Iowa Telecommuting Worksheet

Description

How to fill out Telecommuting Worksheet?

Selecting the appropriate legitimate document template can be somewhat challenging.

Naturally, there are numerous themes accessible online, but how will you identify the proper form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Iowa Telecommuting Worksheet, which can be utilized for business and personal purposes.

First, ensure you have selected the correct form for the jurisdiction/state. You can browse the form using the Review button and read the form description to confirm it is right for you.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the Iowa Telecommuting Worksheet.

- Use your account to search through the legal documents you have previously purchased.

- Navigate to the My documents tab of your account to download another copy of the document you need.

- If you are a new customer of US Legal Forms, here are some simple instructions you can follow.

Form popularity

FAQ

To complete the Iowa sales tax exemption certificate PDF, begin by providing your name and address information at the top of the form. Next, indicate the reason for your exemption, ensuring that it aligns with the provided options. If you're unsure about the specifics, the Iowa Telecommuting Worksheet provides useful guidelines for accurate completion. After filling out the certificate, sign and date it before submitting it to the seller.

To fill out the new Iowa W-4, start by entering your personal information, including your name, address, and Social Security number. Next, indicate your filing status and any additional allowances you wish to claim. If needed, refer to the Iowa Telecommuting Worksheet to ensure accurate calculations of your state withholding. Finally, review your form for completeness and submit it to your employer for processing.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

You'll most likely get a tax refund if you claim no allowances or 1 allowance. If you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent).

Claiming two allowances You are single. Claiming two allowances will get you close to your tax liability but may result in tax due when filing your taxes. You're single and work more than one job. Claim one allowance at each job or two allowances at one job and zero at the other.

Calculate withholding using the annual pay period tax rates and brackets. Then divide T5 by the number of pay periods in the year to get withholding for each pay period. For example, for quarterly pay period, use annual payroll formulas to get T5 and then divide by 4 to get Iowa withholding on each paycheck.

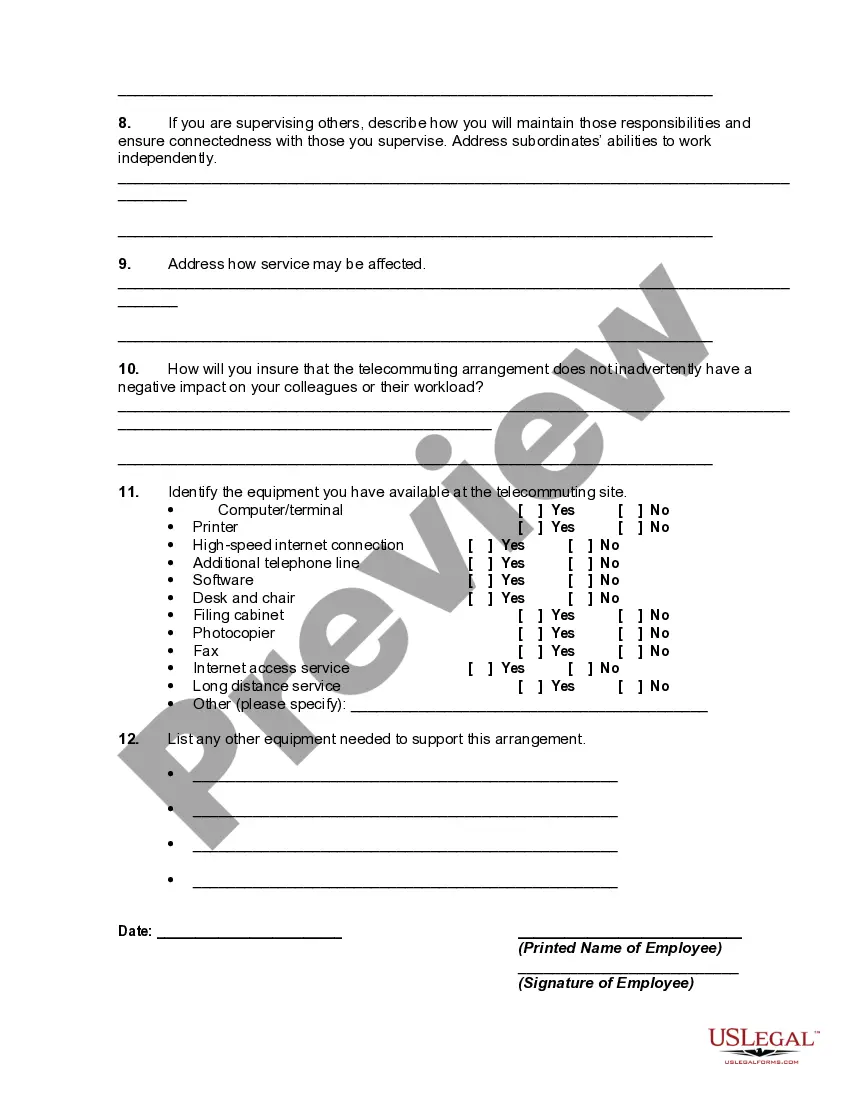

If you want to know if a job can be done remotely, use technology as a guide in determining if that job can be done virtually. A run through FlexJobs' list of 100 Top Companies with Remote Jobs can give you a sense of the broad landscape for jobs that can be done from home.

For instance, remote workers may need:Computer/laptop.Internet connection.Mobile device and service.Apps or software (particularly for timekeeping and scheduling).Printers (if documents cannot be utilized virtually for the position).Supplies (pens, paper, scanner).Transportation (to visit clients, etc.)

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.