Iowa Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Agreement To Compromise Debt By Returning Secured Property?

Have you found yourself in situations where you consistently need documentation for either business or personal reasons.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Iowa Agreement to Settle Debt by Returning Secured Property, which can be tailored to comply with both federal and state regulations.

Once you find the right form, simply click Get now.

Choose the pricing plan you prefer, input the necessary information to complete your order, and pay for the transaction using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Iowa Agreement to Settle Debt by Returning Secured Property template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/state.

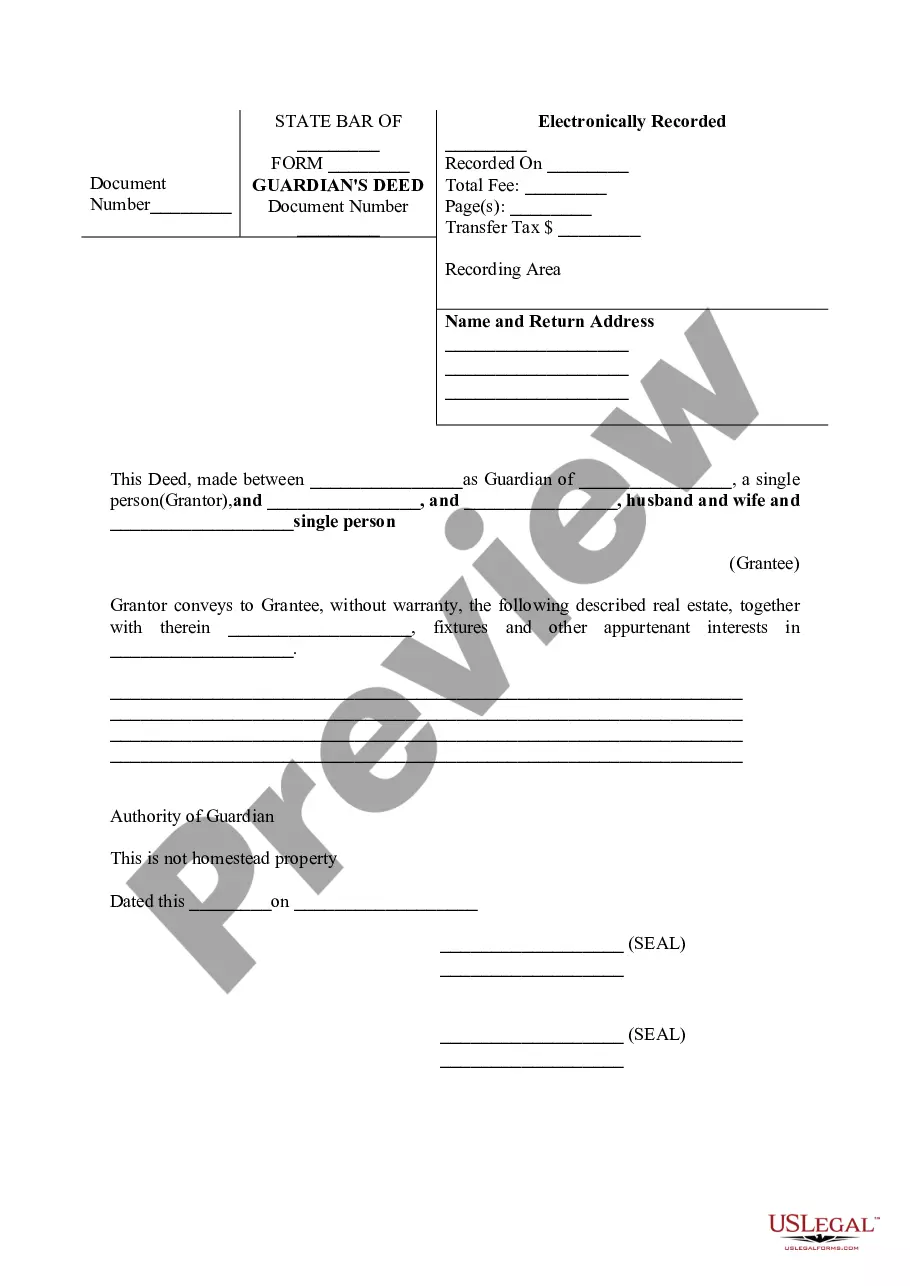

- Use the Review button to examine the document.

- Check the summary to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the template that suits your requirements.

Form popularity

FAQ

The setoff program in Iowa allows the state to recover debts owed to it by deducting funds from tax refunds or other payments. This program can significantly affect individuals dealing with debt, including those considering an Iowa Agreement to Compromise Debt by Returning Secured Property. It's important to be aware of this program, as it could impact your financial recovery, and resources like uLegalForms can provide helpful guidance.

Iowa has a progressive income tax system, which means that the tax rates increase as income levels rise. The rates range from 0.33% to 8.53%, depending on your taxable income. Understanding your tax obligations is crucial, especially when considering an Iowa Agreement to Compromise Debt by Returning Secured Property. Using the uLegalForms platform can help you navigate tax implications effectively.

Yes, you can often set up a payment plan for Iowa state taxes. The Iowa Agreement to Compromise Debt by Returning Secured Property allows taxpayers to negotiate manageable terms. By using this agreement, you can potentially reduce your tax debt and return secured property, making your payments more feasible. Additionally, uslegalforms offers templates and guidance that simplify the process, ensuring you comply with state requirements.

Once your Iowa Agreement to Compromise Debt by Returning Secured Property is accepted, you must adhere to the terms outlined in the agreement. This often includes returning the secured property, which can relieve you of further obligations associated with that debt. It is crucial to follow through promptly, as failure to comply could result in reinstating the original debt.

Determining the right amount to offer in an Iowa Agreement to Compromise Debt by Returning Secured Property depends on your financial situation and the value of the secured property. Generally, you should offer an amount that is realistic and reflects what you can afford while maximizing the benefit for your creditors. Consulting with a financial advisor can provide valuable insights into establishing an appropriate offer.

Filing an Iowa Agreement to Compromise Debt by Returning Secured Property involves completing specific forms and providing essential financial documentation. You must submit these to your creditor or the relevant financial institution overseeing your debt. It is wise to consider seeking assistance from professionals who can guide you through the process and ensure your submission meets all requirements.

To qualify for an Iowa Agreement to Compromise Debt by Returning Secured Property, you typically need to demonstrate financial hardship or an inability to fully repay your debt. Lenders often look for proof of your income, expenses, and overall financial situation. Showing a willingness to return secured property can strengthen your case and increase the chance of a successful agreement.

The downside of an Iowa Agreement to Compromise Debt by Returning Secured Property may include a potential impact on your credit score. Additionally, you may need to forfeit certain assets, which can make it difficult to meet your financial needs in the future. It's also important to be aware that not all creditors may accept this type of agreement.

An offer in compromise can be a viable solution for individuals overwhelmed by debt. It allows you to settle for less while avoiding potential bankruptcy and its long-term implications. If you consider the Iowa Agreement to Compromise Debt by Returning Secured Property, take the time to evaluate your financial situation thoroughly. This option may provide you with a fresh start when approached correctly.

A notice of setoff in Iowa informs a debtor that the state intends to apply their future payments to outstanding debts owed. This legal action can impact various forms of entitlement payments, including tax refunds and state benefits. If you are dealing with the Iowa Agreement to Compromise Debt by Returning Secured Property, understanding setoffs can help you prepare for potential financial implications. Working with professionals can clarify how to proceed under these circumstances.