Iowa Release and Indemnification of Personal Representative by Heirs and Devisees

Description

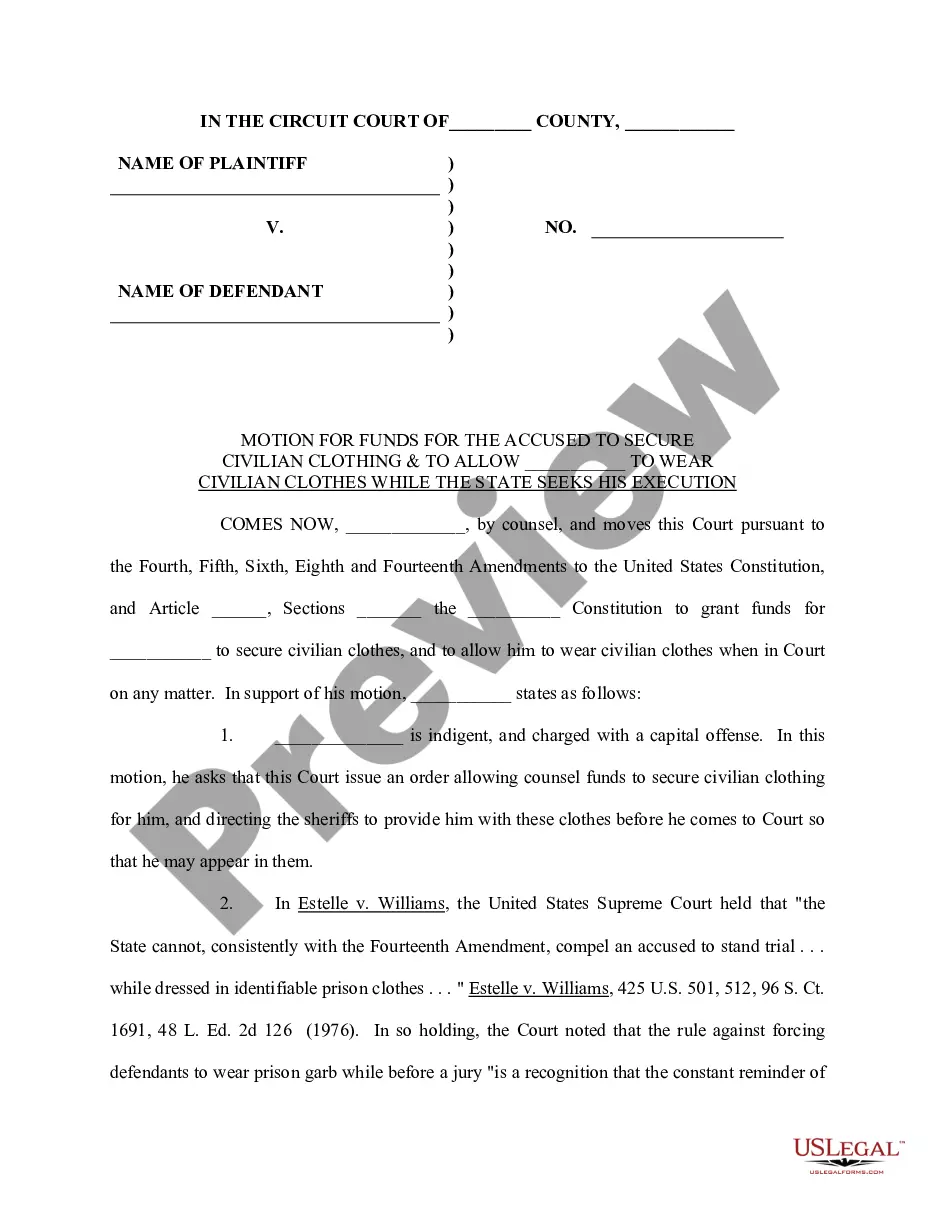

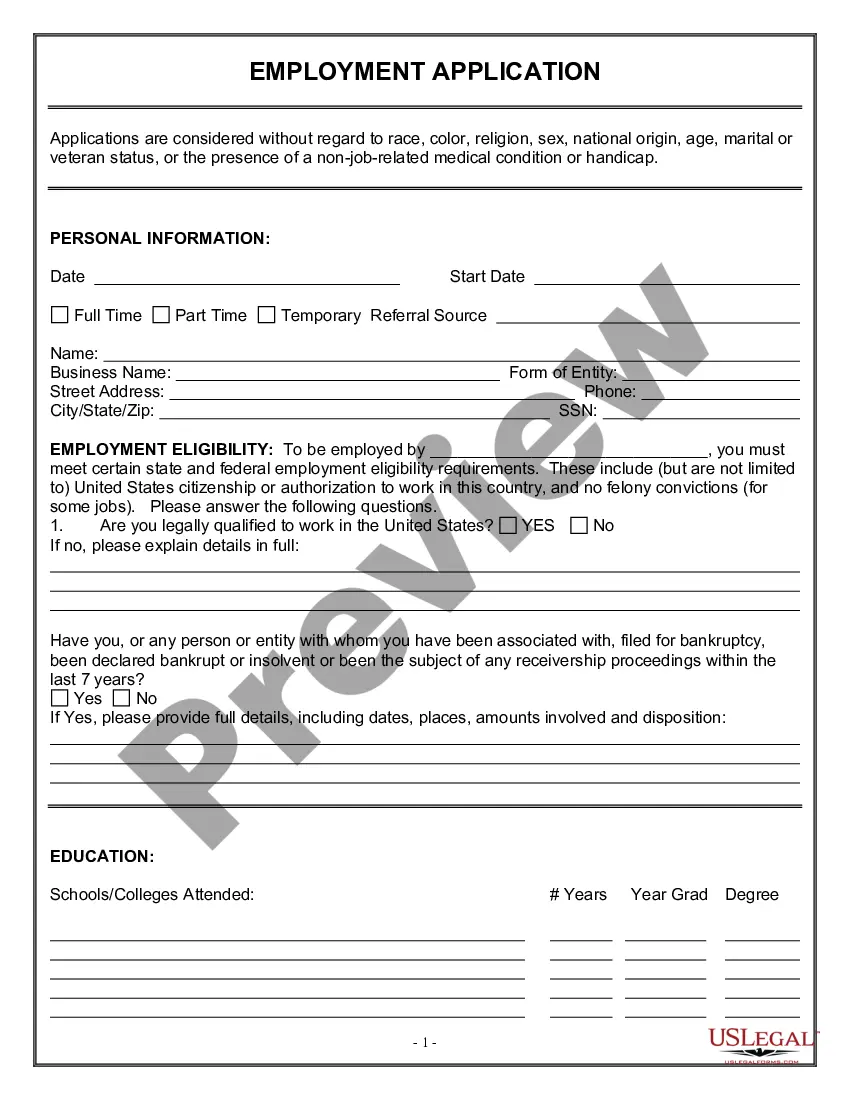

How to fill out Release And Indemnification Of Personal Representative By Heirs And Devisees?

It is feasible to spend hours online searching for the legal document format that aligns with the federal and state requirements you need.

