Iowa Nonresidential Simple Lease

Description

How to fill out Nonresidential Simple Lease?

Are you in a situation where you require documents for either business or personal motives almost all the time.

There are numerous valid document templates accessible online, but finding ones you can trust isn’t easy.

US Legal Forms offers thousands of template options, including the Iowa Nonresidential Simple Lease, which is designed to comply with state and federal regulations.

Select the pricing plan you prefer, fill in the necessary details to create your account, and pay for the transaction using your PayPal or credit card.

Choose a suitable document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Iowa Nonresidential Simple Lease template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

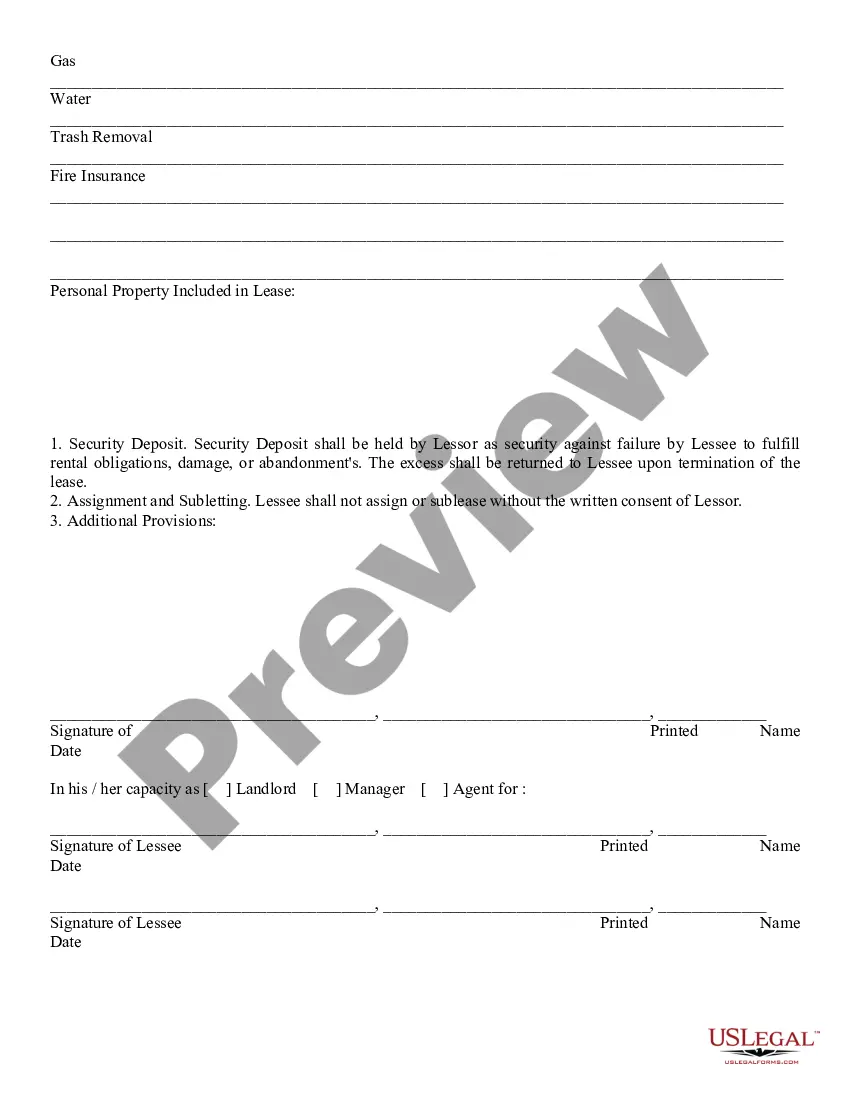

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you are looking for, utilize the Search field to find the form that meets your needs.

- Once you find the appropriate form, click Get now.

Form popularity

FAQ

Renting without signing a lease is possible in Iowa, often through month-to-month rental agreements or verbal arrangements. However, these informal setups can lack legal protections, so it's wise to create written terms for clarity. If you prefer a structured rental experience, consider an Iowa Nonresidential Simple Lease to ensure both parties are legally covered.

The most common way to terminate an Iowa Nonresidential Simple Lease is through mutual agreement between the landlord and tenant. This can occur with written notice and may involve settlement on any outstanding payments. If you decide to terminate your lease, ensure both parties are clear on all terms to avoid disputes.

Renters in Iowa have several rights, including the right to a safe and habitable living environment and the right to privacy. If you're facing issues like unauthorized entry or unresolved maintenance problems, you can discuss these with your landlord or seek legal assistance. Knowing your rights helps protect you when agreeing to an Iowa Nonresidential Simple Lease.

Evicting someone in Iowa without a formal lease can be more complicated but is possible. It usually involves providing a notice to vacate, which can vary in length based on the situation. It's crucial to follow Iowa laws on eviction closely to ensure your actions are lawful, and using a platform like uslegalforms can provide the necessary forms and guidance for your eviction process.

Legally exiting an Iowa Nonresidential Simple Lease often requires specific steps, such as providing a written notice to your landlord. You must also review your lease agreement for any termination clauses or options that may apply. If you face unusual circumstances, such as losing your job or health issues, speak with a legal professional to understand your options.

In Iowa, you generally cannot back out of the Iowa Nonresidential Simple Lease after signing it unless you find a valid legal reason, like misrepresentation. Most leases are binding contracts, so you should carefully read and understand your lease before signing. If you find that you need to withdraw, consider consulting a legal expert for guidance on your specific situation.

Your girlfriend can potentially move in without being on the lease, but this varies based on the landlord's policies. Some landlords allow additional occupants, while others may require all residents to be included on the lease. With an Iowa Nonresidential Simple Lease, it's best to discuss this with your landlord to ensure compliance and avoid any potential issues.

Yes, it is possible to live in a rental property without being on the lease, but it may lead to complications. Typically, most landlords prefer tenants to be listed on the lease, as this establishes legal protections for both sides. In cases involving an Iowa Nonresidential Simple Lease, having all occupants documented helps maintain accountability and proper communication with the landlord.

A simple lease is a basic rental agreement that covers essential aspects of the tenant-landlord relationship. It usually includes information about payment methods, lease duration, and maintenance responsibilities. With an Iowa Nonresidential Simple Lease, both parties can enjoy clarity and straightforward expectations, reducing misunderstandings and potential disputes.

A lease simple refers to a rental contract that includes basic provisions without complicated legal jargon. It simplifies the rental process, allowing tenants to focus on compliance without confusion. In Iowa, an Iowa Nonresidential Simple Lease exemplifies this straightforward approach, ensuring that all essential lease terms are clear and accessible.