A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

Iowa Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business

Description

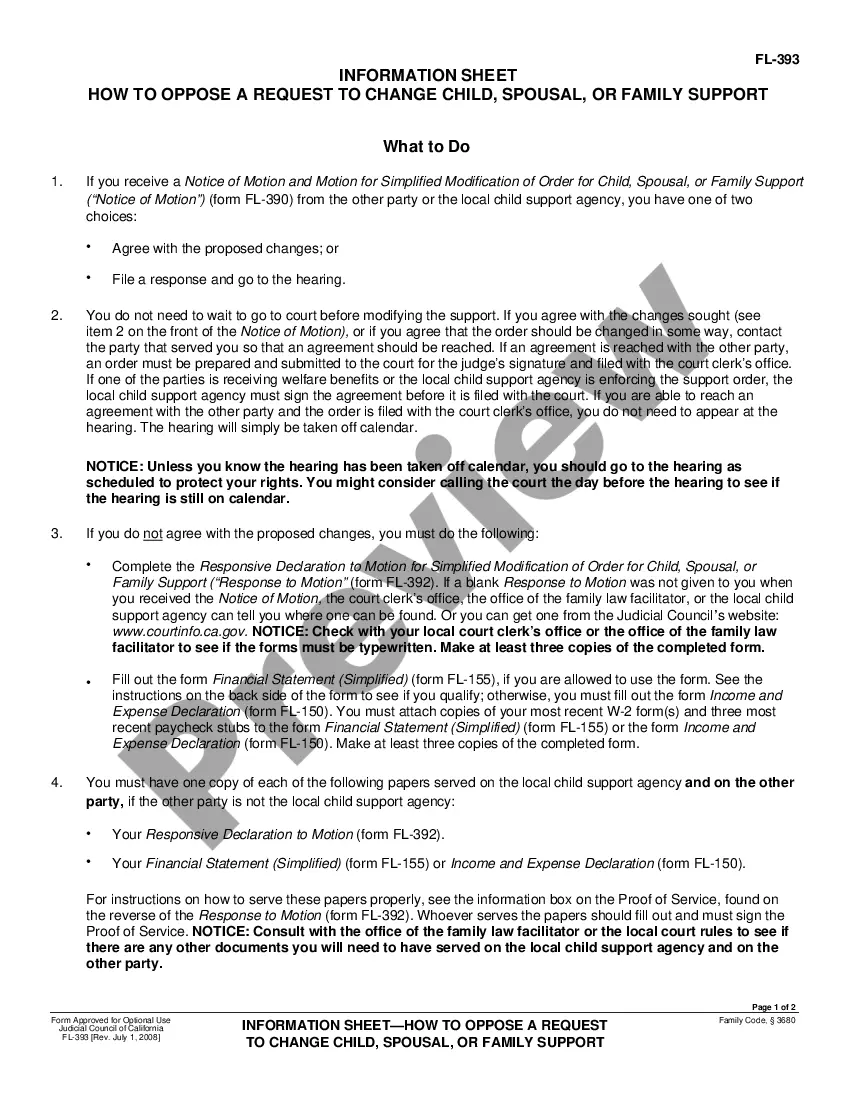

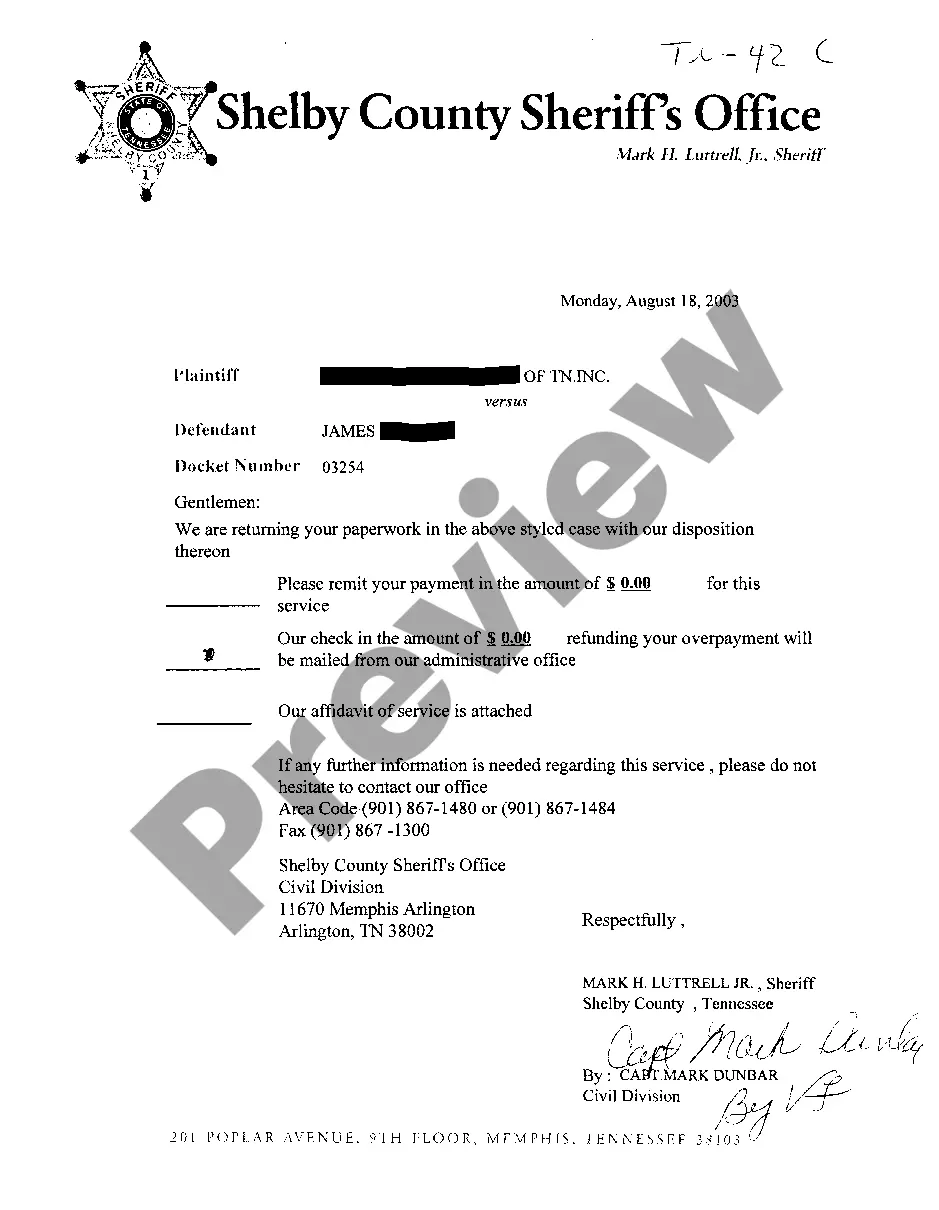

How to fill out Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By using the site, you can access thousands of templates for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of documents like the Iowa Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase in moments.

If the document does not meet your requirements, use the Search area at the top of the screen to find one that does.

If you are satisfied with the document, confirm your choice by clicking the Buy Now button. Then, choose the payment plan you prefer and provide your details to register for an account.

- If you have a subscription, Log In to obtain the Iowa Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase from the US Legal Forms collection.

- The Download option will appear on every document you view.

- You can access all previously downloaded documents in the My documents section of your account.

- To utilize US Legal Forms for the first time, here are easy steps to help you begin.

- Make sure you have selected the correct document for the city/region.

- Click the Preview option to review the content of the form.

Form popularity

FAQ

When a promissory note is secured by a piece of real estate, it is typically called a secured promissory note or a mortgage note. This indicates that the note is backed by specific real property, providing the lender with legal grounds to reclaim the property if the borrower defaults. It is an essential component of any financial transaction involving real estate, especially when structured with a fixed interest rate and installment payments. Uslegalforms offers helpful guides to navigate the complexities of these agreements.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.

A secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

What is a Secured Promissory Note? A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A. As used in this section, "loan secured by real estate" means an obligation executed or assumed by the borrower that is secured by mortgage, deed of trust, or similar instrument, encumbering real estate that is owned by the borrower and upon which the bank relies as the principal security for the loan.

Many states have usury laws that cap the rate of interest a lender can charge for loansoften in the range of 10% to 20%.

You can create a Promissory Note as a lender or borrower by following these steps:Select the location. Our Promissory Note template will customize your document specifically for the laws of your location.Provide party details.Establish the terms of the loan.Include final details.Sign the document.