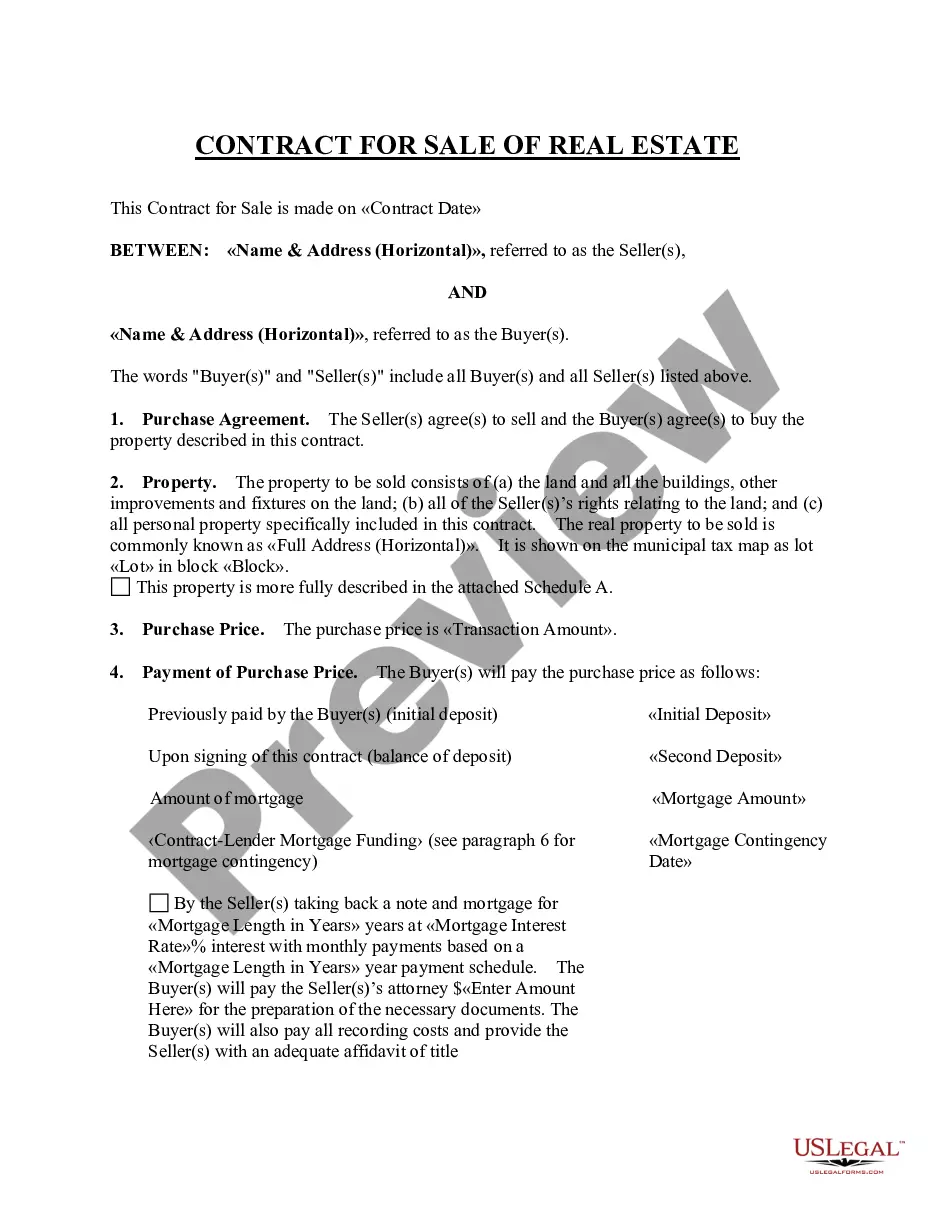

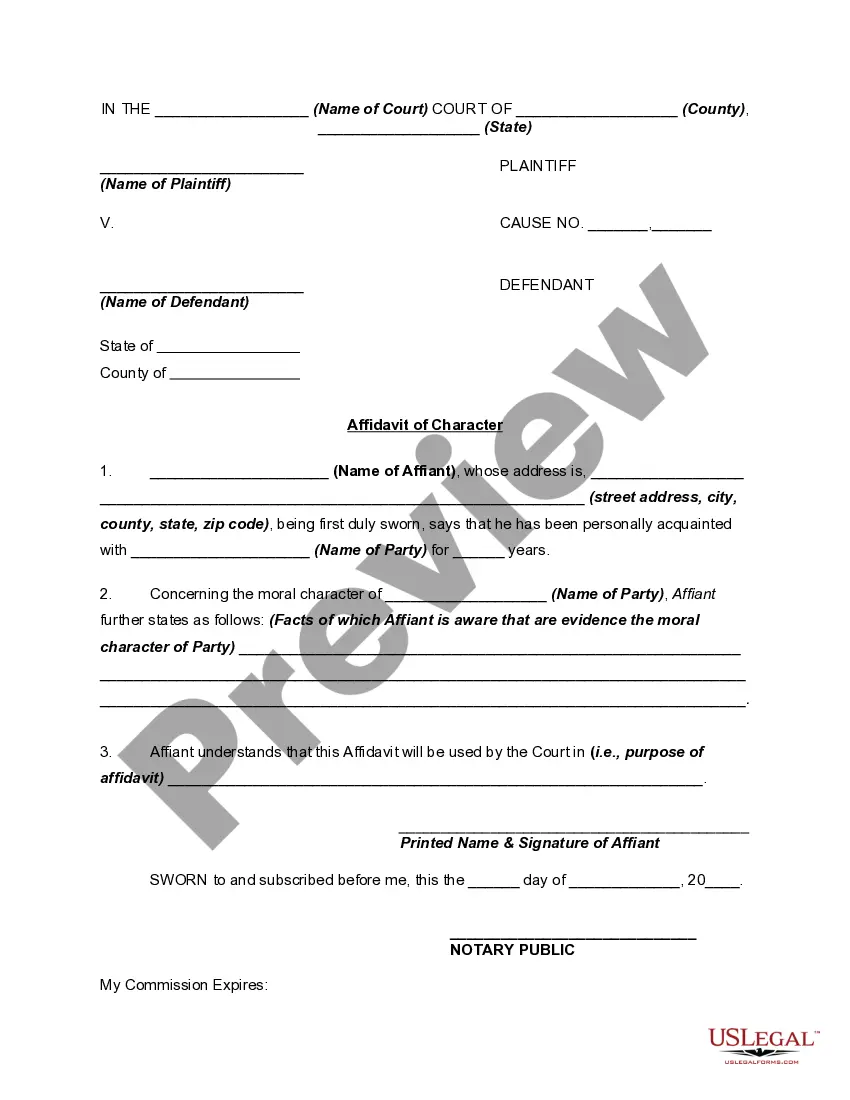

US Legal Forms offers a vast array of legal forms evaluated by experts.

