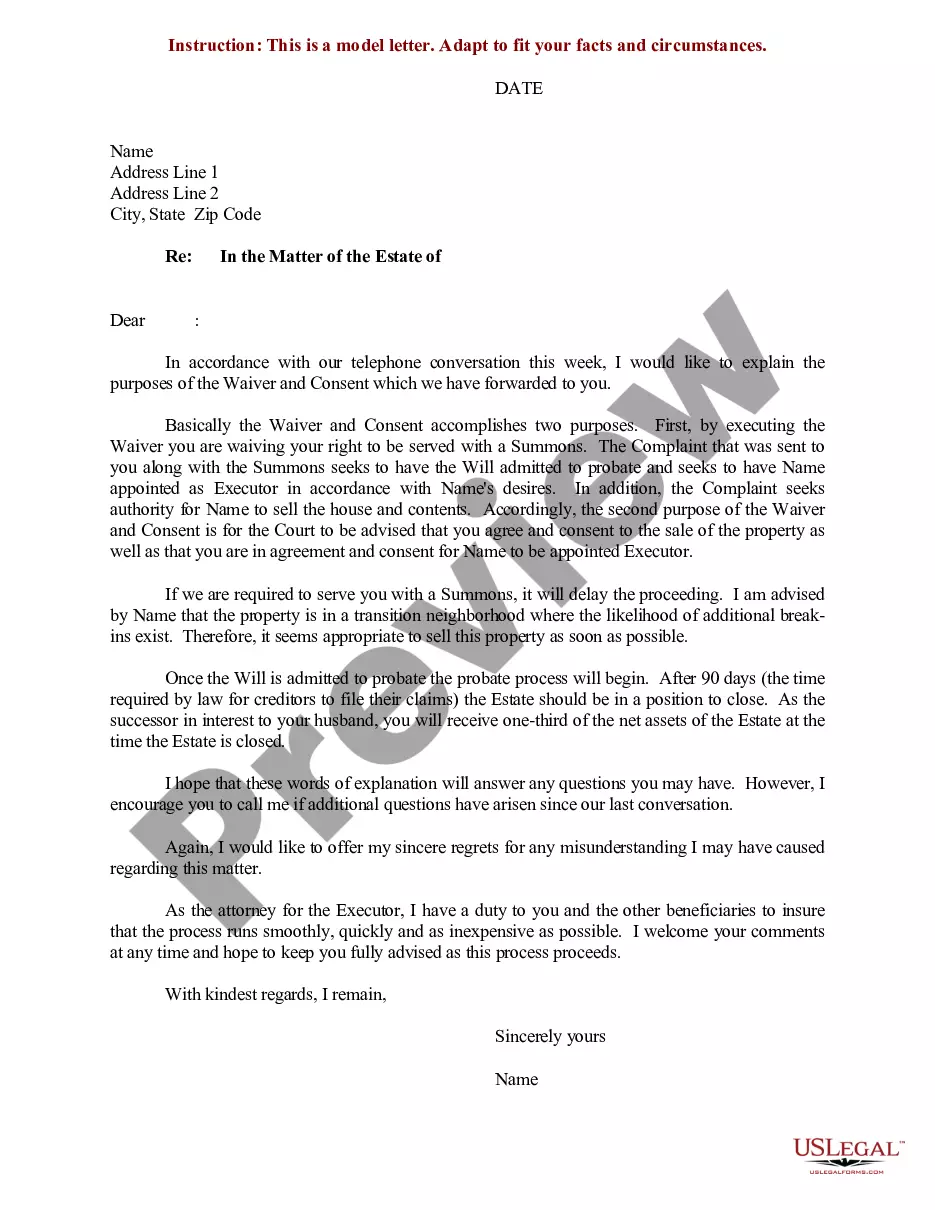

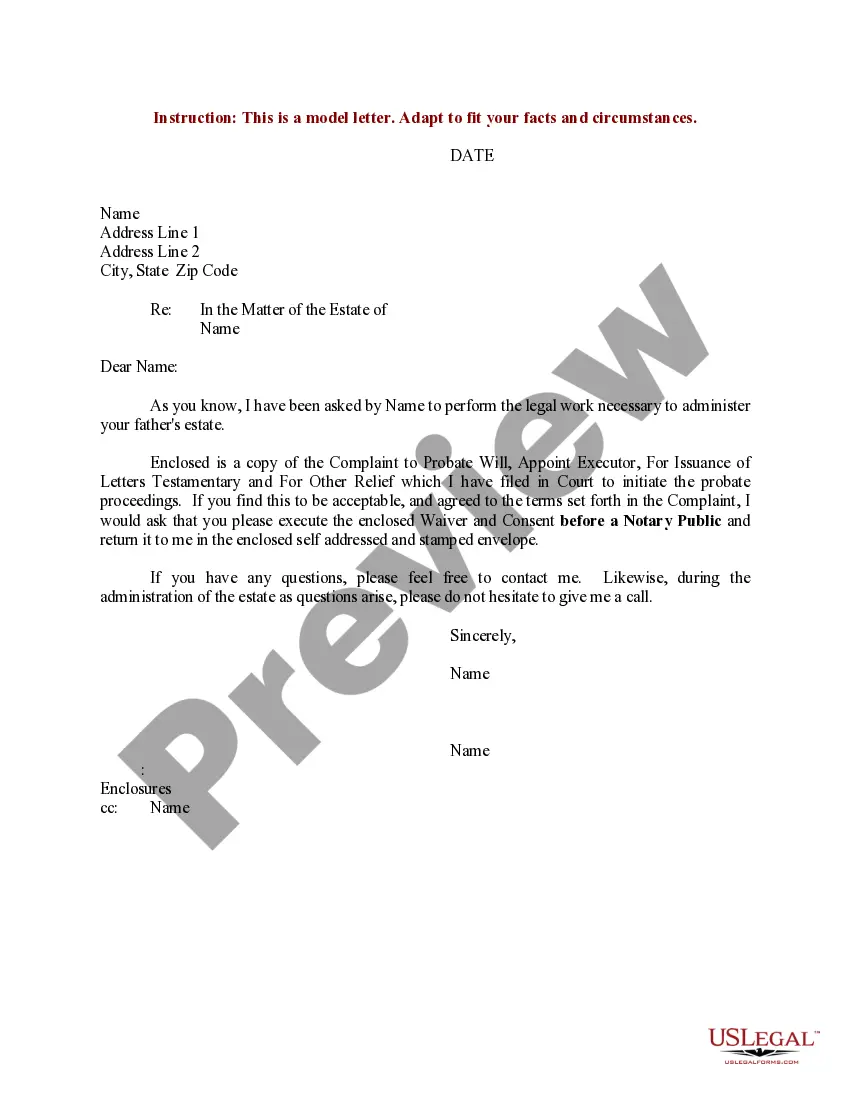

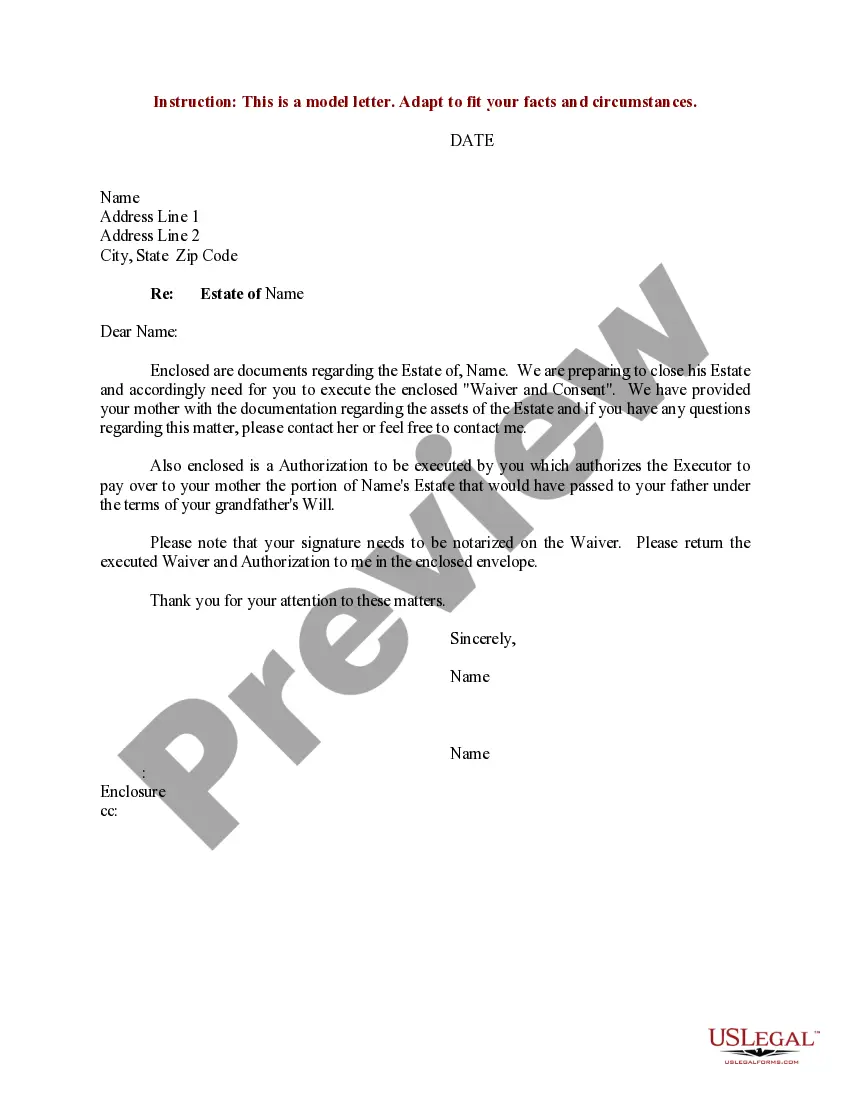

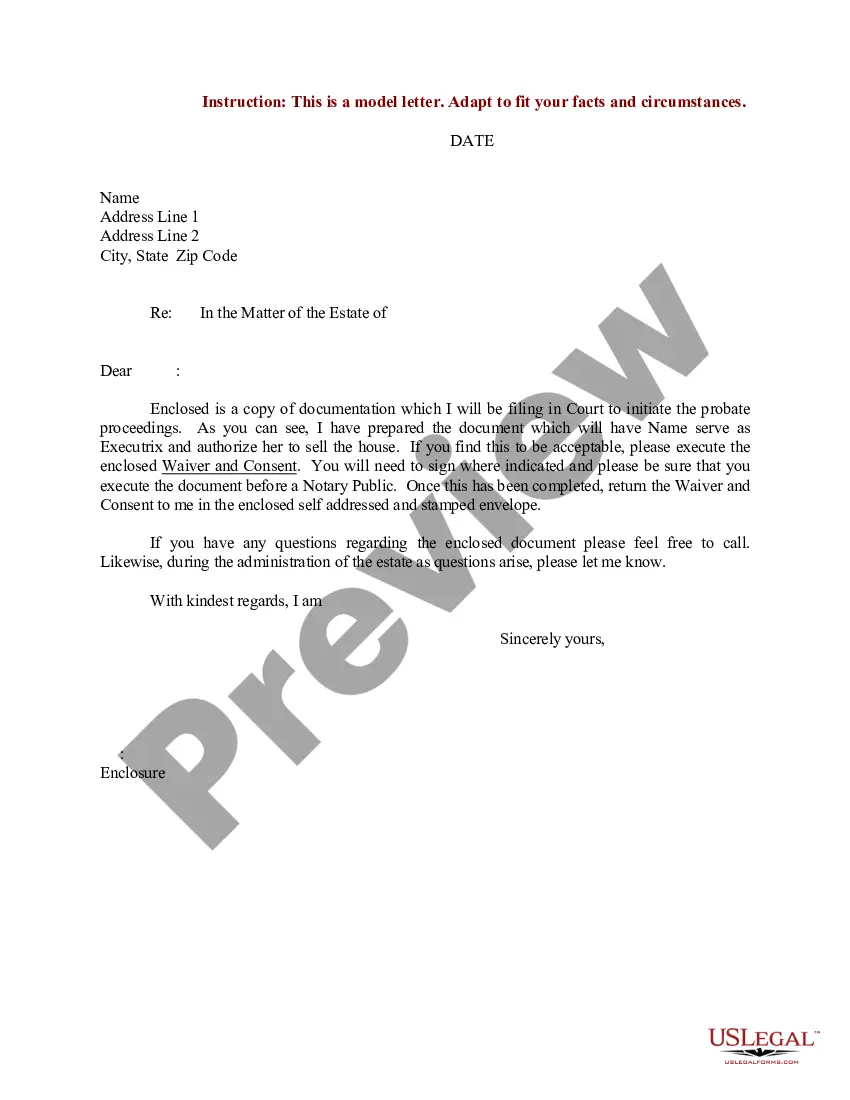

Iowa Sample Letter Explaining the Purposes of the Waiver and Consent regarding an Estate

Description

How to fill out Sample Letter Explaining The Purposes Of The Waiver And Consent Regarding An Estate?

You may spend several hours online trying to find the legitimate papers template that fits the state and federal specifications you want. US Legal Forms supplies a large number of legitimate varieties which are reviewed by experts. It is simple to obtain or printing the Iowa Sample Letter Explaining the Purposes of the Waiver and Consent regarding an Estate from the service.

If you already have a US Legal Forms accounts, you can log in and click on the Acquire option. After that, you can full, revise, printing, or sign the Iowa Sample Letter Explaining the Purposes of the Waiver and Consent regarding an Estate. Each legitimate papers template you purchase is the one you have forever. To get an additional backup of any purchased develop, proceed to the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms website the first time, adhere to the straightforward directions listed below:

