Iowa Conveyance of Deed to Lender in Lieu of Foreclosure

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

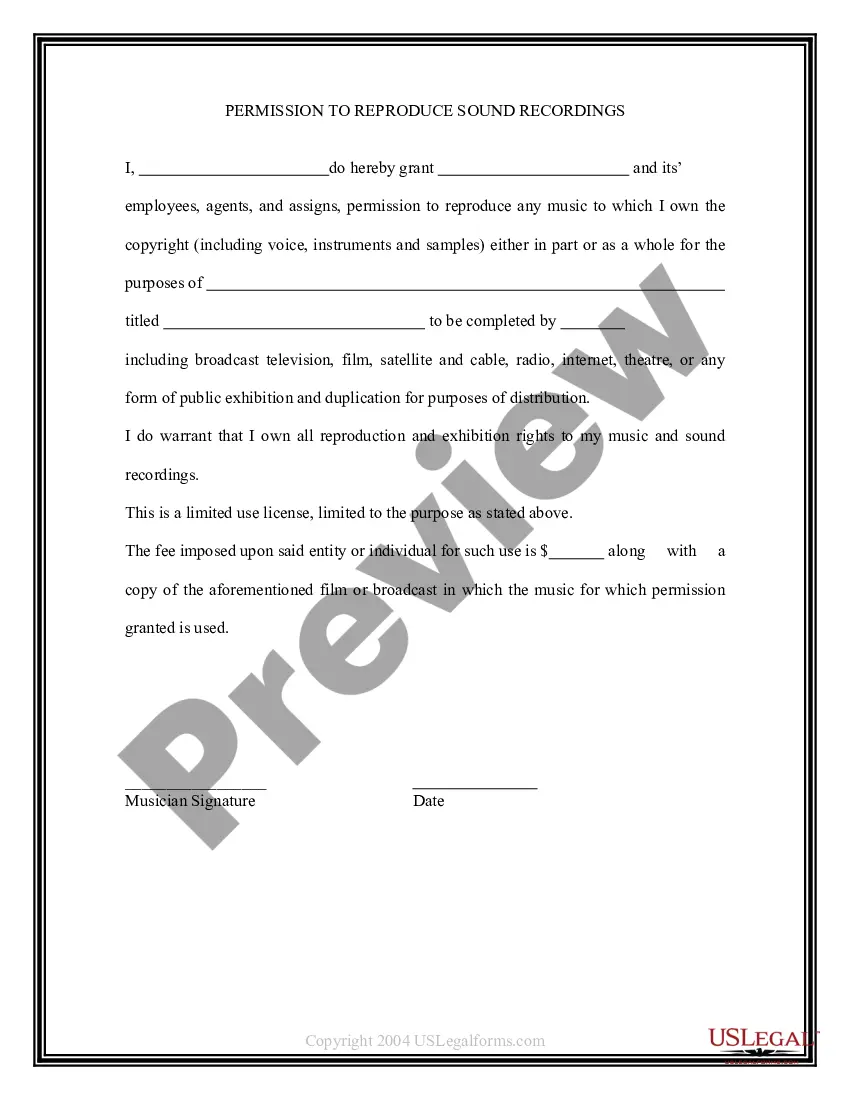

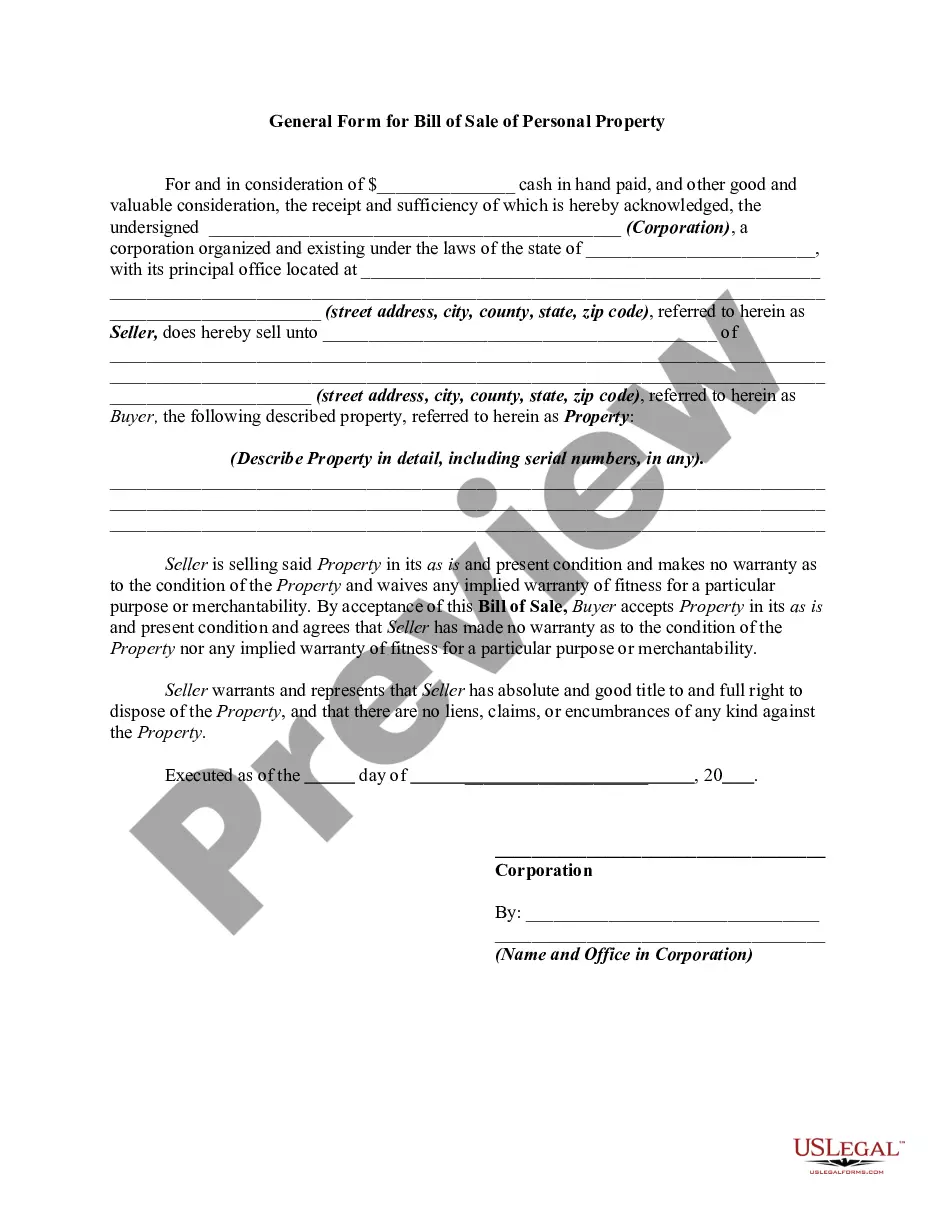

Finding the right legitimate document format might be a struggle. Of course, there are plenty of templates accessible on the Internet, but how will you find the legitimate form you will need? Make use of the US Legal Forms web site. The assistance offers a large number of templates, like the Iowa Conveyance of Deed to Lender in Lieu of Foreclosure, that can be used for company and private demands. Each of the types are checked out by experts and meet up with federal and state requirements.

Should you be presently authorized, log in in your profile and then click the Download switch to have the Iowa Conveyance of Deed to Lender in Lieu of Foreclosure. Utilize your profile to search throughout the legitimate types you have purchased earlier. Check out the My Forms tab of the profile and have one more copy of the document you will need.

Should you be a whole new user of US Legal Forms, listed here are straightforward recommendations so that you can comply with:

- Very first, make sure you have selected the proper form to your metropolis/county. You can look over the form making use of the Review switch and look at the form explanation to make sure this is the right one for you.

- In case the form is not going to meet up with your expectations, make use of the Seach area to discover the correct form.

- When you are positive that the form would work, select the Get now switch to have the form.

- Select the pricing plan you would like and enter in the essential information and facts. Create your profile and pay for the order making use of your PayPal profile or charge card.

- Select the document formatting and obtain the legitimate document format in your gadget.

- Full, change and produce and indicator the obtained Iowa Conveyance of Deed to Lender in Lieu of Foreclosure.

US Legal Forms is the most significant collection of legitimate types that you will find various document templates. Make use of the company to obtain appropriately-produced papers that comply with express requirements.