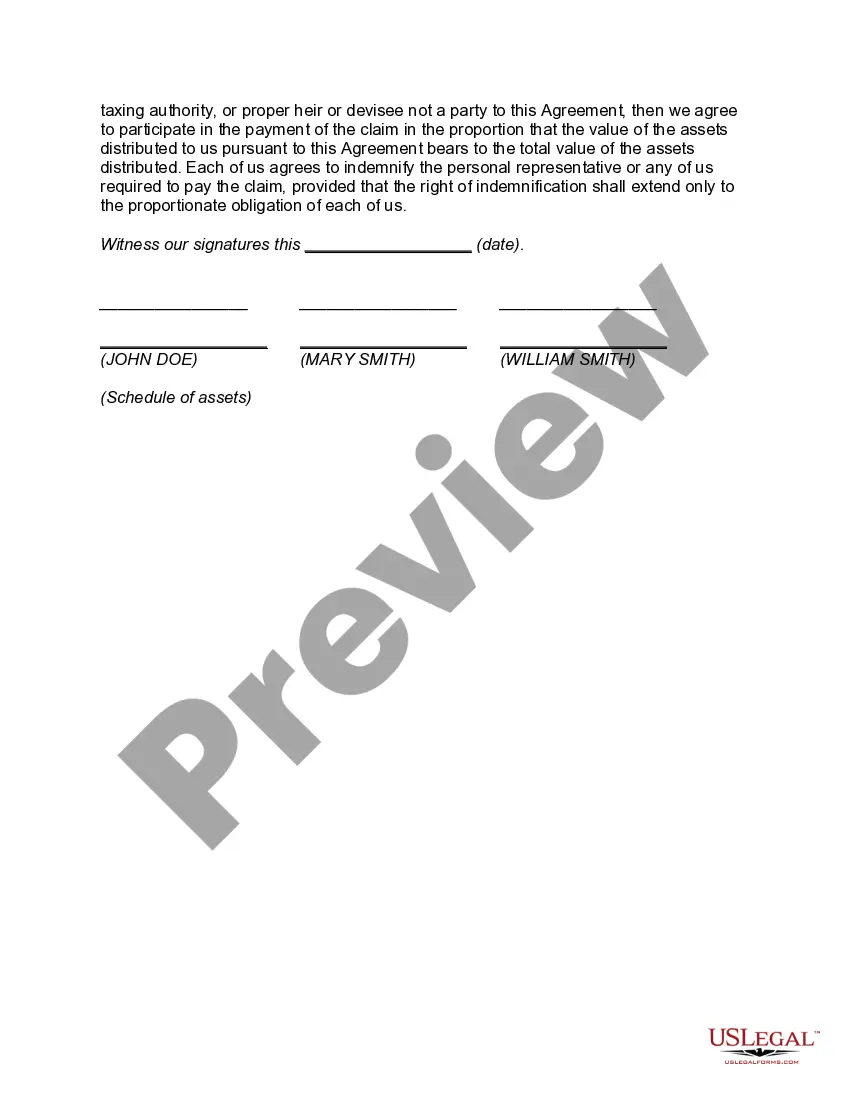

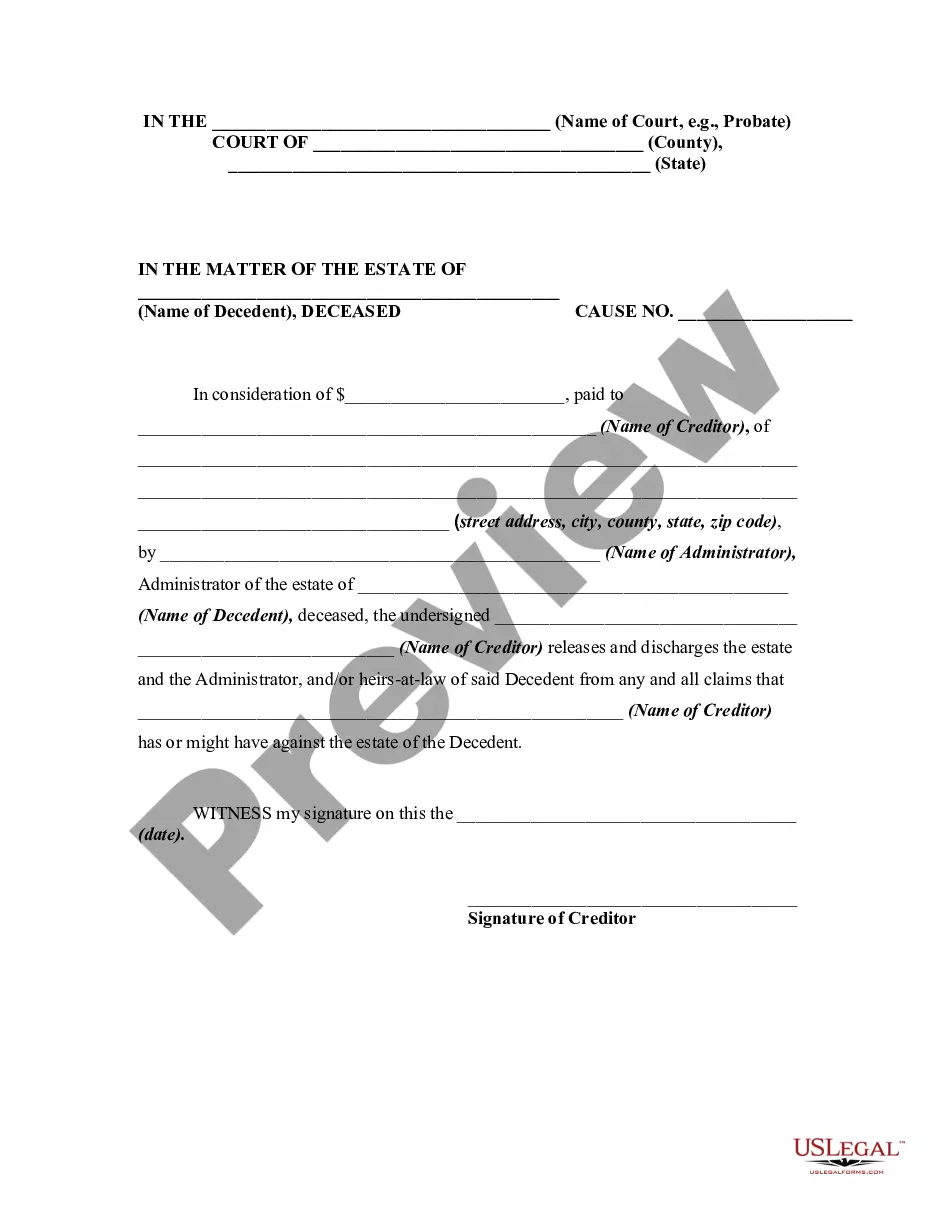

You can obtain or print the Iowa Release and Indemnification of Personal Representative by Heirs and Devisees from the service.

If available, use the Preview button to view the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, edit, print, or sign the Iowa Release and Indemnification of Personal Representative by Heirs and Devisees.

- Every legal document format you obtain is your property indefinitely.

- To acquire another copy of the obtained form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document format for the state/region of your choice.

- Review the form outline to ensure you have selected the appropriate document format.

Form popularity

FAQ

Wait Six Months (or sometimes longer) By law the Executor has to hold onto estate assets for six months from the date Probate is granted, and cannot pay out any money to the beneficiaries before this time is up.

Is Probate Required in Iowa? In most cases, probate is required in Iowa. There are a few exceptions to this rule, such as having a small estate, which is valued at less than $25,000 and only includes personal property. If the assets have a named beneficiary, you can also avoid probate.

More on when is probate necessary Real estate titled in one person's name (see your deed) = probate. Savings bonds totaling >$50,000 and no payable on death certificate = probate. Individual stocks totaling >$50,000 and no transfer on death certificate = probate. Retirement accounts with no named beneficiary = probate.

The executor is entitled to a fee equal to approximately two percent of the gross value of the estate. Likewise, the Iowa Probate statute allows the attorney for the estate a reasonable fee on the same schedule as the executor.

The most common and straightforward situation where a grant of probate will not be needed is where the deceased owned assets in joint names. This may be property, bank accounts, or life policies, that continue in the name of the survivor.

Extrajudicial Settlement of the estate can be done if: i) the decedent did not leave a will; (ii) there are no debts (or the debts have been fully paid); and (iii) all of the heirs agree on the manner of the division and distribution of the estate.

In general, in order for a will to be legally valid in Iowa, a will must be (1) in writing, (2) signed by the person making the will, (3) declared by the person making the will to be his or her will, and (4) witnessed by two competent witnesses who must sign in the presence of the person making the will.

Iowa law requires that an estate be closed within 3 years after the second publication of the notice to creditors, unless a court grants an extension. Even while the estate is still in probate, however, beneficiaries may be able to receive part of their inheritance.