- Very first, be sure that you have selected the right papers template for your region/area of your choosing. Read the develop explanation to make sure you have picked the correct develop. If available, use the Review option to check through the papers template at the same time.

- In order to get an additional variation of the develop, use the Search field to obtain the template that meets your requirements and specifications.

- When you have found the template you desire, simply click Buy now to proceed.

- Pick the costs strategy you desire, type your references, and register for an account on US Legal Forms.

- Full the purchase. You can utilize your credit card or PayPal accounts to purchase the legitimate develop.

- Pick the file format of the papers and obtain it in your system.

- Make adjustments in your papers if possible. You may full, revise and sign and printing Iowa Sample Letter Explaining the Purposes of the Waiver and Consent regarding an Estate.

Acquire and printing a large number of papers templates making use of the US Legal Forms web site, that provides the largest assortment of legitimate varieties. Use specialist and state-distinct templates to deal with your small business or specific needs.

Form popularity

FAQ

The Iowa Code then determines the distribution of assets. If you don't have a will when you die a surviving spouse may not receive all of your assets. This depends on (1) if you had children and (2) if all of your children were also your surviving spouse's children.

Iowa law requires that an estate be closed within 3 years after the second publication of the notice to creditors, unless a court grants an extension. Even while the estate is still in probate, however, beneficiaries may be able to receive part of their inheritance.

If the property received by the surviving spouse under subsections 1, 2 and 3 of this section is not equal in value to the sum of fifty thousand dollars, then so much additional of any remaining homestead interest and of the remaining real and personal property of the decedent that is subject to payment of debts and ...

In a nutshell, executors must prudently sort out the deceased's finances, honestly settle the estate's debts and taxes and equitably distribute remaining assets and property to heirs and beneficiaries. Smith Law in Iowa doesn't want to see you defending your probate management performance in court.

As executor, you are responsible for paying all the beneficiaries. However, you need to ensure all taxes and debts are paid, as an executor can be held liable for mistakes and oversights if things go wrong, even if those mistakes were made in good faith. You are not obliged to take on the role of executor.

Executors and trustees hold legal duties to provide interested parties with timely and accurate estate accountings. Heirs and beneficiaries can sue ingly for breach of fiduciary duty when this doesn't happen.

Unless the courts grant you an extension, Iowa Probate Code 633.361 affirms you'll have you three months starting from the day the court appoints you as executor to appraise, report, and inventory the deceased's estate accurately.

Personal Representative fees - Iowa is a reasonable compensation state; typical fee is two percent of the estate value; Executors can waive their fee (which would be taxable)