Iowa Affidavit That There Are No Creditors

Description

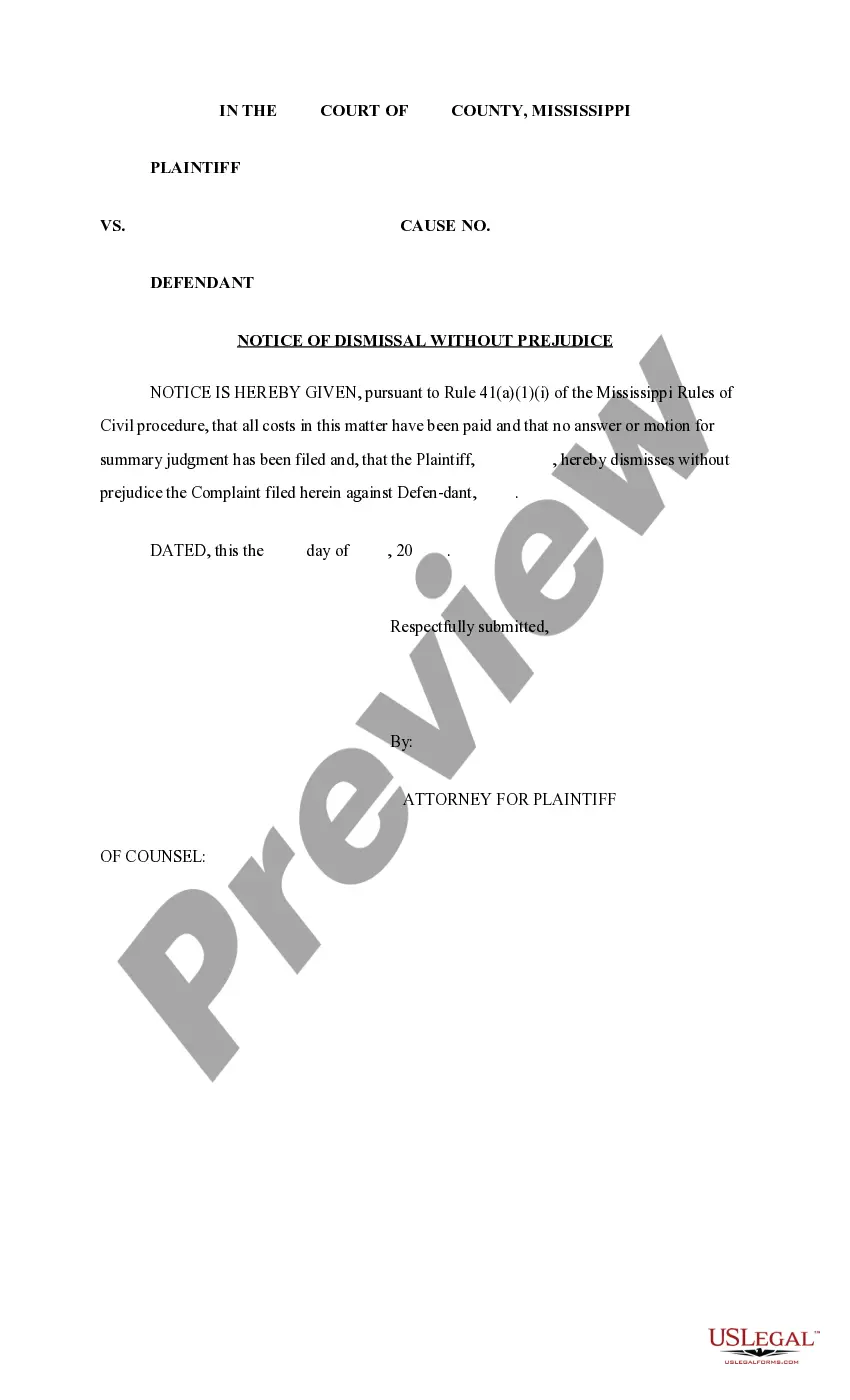

How to fill out Affidavit That There Are No Creditors?

If you want to compile, acquire, or generate legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Leverage the site's user-friendly and efficient search feature to find the documents you need.

A range of templates for commercial and individual purposes are organized by categories and suggestions, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your details to register for an account.

- Utilize US Legal Forms to obtain the Iowa Affidavit That There Are No Creditors with just a few clicks.

- If you are a current US Legal Forms customer, Log In to your account and click the Download button to acquire the Iowa Affidavit That There Are No Creditors.

- You can also access forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Don’t forget to read the description.

Form popularity

FAQ

You may not need a lawyer to file a small estate affidavit, as the process can often be completed independently. However, consulting a legal professional can provide peace of mind, especially if your estate has complexities. Utilizing the Iowa Affidavit That There Are No Creditors can simplify the requirements, but legal advice can always help clarify any uncertainties you may have.

In Iowa, a small estate affidavit does not necessarily have to be filed with the court. However, it may be required by institutions or creditors during the estate settlement process. It’s advisable to check your specific situation and using the Iowa Affidavit That There Are No Creditors can streamline this step, guiding you on when and how to present the affidavit.

When filling out an affidavit example, first understand the specific format required. Use clear and accurate language while providing all necessary details, such as identities and circumstances surrounding the estate. Referring to the Iowa Affidavit That There Are No Creditors provides useful insights, allowing you to avoid common pitfalls and ensuring compliance with local regulations.

To complete a small estate affidavit, collect all relevant details about the deceased's assets, debits, and heirs. Fill out the form with precise information, and ensure that all signatures are acquired where necessary. The Iowa Affidavit That There Are No Creditors provides a structured approach that helps simplify this process, making it easier for you to resolve the estate matters.

Filling out an affidavit of small estate in Iowa starts with gathering necessary information about the deceased's assets and debts. You will need details such as the value of property and any outstanding debts, which all must be included in the affidavit. If you are unsure how to proceed, the Iowa Affidavit That There Are No Creditors can guide you through this process efficiently, ensuring all required information is accurately presented.

To fill out an affidavit of inheritance, begin by gathering essential information about the estate and its beneficiaries. You will need to provide personal details such as names, addresses, and relation to the deceased. Next, ensure you include the legal description of the property and indicate that the deceased had no creditors by mentioning the Iowa Affidavit That There Are No Creditors. Finally, review the completed affidavit for accuracy before signing it in front of a notary public.

Phone codes in Iowa vary by region, allowing residents to connect easily with services and resources. Each area has its specific area code, which is essential when establishing communication. Keep in mind that when using services like the Iowa affidavit that there are no creditors, knowing local phone codes can assist you in seeking legal advice or assistance.

Iowa code 633.489 focuses on the rules for transferring real estate without formal probate when appropriate documentation is provided. If you submit an Iowa affidavit that there are no creditors, it simplifies the transfer procedure. Knowing this code can help you navigate property claims and rights effectively.

Iowa code 633.286 outlines the process for the court to determine the distribution of an estate when there are no creditors present. When you submit the Iowa affidavit that there are no creditors, it helps clarify the distribution process, ensuring timely access to assets for legal heirs. This provision is designed for straightforward cases, promoting efficiency in estate management.

Iowa code 633.308 addresses the proper procedure for claims against an estate. This code sets time limits for creditors to present their claims, which is essential once you file an Iowa affidavit that there are no creditors. Understanding this code is crucial for heirs to ascertain their rights and responsibilities regarding estate claims.