Iowa Receipt of Payment for Obligation

Description

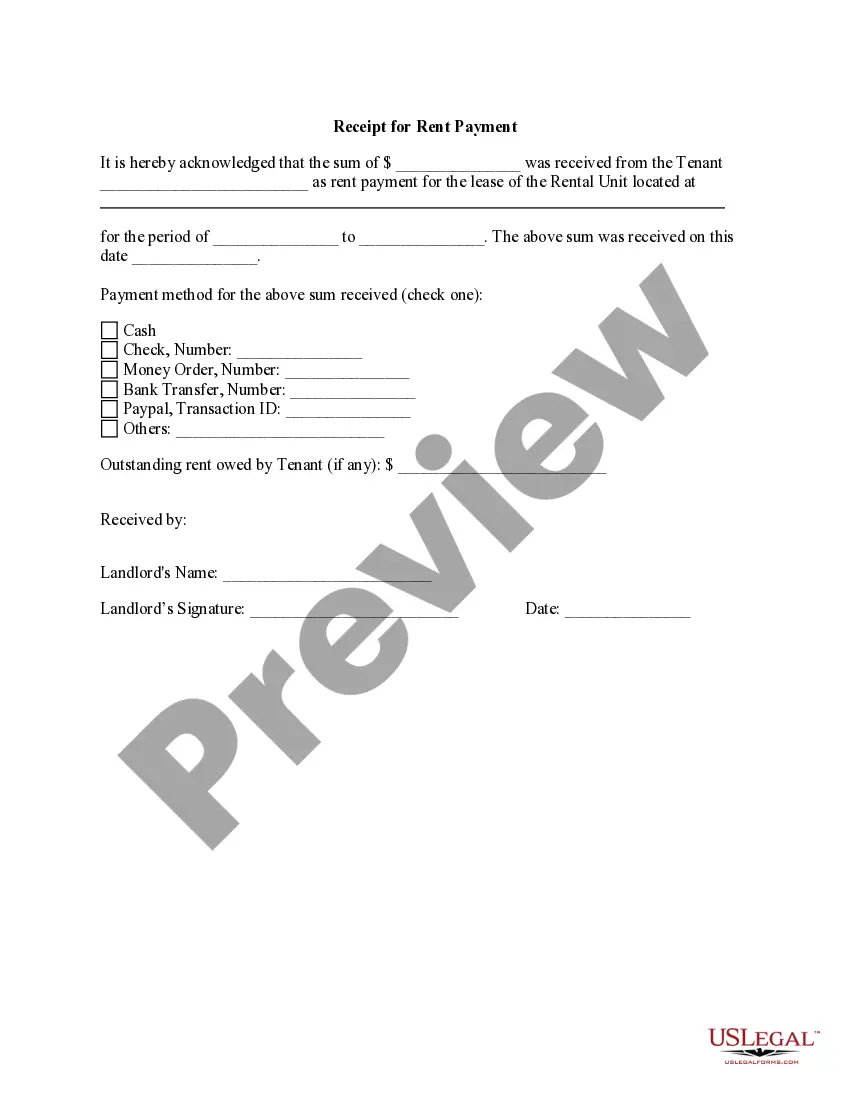

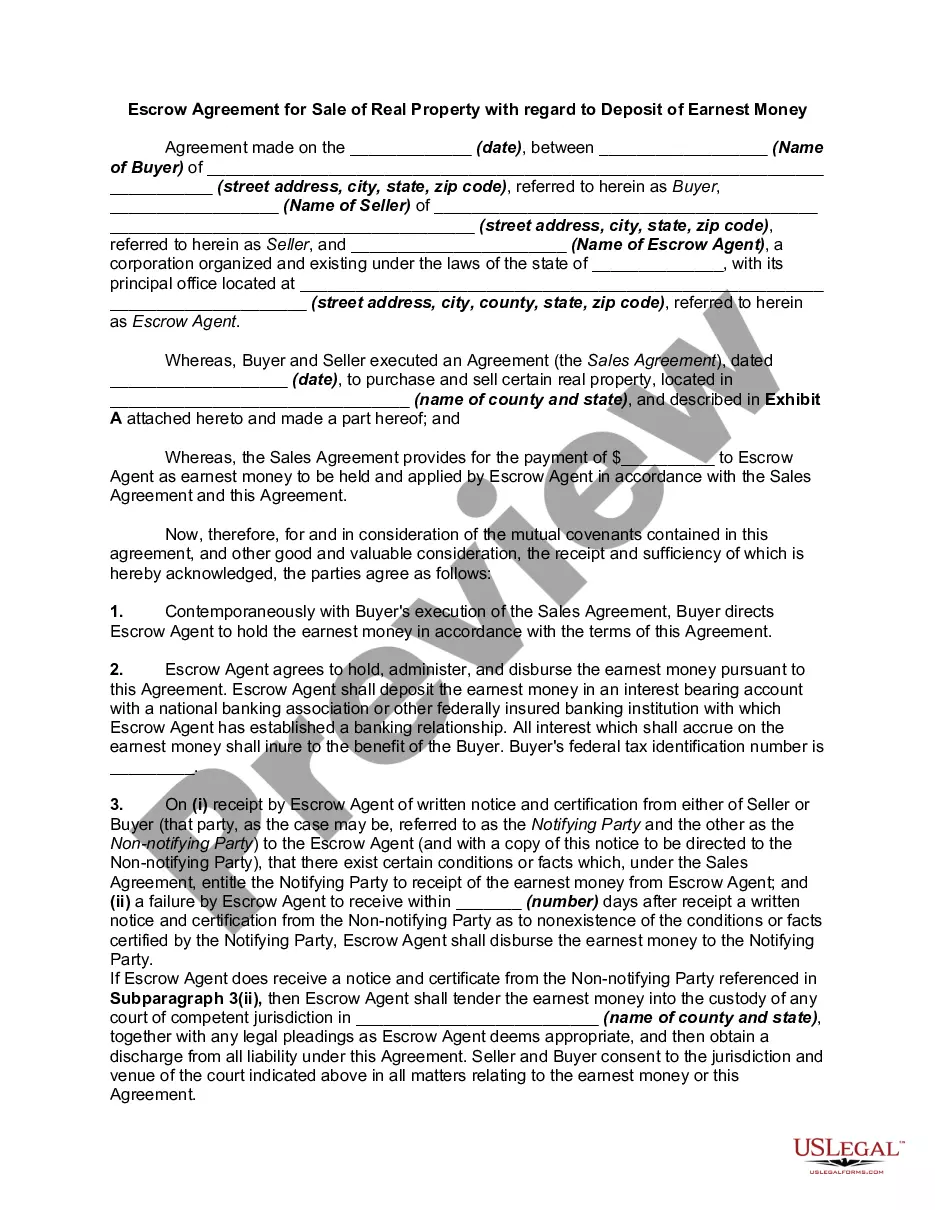

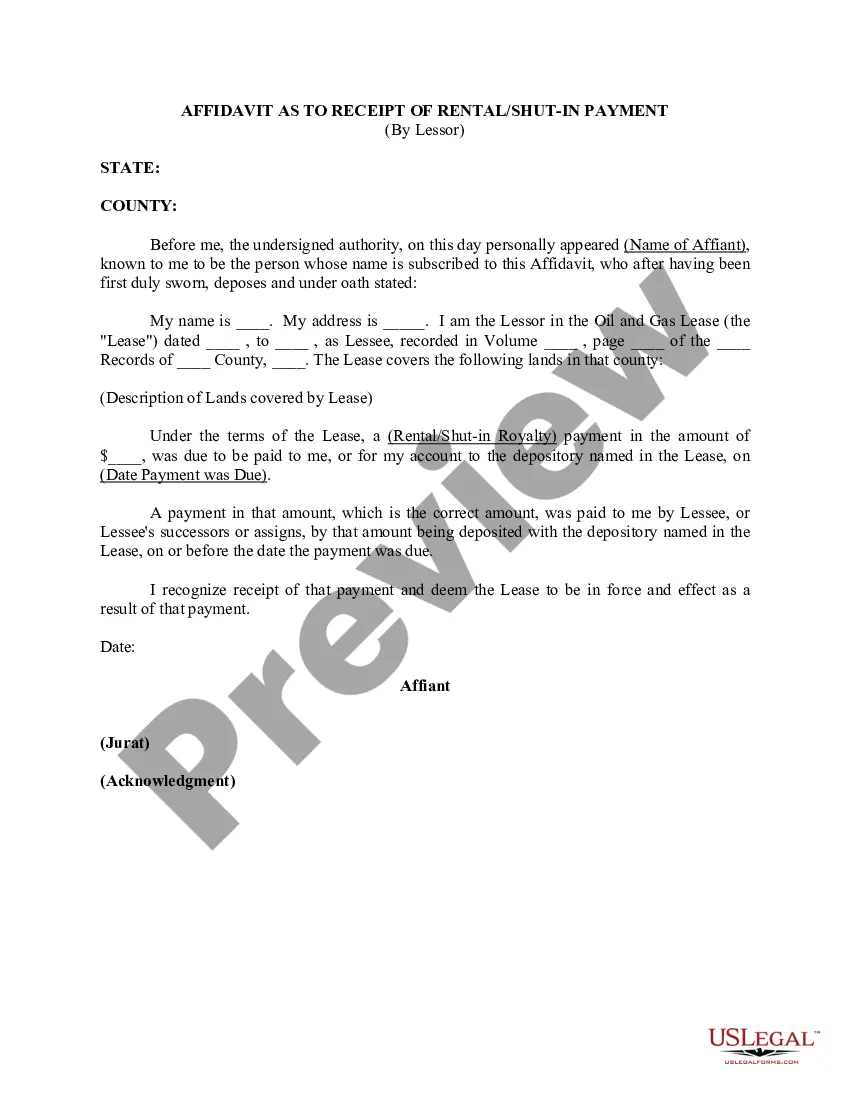

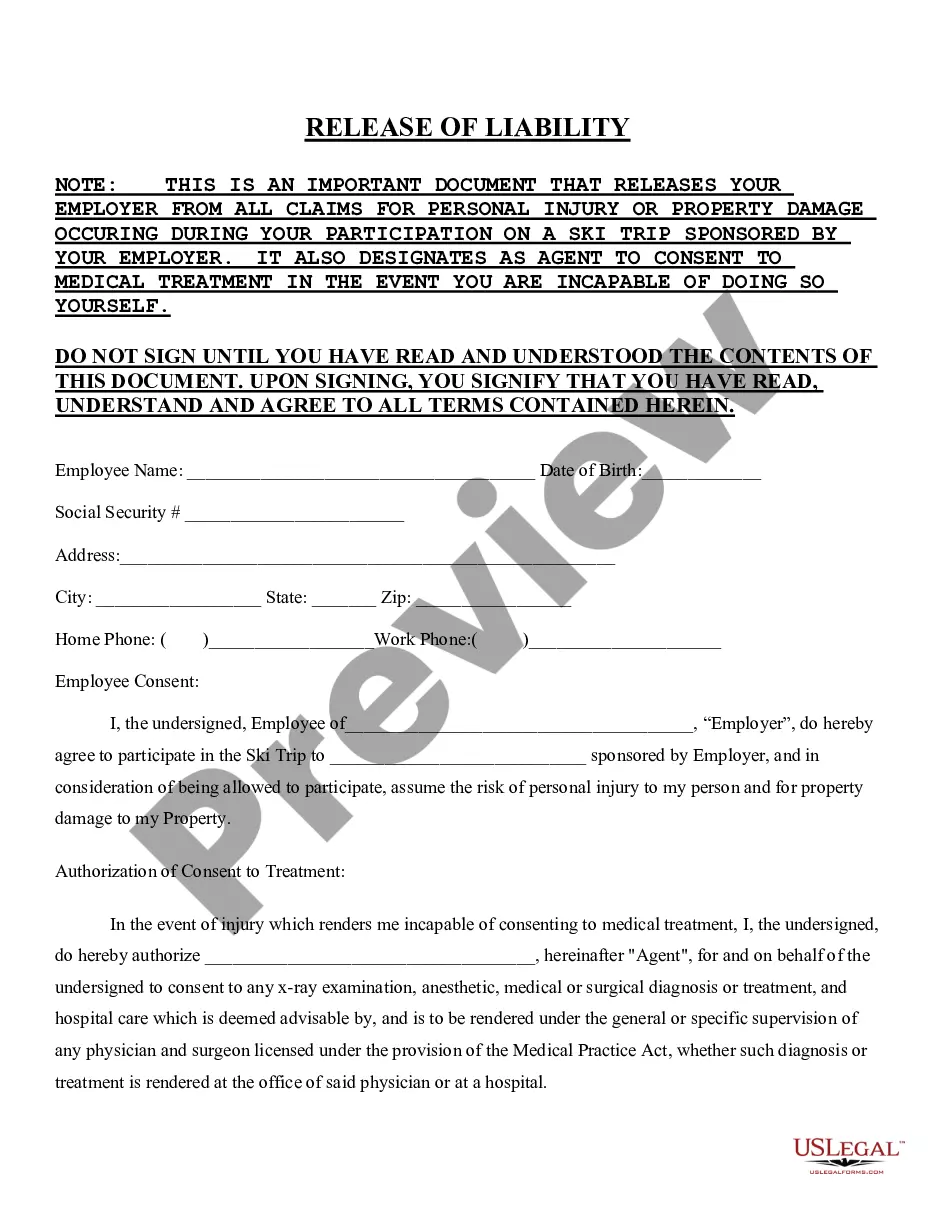

How to fill out Receipt Of Payment For Obligation?

US Legal Forms - one of several biggest libraries of lawful kinds in the United States - provides a wide array of lawful document web templates you are able to download or printing. Using the web site, you may get a huge number of kinds for company and specific uses, sorted by classes, says, or keywords.You can get the most recent models of kinds just like the Iowa Receipt of Payment for Obligation within minutes.

If you already possess a subscription, log in and download Iowa Receipt of Payment for Obligation from the US Legal Forms catalogue. The Acquire option will appear on each and every type you see. You have access to all formerly saved kinds from the My Forms tab of your respective account.