Form popularity

FAQ

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop. Deed In Lieu Of Foreclosure: What To Know - Rocket Mortgage rocketmortgage.com ? learn ? deed-in-lieu rocketmortgage.com ? learn ? deed-in-lieu

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title. Deeds in Lieu of Foreclosure: Advantages, Disadvantages, and ... atgf.com ? tools-publications ? pubs ? deeds... atgf.com ? tools-publications ? pubs ? deeds...

A deed in lieu of foreclosure is a document that transfers the title of a property from the property owner to their lender in exchange for relief from the mortgage debt. Choosing a deed in lieu of foreclosure can be less damaging financially than going through a full foreclosure proceeding. Deed in Lieu of Foreclosure: Meaning and FAQs - Investopedia investopedia.com ? terms ? deed_in_lieu_of... investopedia.com ? terms ? deed_in_lieu_of...

Yes, a deed in lieu of foreclosure harms your credit, but less so than a foreclosure would. If you obtain a deed in lieu, your mortgage will be listed on your credit reports as closed with a zero balance, but not paid in full. This is a negative entry that will remain on your credit report for up to seven years.

inlieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process.

This is when you give the deed to your home to the mortgage company, and the mortgage company agrees not to foreclose. A mortgage company may require you to try to sell your home before agreeing to a Deed in Lieu of foreclosure. How Can I Avoid Debt if I Am Facing Foreclosure? | Iowa Legal Aid iowalegalaid.org ? resource ? how-can-i-avo... iowalegalaid.org ? resource ? how-can-i-avo...

Disadvantages of a deed in lieu of foreclosure You will have to surrender your home sooner. You may not pursue alternative mortgage relief options, like a loan modification, that could be a better option. You'll likely lose any equity in the property you might have.

Disadvantages to Lender A lender should also hesitate before accepting a lieu deed where there are outstanding subordinate liens or judgments against the property. In such a situation, the lender will have to foreclose its mortgage, with the attendant expense and time involved to obtain clear title.