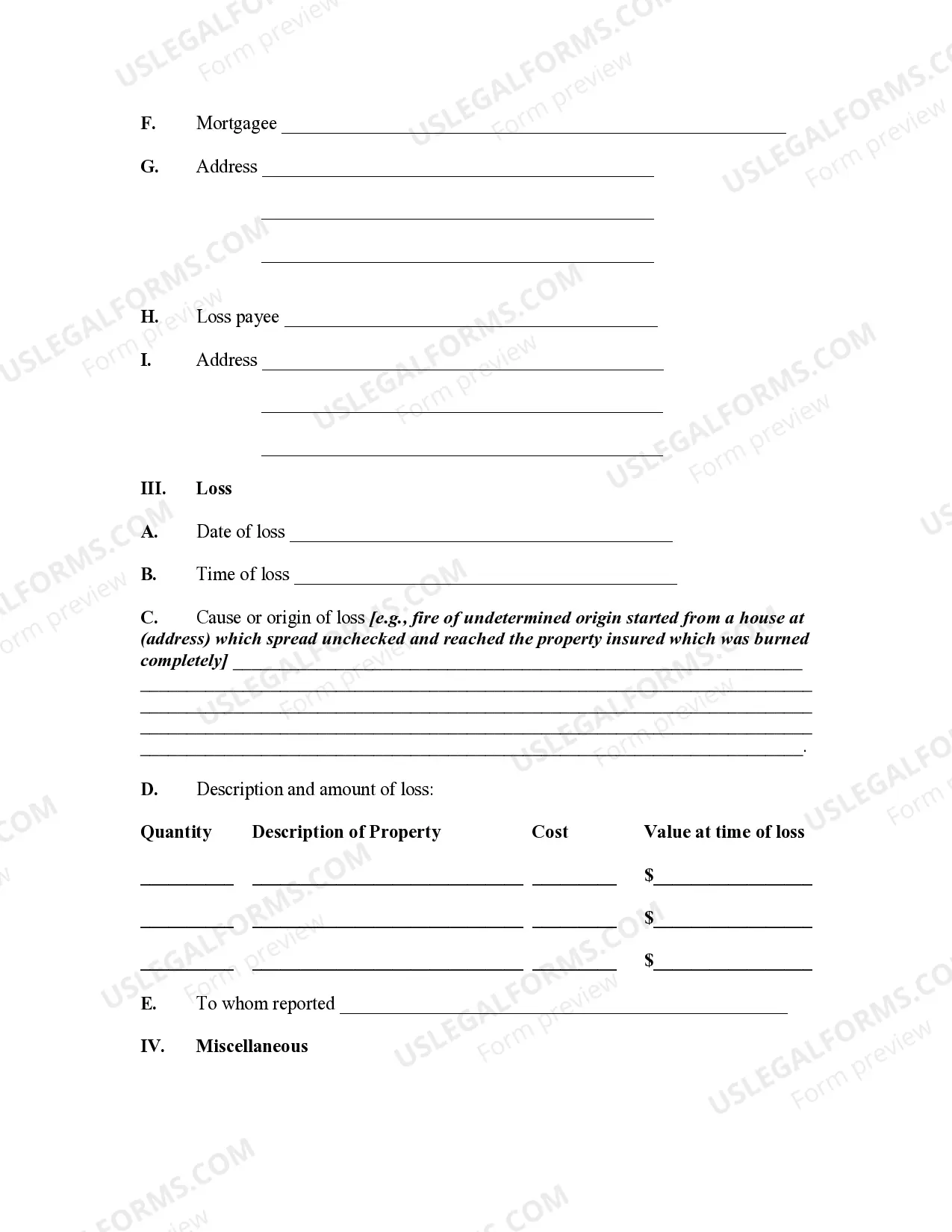

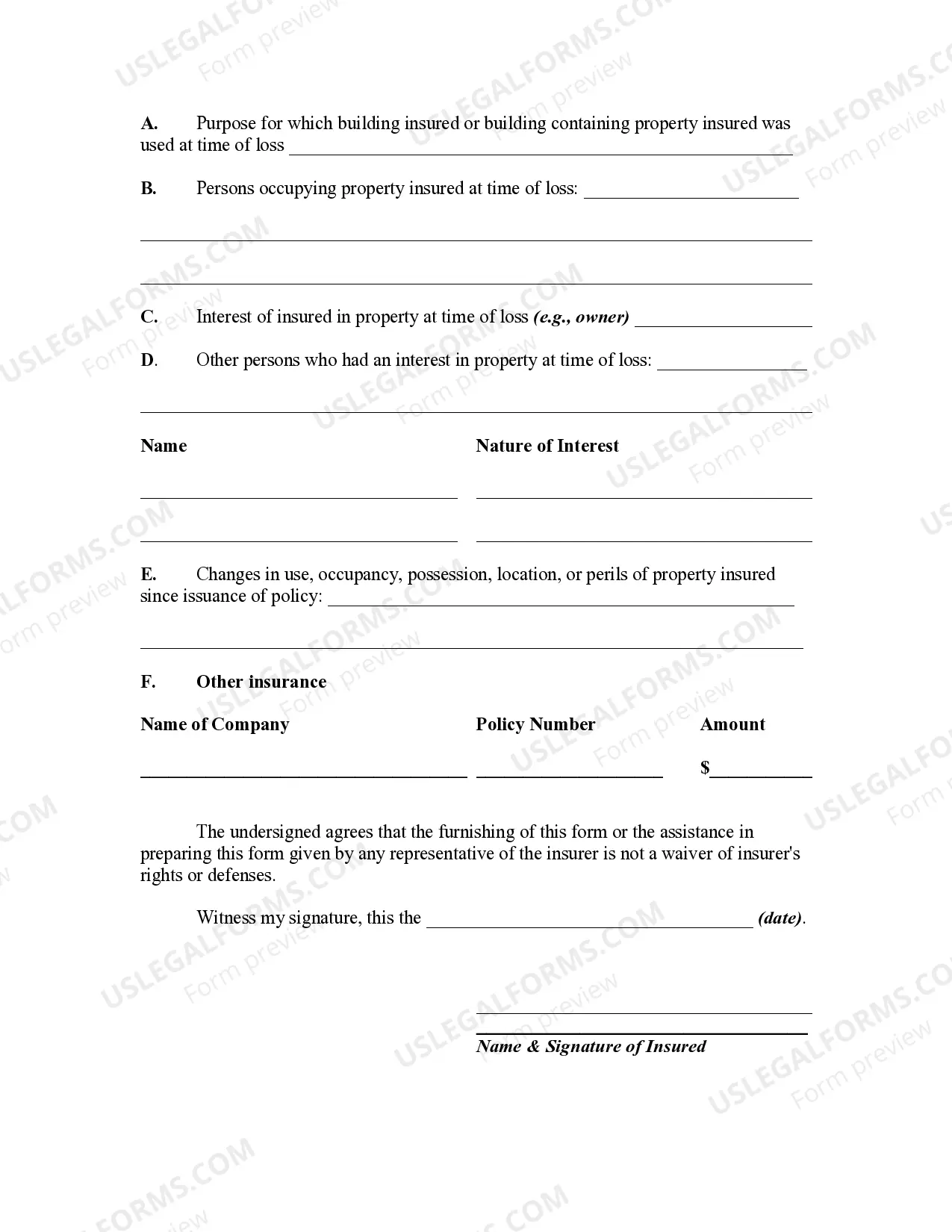

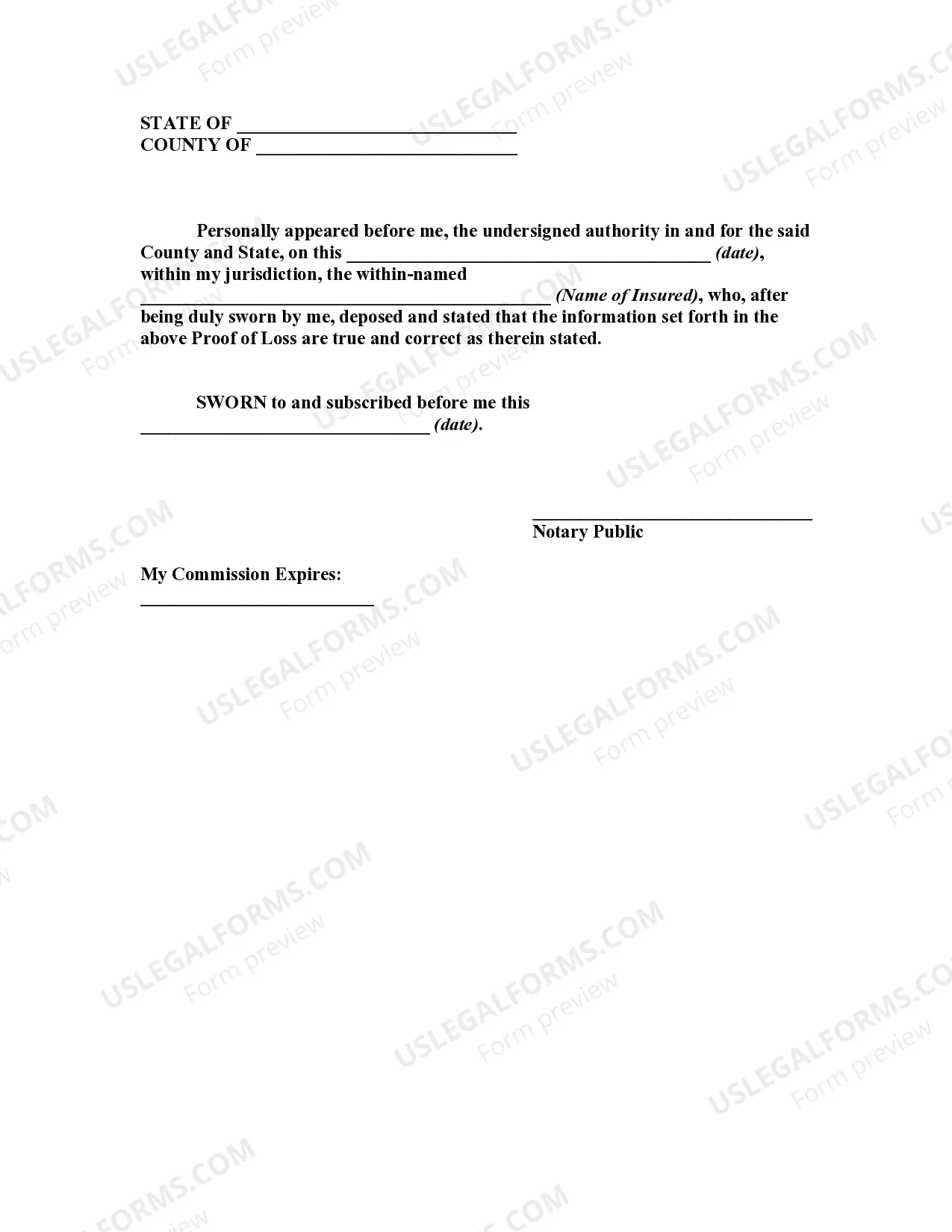

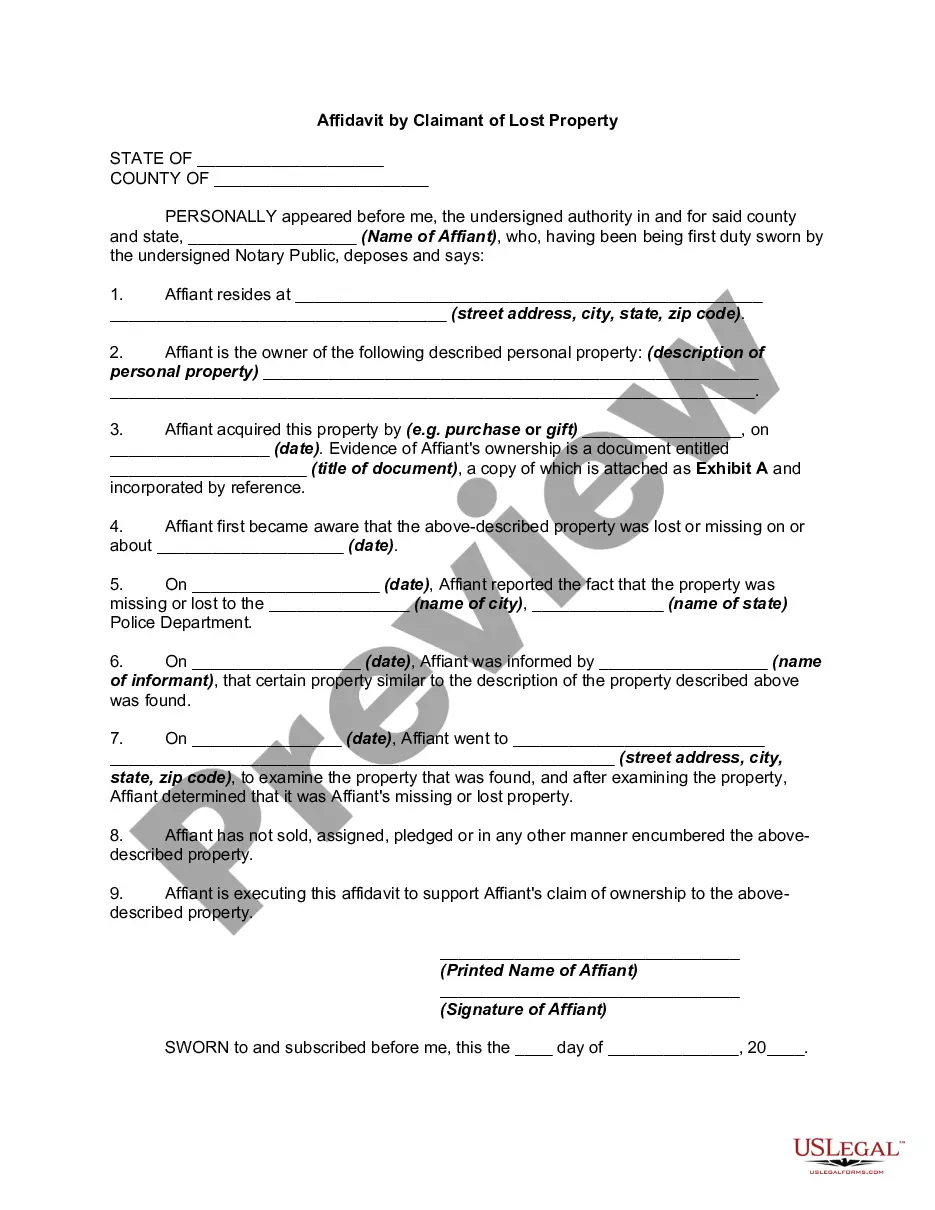

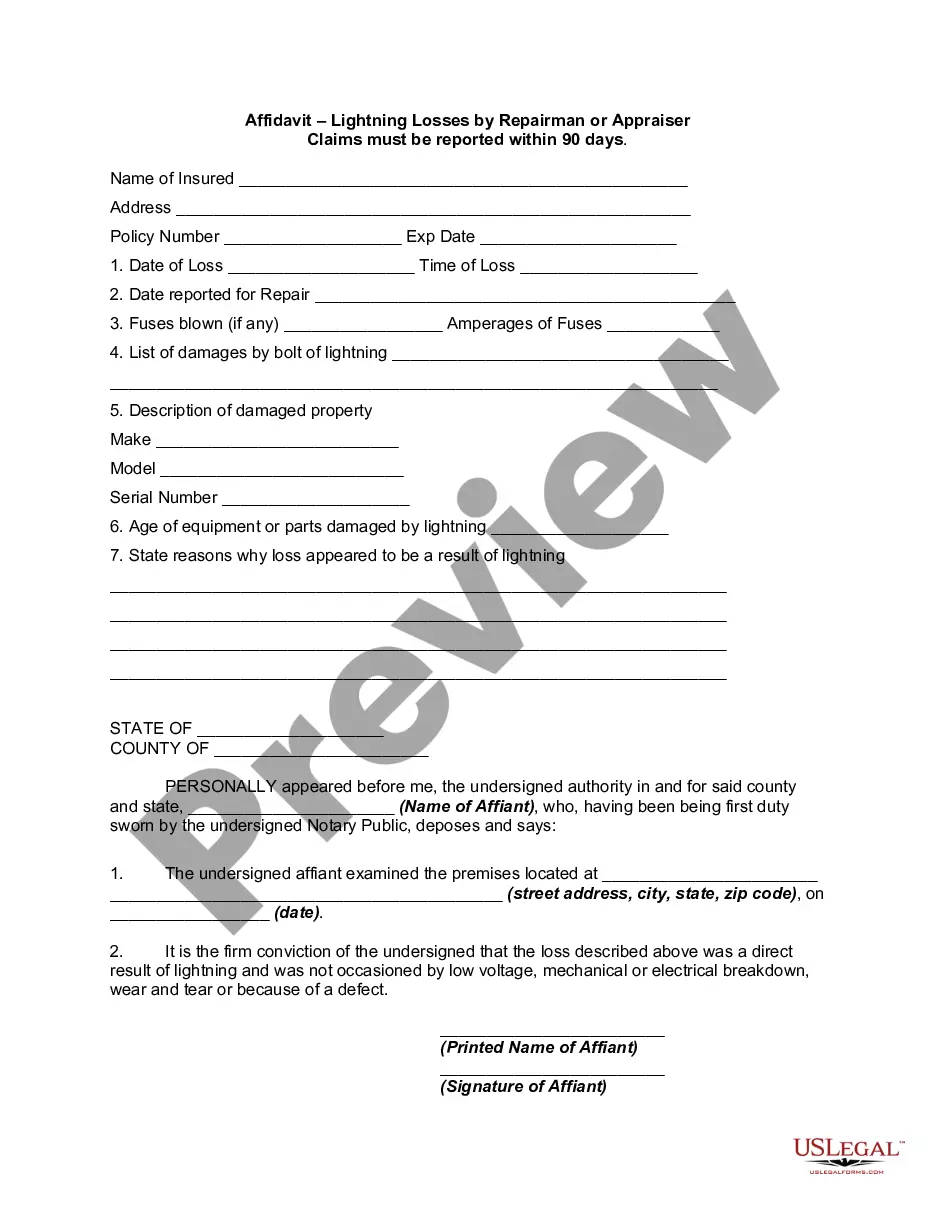

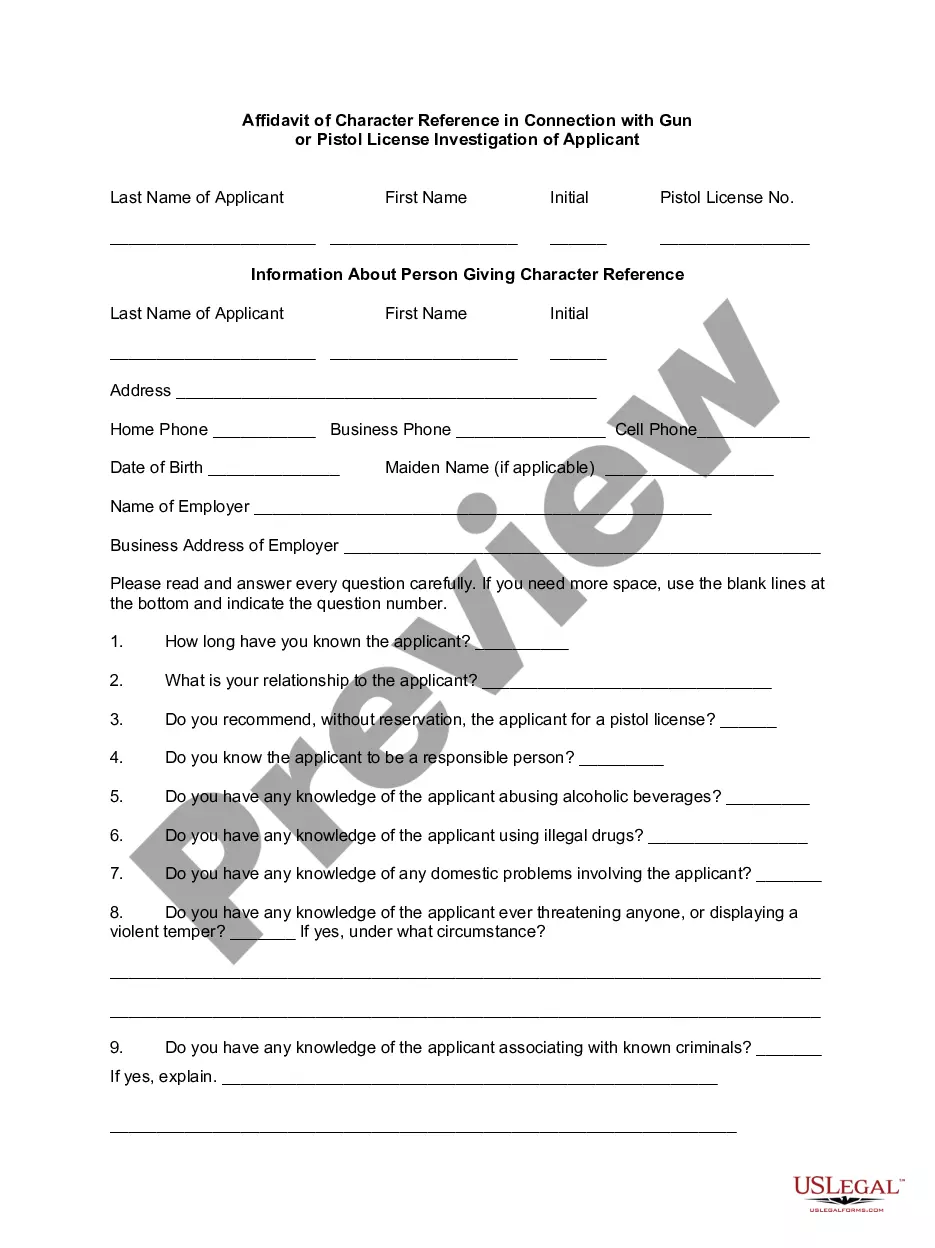

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

Iowa Proof of Loss for Fire Insurance Claim

Description

How to fill out Proof Of Loss For Fire Insurance Claim?

Are you in the position in which you need documents for both company or individual functions virtually every time? There are a variety of lawful record layouts available on the Internet, but finding versions you can rely isn`t straightforward. US Legal Forms delivers a huge number of type layouts, like the Iowa Proof of Loss for Fire Insurance Claim, which can be published to fulfill federal and state demands.

