Iowa Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

You may spend hours on the Internet trying to find the legitimate document web template that suits the state and federal demands you will need. US Legal Forms provides 1000s of legitimate types that happen to be examined by experts. You can easily acquire or print out the Iowa Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust from your service.

If you have a US Legal Forms accounts, you may log in and click the Download button. Following that, you may total, revise, print out, or signal the Iowa Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust. Every legitimate document web template you buy is your own property forever. To obtain an additional version of any bought type, proceed to the My Forms tab and click the related button.

If you use the US Legal Forms site the very first time, follow the easy instructions under:

- Initially, ensure that you have selected the proper document web template for your state/town of your choosing. Browse the type outline to ensure you have picked out the right type. If available, use the Preview button to appear with the document web template too.

- If you want to locate an additional variation in the type, use the Lookup discipline to find the web template that meets your needs and demands.

- When you have discovered the web template you need, simply click Acquire now to proceed.

- Pick the costs program you need, enter your credentials, and register for a merchant account on US Legal Forms.

- Complete the purchase. You may use your bank card or PayPal accounts to pay for the legitimate type.

- Pick the file format in the document and acquire it for your product.

- Make changes for your document if needed. You may total, revise and signal and print out Iowa Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Download and print out 1000s of document themes while using US Legal Forms Internet site, which provides the biggest selection of legitimate types. Use professional and express-distinct themes to take on your business or person requires.

Form popularity

FAQ

§ 633.356(1) defines a very small estate as having a gross value of $50,000 or less, and it must not contain any real property. Signing ? The affidavit must be signed and sworn before a notary public.

If all the property of the estate has a value of less than $25,000, no tax is due. Insurance proceeds paid to a named beneficiary are not taxable. Currently, annual gifts in the amount of $13,000 or less are not taxable. Annuities purchased under an employee pension plan or retirement plan are not taxable.

How Do You Avoid Probate in Iowa? If the individual has a revocable living trust with estate assets and names a beneficiary, you can avoid probate. You can also skip the process if the individual names a beneficiary for all assets.

Unless the courts grant you an extension, Iowa Probate Code 633.361 affirms you'll have you three months starting from the day the court appoints you as executor to appraise, report, and inventory the deceased's estate accurately.

If you have no descendants, your spouse will inherit everything. If you only have descendants from your relationship with your spouse, your spouse will still inherit everything.

If you die with an ownership interest in any property, your estate generally must be probated whether you have a will or not. The court will determine whether your will is valid or determine who is to receive the property if there is no will. Thus, with or without a will you could end up "in court."

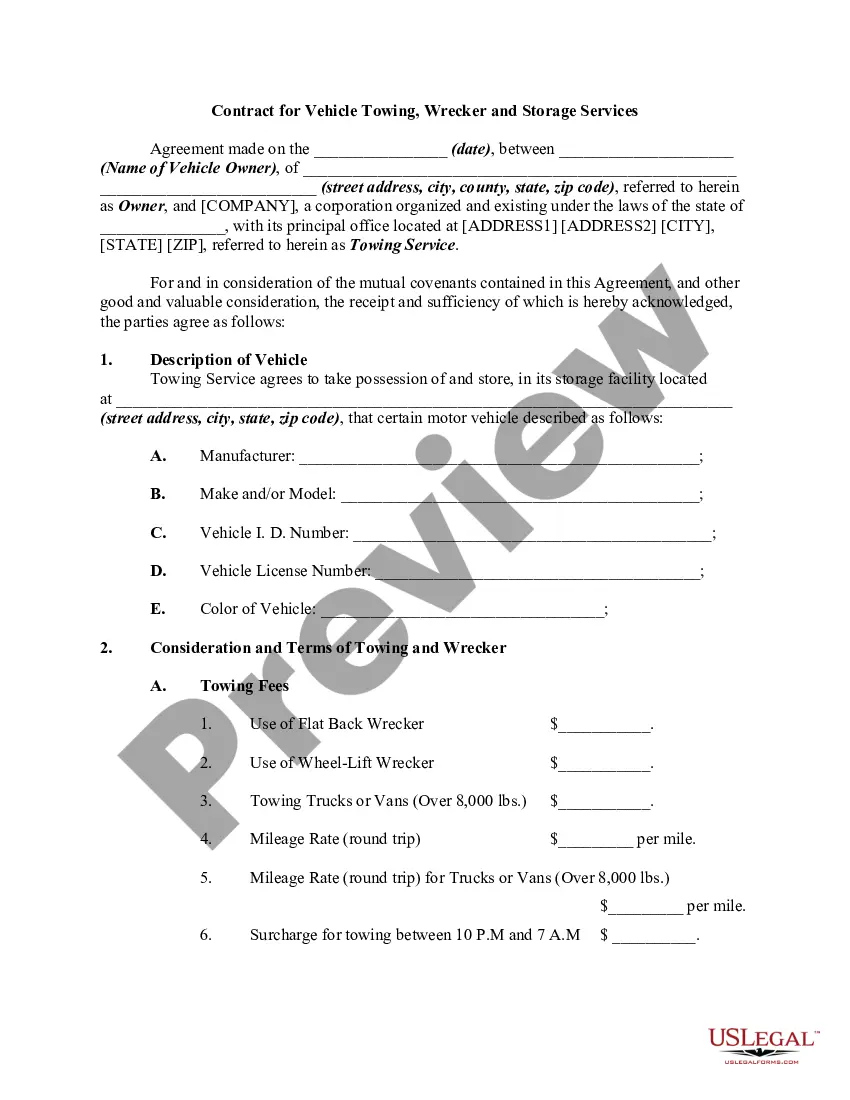

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

Children in Iowa Inheritance Law Intestate Succession: Spouses and ChildrenInheritance SituationWho Inherits Your PropertyChildren but no spouse? Children inherit everythingSpouse but no descendants? Spouse inherits everythingSpouse and descendants from you and that spouse? Spouse inherits everything1 more row ?

The need for probate does not normally depend on the size of your estate. For example, if you are the sole owner of any real property, your estate will have to be probated so your heirs will have clear title to the property. This is true no matter how small your estate.

If you die without a will in Iowa, your children will receive an "intestate share" of your property. The size of each child's share depends on how many children you have, whether or not you are married, and whether your spouse is also their parent (See the table above.)