If you want to use US Legal Forms for the first time, listed here are simple instructions to help you get started out:

- Make sure you have selected the proper type for your town/county. Go through the Review option to analyze the form`s articles. See the type outline to ensure that you have selected the correct type.

- When the type does not match your requirements, take advantage of the Lookup area near the top of the display screen to get the one which does.

- If you are satisfied with the shape, validate your selection by visiting the Purchase now option. Then, pick the rates strategy you want and supply your accreditations to sign up for the account.

- Procedure the deal. Utilize your charge card or PayPal account to accomplish the deal.

- Select the format and download the shape on your system.

- Make adjustments. Load, revise and printing and indicator the saved Iowa Receipt of Payment for Obligation.

Every single web template you added to your bank account does not have an expiration date and is also yours permanently. So, if you want to download or printing another copy, just go to the My Forms portion and click about the type you require.

Obtain access to the Iowa Receipt of Payment for Obligation with US Legal Forms, the most comprehensive catalogue of lawful document web templates. Use a huge number of expert and status-certain web templates that satisfy your organization or specific demands and requirements.

Form popularity

FAQ

Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and s.

If the department needs to verify information reported on your return or request additional information, the process will take longer. Math errors in your return or other adjustments. You used more than one form type to complete your return. Your return was missing information or incomplete.

Withholding on Winnings: The state withholds 5 percent of gambling winnings. In addition, federal law may require tribal s to issue a W-2G form to persons and may withhold winnings if certain conditions are met.

Unlike an SSN or FEIN, your IDR ID is generated by the Iowa Department of Revenue. It is assigned to taxpayers and businesses with accounts in the Department's systems. Your IDR ID is unique to you; think of it as your or the entity's identification number for the Department.

Almost everyone must file a state income tax return in Iowa, including: Residents with at least $9,000 in net income for individuals or $13,500 for married taxpayers.

Iowa Code 537.7102(3) ?Debt? means an actual or alleged obligation arising out of a consumer credit transaction, consumer rental purchase agreement, or a transaction which would have been a consumer credit transaction either if a finance charge was made, if the obligation was not payable installments, if a lease was ...

If the debt is based on an unwritten contract (like many credit cards), the time limit is five years from the date of the last payment or charge on the card, whichever is more recent. If the debt is based on a written contract, the time limit is ten years from the date you made the last payment or broke the contract.