If you are previously acquainted with US Legal Forms internet site and possess your account, simply log in. Following that, you may obtain the Iowa Proof of Loss for Fire Insurance Claim template.

Should you not come with an account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the type you require and make sure it is for the proper city/county.

- Take advantage of the Preview key to examine the shape.

- Read the description to actually have selected the appropriate type.

- In the event the type isn`t what you are seeking, utilize the Research area to discover the type that fits your needs and demands.

- If you obtain the proper type, click on Get now.

- Select the prices prepare you desire, fill out the desired info to generate your bank account, and pay for an order with your PayPal or bank card.

- Choose a convenient paper structure and obtain your version.

Get every one of the record layouts you might have bought in the My Forms menus. You may get a extra version of Iowa Proof of Loss for Fire Insurance Claim whenever, if necessary. Just click on the required type to obtain or print the record template.

Use US Legal Forms, probably the most substantial selection of lawful varieties, to save lots of efforts and steer clear of mistakes. The assistance delivers professionally made lawful record layouts that you can use for a range of functions. Make your account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

So, in insurance term, the loss caused by the 'fire' must satisfy two conditions to be covered under the fire insurance- first, it must be actual fire so no fire-related damage by any other form will be covered. Second, the fire should be accidental.

A proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property loss. It is an official, notarized, sworn statement from you to your insurer regarding the scope of damage to your property.

Actual loss refers to the loss that has been incurred by the insured during the occurrence of fire. Insured value refers to the value for which the insurer purchased the fire insurance. The actual value of property refers to the total value of the property at the time or day of fire incidents.

Damage caused by actions taken by Government authorities, such as demolishing or burning a building for public safety reasons or permanent or temporary dispossession by order of the Government may not be covered under a standard fire insurance policy.

Fire insurance policies provide payment for the loss of use of the property as a result of a fire. They also often provide additional living expenses if the fire caused uninhabitable conditions. Finally, they provide for damage to personal property and nearby structures.

A proof of loss is a formal document you must file with an insurance company that initiates the claim process after a property loss. It is an official, notarized, sworn statement from you to your insurer regarding the scope of damage to your property.

Wear and tear, gradual damage, and maintenance issues Fire insurance generally does not cover damage caused by normal wear and tear, gradual deterioration, or lack of maintenance. It's the policyholder's responsibility to maintain the property to prevent such damage.

Fire insurance is typically included as part of your home insurance. It pays to repair, replace, and rebuild your property after a fire. It also covers any personal belongigns damaged by fire. Most policies include fire protection, but you can also purchase additional protection that increases your plan limits.