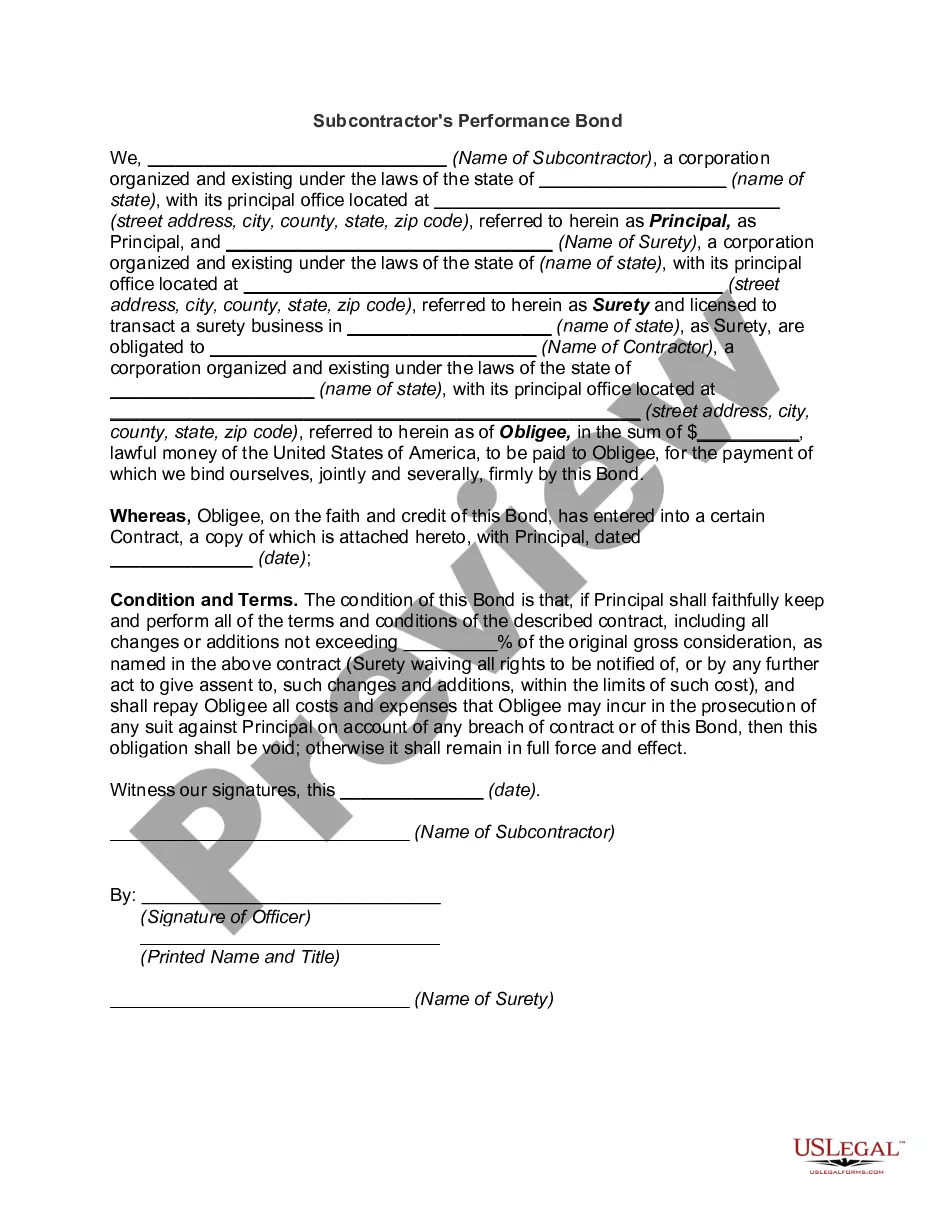

Performance bonds are a subset of contract bonds and guarantee that a contractor will fulfill the terms of the contract. If they fail to do so, the Surety company is responsible for completing the contract obligations, either by securing a new contractor to complete the job or by financial compensation.

First, write the name of the obligor or project owner on line preceded by "are held and firmly bonded to." Then write down how much money is at issue in this bond. Once that's done sign your signature where requested with a notary public present who will then make sure it was signed legally.

One key difference between performance bonds and surety bonds is the scope of their coverage. Performance bonds only cover a specific project, while surety bonds can cover multiple projects or ongoing business activities. Another difference is the party responsible for paying the bond premium.

The contractor has to provide all necessary items needed to fulfill the contractual obligations of bidding. Such items include a signed contract, performance bond and proof of insurance. The bid guarantee is released after these items have been submitted.

To release a Performance Bond, call the bonding company and inform them that you no longer need it. Fill out their bond release form when they send it to you and return it back with your signature.

A performance bond is usually issued by a bank or an insurance company. Performance bonds can also be used in commodity trades as a guarantee of delivery. In commodity markets, a seller is asked to provide a performance bond to reassure the buyer if the commodity being sold is not delivered.